For lenders to successfully grow or maintain market share, they must focus on retaining current customers and actively prospecting for new high-quality customers. Strong customer service, offering competitive products at an economical price point, and implementing marketing campaigns are all effective strategies. In addition, lenders often rely on internal or external marketers to research and develop advertising campaigns that will resonate with their ideal customer.

With over 90 million single-family residences in the U.S., it’s difficult to know which customers to target. There are known indicators of the likelihood to list a home, such as rising home prices, real estate equity, and interest rates. But when there is a healthy market with a high refinance origination rate, do you send marketing materials to every house in the market, or target using filters related to available equity, recent activity and demographic profiles? Or, perhaps a better option is to use AI to understand the factors that indicate a propensity to refinance.

Recent Trends

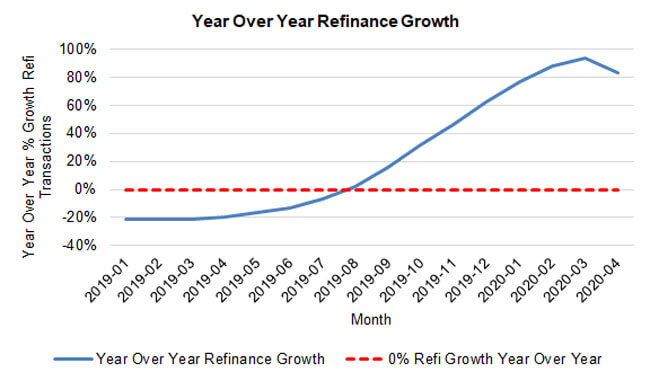

With the recent decrease in interest rates, the number of refinance applications is growing significantly year-over-year. Figure 1 below illustrates the year-over-year growth from January 2019 to March 2020. In January 2019, refinance transactions decreased 20% compared to January 2018. However, by March 2020, refinance loan counts were about 80% higher than January 2019.

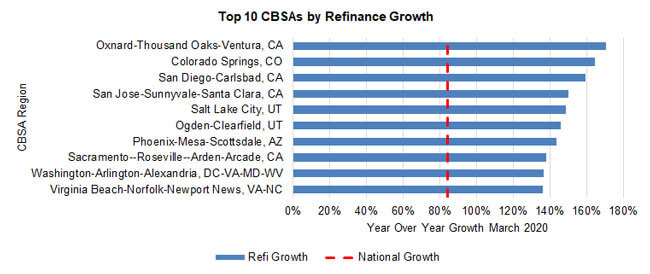

The refinance growth and amount, however, varies by Core Based Statistical Areas (CBSA). Figure 2 below illustrates the top 10 CBSA refinance growth year-over-year from January 2019 to March 2020. The top 10 CBSA growth rates are substantially above that of the overall U.S., varying from 35% to 70% above the national average.

Leveraging AI for Targeted Marketing

Using AI and comprehensive property and loan origination data, it becomes possible to assign a value to every home in the U.S. that quantifies the likelihood of a refinance application in the next six months. Many factors contribute to the propensity to refinance. For example, the proportion of properties listed for sale in a geographical segment is a predictor of a refinance for several reasons. One reason is when fewer properties are listed for sale, the available housing supply is limited. Therefore, if real estate equity is high and interest rates are low, customers may look to refinance and cash-out some equity in order to invest in improvements or additions in their current property.

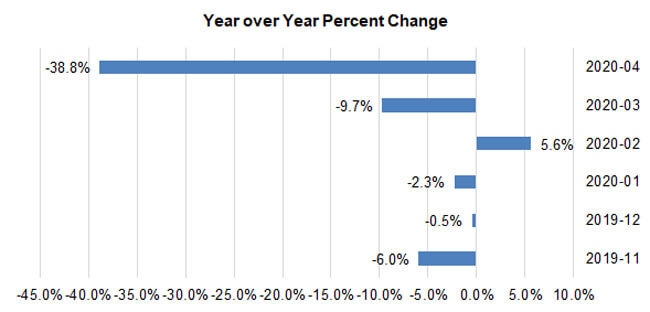

Figure 3 illustrates that MLS sales listing volumes can vary significantly each month when compared to the previous year. While the effect of shelter-in-place directives resulting from the COVID-19 pandemic is clear in the sharp decline in listings in March and April 2020, there is evidence of significant monthly variation is the months prior to COVID-19. MLS sales listings varied each month, from -6.0% to +5.6%, from November 2019 to February 2020 when comparing to the prior year.

