Traditional Appraisal and Automated Valuation Models Don’t Always See Eye to Eye

Recently the two government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac announced plans to waive the requirement of a professional appraisal on qualified purchase loans with a loan-to-value ratio at or below 80 percent.[1] For Fannie Mae, the new waiver option extends the Property Inspection Waiver program which was initially only applicable to refinancing loans. Similarly for Freddie Mac, the move has expanded lenders’ option to use automated evaluation tools, in lieu of a traditional appraisal, on both purchase and refinancing loans when working with its Loan Advisor Suite.

The GSE announcements came amid reports of a shortage of state-certified and licensed appraisers, especially in rural areas.[2] Nonetheless, the announcement was not without controversy. The Appraisal Institute (AI), the country’s largest trade association of real estate appraisers, has raised safety and soundness concerns of eliminating the appraisal requirement and is seeking a legislative rollback as it regards “the requirement for the completion of full appraisals to determine the true equity position of individual properties” fundamental to prudent risk management for the mortgage finance sector.[3] Under the federal banking regulations for real estate transactions, automated appraisal methods are generally reserved as a due diligence tool rather than as the primary valuation.[4]

From a market economics perspective, a clash between automated evaluations and traditional appraisal seems rather inevitable, as advanced analytics and big data technology have steadfastly pushed the boundaries of collateral evaluation capabilities. Today’s automated valuation alternatives are often powered by large databases that can capture information on a given property as well as transaction records in and around the property in consideration.

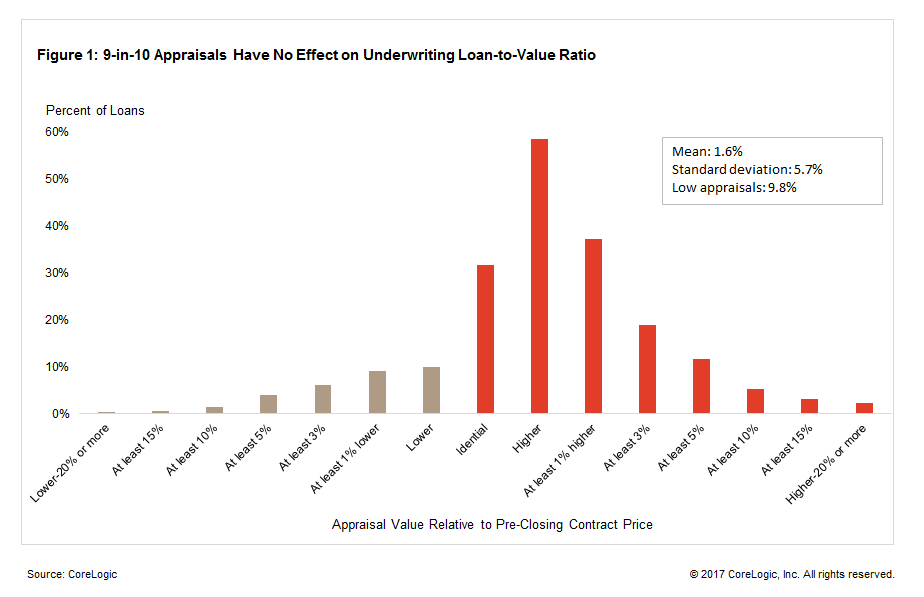

In mortgage underwriting and securitization, collateral risk is typically quantified by loan-to-value (LTV) ratios. For purchase loans, the LTV ratios at origination are valued at the lesser of purchase price and appraised value. Since traditional appraisals infrequently come in below purchase price – about 10 percent of the time among loan applications or less than 4 percent among funded loans[5] – a loan’s collateral risk measure is typically unaffected by appraisal.

