Introduction

Many U.S. companies face complex tax-compliance challenges. Convoluted and overlapping tax jurisdictions, ever- changing remittance requirements, internal audits and automation maintenance are just a few of the daunting tasks facing companies today. And the price of getting it wrong is high. Misspent taxes, penalties, accounting adjustments and bad publicity are just few of the risks associated with inaccurate tax reporting.

This paper will explore some of these challenges and explain how introducing parcel-level data into the tax process workflow can minimize certain risks associated with current practices.

The Challenge

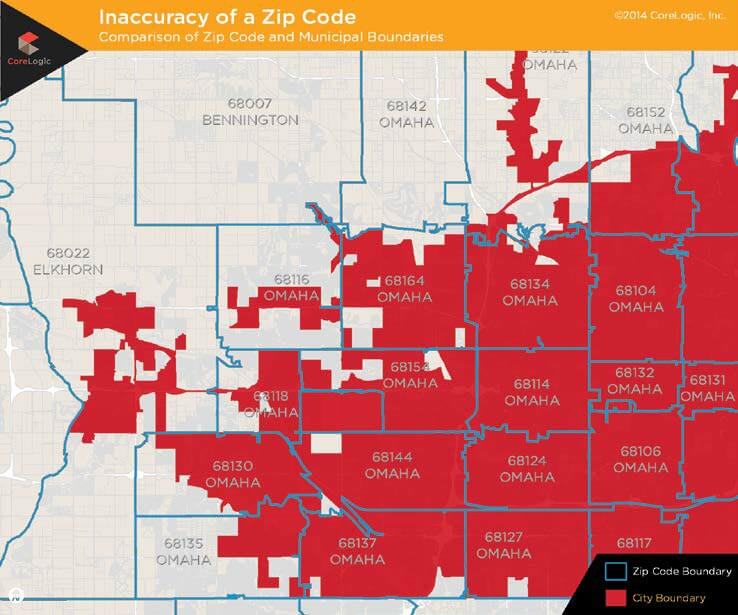

Of the 20,000 municipalities across the U.S., approximately 30 percent of ZIP Codes are in conflict with municipal, county and even state boundaries. Additionally, new special tax districts are created each year and as many as 25 percent of municipal boundaries change . These factors alone can result in improper tax reporting and remittance, often including payments made when none are due.

Most cities and counties are getting far more aggressive on compliance. Businesses can anticipate average internal costs of about $75,000 for each taxing authority audit, plus the resulting fine. Finding a cost-effective tax calculation method is an important step on the path to tax compliance .

The Problems

One: Inaccurate Geocoding

Determining the location of taxable entities, such as customers, linear assets and other facilities requires accuracy. Matching addresses with the right tax jurisdiction is a common geocoding challenge . Compliance often hinges on a classic point-in- polygon geometry problem; where points most often represent homes and buildings the business serves and polygons are the areas controlled by various taxing authorities . Solving the address- matching problem requires a set of accurate geospatial polygons and an electronic procedure for assigning a precise location to an address file. Unfortunately, many tax systems still use one or more of the following geocoding methods.

ZIP Codes: Created to provide efficient mail delivery, a ZIP Code places the customer inside a defined geographic area. Because mail routes do not necessarily match city or county boundaries, using ZIP Codes produces results that are seldom accurate enough to calculate local taxes .

