Higher interest rates and home prices reduce the demand for second homes

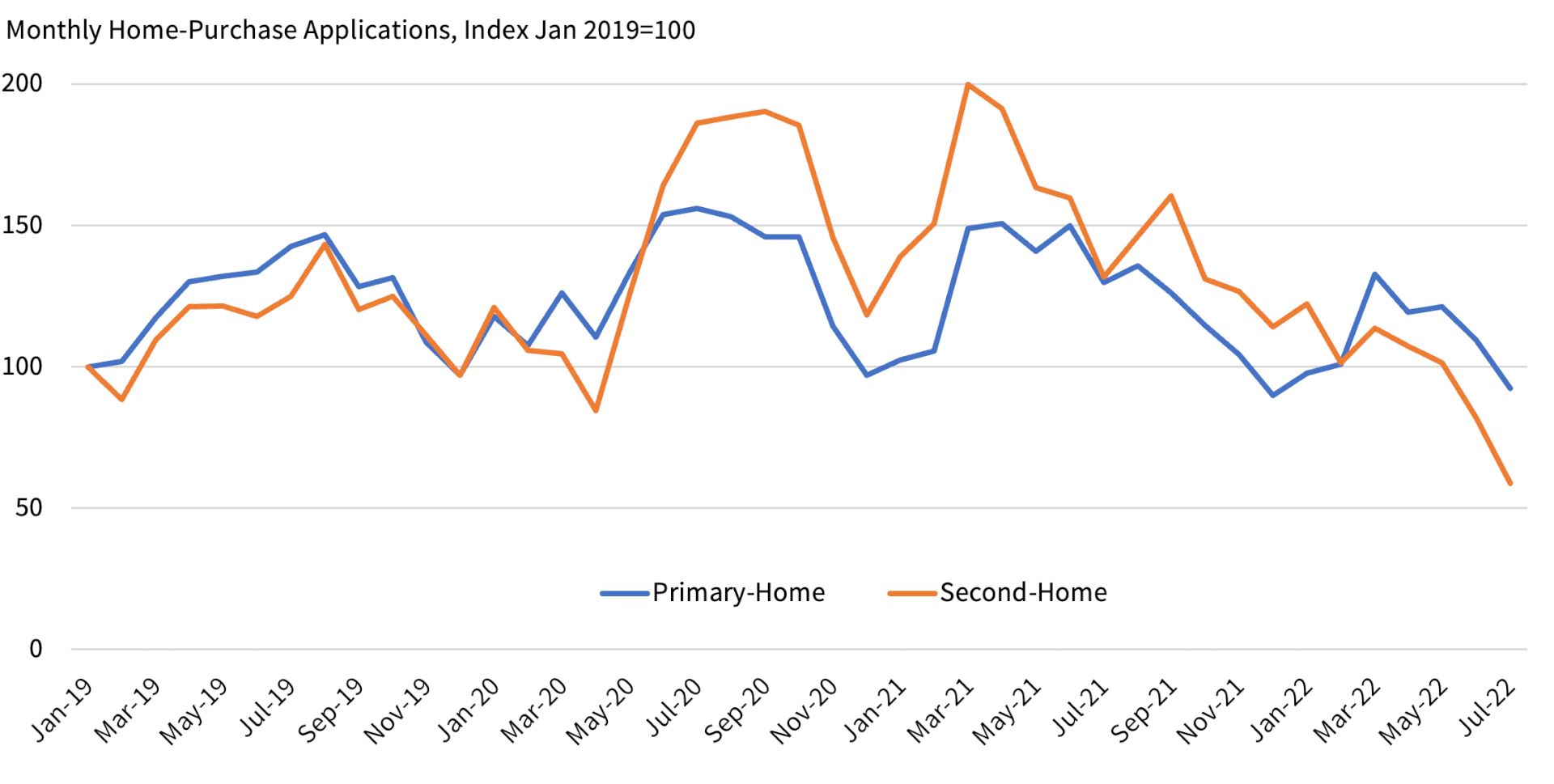

Demand for second homes surged after the onset of the COVID-19 pandemic nearly doubling the pre-pandemic demand level in late 2020.

Flexibility to work remotely, coupled with record-low interest rates, induced the hike in second home demand in 2020 and 2021.Though remote work remains common in 2022 and will for the foreseeable future, low interest rates have vanished, while home prices are at record highs. As a result, home affordability has decreased for all, whether looking to buy a primary residence or a second home.

Loan application data from CoreLogic reveals that second home purchase applications have been declining since the spring 2021 peak and are 19% lower in second quarter for 2022, compared to the same pre-pandemic period in 2019 (Figure 1). In addition to rising interest rates and home prices, the Federal Housing Finance Agency (FHFA) increased fees for second home loans sold to Fannie or Freddie effective April 1, 2022,[1] which contributed to slower demand for second homes.

