One yield spread that is closely monitored by most economists is the difference between the yield on the 10-year Treasury bond and the yield on the 2-year Treasury bond. The typical shape of a yield curve has yields rising with bond term, that is, the 10-year-to-2-year spread is positive.

A negative spread is often viewed as a harbinger of a recession. When the yield curve is negative, or “inverted,” the short-term rate is higher than the long-term rate and the chance of a recession becomes almost inevitable. As a matter of fact, a negative 10-year-to-2-year term spread has successfully signaled all recessions but one for the past 60 years1.

The housing market accounts for about 15% of gross domestic product (GDP)2, so it is a large part of the economy. If the economy is in recession, housing demand weakens and more neighborhoods experience home-price declines. Thus, it seems natural to expect that the yield curve is a leading indicator of the housing market as well.

The yield curve became inverted in 2006 and what followed was a housing bubble burst in 2007 that preceded the 2008-2009 Great Recession. However, the yield curve inversions prior to 2006 only led to local housing market downturns instead of nationwide ones. One reason for the localized downturns is that housing demand and supply is local and there are many factors that drive local housing price dynamics. As Frank Nothaft, the Chief Economist at CoreLogic pointed out, there have always been areas with home price decline even when home prices are up nationally. The flip side is also true: there have always been areas with home price increases even when the home prices have declined nationally3.

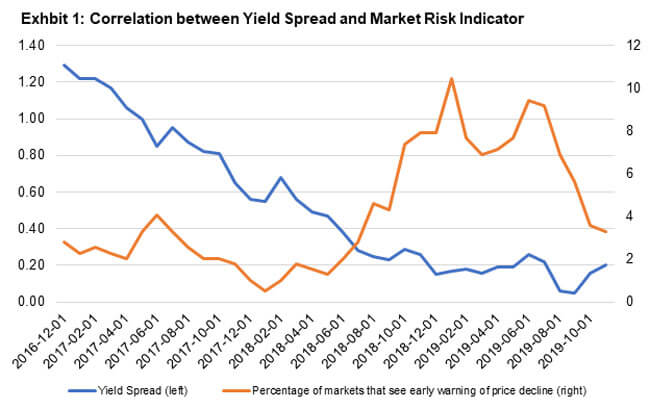

The CoreLogic Market Risk Indicators (MRI) are a risk-management monitor. The MRI provide probability estimates of a one-year housing market decline and are updated monthly. Exhibit 1 examines how the MRI relates to the 10-year-to-2-year yield spread in the past three years. As the yield curve flattened and the spread got close to zero, the percentage of markets that saw an early warning of a price decline increased significantly. As the yield curve steepened, the percentage of markets that had early warning signs based on the Indicators dropped too.

It appears the yield curve is a good leading indicator for the housing market, but it is not the only factor. In a fast-changing environment, it is critical to leverage tools that can help assess the real estate risk in a timely manner.

- Economic Forecasts with the Yield Curve, Michael D. Bauer and Thomas M. Mertens, FRBSF Economic Letter, 2018-07

- Introduction to U.S. Economy: Housing Market, Congressional Research Service, https://fas.org/sgp/crs/misc/IF11327.pdf

- Home Prices; While Up in Most Areas, Some Places See Decline

- Please reach out to us If you would like to learn more about CoreLogic Market Risk Indicators.

© 2020 CoreLogic, Inc. All rights reserved.