Following record highs, the jumbo market is expected to contract in 2022

In terms of both dollars and market share, jumbo mortgage originations grew significantly in 2021 relative to the prior year, according to an analysis of CoreLogic data. Reduced interest rates, coupled with double-digit growth in home prices last year, likely drove this increase in demand.

An earlier blog found that jumbo loans were less expensive to borrow in 2021 than during the early months of the pandemic. On average, the contract interest rate on jumbo fixed-rate loans was 0.18 percentage points lower in 2021 than during the final three quarters of 2020.

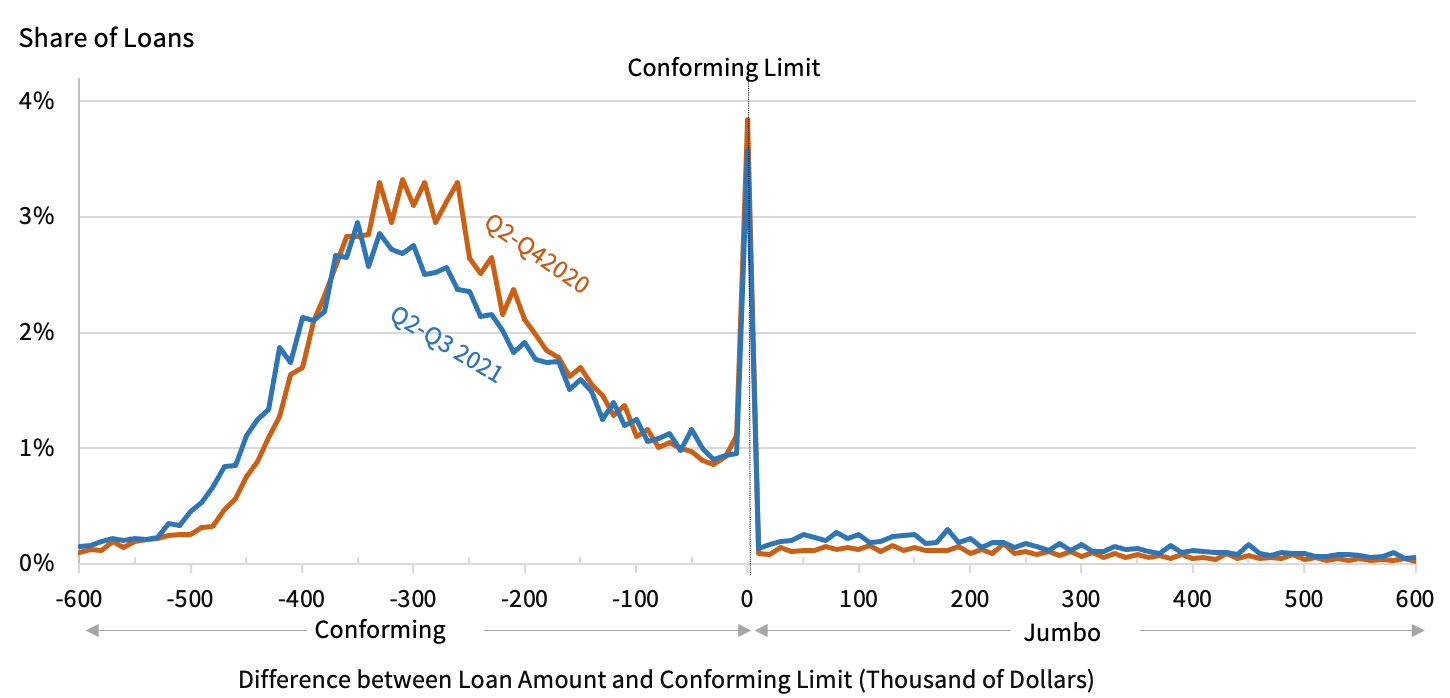

Figure 1 compares the difference between loan amounts and local-market conforming loan limits for loans originated between the second and fourth quarters of 2020 and 2021. The cutoff is at the conforming limit, which is indicated by the dotted vertical line labeled “0.”[1] The orange line represents loans originated between the second and fourth quarters of 2020, and the blue line represents loans originated between the second and third quarters of 2021.