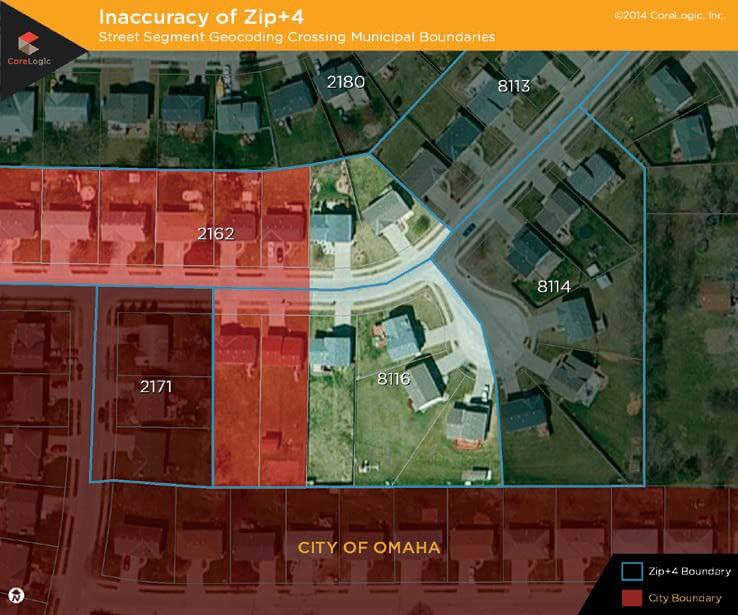

ZIP+4 Geocoding: Nine-digit ZIP Codes, or ZIP+4, are defined as a block face, which means that the addresses on one side of a city block have one 4-digit append to the 5-digit ZIP Code, while addresses on the other side of the block have another. ZIP+4 geocoding assigns a latitude/ longitude to every address with the same ZIP+4 append as the centroid of the street segment; offset some distance from the centerline of the street . If there are 10 addresses on the east side of a street with the same 9-digit ZIP Code, they will all receive the same ZIP+4 append. As block faces lengthen and population density decreases, ZIP+4 geocoding becomes progressively less accurate. It is important to note that many commercial tax solution providers still use ZIP+4 data.

Street Segment Geocoding: In 1990, the U.S. Census Bureau developed an electronic geographic coding system called TIGER/Line® files. This master file became the basis for almost all U.S. street-level maps, including those used by automobile and cell-phone navigation systems and Internet search engines, such as Bing® and Google® . Each street is divided into segments based on underlying postal addresses and natural breaks, such as intersections. Postal addresses have an odd/even component for different sides of a given street segment and a numeric range of addresses such as 900–999; often referred to as a block. Street-segment geocoding assumes that addresses are evenly distributed along a segment, such that 950 Elm Street will fall halfway along the 900 segment on the even side of the street. This type of geocoding may be very accurate within cities with regular and short street blocks, but the system breaks down as population density declines.

Two: Tax-Boundary Maintenance

Tax boundaries are extremely volatile and can have an enormous impact on accuracy if not continually updated and maintained. However, boundary development is a highly specialized, time-consuming, and costly endeavor. It requires a dedicated geospatial team with in-depth understanding of base geographic descriptions, source data manipulation, and geographic analysis techniques, as well as an understanding of the various state and local governments taxes levied, which can include:

- Sales and Use

- Leasing/Rental

- Property/Linear Asset

- Utilities

- Cable

- Payroll

- Telecommunications

- Special Tax Districts

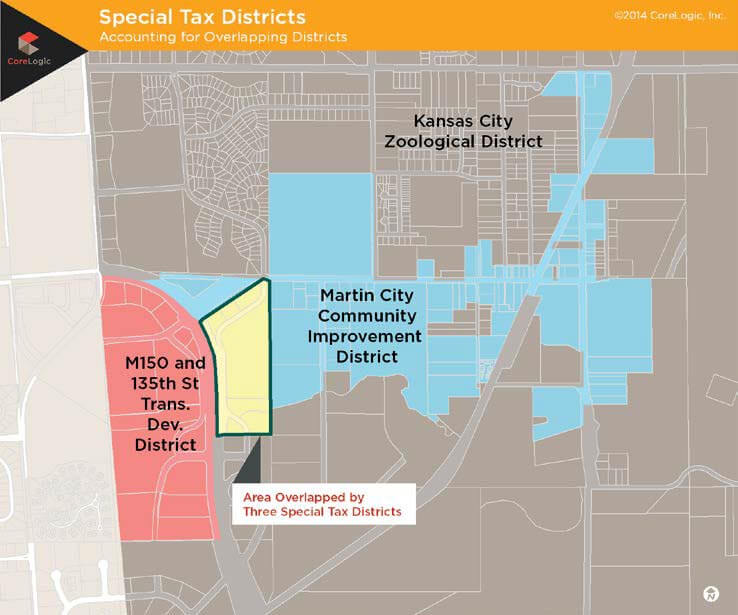

The last item on the list, special tax districts (SpTDs), present an ever- growing and unsolved problem for most telecom tax departments. Cities are increasingly relying on SpTDs to raise revenue for local initiatives, such as schools, transit systems, and sports arenas and stadiums. In 2010, there were 1,424 SpTDs in the nation. Today, SpTDs exist in 36 states and the District of Columbia, 593 counties and 961 municipalities. In the state of Texas alone, there are 854 special districts, up from 164 in 2010 . These special boundaries are often irregularly shaped polygons that do not follow established boundaries, such as ZIP Codes, city, or county boundaries. Figure C helps to visualize the complexity of SpTDs.

