| United States | Canada | |||

| Quarter | Year | Quarter | Year | |

| Aluminum Conduit | 2.1% | 4.2% | 0.0% | 1.7% |

| Asphalt Shingles | 0.1% | 1.9% | -0.2% | 0.4% |

| Concrete Block | -0.4% | 1.5% | 0.1% | 1.8% |

| Drywall | -0.1% | 0.4% | 0.4% | 1.1% |

| Felt Paper | 0.1% | 0.9% | 0.4% | 3.0% |

| Galvanized Pipe | 0.0% | 1.4% | 1.5% | 6.3% |

| Lumber | 5.2% | 46.7% | 11.7% | 70.0% |

| Plywood | 5.3% | 35.0% | 11.2% | 32.2% |

| Ready Mix | 0.6% | 3.5% | 2.0% | 8.4% |

| Rebar | 0.6% | 1.0% | 0.2% | -1.2% |

| Steel Deck | 0.6% | 2.1% | 0.4% | 3.7% |

| Steel Stud | 0.4% | 2.5% | 0.4% | 3.0% |

| Structural Steel | 0.6% | 0.0% | 0.3% | 1.4% |

| 1/2″ Copper Pipe | 1.0% | 0.7% | 0.2% | 2.6% |

| National Average | Commercial | Agricultural |

| United States | 1.6% | 1.4% |

| Canada | 1.2% | 1.1% |

| US Quarterly Material Cost Changes | ||||||||||

| 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | 2Q20 | 3Q20 | 4Q20 | 1Q21 | |

| Aluminum Conduit | 1.0 | 1.7 | 1.4 | 0.1 | 0.6 | 0.6 | 1.0 | -1.0 | 2.0 | 2.1 |

| Concrete Block | 0.2 | 0.8 | 1.1 | 0.4 | 0.8 | 1.0 | 0.7 | 0.6 | 0.7 | -0.4 |

| Drywall | 1.2 | -0.3 | -0.1 | 0.3 | 0.7 | -0.5 | -0.1 | 0.0 | 0.7 | -0.1 |

| Galvanized Pipe | 1.9 | 1.9 | 1.1 | 0.8 | 0.5 | 0.5 | 0.5 | 0.6 | 0.3 | 0.0 |

| Ready Mix | 0.1 | 0.3 | 1.6 | 1.5 | 0.9 | 0.7 | 1.0 | 0.2 | 1.7 | 0.6 |

| Rebar | 1.4 | 0.6 | -0.4 | 0.5 | -0.1 | 0.8 | -0.1 | 0.4 | 0.1 | 0.6 |

| Steel Deck | 1.7 | 1.0 | 0.5 | -0.3 | 0.0 | 0.4 | 0.6 | 0.1 | 0.8 | 0.6 |

| Steel Stud | 2.4 | 1.0 | -0.6 | 0.1 | 1.5 | 0.2 | 0.6 | 0.6 | 0.8 | 0.4 |

| Structural Steel | 1.1 | -0.1 | -0.5 | -1.3 | -0.8 | -0.3 | -0.8 | -0.1 | 0.3 | 0.6 |

| ½” Cooper Pipe | -1.1 | -1.0 | 0.1 | -0.3 | -1.4 | -0.4 | -0.4 | -0.3 | 0.3 | 1.0 |

