Tenants prefer houses over apartments during pandemic in many nations

The U.S. has experienced record annual home-price growth with faster appreciation for detached houses than attached homes. A similar pattern has occurred for rent growth, and that experience is not unique to the U.S.

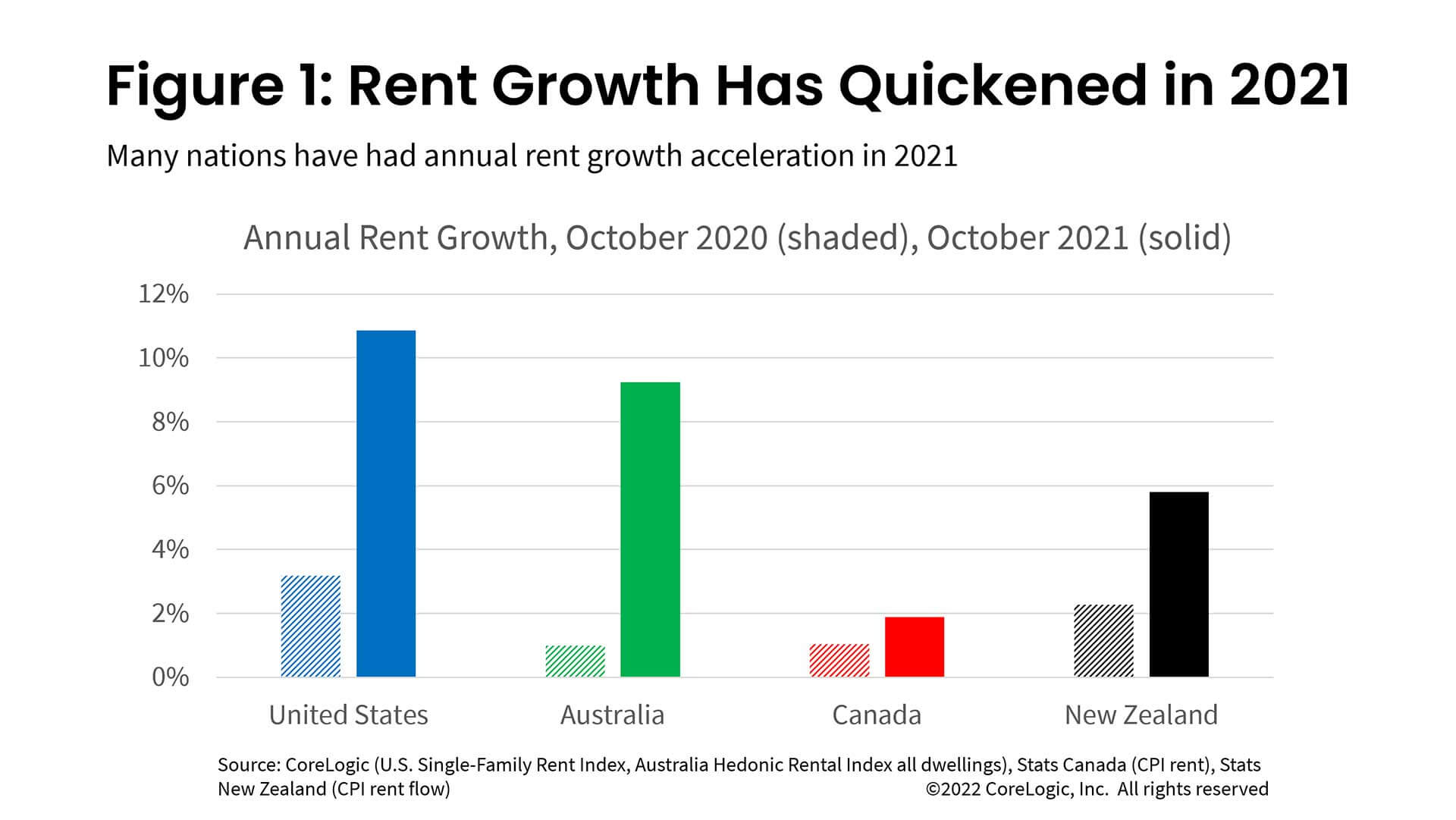

The CoreLogic Single-family Rent Index has found an acceleration in annual rent growth to the highest recorded since the series’ inception in 2005. The double-digit rise of the past year is eight percentage points faster than measured one year earlier. Likewise, the CoreLogic Hedonic Rental Index for Australia has also accelerated a similar amount. Rent growth in Canada and New Zealand is about double what it had been a year ago.[1] (Figure 1)

