The pandemic contributed to an unprecedented migration within the U.S. and the increasing need for new homes in places with fast population growth. Families moved from high-cost communities with a dense housing stock to places with a lower cost of living and more space between homes. During the first 15 months of the pandemic, the states of New York and California lost a total of more than 600,000 population, while Texas and Florida gained 600,000. Arizona and North Carolina also gained more than 100,000 people each to round out the list of top four states by population gain.

These swings in population are reflected in the latest single-family construction data.

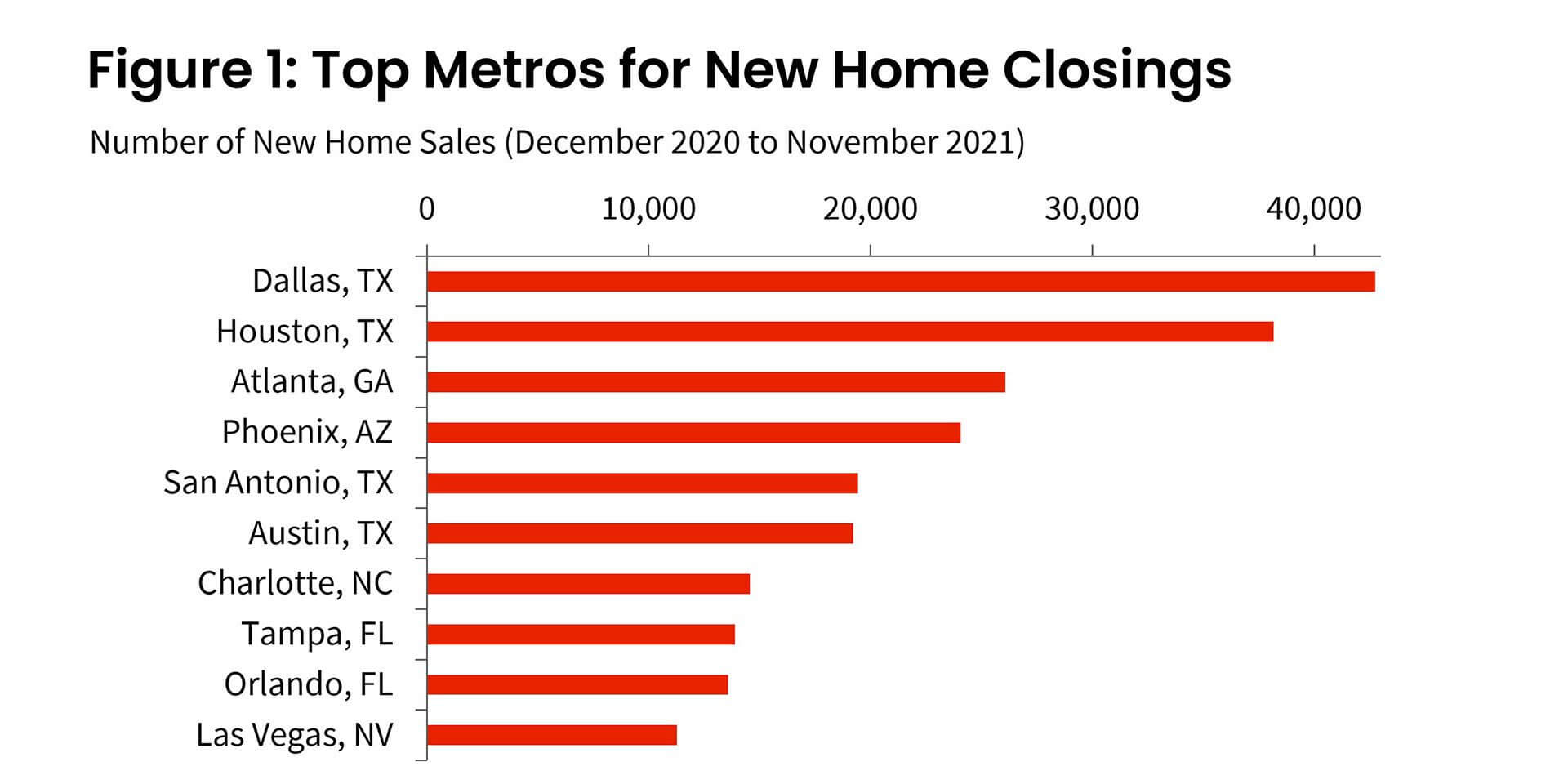

CoreLogic analysis of new-home settlements during the past year show that 8 of the 10 metros with the largest number of new home closings were in the four states with largest population gain. The Dallas and Houston metro areas topped the list, with a combined total of more than 80,000 single-family home closings.

