The process of acquiring a home has always been rife with fraud, and as the mortgage process has further digitized, new opportunities for fraud have emerged. There are two major trends that play a role in the rise of fraud.

First, while mortgage rates reached historical lows, the largest cohort of millennials reached their peak homebuying age. This combination of forces resulted in an increasing number of younger, first-time homebuyers in the marketplace. Even though the younger generation is digitally savvy, this group has also never gone through the homebuying process before, leaving them vulnerable targets to scammers.

Secondly, the pandemic has caused financial stress for some individuals. As jobs were lost, people lost the ability to make payments on their loans, and as a result, this increased mortgage delinquencies. While payment forbearance and foreclosure moratoriums have allowed most people to keep their homes, as these programs end, those who haven’t been able to get back on their feet may be in trouble.

Economic hardship often creates an environment that is ripe for scammers. As homeowners face financial challenges, they can become increasingly desperate for a solution and sometimes make risky decisions when under duress.

In response to this, district attorneys are advancing efforts to help people protect their investment and themselves against fraud. For example, in San Bernardino County, California, the District Attorney’s Real Estate Fraud office includes a team of professionals who investigate and prosecute individuals and businesses who commit real estate fraud.

Digital transformation and fraud

The use of digital and mobile technology to complete real estate transactions has increased in recent years, particularly during the pandemic. Overall online transactions grew by 80% in 2020[1] in comparison to 2019.

While online and mobile transactions offer the benefit of speed and convenience, they also provide a new opportunity for fraudulent activity.

In 2020, there was a 48% increase in the number of mobile fraud attacks. While lenders, title companies and real estate brokerages address cybersecurity internally and with their customers, identity theft and fraud continue to be issues in the real estate market. Consumers reported losing more than $3.3 billion to fraud in 2020, up from $1.8 billion in 2019, and 21% of all fraud attacks occurred in mobile transactions.[2]

Property fraud trends

Unfortunately, a corollary of increased fraud on digital and mobile transactions as a whole — as well as the intersection of a flood of first-time homebuyers and existing homeowners in stages of mortgage distress — is an increase in mortgage fraud. The CoreLogic® National Mortgage Application Fraud Risk Index increased by 11.9% during the first quarter of 2021 compared to the fourth quarter of 2020 and increased 7.7% compared to the first quarter of 2020.

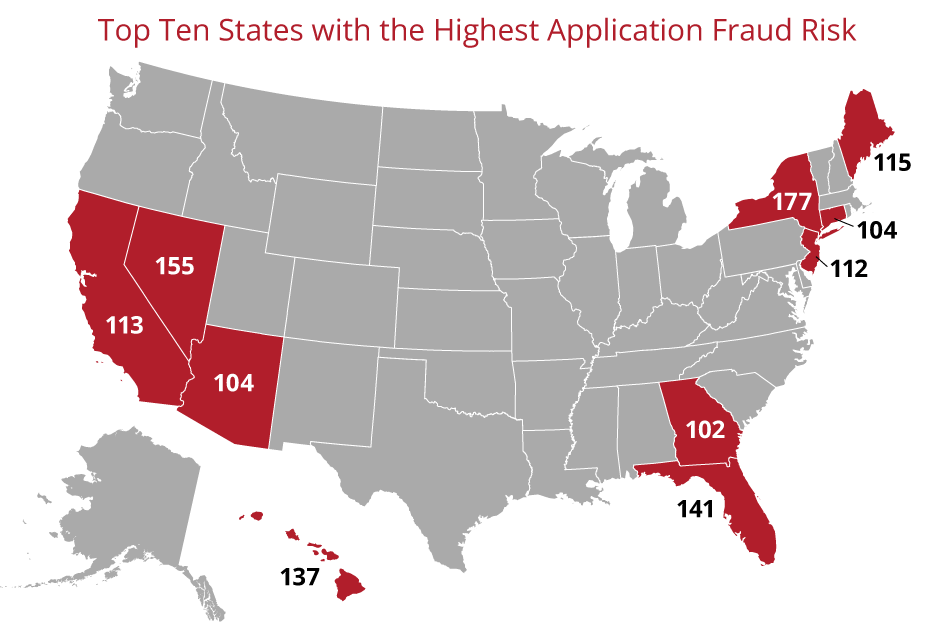

A variety of types of mortgage fraud increased in 2020, including alerts related to income reasonability for both purchase and refinance applications. Other issues of potential fraud include questions about valuations because of rapid price increases. The states with the highest mortgage fraud risk indexes include New York, Florida and Nevada.

According to CoreLogic, mortgage fraud is predicted to continue to rise in 2021 as interest rates rise and affordability declines, which will contribute to market volatility and stressed borrowers.

Solutions to property fraud

Stopping property fraud or reducing the consequences of fraud by catching it early requires both education and monitoring. District attorneys and their staffs have a role to play in both of these tasks as well as in prosecuting people who commit fraud.

First, alerting first-time buyers about the potential types of fraud and identity theft that occur reminds them to protect their data and avoid taking risks during a transaction. Scammers sometimes monitor real estate transactions and send fraudulent emails requesting financial information or a transfer of funds to a false bank account. The offices of district attorneys can use social media, direct outreach and service providers to reach millennial buyers, thus increasing their awareness of the risks they face.

Senior homeowners are frequent targets of scammers for property fraud and should be educated about the potential risks they face as well. Seniors may be at risk from fraudulent loan modifications, false access to their home equity and deed transfers that can result in their losing their homes.

CoreLogic’s property verification and fraud services offers extensive data and insight into property records such as liens, deeds and mortgages that can keep each county agency informed and track potential fraud. The digital monitoring service, when activated by the local municipality, can search data nationwide to identify potential instances of false occupancy or exemption claims. In addition, homeowners can proactively receive notifications about deeds recorded on their property and default or notice of sale transactions, so they have an opportunity to prevent a scammer taking their equity and their home.

Early detection of potential property fraud can be beneficial to law enforcement, too, since it can be difficult to pursue and catch scammers if the criminal act goes unnoticed for several years. Sometimes homeowners are unaware of property fraud until they attempt to refinance or sell their home.

Keeping an eye out for red flags and ensuring the district attorney’s staff is up to date on the latest trends can mean preserving the safety of someone’s home, typically their biggest financial asset. As the real estate market adapts to more first-time buyers and more distressed homeowners, educating and notifying residents about potential scams becomes an even more essential service.

©2021 CoreLogic, Inc. All rights reserved.

[1] 2020 Brings Good News for Digital Payments, Increases Online Transactions by 80% From 2019: Razorpay Report (aithority.com)

[2] Fraud Attacks Double in 2020 as COVID-19 Transforms the (globenewswire.com)