A magnitude (M) 6.4 earthquake shook the residents of Northern California’s Humboldt County at 2:34 a.m. PST (10:34 UTC) on Dec. 20.

The earthquake hypocenter was located approximately 15 km (9.3 miles) southwest of Ferndale, California at a depth of 18 km (11.2 miles), according to the U.S. Geological Survey (USGS). The earthquake occurred near the Mendocino Triple Junction where the Pacific, North America and Juan de Fuca plates meet. The USGS has cataloged more than three dozen smaller aftershocks across Northern California associated with the M6.4. The National Oceanic and Atmospheric Administration (NOAA) reported no tsunami threat.

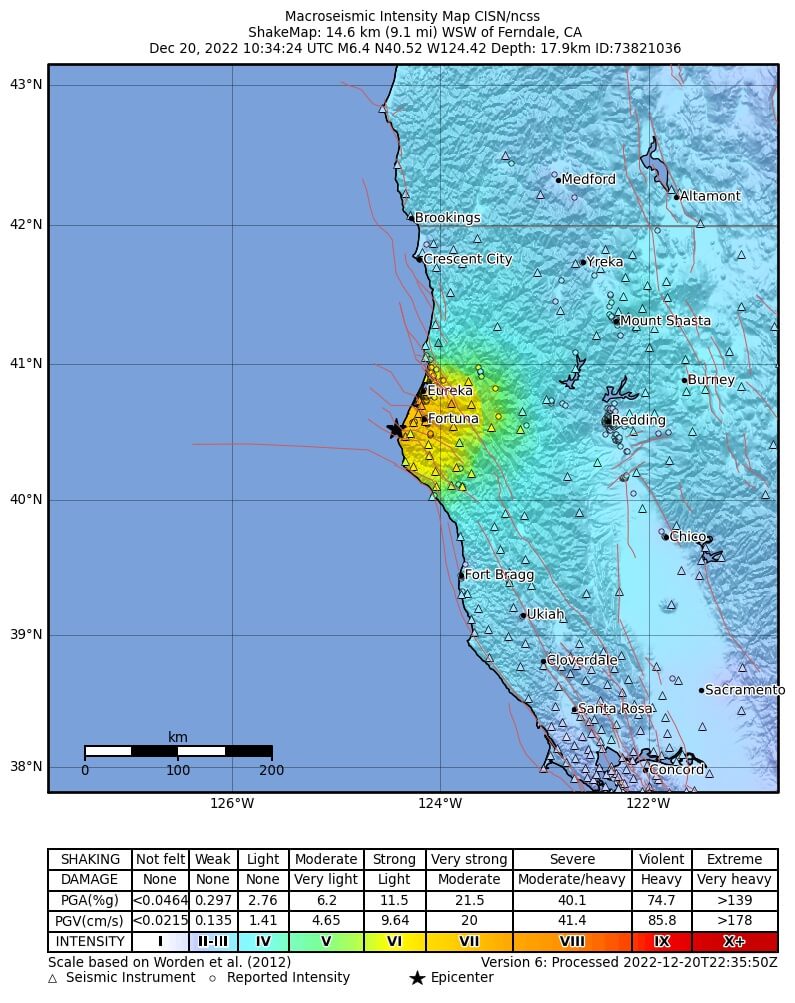

The USGS recorded ground shaking across Northern California with Modified Mercalli Intensity Scale (MMI) values of up to VIII in select areas of Humboldt County. Tremors were reported from Medford, Oregon to San Jose, California. The most intense ground shaking was reported in the California cities of Ferndale, Fortuna and Eureka (Figure 1).

Figure 1: Ground Shake Intensity from the Dec. 20 M6.4 Earthquake.

Local and federal authorities are performing initial damage assessments across Humboldt County. There is reported damage to infrastructure, such as roads and bridges, as well as utilities such as power, gas and sewer lines. Over 70,000 customers (approximately 70% of the county total) are without power in Humboldt County as of 9 a.m. PST, according to poweroutage.us.

According to the USGS, structures in this area of Northern California are resistant to earthquake shaking, which should reduce the total economic and insured losses from this event. However, secondary earthquake hazards like landslides and liquefaction may damage roads and property and contribute to the total loss figure.

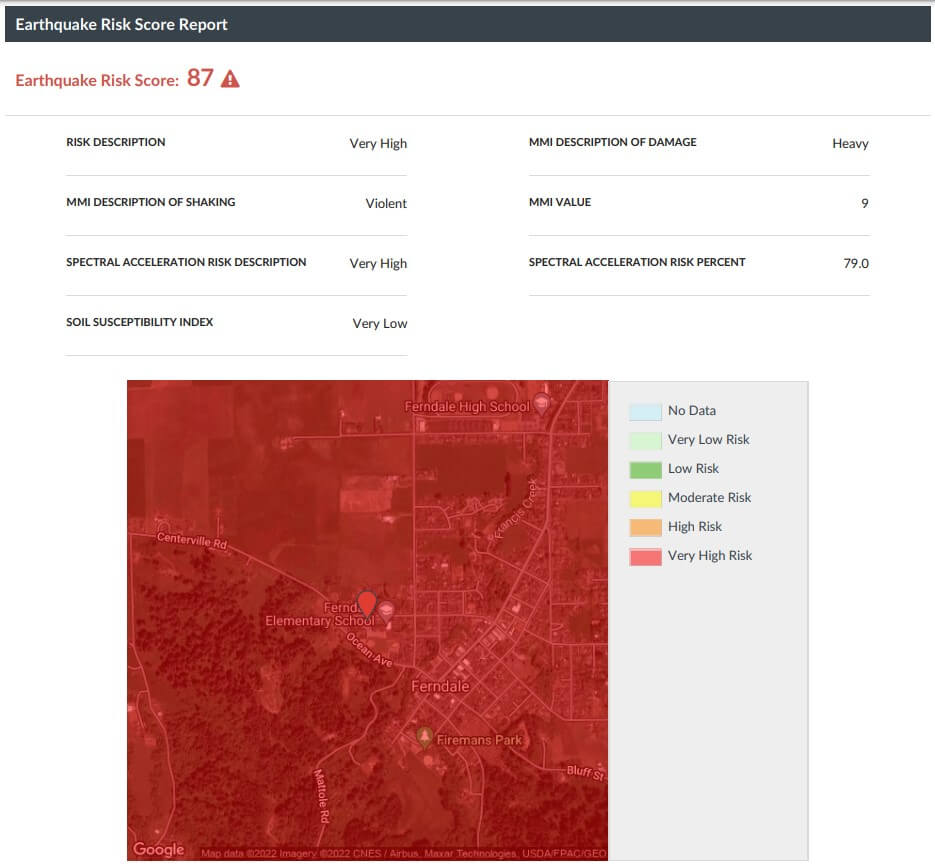

CoreLogic has computed Earthquake Risk Scores, on a scale of 1 to 100, for more than 150 million parcels nationwide (Figure 2). The Risk Score combines the degree of structure shaking with the effect of the local soil conditions on stability based on the 475-year hazard return period. The potential for certain soil types to fail, which can lead to liquefaction and landslides, is based on the degree of ground shaking and is captured in the Soil Susceptibility Index.

Figure 2: Sample CoreLogic Earthquake Risk Score Report as Viewed in Risk Meter.

Visit CoreLogic Hazard Risk Solutions for more information about earthquake risk in your area.

The CoreLogic Event Response Team is monitoring the situation in Northern California. Updates will be posted to http://hazardhq.com if more information becomes available.