Dr. Frank Nothaft Shares Research on Natural Hazards at EPIQ 2019

We all know that natural disasters have become a growing concern, both in the United States and around the world. Whether flooding, storms, earthquakes or fires, the increasing frequency and severity of natural hazards has been felt throughout the housing industry, but the scope of the effects may surprise you. In his EPIQ 2019 session “Economic Outlook & State of the Housing Industry,” CoreLogic Chief Economist Frank Nothaft shared some of the most unexpected effects of natural catastrophes.

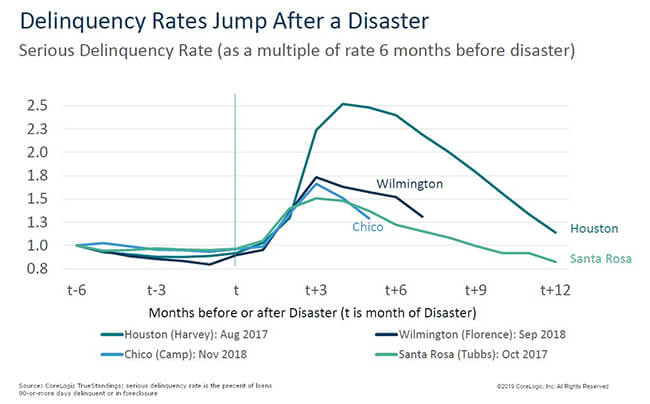

Delinquency Rates

The ramifications of a natural disaster go far beyond the physical damage they inflict on homes. They also wreak havoc on the finances of the local residents, which increases mortgage delinquency rates. Nothaft illustrated the effects with data taken from four recent disasters: two hurricanes (Harvey and Florence) and two wildfires (the Tubbs fire and the Camp fire). He noted, “Within three months, there’s a huge spike in serious delinquency rates on mortgages. And it happens even on those properties that didn’t have any damage.”

One tends to think that everyone whose home survived the disaster is in the clear, but this is far from the truth. Commercial buildings that supply jobs to the local community can also get burned down, torn apart or washed away. Even undamaged companies may suffer a sharp drop in business. Residents working in a disaster-damaged area will often find themselves without the income they were expecting to make their bill payments. As a result, even those whose homes are completely undamaged can be at an elevated risk of delinquency.

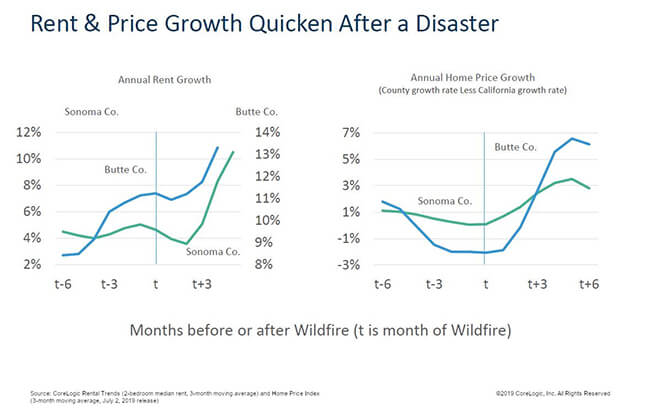

Rent and Home Sales

Disasters destroy homes and displace residents, so it’s expected that they would have a strong effect on the housing market. When residents lose their homes, they need to find a new place to live, and they typically stay within the local area to remain with family, jobs and their familiar community. This causes an increase in demand for the remaining housing in the area.

Nothaft illustrated the effect by examining the aftermath of the fire in Paradise, California. He noted, “No big surprise, home sales in Paradise compared to a year earlier plummeted, down 40-50%. But in neighboring cities that were not damaged, in the same county, 10-20 miles away, their home sales jumped.”

As a result of this increased demand for housing, the prices on vacant stock in the surrounding community rises considerably. Still examining the effects of the Paradise fire, we see that both rents and home prices in Butte and Sonoma counties jumped about 3% and 6% respectively between three to six months after the time of the fire.

So we see that natural disasters can have many effects on a community apart from the damage they inflict on properties. Residents throughout the area may find themselves earning less and spending more than they had before the catastrophe, even if their own homes were untouched by the disaster.

© 2019 CoreLogic, Inc. All rights reserved.