Figure 1: Second Home Purchase Applications Trend Lower than Pre-pandemic Levels

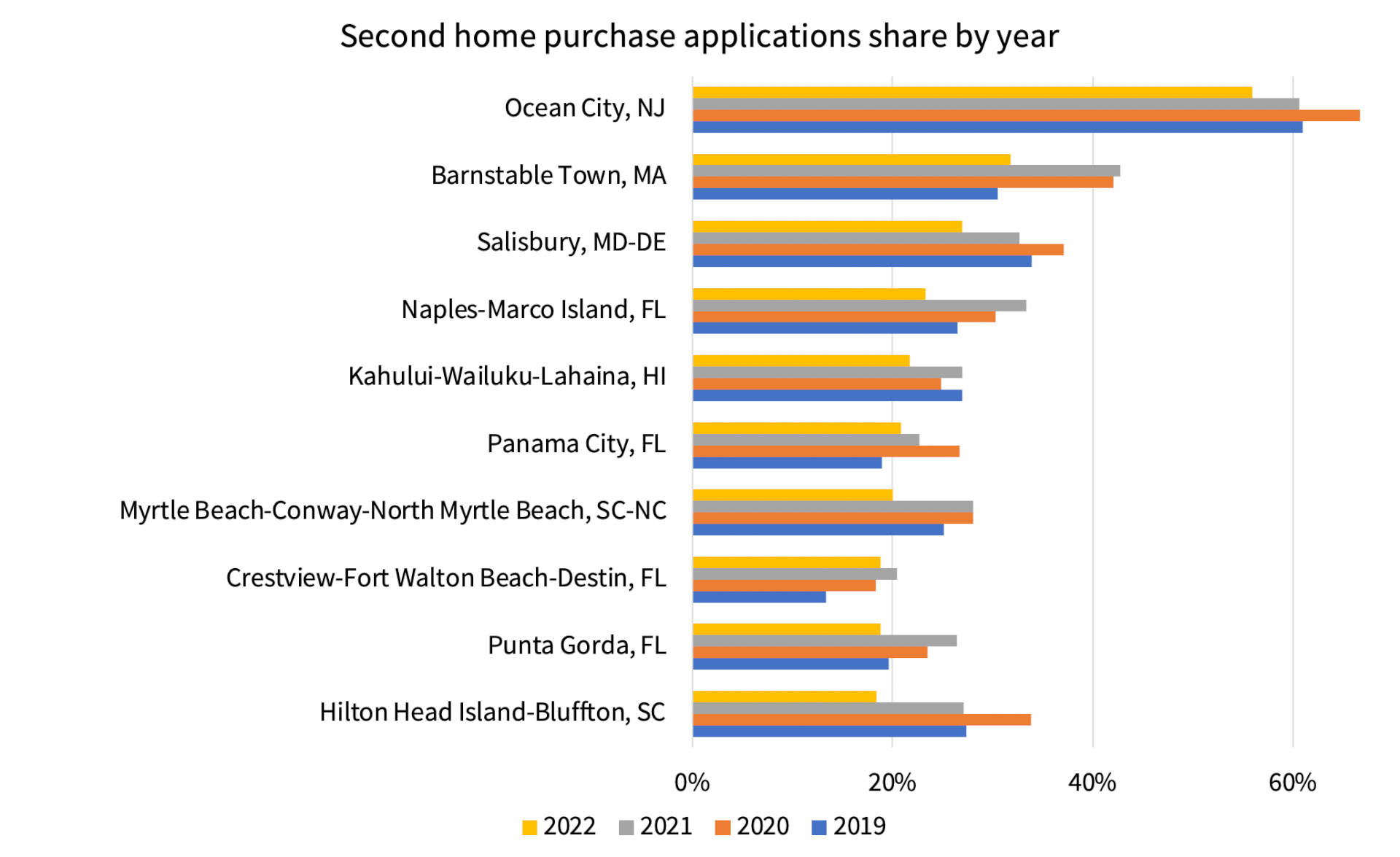

The share of mortgage applications for second homes varies nationally. Figure 2 shows the top 10 metros by share of second home mortgage purchase applications in 2022 compared with previous years (sorted by share in 2022).[2] So far in 2022, Ocean City, New Jersey, has the highest share with 56% of mortgage applications being for second homes, a lead Ocean City has held for the past 4 years. Barnstable Town, Massachusetts, ranked second with 32% of mortgage applications for second homes, followed by Salisbury, Maryland (27%) and Naples, Florida (23%). Four metros in Florida were among the top 10 by share of mortgage applications for second homes in 2022.