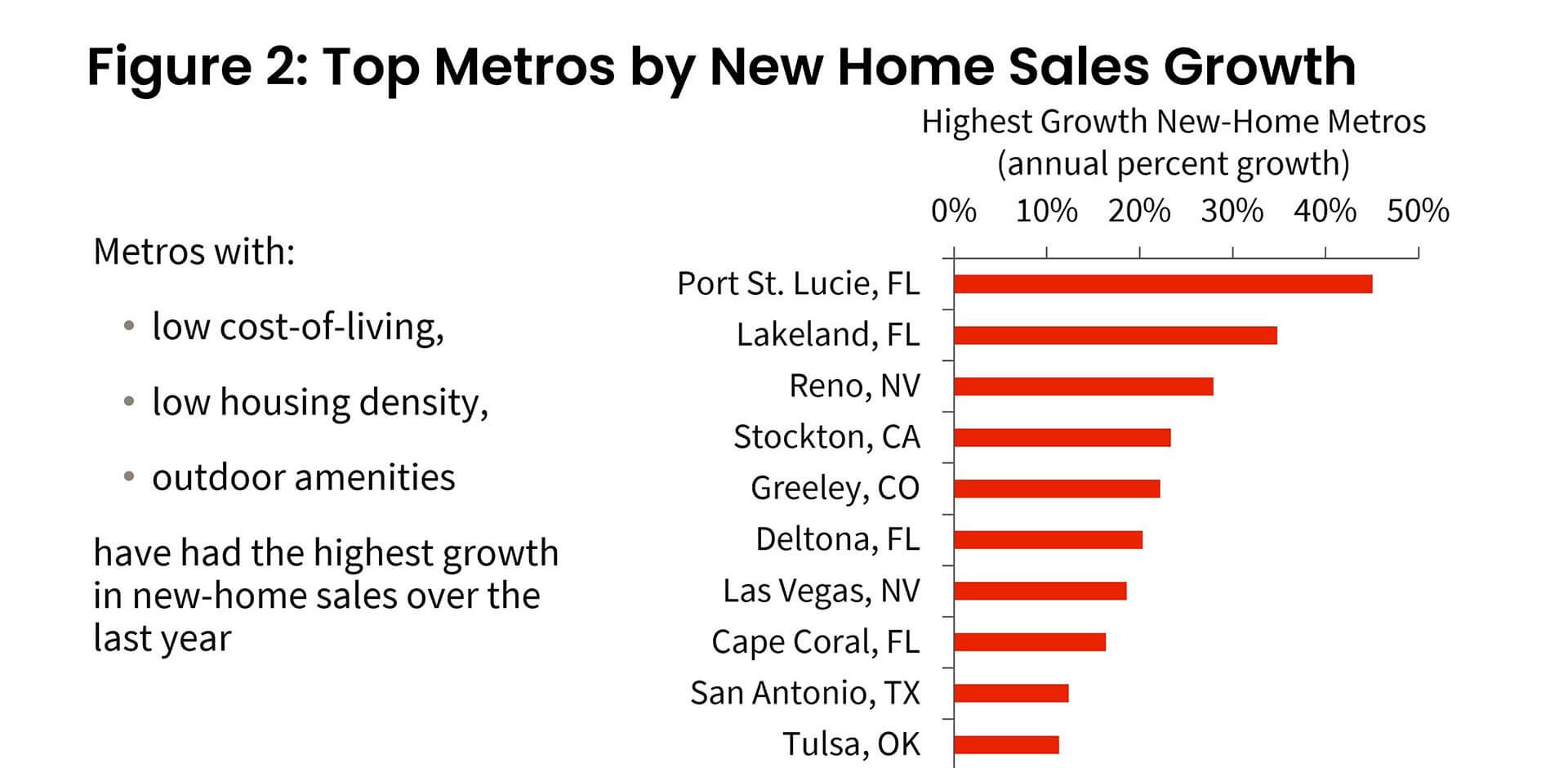

Likewise, looking at markets that had the largest percentage jump in new home settlements compared with the prior year show 9-of-10 were in states with population growth rates well above the national rate. Common attributes that these markets have are a lower cost-of-living, lower population density, and nearby outdoor amenities.