A large majority of borrowers have conforming conventional loans and a significant share of these are at or right below the conforming loan limit in both years. More borrowers took jumbo loans in 2021 than a year prior. It is worth noting that some borrowers in 2020 may have preferred to take a jumbo loan but instead chose a conforming loan due to its lower cost — the average interest rate for a conforming loan was about 0.2 percentage points lower between the second and the fourth quarter of 2020.

Figure 1: Loan Distribution around Conforming Loan Limit: Q2-Q4 2020 and Q2-Q3 2021

(Conventional 30-Year Fixed-Rate Home Purchase Loans)

Mortgage Origination Trend:

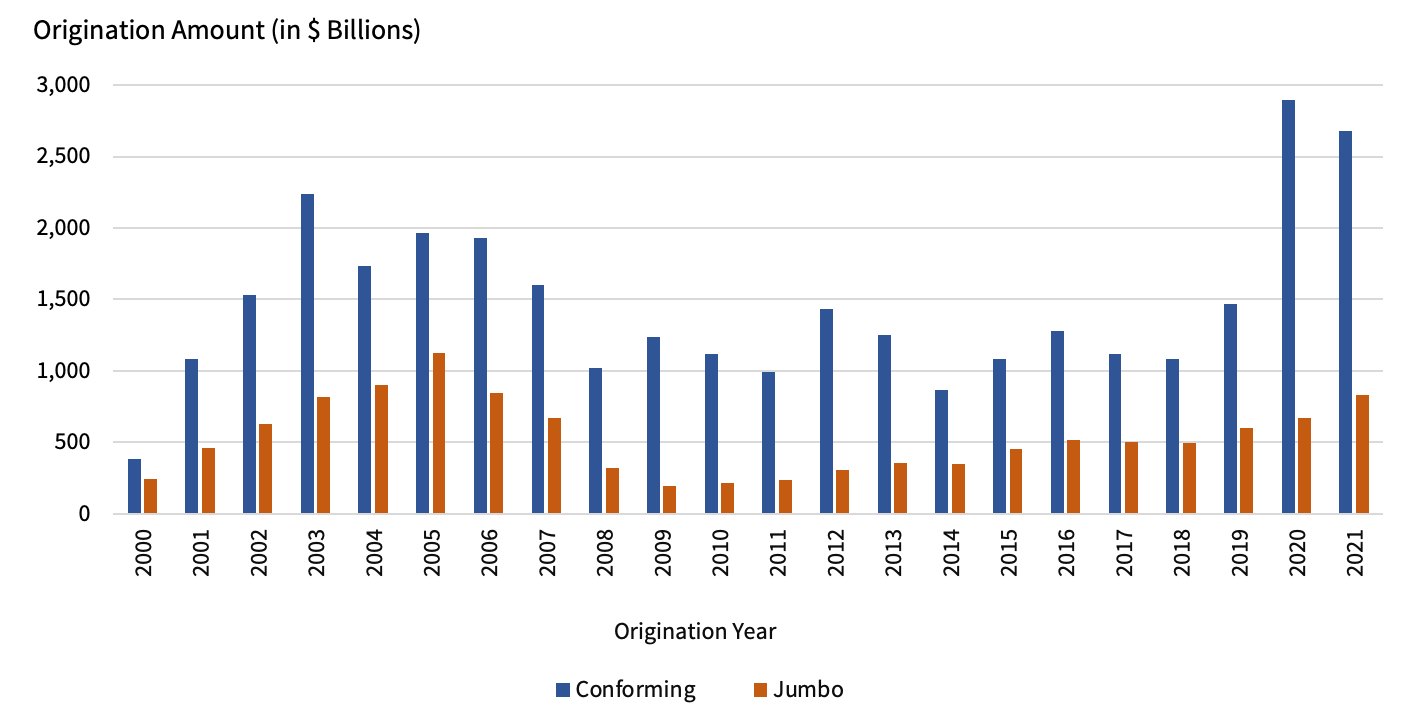

Both the conforming and jumbo loan origination volume have varied over time. Figure 2 shows aggregate origination volumes of conforming and jumbo mortgages (includes both purchase and refinance). The conforming loan volume nearly doubled from 2019 to 2020 while jumbo loan volumes only increased by 11%.

