Home / Insurance / Hazard Risk Solutions / Wildfire Mitigation Score

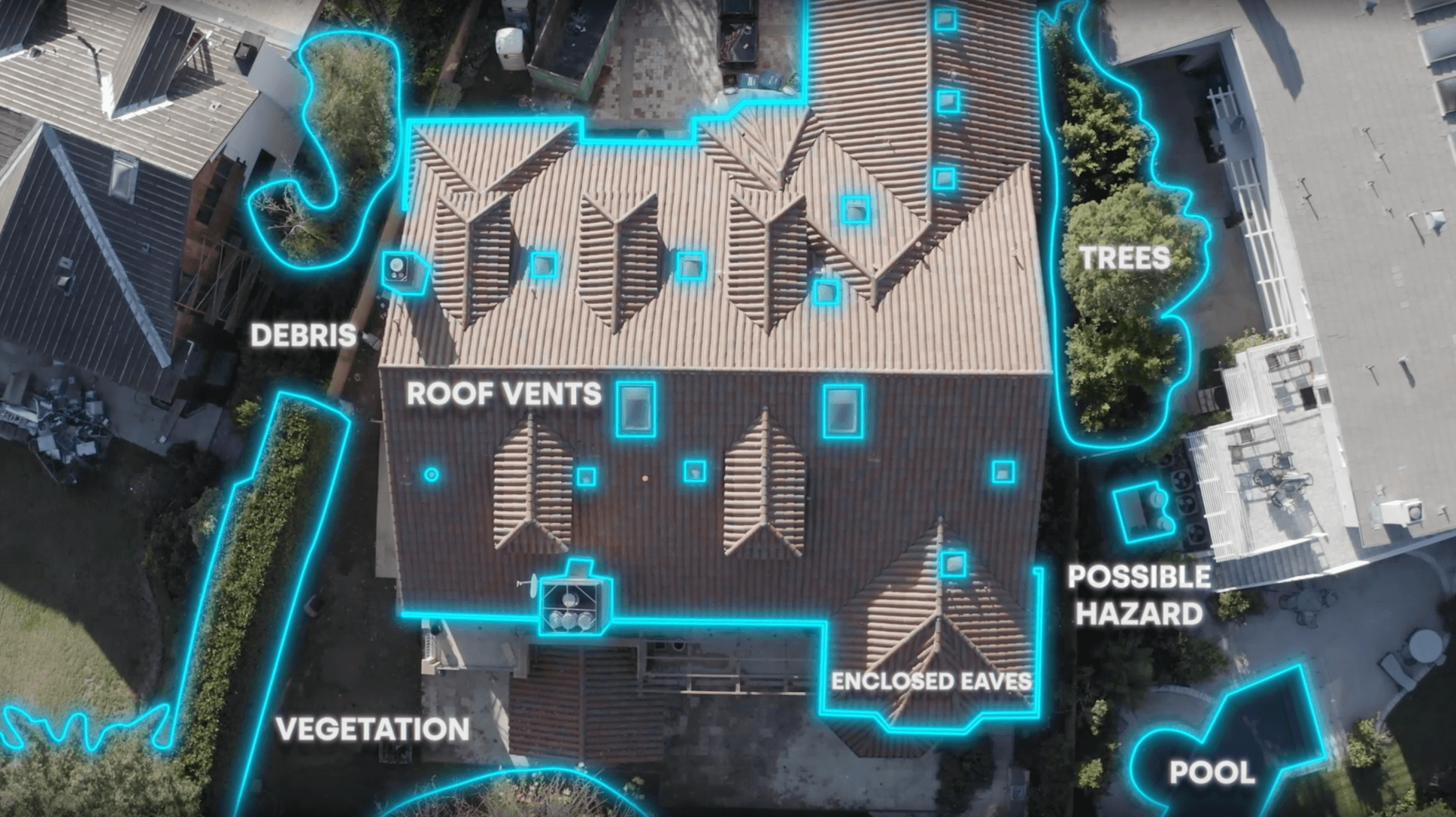

Built for insurers, lenders and other service providers impacted by systemic changes to wildfire regulations, CoreLogic®️ Wildfire Mitigation Score™️ provides a measurement of wildfire risk on any property — all on a straightforward scale of 0.1 to 100. Wildfire Mitigation Score incorporates all mandated community, property and structural mitigation efforts taken to lower the risk of wildfire damage on structures in the state of California.

CoreLogic’s Wildfire Mitigation Score provides insurers with a simple mechanism for measuring risk and mitigation factors that can be incorporated into rating systems utilizing unique business guidelines, all while remaining compliant with the California Department of Insurance’s newest regulations. Built on a 30×30 meter grid, Wildfire Mitigation Score provides a foundation for insurers to build compliant business systems and differentiate risk between properties to assess potential loss.

With an easy-to-understand scoring scale, the score is designed to easily integrate into any workflow to help comply with new standards.

CoreLogic Wildfire Mitigation Score allows insurers to fully understand the impact of wildfire risk on their portfolios. The scoring system is structured using the industry’s most comprehensive property dataset and enhanced analytics of residential and commercial properties. With this proprietary real property data, combined with unique deterministic and probabilistic models, insurers can plan and strategize for the looming threat of wildfire-related events

The CoreLogic Wildfire Mitigation Score also provides clear insights for operators outside of the insurance industry, allowing everyone to understand the impacts of wildfire risk and mitigation efforts on properties. This includes lenders who must recognize when lending may pose greater risks and where loss may occur; governments that need to reduce disaster assistance costs; and borrowers who must understand the financial and safety risks of purchasing certain properties.

Understanding wildfire hazard risk and associated mitigation actions leads to greater success for anyone who must make property-related decisions.