Older Millennials Closer to Generation Xers than to Younger Millennials

Millennials, born from 1981 to 1997, accounted for 40 percent of homebuyer loan applications during January to September of this year.[1] However, there are notable differences between the younger millennial homebuyers (born 1990 to 1997) and older millennial homebuyers (born 1981 to 1989). Often, younger millennials have less credit history (and sometimes no credit history), limited or no savings, and lower levels of income because they are just beginning their working careers. In contrast, older millennials generally have an extensive credit history, more savings, and higher levels of income as they have work experience and established careers.

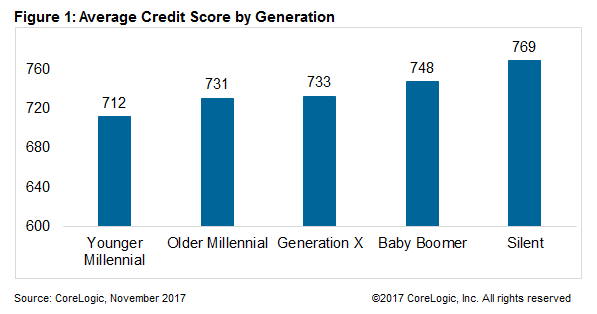

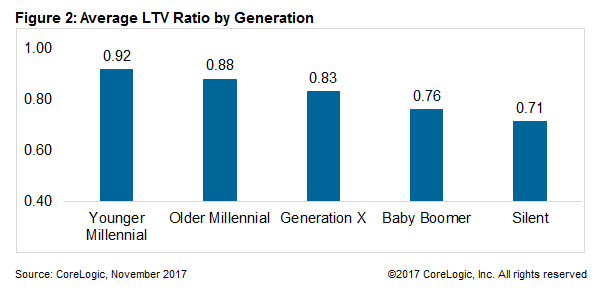

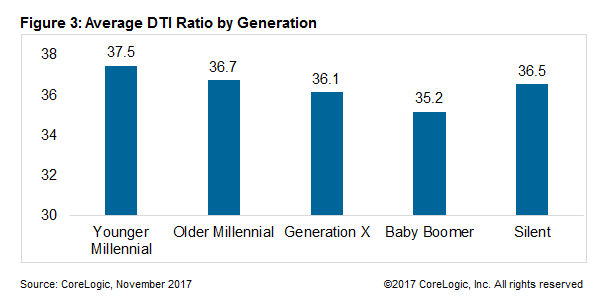

These trends are borne out when comparing three important credit risk attributes of new mortgage loan applications by generation: credit score, loan-to-value (LTV), and debt-to-income (DTI) ratios. Let’s look at each of these.

Experience using credit prudently and the attainment of larger financial savings (as a buffer to offset temporary income dips and remain current on debt obligations) help to support higher credit scores. Thus, it may not be surprising to observe that the average credit score of home-purchase applicants rises with the cohort’s age. Younger millennial applicants have the lowest average credit score, which rises with each older cohort and was highest for the “silent generation” – those born between 1928 and 1945 (Figure 1)[2]. Older millennials have an average credit score closer to Generation Xers than to younger millennials. Compared to older cohorts, younger millennials have had less time to build their credit history and have smaller amounts of savings to offset fluctuations in earnings.

Younger millennials have the highest average LTV ratios, which drops with each older cohort and was lowest for the silent generation (Figure 2). About 90 percent of the applications from younger millennials had an LTV ratio equal to or above 80 percent compared with 82 percent for the older millennials. Since many of the younger millennials do not have enough savings for a substantial down payment, their LTV ratios are higher compared with older cohorts. Older cohorts are also more likely to be repeat buyers and have home-equity wealth from the sale of their primary residence to use for a large down payment, and thus have lower LTV ratios. For many members of the baby boomer and silent generation cohorts, they may also be ‘downsizing,’ thereby selling a larger, higher-priced home and buying a smaller, lower-priced home with a smaller LTV.

Similarly, younger millennials have the highest average DTI ratios, which drops with each older cohort but rises for the silent generation (Figure 3). Younger millennials often have student or other debt, and are early in their working careers (hence, have lower earnings than more experienced workers). On average, earnings typically peak for workers aged in their early 50s, helping to lower DTI. The silent generation cohort mostly consists of retirees with low current income; this fact elevates their DTI ratios even though they may not be carrying substantial amounts of debt.

Younger millennial applicants have contracts to buy the least expensive homes at an average home price of $213,800 compared with $319,700 for older millennials, $374,000 for Generation Xers, $336,200 for baby boomers, and $315,400 for the silent generation. Generally, with little savings and lower income, younger millennials can only afford the lower-priced homes, whereas older millennials and Generation Xer’s are ‘trading up’ and baby boomers and the silent generation are ‘downsizing.’

Based on the above discussion it can be said that older millennials are closer to Generation Xers than to younger millennials in terms of mortgage credit attributes. Though younger millennials’ credit-risk attributes may look weaker today than for older cohorts, they have the potential for faster earnings growth and more savings accumulation, which are important offsets in their risk profile.

- [1] Pew Research Center defines generations born 1981 to 1997 as millennials, 1965 to 1980 as Generation X, 1946 to 1964 as baby boomers, and 1928 to 1945 as the silent generation.

- [2] The analysis in this blog is based on home-purchase mortgage application data. All first-lien applications, whether approved or not, were included in the analysis.

© 2021 CoreLogic, Inc. All rights reserved