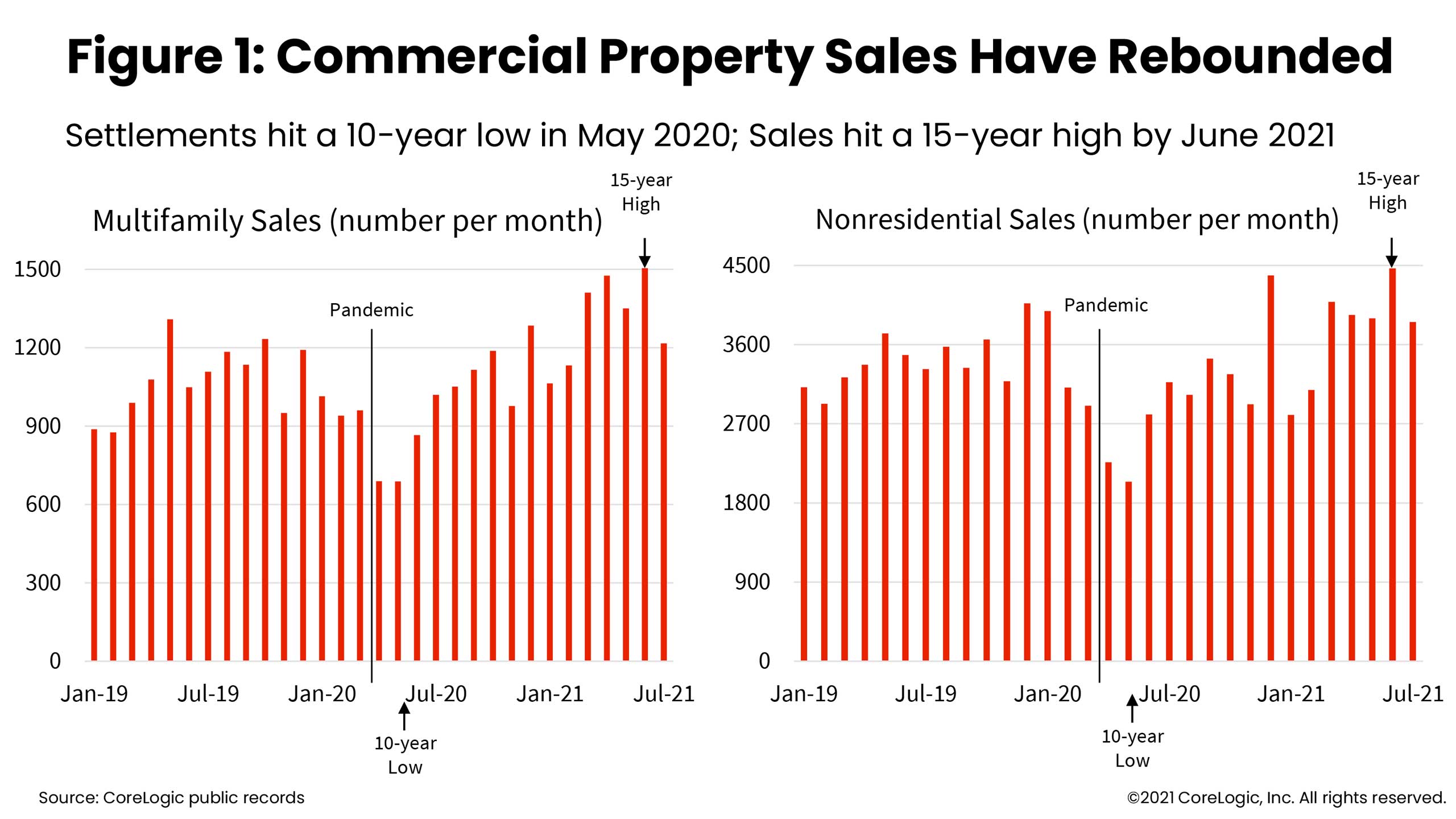

Sales hit a 10-year low in May 2020, and a 15-year high in June 2021

Much like other parts of the U.S. economy, commercial property sales fell when the pandemic began. By the second full month of the pandemic, settlements on commercial real estate transactions were about one-half the prior year’s level, hitting a 10-year low in May 2020 and down nearly 50% from one year earlier.

The commercial property market rebounded strongly as the economic recovery began and financing costs fell to record lows.[1] By June 2021 apartment building and nonresidential sales reached a 15-year high, the largest sales count since June 2006.