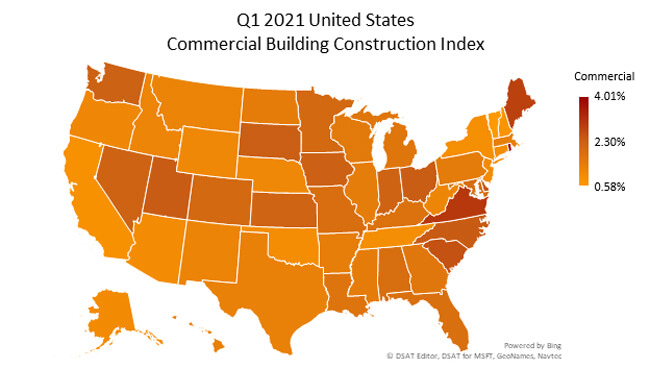

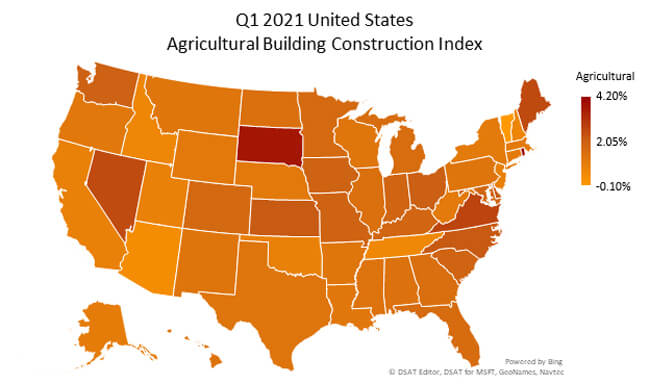

| State | Commercial | Agricultural |

| Alabama | 1.87% | 1.34% |

| Arizona | 0.97% | 0.35% |

| Arkansas | 1.38% | 1.19% |

| California | 0.82% | 0.79% |

| Colorado | 2.01% | 1.69% |

| Connecticut | 0.93% | 1.05% |

| Delaware | 2.46% | 2.10% |

| District Of Columbia | 0.62% | 1.20% |

| Florida | 1.81% | 1.57% |

| Georgia | 1.59% | 1.48% |

| Idaho | 1.17% | 0.60% |

| Illinois | 1.42% | 1.42% |

| Indiana | 2.18% | 1.86% |

| Iowa | 2.24% | 1.93% |

| Kansas | 2.16% | 2.15% |

| Kentucky | 1.75% | 1.80% |

| Louisiana | 1.67% | 1.15% |

| Maine | 2.84% | 2.53% |

| Maryland | 1.90% | 1.82% |

| Massachusetts | 1.34% | 1.05% |

| Michigan | 1.63% | 1.53% |

| Minnesota | 2.00% | 1.67% |

| Mississippi | 1.43% | 1.30% |

| Missouri | 1.86% | 1.90% |

| Montana | 1.21% | 1.19% |

| Nebraska | 1.08% | 1.07% |

| Nevada | 2.20% | 2.51% |

| New Hampshire | 0.73% | 0.63% |

| New Jersey | 1.00% | 0.81% |

| New Mexico | 1.19% | 1.23% |

| New York | 0.88% | 1.03% |

| North Carolina | 2.38% | 2.18% |

| North Dakota | 1.43% | 1.42% |

| Ohio | 2.34% | 2.02% |

| Oklahoma | 0.93% | 0.78% |

| Oregon | 1.10% | 1.12% |

| Pennsylvania | 1.44% | 1.23% |

| Rhode Island | 4.01% | 4.20% |

| South Carolina | 2.53% | 1.87% |

| South Dakota | 2.30% | 3.69% |

| Tennessee | 0.91% | 0.54% |

| Texas | 1.30% | 1.25% |

| Utah | 2.35% | 0.80% |

| Vermont | 0.58% | -0.10% |

| Virginia | 3.00% | 2.67% |

| Washington | 2.23% | 1.96% |

| West Virginia | 1.15% | 1.05% |

| Wisconsin | 1.51% | 1.20% |

| Wyoming | 1.08% | 1.09% |

| Alaska | 0.98% | 0.97% |

| Hawaii | 1.31% | 1.30% |

| Canada Quarterly Material Cost Changes | ||||||||||

| 4Q18 | 1Q19 | 2Q19 | 3Q19 | 4Q19 | 1Q20 | 2Q20 | 3Q20 | 4Q20 | 1Q21 | |

| Aluminum Conduit | -0.5 | 1.6 | 1.8 | 1.9 | 1.5 | 0.8 | 1.1 | 0.1 | 0.6 | 0.0 |