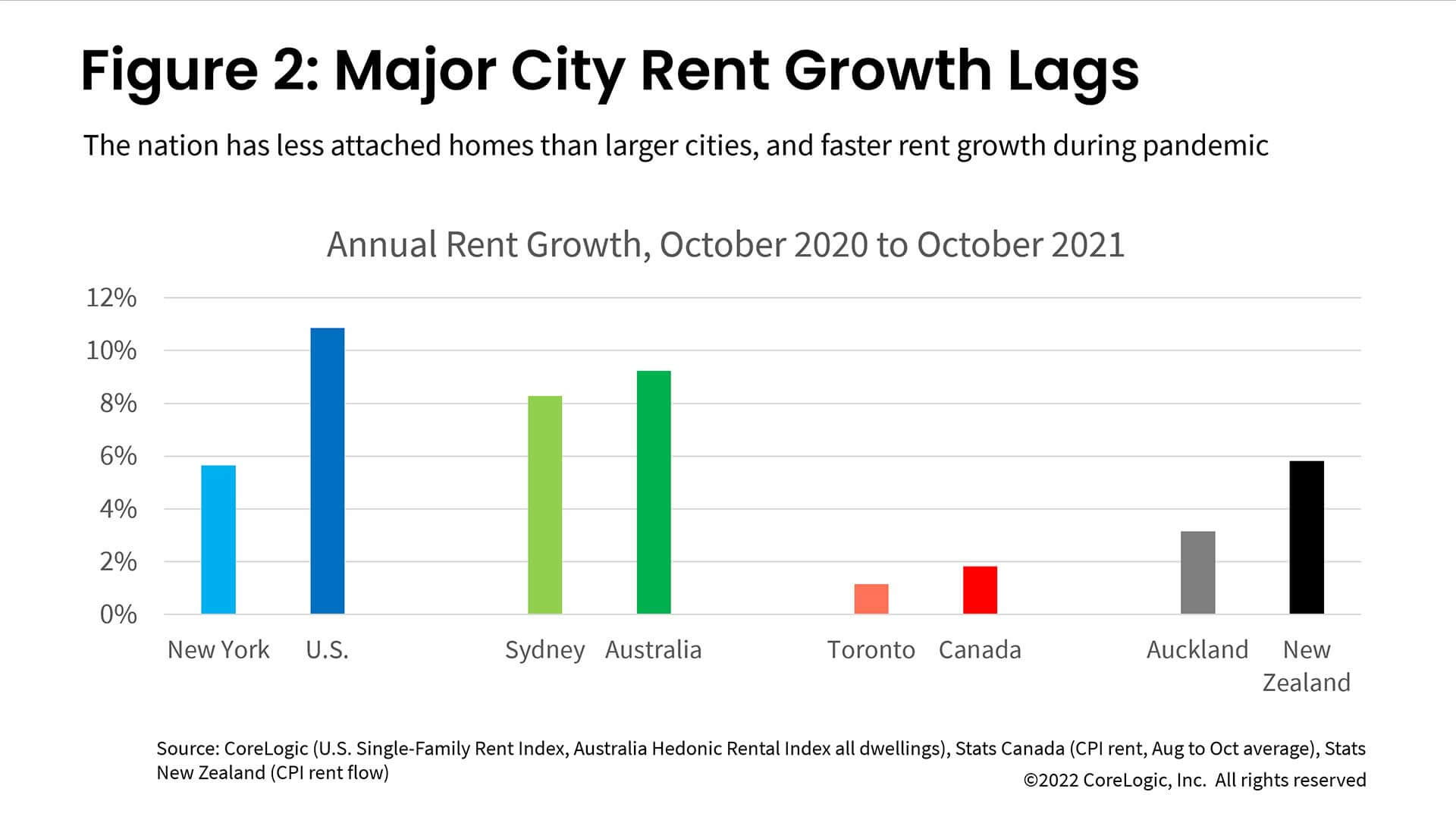

Rent growth is up in most cities too, albeit not equally across the country. Large cities with high population density and relatively few detached houses generally experienced slower rent growth compared to other places this past year, as prospective tenants often sought homes in suburban and exurban communities. To illustrate, single-family rent growth in the New York City area was about one-half that of the U.S. Sydney, Toronto, and Auckland also experienced annual rent growth that was less than for their respective nation. ( Figure 2)

