ARM shares were highest in expensive metro areas

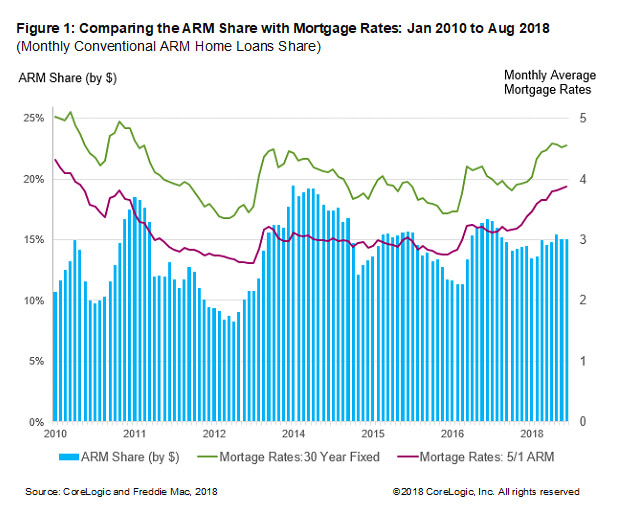

The average mortgage rates on both 30-year fixed-rate mortgages (FRMs) and 5/1 adjustable-rate mortgages (ARMs) jumped by about 70 basis points from August 2017 to August 2018.[1] After the housing bubble burst, FRMs have been far more popular than ARMs. The ARM share of the dollar volume of conventional loan originations precipitously dropped from more than 50 percent during mid-2005 to a low of 4 percent in early-2009. Since then, the ARM share has fluctuated between about 8 and 18 percent, generally rising when FRM rates increase and falling when FRM rates decline (Figure 1). However, the ARM share has not changed from last year despite the rise in the mortgage interest rate. As of August 2018, ARMs accounted for 15 percent of the dollar volume of conventional single-family mortgage originations.

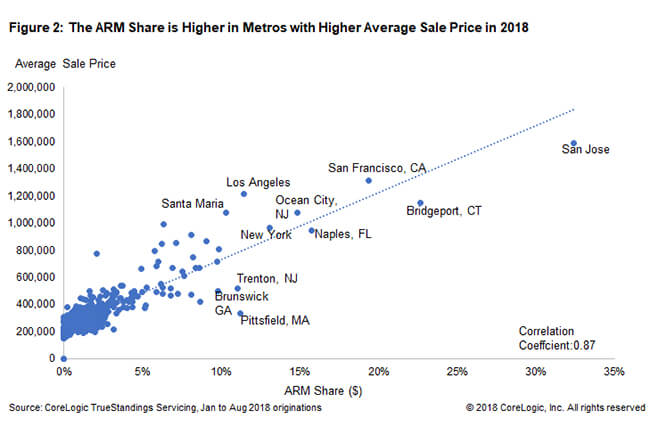

Though the national ARM share has remained roughly stable since 2010, the ARM share varies significantly across locations and by loan sizes. ARMs are more common in expensive areas and among homebuyers borrowing large-balance mortgage loans than for those with smaller loans. As ARMs have a lower initial interest rate than FRMs, buyers see bigger monthly savings in the initial payment, especially for bigger loans. Figure 2 plots the average sale price against the ARM share for metro areas in 2018 (January to August).[2] There is a strong relationship between the average sale price and the ARM share. The ARM share is higher for metros with higher average sale price. For example, the San Jose metro had the highest average sale price and the largest share of ARMs out of all conventional mortgage originations in 2018 (through August).

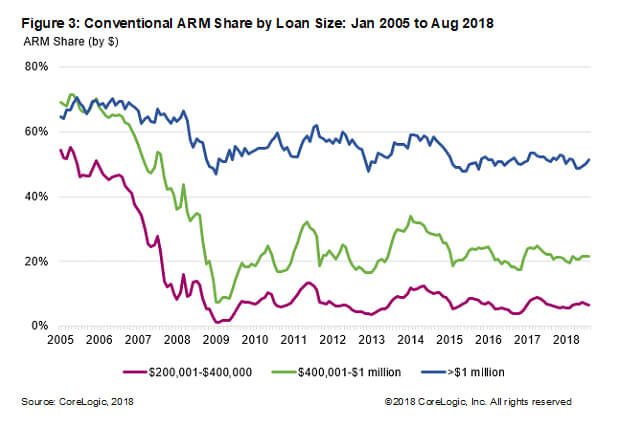

Among mortgages of more than $1 million originated during August 2018, ARMs comprised 51 percent of the dollar volume, unchanged from August 2017 (Figure 3). Among mortgages in the $400,001-$1 million range, the ARM share was about 21 percent, down 1 percentage point from August 2017. However, among mortgages in the $200,001-$400,000 range, the ARM share was just 7 percent for August 2018, unchanged from August 2017.

Historically, demand for ARMs have been affected by the level of FRM rates and by the difference in initial interest rates between FRMs and ARMs, among other factors. The higher default rates on ARMs during the housing crash and stricter underwriting requirement of lenders in recent years may have discouraged ARM volume.[3] Also, another factor may be the lengthening period of expected ownership.[4] An ARM may be a bargain for a borrower who doesn’t plan to stay in their home that long. However, for homeowners who expect to remain in their home a long time, relatively low FRM rates, albeit higher than a year ago, continue to remain attractive.

[1] The rate on 30-year FRMs surged to 4.55 in August 2018 from 3.88 in August 2017. Similarly, the rate on 5/1 ARMs rose to 3.87 in August 2018 from 3.15 in August 2017 (Source: Freddie Mac).

[2] Metro areas used in this analysis are Core Based Statistical Areas.

[3] Underwriting standards were relaxed during the boom period as numerous risky products were available. These included the option ARM and the interest-only ARM. The underwriting guidelines also didn’t always require verification of borrower’s ability to repay. The ARMs today are very different than the pre-crash ARMs.

[4] Both CoreLogic data and government survey data for all homeowners shows a lengthening of ownership period.

© 2018 CoreLogic, Inc. All rights reserved