The Solution

Parcel-Level Geocoding

The parcel is critical for accurate geocoding . Parcels, or lots, are units of land ownership. The entire parcel network of an area is a cadastre, which is a catalog of landownership. By definition, the cadastre cannot contain overlaps, or different entities would both own the same piece of land; nor can it have gaps. Parcel- level geocoding assigns the latitude/ longitude to the centroid of the addressed parcel .

This parcel-specific system works equally well for urban or rural properties and across all population densities, providing a significant improvement over other geocoding methods. The only real caveat to its workability is the completeness of the parcel-level data set .

Figure D shows the address,

481 Deland Drive, Utica, NY, as positioned by the ZIP+4 centroid (red flag) and by a parcel geocode (green flag). The physical location of this address is represented by the parcel boundary, which is outside of the city limits. If used, the ZIP+4 centroid location (inside the city of Utica) would return an incorrect jurisdiction.

Defendable Tax Jurisdiction Layers

Tax boundary development and

maintenance requires constant vigilance . The professionals at CoreLogic® are dedicated to tracking ongoing changes and, on average, log about 6,000 municipal boundary modifications each year.

To ensure data currency, the CoreLogic team continually updates the jurisdictional boundary information down to the municipal, school, and special tax district level. Because tax layers are based on the actual street address and not on postal ZIP Code information, the CoreLogic approach eliminates errors that are common to other geocoding methodologies .

Potential Savings

To demonstrate the effect spatial accuracy has on sales- tax billing and remittance, the professionals at CoreLogic conducted a study of 43,043 telecom billing records.

Parcel-level, tax jurisdiction data from CoreLogic was added to the telecom’s existing ZIP+4-based billing system to identify the number of billing addresses that were assigned the wrong sales tax. Of the 43,043 billing records submitted, 964 addresses were assigned to the wrong municipal tax jurisdiction and 1,460 to the wrong township tax jurisdiction for a total error rate of 5.6 percent.

Next, our professionals worked with the telecom to calculate the cost savings that could be gained if the company’s billing records were improved with spatial accuracy. In previous years, the telecom issued about $500,000 in tax refunds to customers who were incorrectly billed; a cost that was rarely recovered from the municipality receiving the misappropriated funds. With the implementation of the CoreLogic tax layers, this number dropped to about $100,000 annually, saving the telecom about $400,000 per year. The telecom was also able to save an estimated $100,000 annually in overhead costs associated with tax refund investigations. Additionally, with the use of defendable tax jurisdiction data, the telecom felt confident is could annually deflect three audits, saving an estimated $225,000 in audit costs .

For this telecom, simply aligning this relatively small number of customers’ billing addresses with the correct tax jurisdictions could add approximately $725,000 to the bottom line.

Summary

Telecoms Businesses that rely on tax-boundary data to correctly bill customers may be losing money to inaccurate geocoding systems. The most reliable geocoding system available, parcel-level geocoding, overcomes the challenges inherent in other methods, provided that the parcel-level data set is complete. According to a study CoreLogic conducted on 43,034 telecom customer bills, improving geocoding accuracy results in fewer mistakes on customer bills and fewer refunds to customers, which are seldom recovered from the taxing authorities. In addition, beginning with accurate and defendable geocoding data could help telecoms avoid collateral costs resulting from tax refund investigations and taxing authority audits.

The CoreLogic geospatial professionals vigilantly maintain the nation’s most current and complete parcel data, with more than 155 million parcel boundaries in its ParcelPoint® data set. In that role, they manage tax boundary changes, normalize addresses and provide spatial analysis to ensure client solutions reduce taxing errors and provide a solid audit defense, while offering an opportunity to reduce internal expenses, fines and audit costs.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

For more information, call 512-977-3236

or visit https://www.corelogic.com/solutions/tax-jurisdiction-layers.aspx