Loan Performance Insights Report Highlights: July 2020

- The nation’s overall delinquency rate was 6.6% in July.

- All states logged annual increases in both overall and serious delinquency rates in July.

In July 2020, 6.6% of home mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure)[1], slightly lower than the June 2020 rate of 7.1%, but a 2.8-percentage point increase from July 2019, according to the latest CoreLogic Loan Performance Insights Report.

The share of mortgages that were 30 to 59 days past due – considered early-stage delinquencies – was 1.5% in July 2020, down sharply from a post-pandemic high of 4.2% in April 2020 and below the year ago rate of 1.8%. The share of mortgages 60 to 89 days past due was 1% in July 2020, up from 0.6% in July 2019 and down from 2.8% in May 2020.

The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – increased to 4.1% in July up from 1.3% a year earlier. July’s number represented the highest rate since April 2014. The increase in the serious delinquency rate was driven by an increase in the share of mortgages 120 to 149 days past day, which spiked to 1.4%, the highest rate in more than 21 years and double the December 2009 peak caused by the Great Recession. The foreclosure inventory rate – the share of mortgages in some stage of the foreclosure process – remained low at 0.3% in July 2020, down from 0.4% from July 2019.

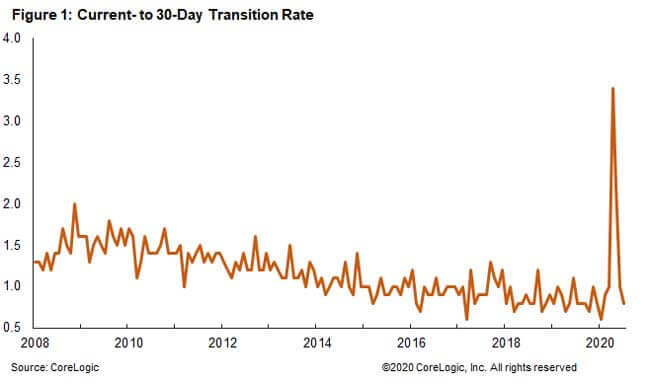

In addition to delinquency rates, CoreLogic tracks the rate at which mortgages transition from one stage of delinquency to the next, such as going from current to 30 days past due (Figure 1). The share of mortgages that transitioned from current to 30 days past due dropped back to 0.8% in July 2020 – a decrease from 3.4% in April 2020.

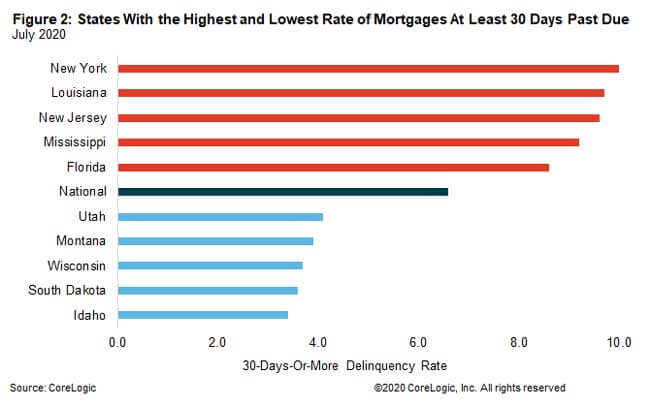

Figure 2 shows the states with the highest and lowest share of mortgages 30 days or more delinquent. In July 2020, that rate was highest in New York at 10% and lowest in Idaho at 3.4%. All U.S. states posted annual gains in their overall delinquency rate in July 2020. The states that logged the largest annual increases were Nevada (+5.2 percentage points), New Jersey (+4.8 percentage points), Hawaii (+4.7 percentage points) and New York (+4.6 percentage points).

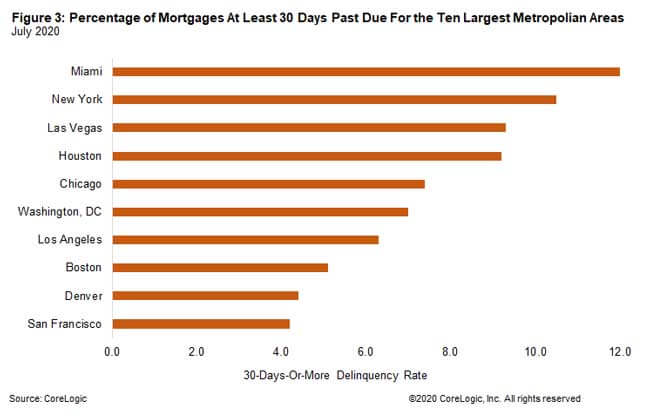

Figure 3 shows the 30-plus-day past-due rate for July 2020 for 10 large metropolitan areas.[2] Miami had the highest rate at 12.1% and San Francisco had the lowest rate at 4.2%. Miami’s rate increased 7.1 percentage points from a year earlier. Outside of the largest 10, all but two metros recorded an increase in the overall delinquency rate, with tourist destinations such as Kahului, Hawaii, Las Vegas, Nevada and Miami, Florida as well as oil-dependent Odessa, Texas and Midland, Texas, showing the largest gains.

© 2020 CoreLogic, Inc. All rights reserved.

[1] Data in this report is provided by TrueStandings Servicing. https://www.corelogic.com/products/truestandings-servicing.aspx. The CARES Act provided forbearance for borrowers with federally backed mortgage loans who were economically impacted by the pandemic. Borrowers in a forbearance program who have missed a mortgage payment are included in the CoreLogic delinquency statistics, even if the loan servicer has not reported the loan as delinquent to credit repositories.

[2] Metropolitan areas used in this report are the ten most populous Metropolitan Statistical Areas. The report uses Metropolitan Divisions where available.