Have Appraisals Caught up to a Fast-moving Market or Has the Market Slowed?

- In May 2021, 1-in-5 purchase-home loan applications had an appraisal gap (meaning the estimated value in the appraisal is lower than the agreed upon contract price) that averaged 4.5% below buyer’s offer price.

- The frequency of an appraisal gap has since closed quickly after rising rapidly between January and May 2021.

- The decline in the appraisal gap occurred amid the fastest-rising annual home prices on record but weakening month-to-month price momentum.

- Slowing month-to-month prices lessens the impact of the lag time in recent comparable sales, so fewer or smaller market condition adjustments are needed on the sales data.

The housing market’s recovery in summer 2020 from the outbreak of the pandemic was largely unexpected: by July, despite a high unemployment rate with more than 16.3 million people out of work, home sales rebounded strongly to climb back to pre-pandemic levels and surpassed the same-period sales from a year ago.

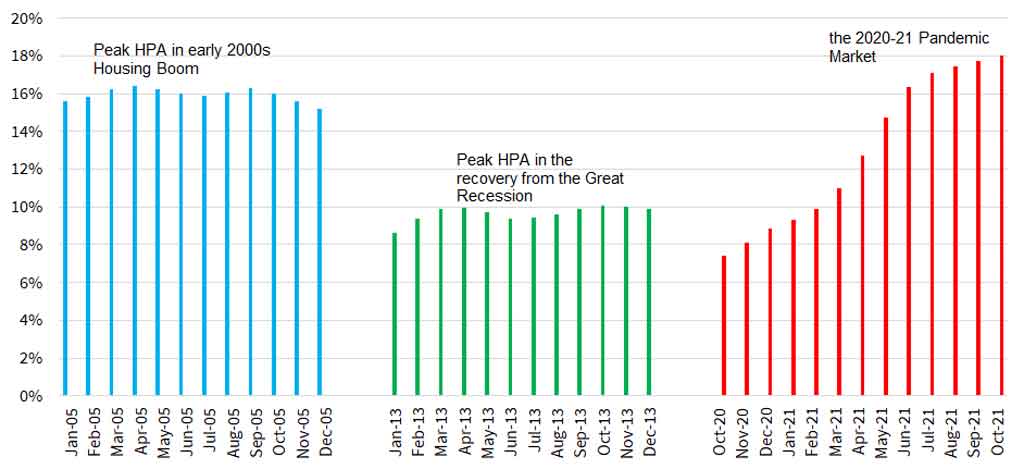

Surpassing expectations, the post-pandemic housing market may be the hottest on record: Judging by the 12-month movement in the CoreLogic National Home Price Index (HPI), the 2020-21 pandemic housing market has recorded the fastest annual home price appreciation (HPA) in the 45-year history of the CoreLogic National HPI.

Figure 1: The 2020-21 Pandemic Market has the Fastest Rising Home Prices on Record

However, homebuying in the hottest market carries a greater risk of overpaying as the market conditions often encourage higher offer prices and frenzied bidding wars. If buyers are financing the home, they could see the appraised value come back below the sales contract price to raise the loan-to-value ratio and affect the loan’s approval.

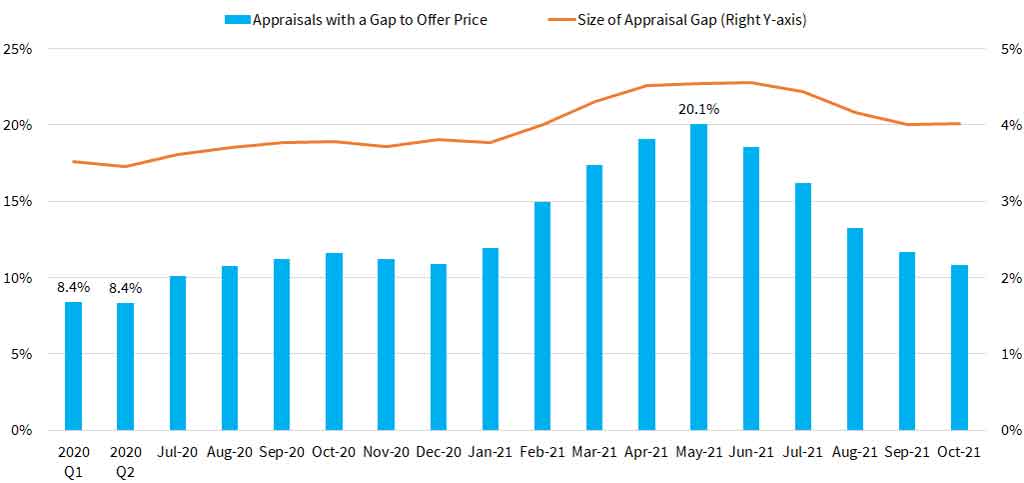

It is no surprise that increased pandemic homebuying has sent the frequency of an appraisal gap to unprecedented levels. Shown in Figure 2 below, by May 2021 as many as 20% of purchase-home loan applications had appraisal come back below buyer’s offer price, up 140% from the rate seen in the first half of 2020.