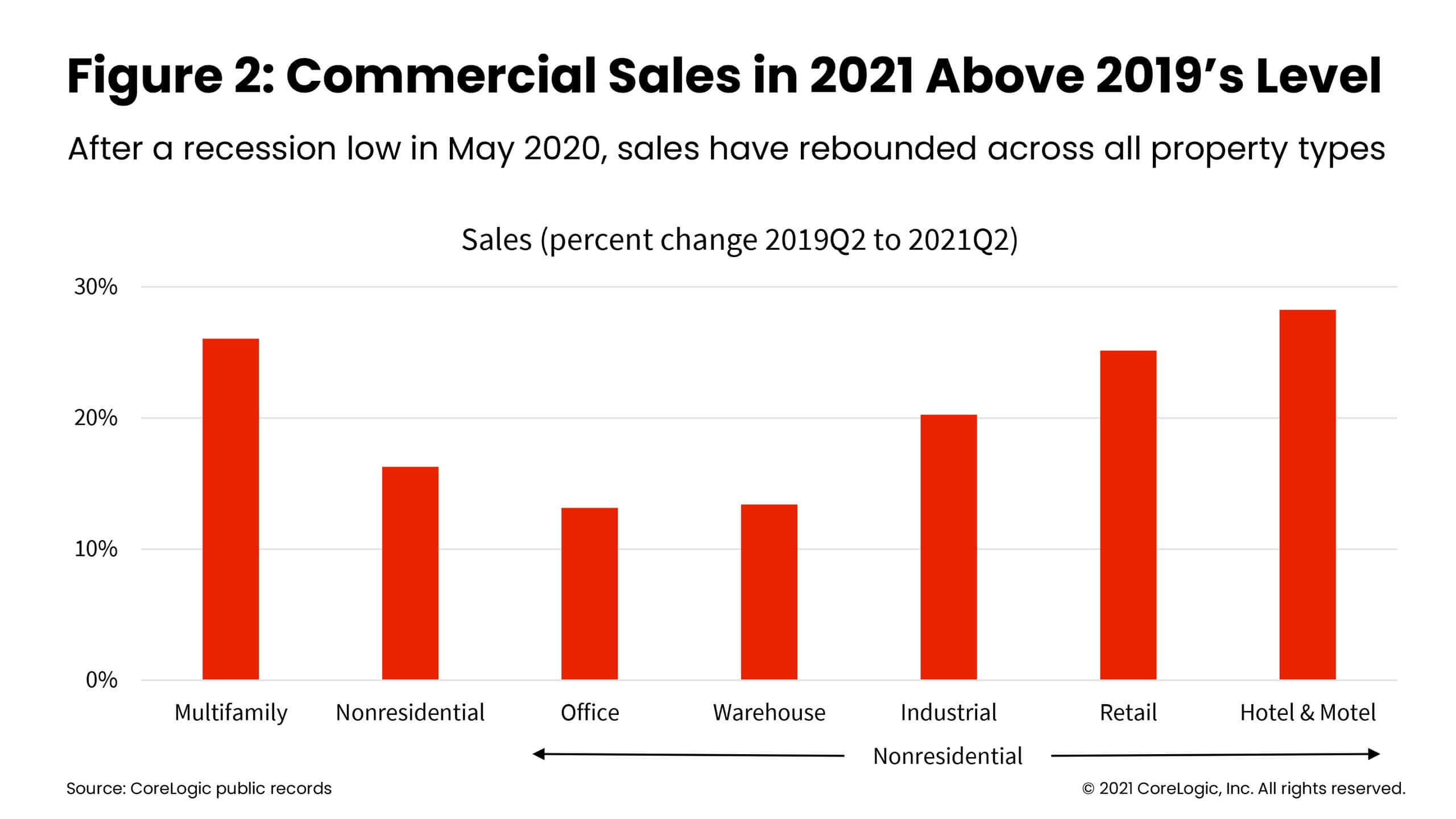

The pickup in sales occurred across all major property types and pushed settlements higher than the year before the pandemic.

Comparing the second quarters of 2019 and 2021, property sales were up 26% for multifamily and 16% for non-residential properties, with increases across all property categories.

