After catastrophic wildfires swept across California in 2017 and 2018, state insurers were hit with record-breaking losses of over $25 billion.[1][2] With three million acres burned and over 30,000 structures destroyed, the two years were the deadliest and most destructive wildfire seasons that the state has ever seen.[3] Santa Rosa and Paradise were two of the hardest-hit towns over the two-year period. CoreLogic has been tracking the latest data on the reconstruction effort.

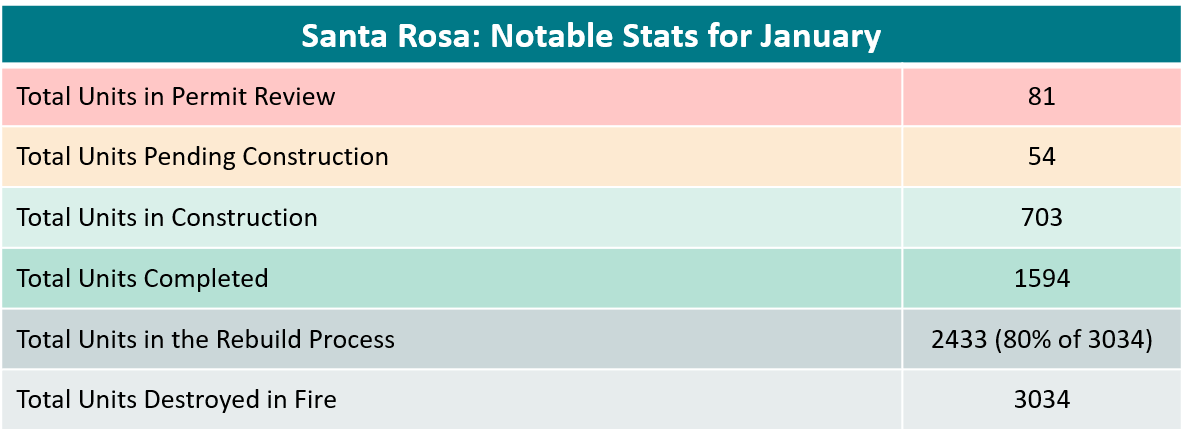

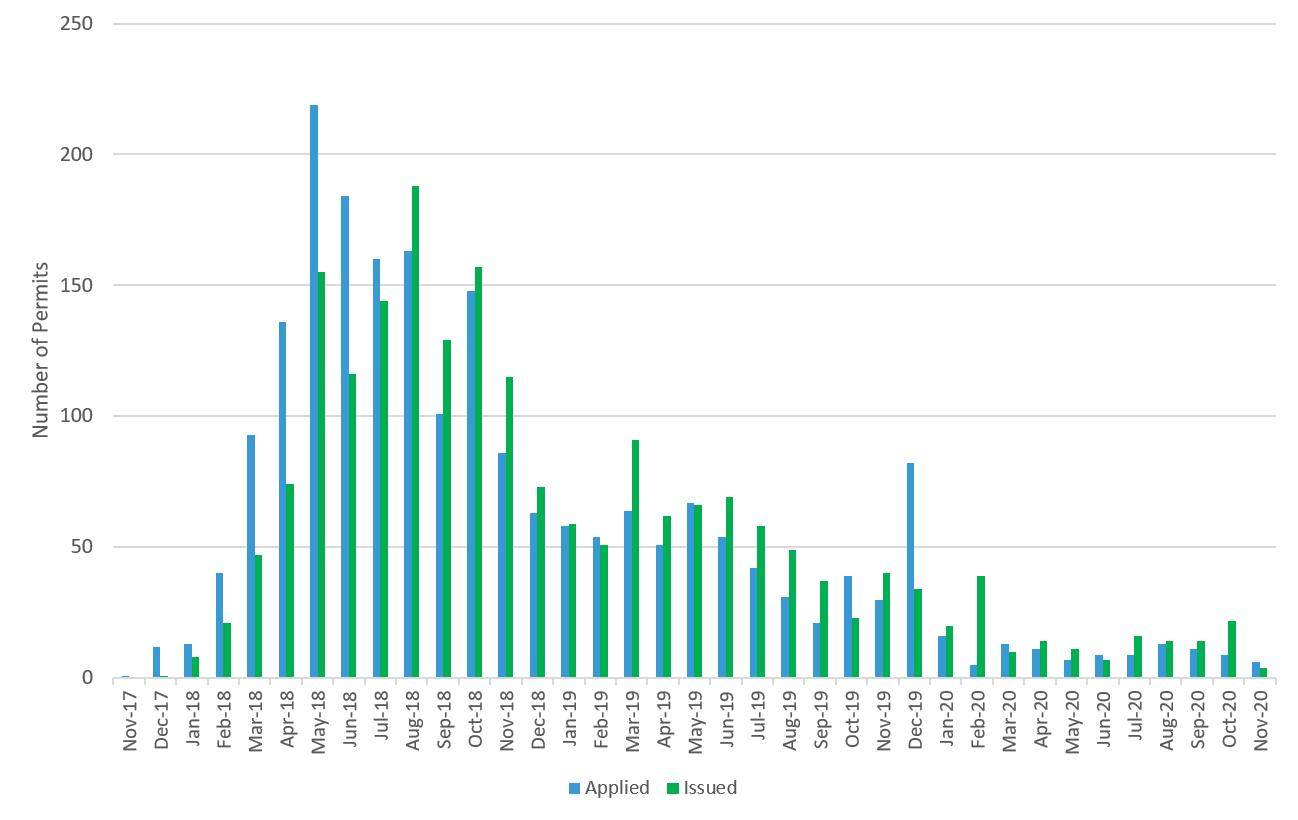

Santa Rosa

After the October 2017 Tubbs Fire in Northern California, the Napa, Sonoma and Lake counties suffered devastating losses. Santa Rosa in Sonoma County was the hardest hit, with $1.2 billion of damage[4] and 3,043 housing units destroyed.[5] A few years later, Santa Rosa is gradually recovering from this calamity, as homeowners, insurers and developers work to rebuild the community.