At least two factors contributed to the much slower rise in jumbo mortgage originations. First, with conforming mortgages cheaper than jumbo loans in the early months of the pandemic, and conforming mortgage rates falling to record lows, some borrowers with jumbo mortgages refinanced into a conforming loan. Second, the economic uncertainty and shelter-in-place restrictions observed in many communities resulted in a decline of expensive home sales as a share of overall sales during 2020.

The rapid home price appreciation and record-low mortgage rates have influenced the rise of mortgage origination volumes in 2020 and 2021. The average interest rate on 30-year fixed-rate conforming mortgages averaged 2.96% during 2021, the lowest annual average ever. And jumbo interest rates also declined to the lowest ever measured during 2021. Very rapid home price appreciation in 2020 and 2021 has led the average loan size to rise to an all-time high in 2021. As a result, the average loan size went up by 14% in 2021 from 2020.[2]

The overall 2020-dollar volume is the highest to date. However, 2021 may beat it. Through November, the 2021 jumbo volume was already higher than the 2020 jumbo volume and is on pace to be the highest since 2005. Conforming volume is more than 92% of the 2020 conforming volume.

Figure 2: Conforming and Jumbo Markets Origination Volumes (in $ Billions): 2000-2021

Note: 2021 includes data through November 2021

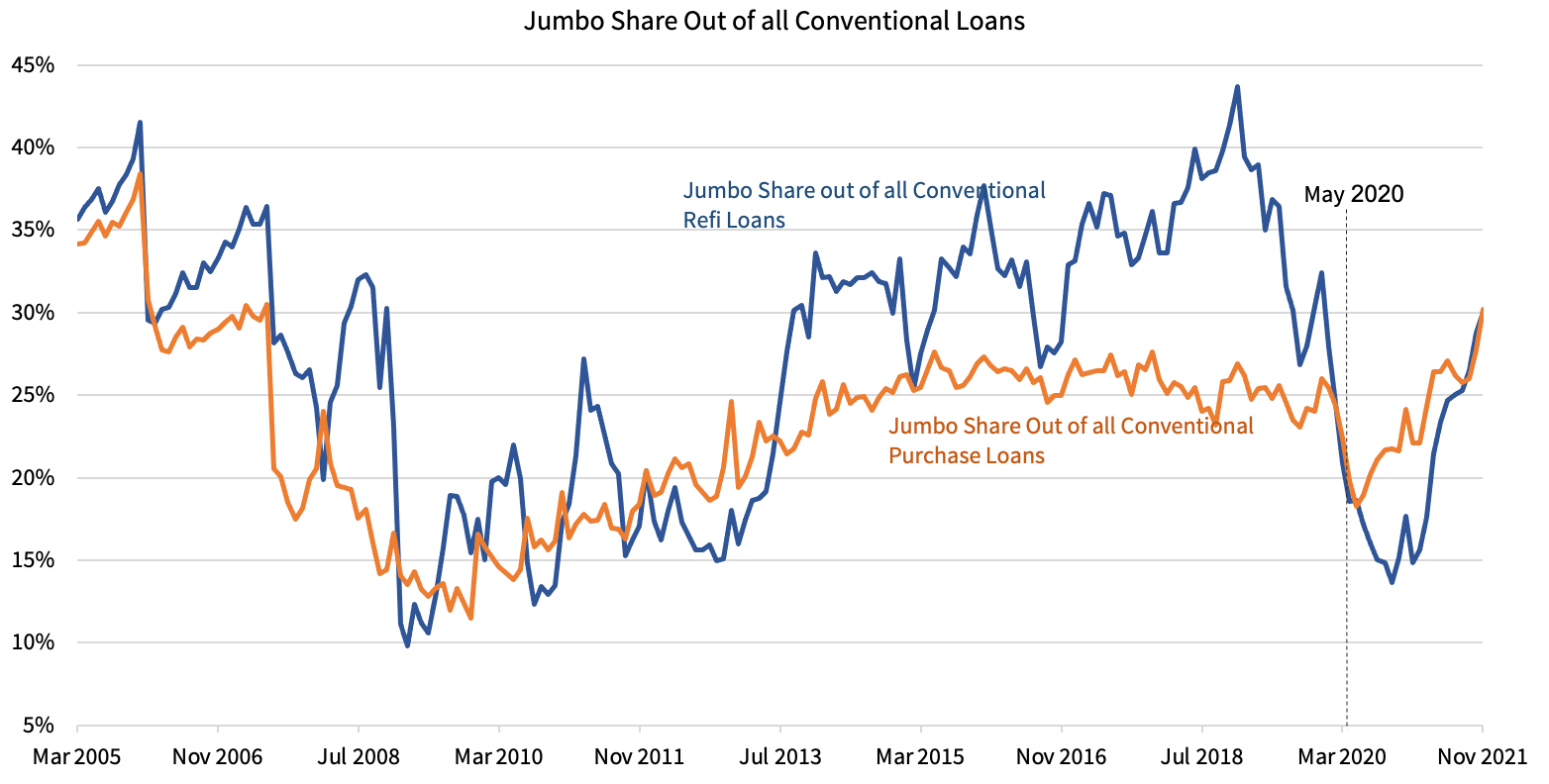

A closer look at CoreLogic data reveals that the jumbo mortgage market contracted during the early months of the pandemic for both purchase and refinance loans. Figure 3 shows jumbo loan originations as a share of all conventional (non-FHA/VA/RHS) mortgages by dollars originated. As a share of purchase loans, jumbo loans dropped 7 percentage points over 12 months to 18% in May 2020 reaching the lowest market share since 2012. However, following that dip, jumbo purchase loans began to rebound. In contrast, the share of jumbo refinance loans continued to drop to its lowest point since 2011, reaching 14% of total mortgages in October 2020.