Figure 2: The Rise and Fall of the Appraisal Gap during the Pandemic-National View

The second half of 2020 saw a small uptick in loans with appraisal gaps, but it wasn’t until the start of 2021 that the acceleration quickly picked up. In a matter of months, the percentage of appraisals falling short of buyer’s offer price climbed from 11.9% in January 2021 to 20.1% in May 2021. The acceleration is also accompanied by a widening difference between the appraised value and offer price. In May 2021, the median difference between a home’s appraised value and buyer’s offer price was 4.5%, up from 3.5% seen in the first half of 2020.

The risks of overpaying amid an inventory shortage and bidding wars are just some of the reasons why the frequency and severity of an appraisal gap has increased. For appraisers, fast-rising home prices also present challenges. Fast-rising home prices can render recent comparable home sales—the primary basis for appraisers to develop an independent estimate of a house’s fair value — relatively obsolete quickly, giving rise to appraisal data lags if recent comparable home sales are insufficiently adjusted to current market conditions. A recent CoreLogic Intelligence blog observed just that and attributed the surge in appraisal gap to the impact of fast-moving housing market.

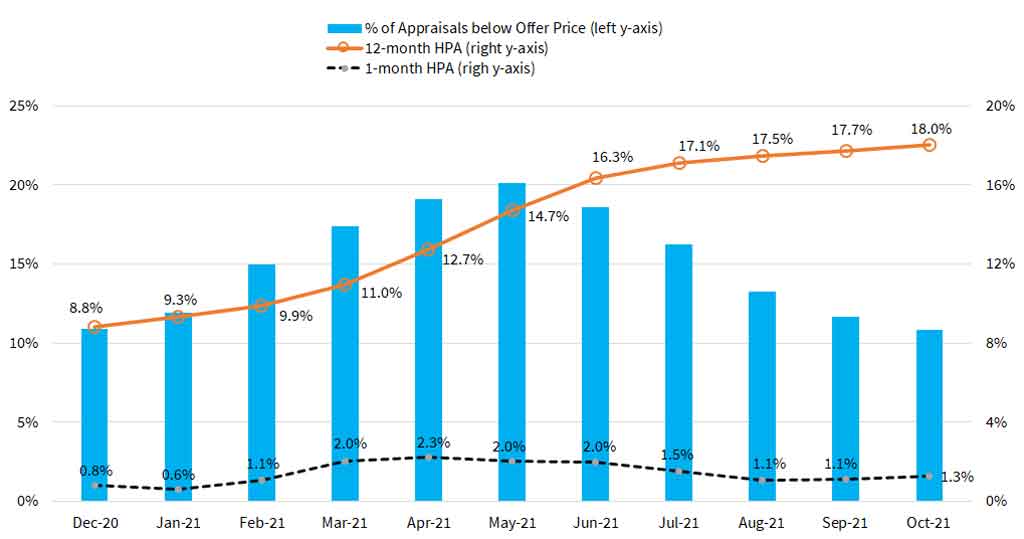

Figure 3 below plots appraisal gap frequencies along with 12-month and 1-month home price movements. It shows a precipitous decline in appraisal gap frequencies amid the fastest-rising annual home prices on record – at a time when one may expect the impact of lags in recent comparable home sales to have persisted. After peaking in May, appraisals with a gap to buyer’s offer price have fallen just as rapidly as they have risen in the months earlier to just about a half of the peak rate.

Figure 3: Appraisal Gap and Home Price Growth

What explains the decline in appraisal gap frequencies in the fastest rising market? If the risks of overpaying and overbidding may have contributed in part to the rising appraisal gap frequencies , then it is rather unconvincing to suggest that the same risks may have subsided at a time when bidding wars and buyers paying higher premiums to secure those winning bids have likely continued and possibly intensified. According to the CoreLogic MLS data, the share of homes selling at or above list price reached new highs in August.

While not ruling out the impact of heated homebuying and bidding wars on the appraisal gap, a more likely scenario is that appraisals may have caught up with the fast-moving market after they were initially impacted by lagging comparable sales data. Additionally, iIt is plausible that after months of rapid home price appreciation, appraisers have become more confident and adept at incorporating market condition adjustments into recent comparable sales, thus negating the appraisal data lag between recent comparable sales and current purchase transactions.

As shown in Figure 3, month-to-month price growth has slowed since April. Subsiding month-to-month price momentum means that the need or the size of required market condition adjustments to calibrate recent comparable sales have likely become fewer or smaller, making it less likely for the appraised transaction to be impacted by the lag in the comparable sales data..

While the rise and fall in appraisal data lag may offer an understanding of the rise and fall of the frequency of an appraisal gap, its significance remains an empirical question and is worthy of further analysis. Home prices are expected to grow at a slower and more sustainable pace in 2022. That means we can also expect frequency of an appraisal gap being present in a purchase transaction to return to the 7-9% levels that prevailed before the pandemic.