Today, first-time homebuyers represent just over a third of all buyers

First-time homebuyers (FTHBs) represent a growing share of the population, a trend that accelerated in 2020. The average age of FTHBs is 34, and most of them can be classified as Millennials or Generation Z.

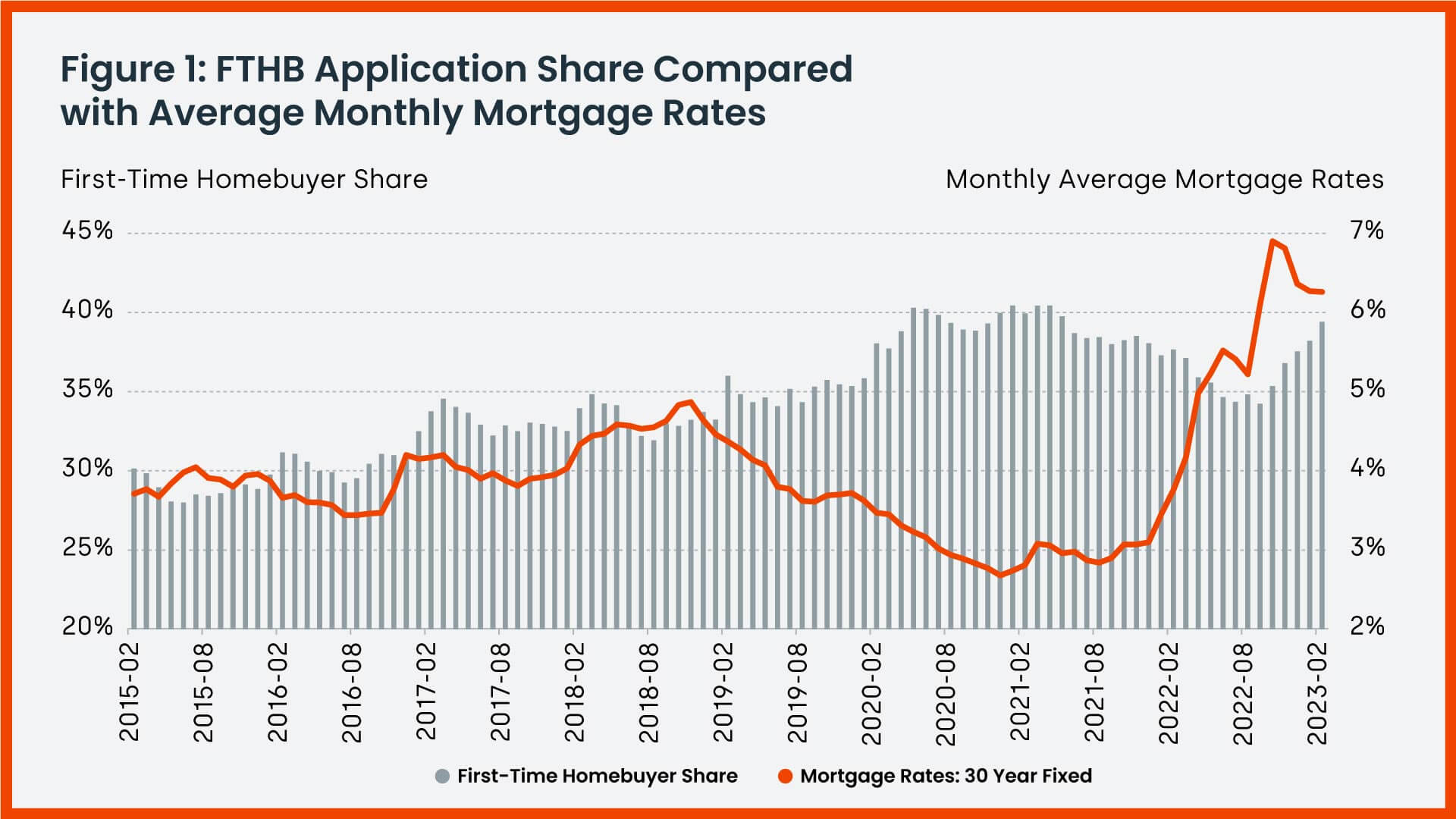

According to CoreLogic Fraud Consortium Loan Application data[1], the share of FTHB applications increased to 39% in 2020, up from about 29% in 2015 (Figure 1). However, the share dropped to a three-year low of 34% during the third quarter of 2022, as mortgage rates surged to the highest level since early 2000.

The increase in FTHB share closely tracks closely with declines in mortgage rates in early 2019. During the pandemic, the average 30-year, fixed-rate mortgage dropped further to hover at an all-time low of around 3%. These exceptionally low rates alleviated some affordability challenges, especially for FTHBs.

Though home prices have been rising on an annual basis for more than a decade as of January 2023, record-low interest rates helped offset appreciation pressures and buoy buyer purchasing power. As a result, the FTHB share increased to a ten-year peak of 40% during 2021.

Interest rates began climbing early last year, reaching 5% by April 2022, leading potential homebuyers — especially FTHBs — to deal with not only high housing prices, but also elevated interest rates. As a result, the FTHB mortgage application share dropped to its lowest pre-pandemic rate, representing 34% of all purchase applications in September 2022. Interest rates continued to rise, peaking at nearly 7% in October 2022. Figure 1 shows that FTHB demand has an inverse relationship with mortgage rates.

With rapidly increasing mortgage rates, housing demand declined, slowing sales activity. This domino effect led to decelerating home prices, which slightly improved housing affordability and provided a window of opportunity for FTHBs, while also dissuading existing homebuyers from buying and selling properties. Since 95% of existing homeowners have locked in a mortgage rate of 5% or less, they are incentivized to hold their current properties.

As a result, less competition among move-up homebuyers and slightly improving affordability conditions caused the FTHB share to bounce back in November 2022. By February 2023, the share of FTHB applications reached 39%.

Despite affordability challenges, the FTHB share is likely to stay at its current level for the foreseeable future. Potential FTHBs who have temporarily stopped their search may enter the housing market in 2023, while many current owners may continue to watch mortgage rates to decide when or if to list their homes.

[1] This analysis is based on all home-purchase mortgage applications, accepted or not, from January 2019 to February 2023. Investors and second-home buyers were excluded from the analysis. This doesn’t include cash buyers as well.