Propensity scores are useful in understanding expectations at a macro level. For example, the top 20% of scores in the US are more than twice as likely to have a refinance loan originated in the next six months. When looking at geographical regions, some areas have a higher expected proportion of properties that will be refinanced than others. Table 1 below illustrates the current top 10 CBSAs by high score index which measures the proportion of high scored properties in that region. The average high score index is approximately 100, and any region with an index of 150 or greater could be considered a hot market for refinances.

| CBSA | High Score Index |

|---|---|

| Colorado Springs, CO | 189 |

| Ogden-Clearfield, UT | 186 |

| Denver-Aurora-Lakewood, CO | 179 |

| Las Vegas-Henderson-Paradise, NV | 176 |

| Boise City, ID | 175 |

| Salt Lake City, UT | 173 |

| San Diego-Carlsbad, CA | 162 |

| Phoenix-Mesa-Scottsdale, AZ | 158 |

| Portland-Vancouver-Hillsboro, OR-WA | 154 |

| Riverside-San Bernardino-Ontario, CA | 153 |

*High Score Index is a measure of the percent of properties above a specific score threshold. An index of 100 means the percent of properties in the CBSA above the national threshold is the same as the percent above the threshold in the overall US. An Index of 150 means the percent of properties in the CBSA above the national threshold is the 50% greater than the percent above the threshold in the overall US.

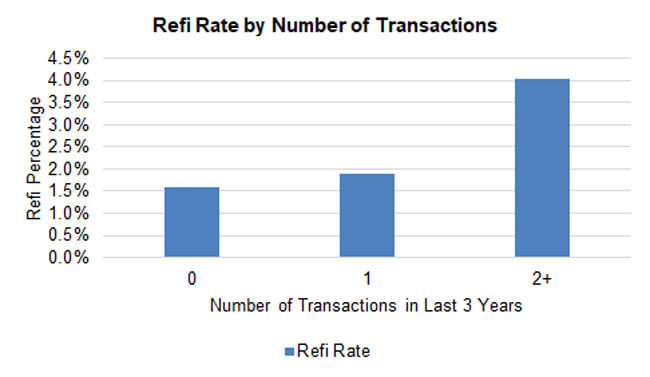

Not only can propensity scores be used to measure expectations on a macro scale, they can also be utilized to assign a value to every home in the U.S. Even markets with overall lower refinance rates have properties with a high likelihood to refinance making them prime targets for marketing campaigns. Factors such as being owner occupied and historical origination transactions can contribute to the likelihood of refinance as well. For example, a refinance is more than twice as likely if there are two or more transactions recorded on the property in the last three years compared with a single transaction, as illustrated in Figure 4.

Conclusions:

Lenders and marketers can retain current customers and actively prospect for new high-quality customers while optimizing expenses. There are many factors and complex relationships that indicate the likelihood of a refinance loan application. With AI, CoreLogic® advanced modeling capability and an extensive data warehouse, those complex relationships can be distilled into a single score that quantifies the propensity of a refinance loan application in the next six months. Using this score, a marketing program’s success rate can more than double. It can also be used to understand opportunities at a macro-level, especially when looking to target or grow market share in specific geographic areas. And, this intelligence can even be delivered through custom digital audiences including via bulk data transfers, match and append services and RESTful APIs. With an increase in refinances in the past year, optimizing your program is more important than ever.

Sources:

1. CBSAs: https://www.census.gov/topics/housing/housing-patterns/about/core-based-statistical-areas.html

2. MLS: Source for Sales listings

© 2020 CoreLogic, Inc. All rights reserved.