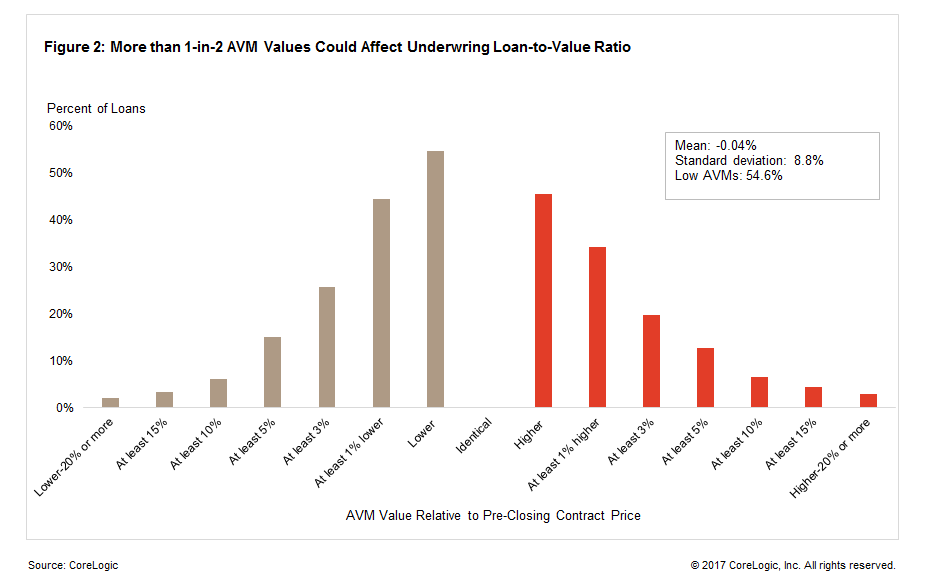

But that could change quickly using an automated valuation model (AVM). Here is a quick look at the difference between traditional appraisal and AVMs, with implications for origination LTV. This blog analyzed a sample of recently appraised single-family homes purchased with mortgage financing for which a CoreLogic AVM value was also available.[6] The sample consists of approximately 190,000 purchase-loan properties appraised between July 2016 and June 2017.

Figure 1 shows the distribution of the properties’ traditional appraisal value relative to their purchase price. A majority of the appraisals were either exactly at the contract price (31.6 percent) or slightly above it (58.6 percent), leaving about 10 percent of the properties appraised below the purchase price. With very few appraisals on the low end, the purchase price effectively determined origination LTV during loan underwriting.

Figure 2 shows the distribution of the AVM values relative to the purchase price: 45.4 percent of the AVM values were at or above the contract price, while 54.6 percent were below it. Compared with traditional appraisals, the AVM values were more symmetrically distributed about the purchase price but with thicker tails on both ends (that is, greater uncertainty in the valuation). For the 5-in-9 properties with an AVM value below the purchase price, the LTV ratios for these loans would be higher had the AVM valuations been used instead of a traditional appraisal.[7]

Since the odds of an AVM coming in below the purchase price were 55-45 in this analysis, compared with 10-90 for traditional appraisals, AVM usage will increase the underwriting LTV on a much larger number of loans. And the ‘fatter tail’ of the distribution below the contract price means that the upward LTV adjustment will more often be larger than for a traditional appraisal.

While the industry may debate which valuation method is likely more accurate than the other, or more importantly, which is more useful than the other in predicting default risk and loan performance, there is one thing we can all agree on: Lenders and mortgage investors need reliable information about a loan’s and portfolio’s collateral risk to make informed underwriting and investment decisions.

[1] The property must be a single-family, primary residence or second home with a value less than $1 million; additional restrictions apply.

[2] See the Interagency Advisory on the Availability of Appraisers, issued by the federal banking regulators on May 31, 2017. https://www.occ.gov/news-issuances/news-releases/2017/nr-ia-2017-60a.pdf

[3] The Appraisal Institute press release, “Appraisal Institute Joins 35 Groups Seeking to Halt Appraisal Waivers,” September 7, 2017.

[4] See the Interagency Appraisal and Evaluation Guidelines 2010, which was originally issued in 1994 by the FDIC, OCC, FBR, and OTC, in accordance with Title XI of the 1989 FIRREA.

[5] A recent study by researchers at Fannie Mae reported less than 4 percent of the purchase loans guaranteed by the agency during 1992-2015 had an appraisal below the purchase price. The study can be accessed at http://www.fanniemae.com/resources/file/research/datanotes/pdf/working-paper-102816.pdf

[6] The AVM valuation date (or, AVM “as of” date) did not fall exactly on the appraisal date, but ranged from 15 days to about 3 ½ months after the appraisal date.

[7] Because the data set did not include the buyers’ loan amount, analysis by LTV ratio could not be performed. It remains to be seen whether the distribution of AVM valuations or appraisal is affected by leverage. However, if the valuations are unbiased, we should not expect leverage to affect the valuation outcome.

© 2017 CoreLogic, Inc. All rights reserved.