Figure 2: Top 10 metros with highest share of second home purchase applications

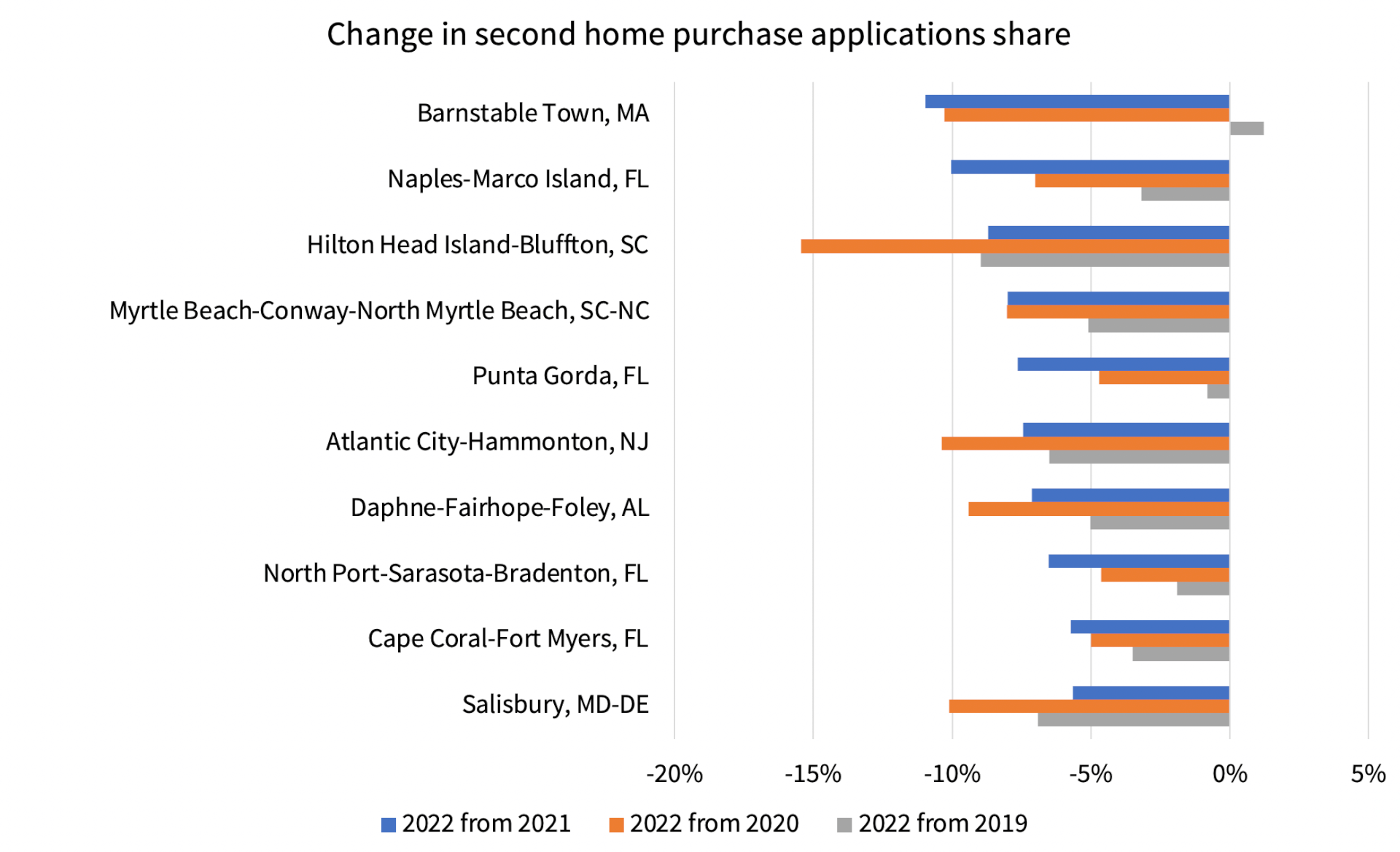

With rising mortgage interest rates and home prices, the demand for second homes in 2022 slowed in almost all the metros compared to 2021 and pre-pandemic demand levels but varied by market.[3] Figure 3 shows the top 10 metros with the largest decline in share of mortgage applications for second homes in 2022, compared to 2021. Barnstable Town, Massachusetts, experienced the largest drop in demand with 11 percentage points in mortgage applications for second homes in 2022 from 2021 and a 10 percentage points drop from 2020. Low inventory coupled with rising interest rates and home prices are the contributing factors. However, it is still slightly higher compared with the 2019 share. Naples, Florida ranked second with a 10 percentage points decline in the share of mortgage applications for second homes compared to 2021 and a 7 percentage points drop from 2020.

The demand for second homes is likely to decline as the cost of borrowing money increases with rising interest rates and lender costs such as the FHFA fee increase on second home loans. Rising home prices will also deter the demand for second home.

Figure 3: Top 10 metros with biggest decline in share of second home purchase applications

[1] See FHFA press release

[2] The analysis is based on all home-purchase mortgage applications, accepted or not, from January 2019 to July 2022.

[3] More people are choosing to travel now as most travel restrictions have been lifted.