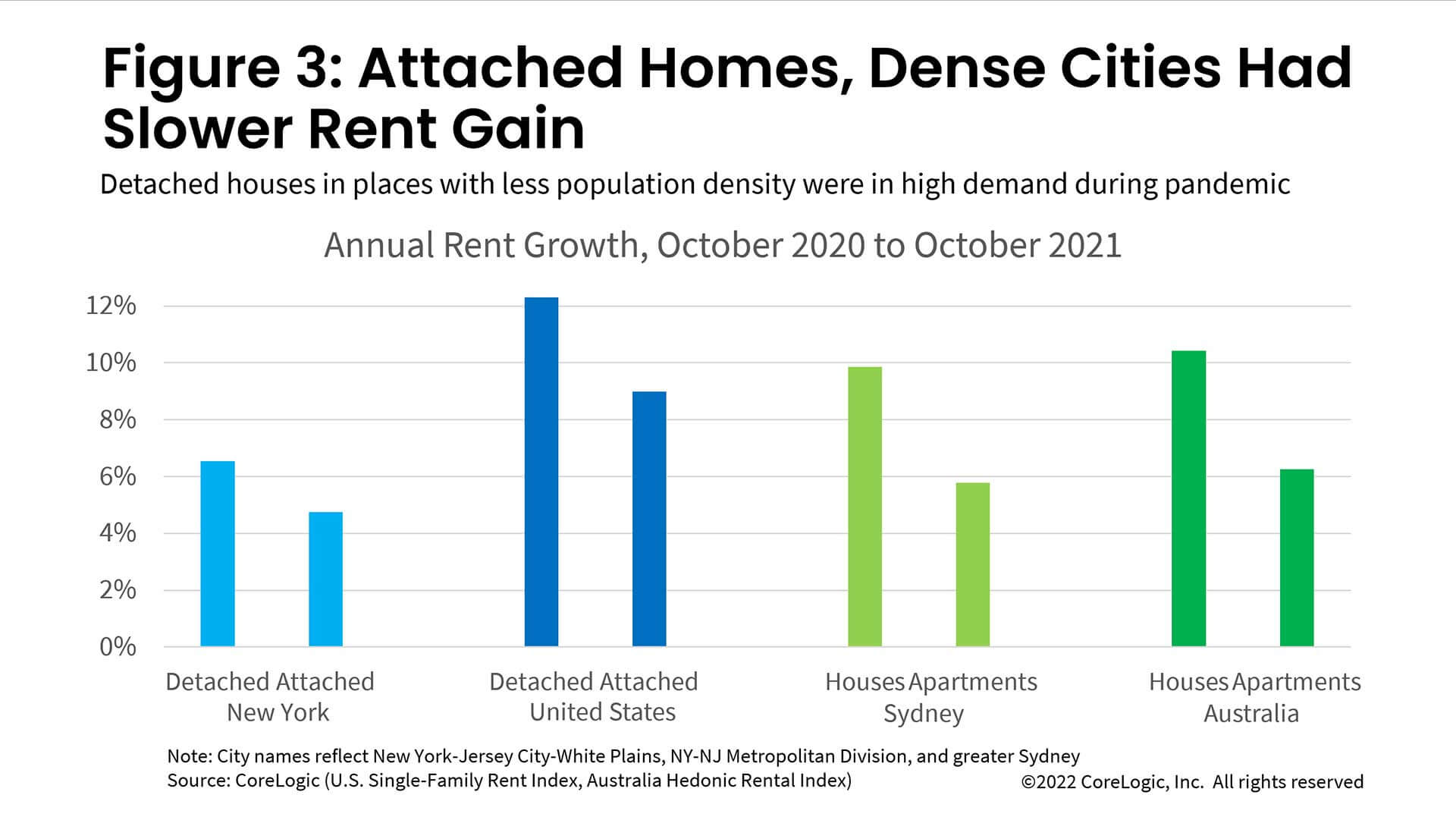

The weaker rent growth in the New York City region reflects both the larger proportion of attached single-family homes and the greater population density of the inner suburbs which led many tenants to seek a home outside the metro area. About 44% of one-family rental homes are attached in the New York metro, compared with 19% nationwide.[2] Further, detached houses in New York experienced much less rent growth than in the rest of the U.S. last year. A similar tenant preference for houses versus apartments has occurred in Sydney and throughout Australia as well, with rent for apartments rising less than for houses. ( Figure 3)

These differences in rent growth by residential structure and location will likely continue until the pandemic wanes. Rent growth for detached houses will likely remain strong in 2022.

Acknowledgment: Tim Lawless, CoreLogic Executive and Research Director Asia Pacific, provided the Australia Hedonic Rental Index.

Summary:

- Annual rent growth has quickened compared to one year ago in the U.S., Australia, Canada, and New Zealand.

- Large cities generally had slower rent growth compared with the rest of their nation.

- Tenants preferred one-family detached houses over apartments during the pandemic.

- Cities with a dense population and few detached houses had slower rent growth.

2022 CoreLogic, Inc. , All rights reserved.

[1] According to Stats New Zealand, their rent index reflects the following: “The flow measure of rents captures rental price changes only for dwellings that have a new tenancy started in the reference month.” Rent data from Stats Canada reflect the entire rental stock.

[2] Census Bureau, American Community Survey 1-year estimate for 2019, Table S2504, for U.S. and New York-Jersey City-White Plains, NY-NJ Metropolitan Division.