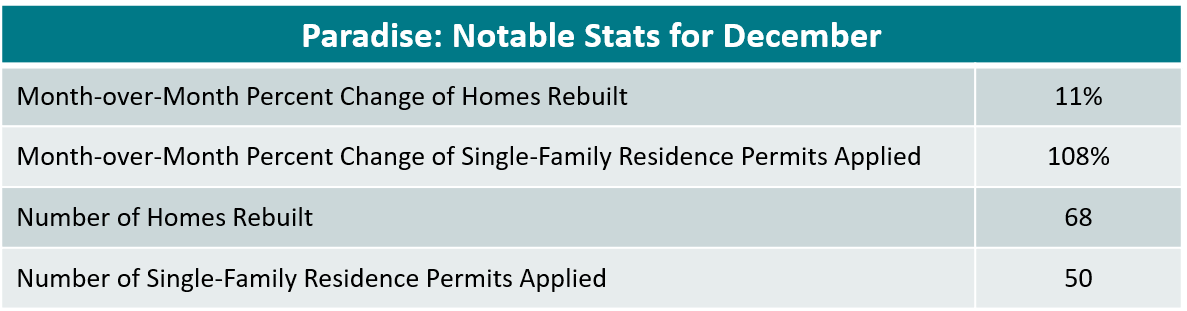

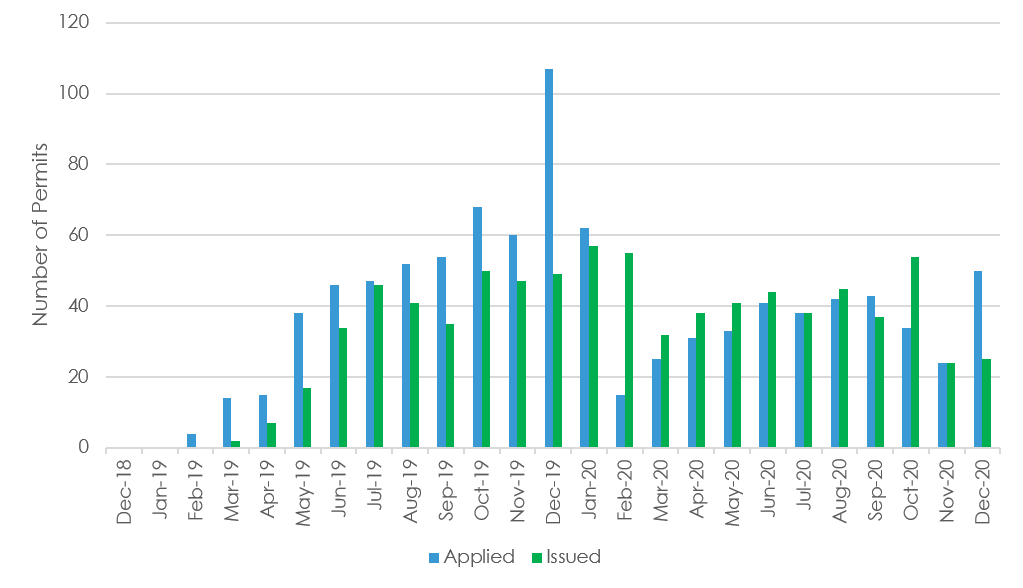

Paradise

The November 2018 Camp Fire in California was the deadliest and most destructive wildfire in the state’s history. The fire, which originated in the town of Paradise in Butte County, cost $16.5 billion in damages (with only $4 billion insured)[6]and destroyed 18,804 structures, making it the single most-expensive natural disaster for insurers worldwide that year.[7]The fire played a large role in setting up 2018 to be the fourth-costliest year for insurance companies since 1980.

After an investigation conducted by Cal Fire, a faulty power line, managed by the local utility Pacific Gas and Electric, was found to be responsible for starting the Camp Fire. In January 2019, the company filed for bankruptcy, expecting to pay $30 billion in liabilities to compensate for damages caused by the fire.[8]