Over the course of 2021, both purchase and refinance jumbo mortgages began to rise as the economy recovered. Home price growth accelerated and interest rates on jumbo mortgages declined with both contributing to the bounce back in the jumbo share of purchase and refinance loans. Currently, the jumbo share of purchase loans is at its highest since 2007. Conversely, the market share for refinance loans, which experienced a sharper decline in 2020, has only recovered back to 2019 levels.

Figure 3: Jumbo Market Share of Conventional Purchase and Refinance Mortgages (by dollars originated)

How will the FHFA limit change the mortgage market in 2022?

Though the share of jumbo mortgages went up in 2021 relative to conforming loans, the market may experience a contraction in 2022 due to the FHFA announcing new limits for conforming mortgages. Limits for loans acquired by GSEs will rise significantly this year to adjust for soaring home prices.

In 2022, the maximum conforming loan limit for one-unit properties in most areas increased by 18%, from $548,250 to $647,200. The upper limit allows for borrowers who currently have jumbo loans to qualify for loans backed by the GSEs. Under these new limits, about 20% of the jumbo loans originated in 2021 meet the FHFA requirements for 2022.

The CoreLogic HPI Forecast projects just a 2.8% increase from November 2021 to November 2022, compared to the 18.1% jump from November 2020 to November 2021. The combination of lower home price appreciation and the increase in the GSE loan limit will likely contract the jumbo market share in 2022.

However, the share may be similar if the price growth continues at the current rate, though there is little chance for that.

2022 CoreLogic, Inc. , All rights reserved.

[1] For loans originated in 2021, the local-market conforming loan limit for one-unit properties for most areas was $548,250, with higher limits of up to $822,375 in areas designated as high-cost. The 2020 maximum conforming loan limit for one-unit properties for most areas was $510,400, with higher limits of up to $765,600 in high-cost areas.

[2] Includes all conventional mortgages (both purchase and refinance for both jumbo and conforming loans).