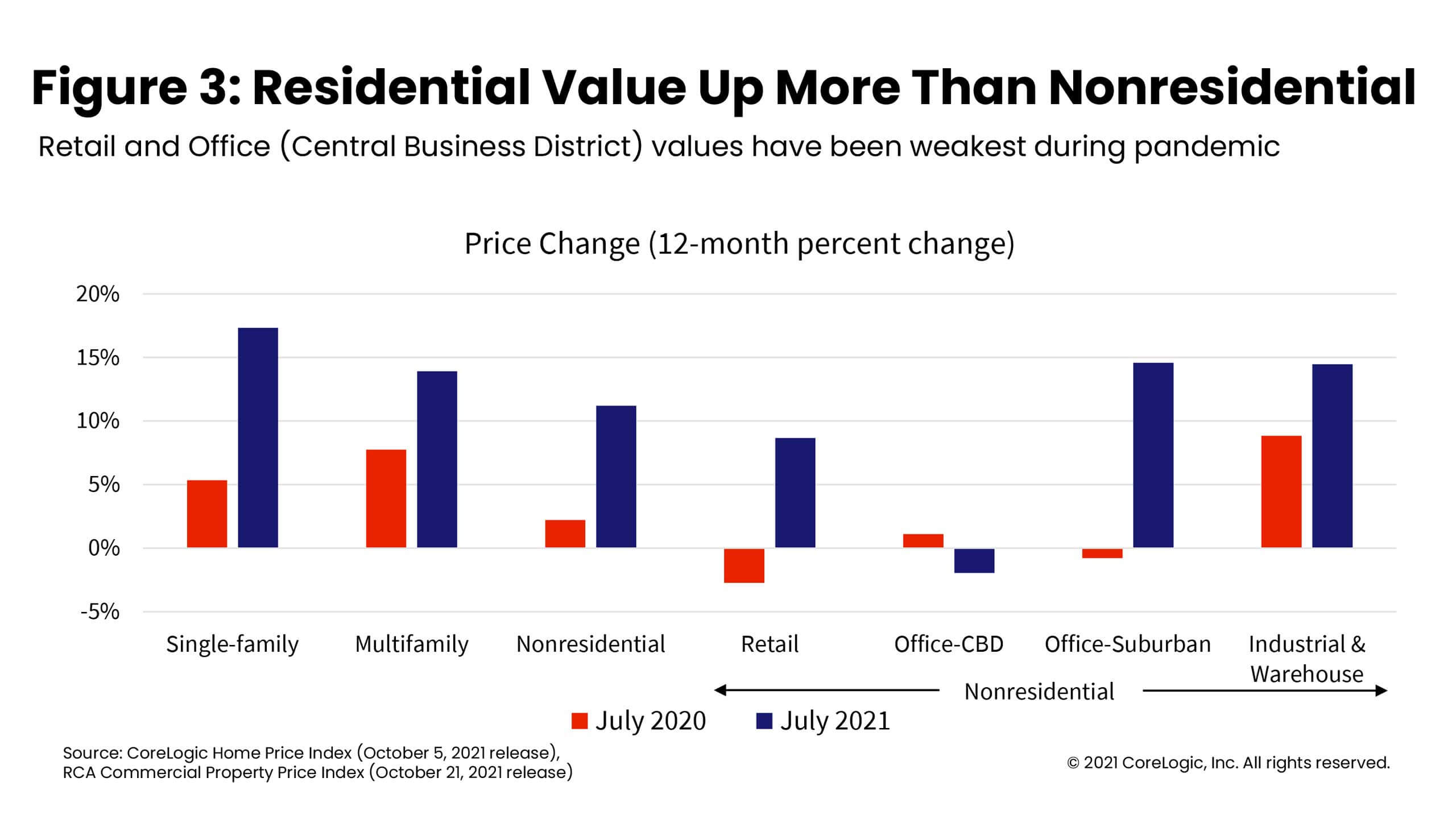

A decline in cap rates during the last year has supported commercial property values. Job growth and rising single-family home prices have increased demand for apartments, leading to lower multifamily vacancy rates in recent months and an increase in building values.

The pandemic has also increased demand for warehouses to support online shopping and for properties in places with a lower population density, such as suburbs rather than central business districts. As a result, garden-style apartment buildings, suburban office and industrial-warehouse prices were up double-digits in July, although still less than single-family homes.

The commercial property market took a big hit at the onset of the pandemic, but sales and prices have recovered for most properties, especially in suburban locations. The consensus view is that commercial property sales will increase in the coming year. Price growth is also projected to moderate from 2021’s pace but remain above the average of the past 20 years.[2]

Summary:

- Commercial property sales fell when the pandemic began and have rebounded.

- Property sales are higher than just before the pandemic: compared with two years earlier, sales in 2021Q2 were up 26% for multifamily and 16% for nonresidential.

- The pandemic increased demand for warehouses and suburban properties, with prices up more than 10% during the last 12 months.

[1] For multifamily loans, ACLI mortgage commitments data show that mortgage rates have been below 3% from October 2020 through June 2021, and capitalization rates for fixed-rate loans reached a new low during the second quarter of 2021. Both mortgage rates and capitalization rates are the lowest recorded by ACLI since the inception of their time series in 1965.

[2] ULI Real Estate Economic Forecast, October 2021.

** Note: Yanling Mayer tabulated the data for Figure 1 and 2.