| Concrete Block | 0.7 | 0.3 | 2.1 | 1.1 | 0.7 | 0.7 | 0.4 | 0.1 | 1.1 | 0.1 |

| Drywall | 1.1 | 2.1 | 2.0 | 1.2 | 0.8 | 0.3 | 0.1 | 0.2 | 0.4 | 0.4 |

| Galvanized Pipe | -0.3 | 0.5 | 1.9 | 1.2 | 1.9 | 1.6 | 1.6 | 1.3 | 1.7 | 1.5 |

| Ready Mix | -0.1 | 0.7 | 2.4 | 0.8 | 1.1 | 0.0 | 2.2 | 1.5 | 2.5 | 2.0 |

| Rebar | 1.2 | 0.1 | -0.7 | -1.6 | -1.6 | -0.6 | -1.1 | 0.2 | -0.5 | 0.2 |

| Steel Deck | 0.3 | 0.1 | 1.1 | 0.9 | 0.8 | 1.7 | 0.8 | 1.1 | 1.4 | 0.2 |

| Steel Stud | 2.0 | 2.4 | 2.0 | 1.1 | 0.7 | 0.9 | 0.9 | 1.0 | 0.8 | 0.4 |

| Structural Steel | 0.9 | 0.8 | -0.6 | 0.8 | 0.3 | 0.5 | 0.6 | 0.3 | 0.2 | 0.4 |

| ½” Cooper Pipe | 0.0 | 1.8 | 2.2 | 0.4 | 1.0 | 1.8 | 1.5 | 0.4 | 0.5 | 0.2 |

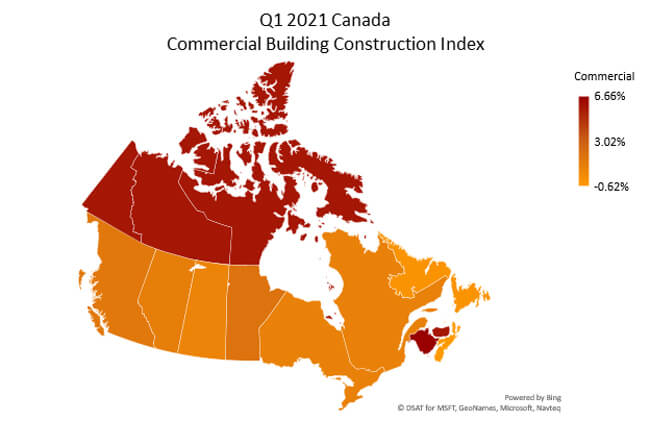

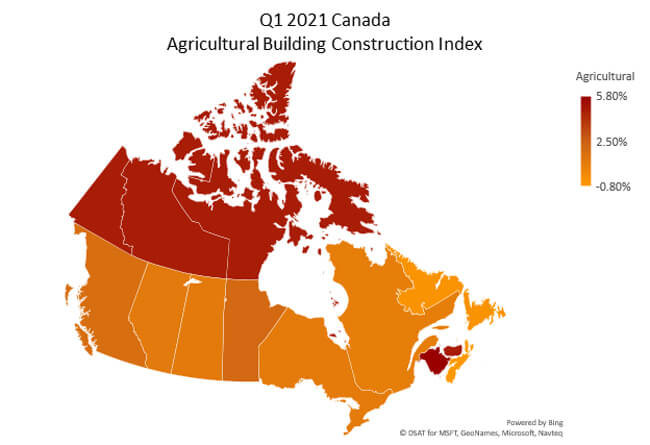

| Province | Commercial | Agriculture |

| Alberta | 1.13% | 1.02% |

| British Columbia | 1.49% | 1.71% |

| Manitoba | 1.81% | 1.98% |

| New Brunswick | 6.66% | 5.80% |

| Nova Scotia | -0.62% | -0.80% |

| Ontario | 0.94% | 0.91% |

| Quebec | 0.94% | 0.76% |

| Saskatchewan | 0.72% | 1.00% |

| Newfoundland & Labrador | 0.25% | -0.46% |

| Prince Edward Island | 5.78% | 4.80% |