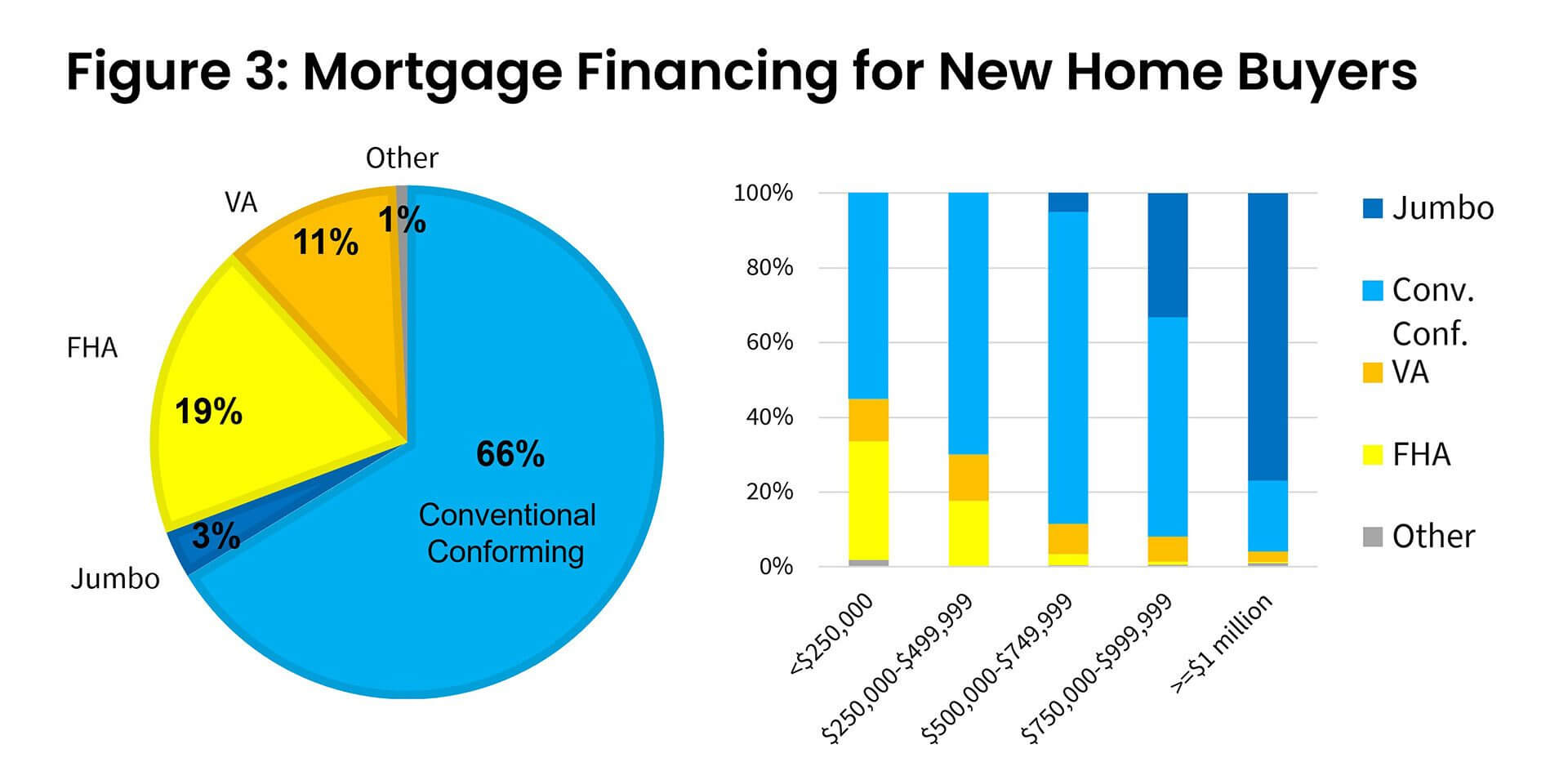

Even when buying a new home in a lower cost-of-living market, the average sales price is typically higher than for an existing home and will require financing. The buyer’s choice of mortgage product to finance the purchase varies with the sales price. For new homes that sold for less than $250,000 last year, about one-half were financed with an FHA or VA loan and the rest by a conventional loan. At the opposite end of the price spectrum, for homes selling above $1 million, nearly all the mortgages were conventional, and most of these were jumbo loans that exceed the loan limits of Fannie Mae and Freddie Mac.

We expect new home sales to increase in 2022 with the biggest gains in places with high population gains, projected to be Texas, Florida and Arizona.

2022 CoreLogic, Inc. , All rights reserved.