When homeowners think about the value of their properties they usually focus on the physical attributes of their houses and pay less attention to the land parcels on which their houses sit. This makes sense since most people spend more time inside their houses than in their backyards. But in many housing markets, especially expensive markets on the East and West Coasts, the values of residential land parcels exceed the replacement costs of houses. Furthermore, unlike houses, the values of parcels are not closely tied to the physical attributes of the land, but depend more on the locations of each parcel. That is why real estate agents always remind home buyers and sellers that “location, location, location” is a primary driver of home value.

Of course, it is not easy for home buyers and sellers to estimate the dollar values of the hundreds of locational factors that sum up to total land value. If I have school-age children, how much more would I be willing to pay for a house located in a school district with higher test scores? What if that house is located on a busy street or on the edge of a flood plain? The kids in the house next door have moved out, so do my potential neighbors place less value on school quality? How do their preferences or the preferences of future home buyers affect the current and future value of the house that I am thinking of buying?

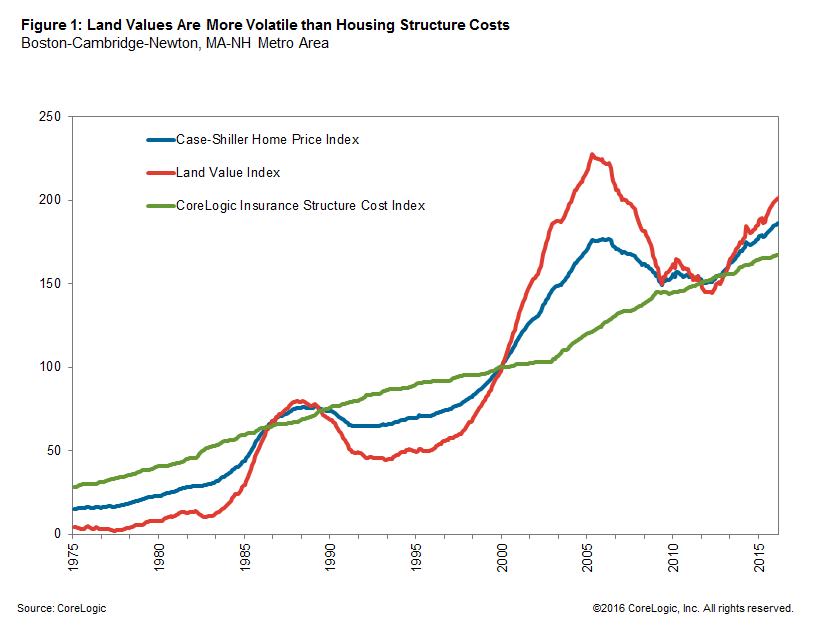

Because of this uncertainty, land value is more volatile than structure cost as a component of residential property prices. This can be seen in Figure 1, in which the CoreLogic Case-Shiller home price index for the Boston area is decomposed into land value and housing structure replacement cost components.[1] It is easy to see that Boston land values exhibit far more cyclical and month-to-month volatility than structure costs, a pattern that holds true in most housing markets. Furthermore, declines in Boston area home prices are almost entirely attributable to falling land values – structure costs can increase even while home prices are falling.

Structure costs are determined by construction wages and the prices of building materials for particular types of homes in specific markets. These costs can vary widely depending on methods of construction (e.g., masonry or wood frame), the attributes of a house (e.g., one or two stories), and the supply and demand conditions in the local construction labor and materials markets. But when structure costs are averaged across individual houses within a metro area market, as they are in a cost index, their average, inflation-adjusted values tend to increase relatively steadily, especially when compared to land values.

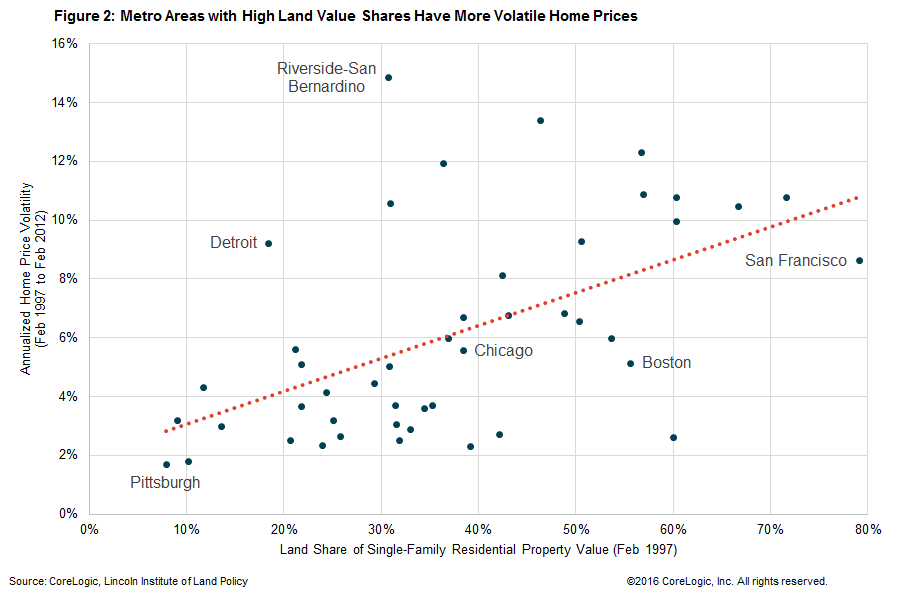

Because the values of locational factors are so uncertain, residential land values in most markets are highly speculative. Buyers, sellers and residential developers are making guesses – sometimes educated, sometimes not – about the current and future values of locations when they are setting the prices for properties. This means that property prices are more speculative and volatile in markets where land values are a larger proportion of total property value.

Average home price volatility for the last housing market cycle (1997 to 2012) is plotted against the land share of property value at the start of the cycle for 46 metro areas in Figure 2. In general, metro areas with lower land value shares at the beginning of the cycle had less volatile home prices across the entire span of the cycle. At one extreme, Pittsburgh, which had the lowest land value share in 1997, also had the least volatile home prices between 1997 and 2012. If fact, Pittsburgh is one of the very few markets in which home prices did not fall during the housing market crash. At the other extreme, San Francisco, which had the highest land value share in 1997, experienced two double-digit percentage home price declines – one following the “dot.com” stock market crash in 2000 and another during the housing market crash.

Land value indexes can be used to track direct and indirect exposure to land prices for individuals or organizations that own either developed or undeveloped residential land parcels or hold mortgages for residential properties. Since higher land value shares of total property value are associated with increased home price volatility, information about land values can also be used as an early warning indicator for future home price declines.

- In the decomposition, structure cost trends are measured by the CoreLogic Residential Construction Indexes.

© 2021 CoreLogic, Inc. All rights reserved.