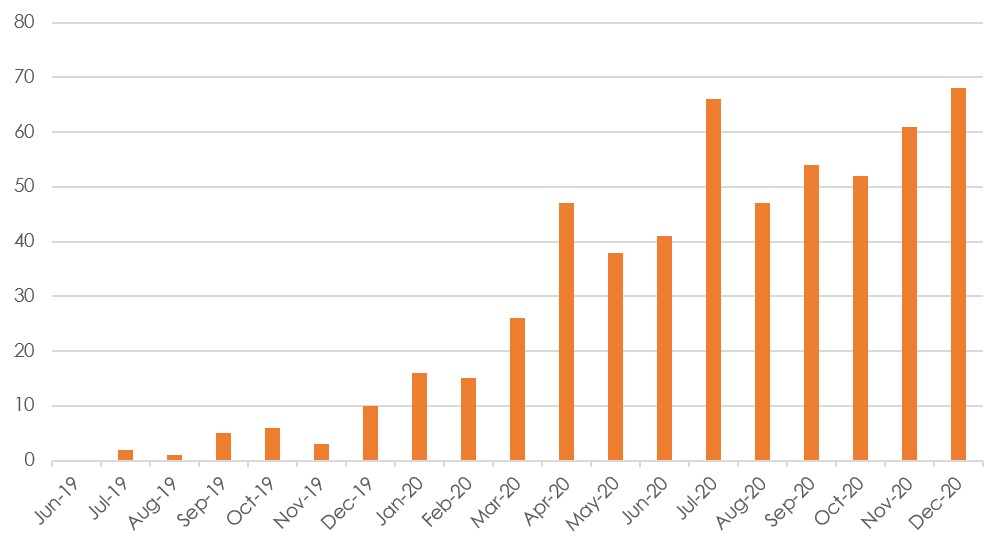

Paradise is slowly recovering. Available data indicates applications for permits have gradually increased since the disaster.

[1] http://www.insurance.ca.gov/0400-news/0100-press-releases/2018/release013-18.cfm

[2] http://www.insurance.ca.gov/0400-news/0100-press-releases/2019/release041-19.cfm

[3] https://www.fire.ca.gov/incidents/

[4] Los Angeles Times, “Death toll from Northern California fires jumps to at least 34; 5,700 structures destroyed,” October 13, 2017

[5] City of Santa Rosa, “Summary of Residential Destruction Resulting from October 2017 Wildfires,” October 2017

[6] Los Angeles Times, “California’s Camp Fire was the Costliest Global Disaster Last Year, Insurance Report Shows,” 2020

[7] Cal Fire, “Camp Fire,” November 15, 2019

[8] CNBC, “PG&E expects more than $6 billion in wildfire costs,” November 7, 2019