Buyer competition fell in early 2023, and home sales prices returned to pre-pandemic rates

Rising home prices and climbing mortgage rates continue to challenge property market affordability in early 2023.

The 30-year, fixed-rate mortgage hovers at one of the highest levels seen over the past 15 years, and home prices remain elevated despite the national CoreLogic Home Price Index (HPI®) softening from double-digit to single-digit annual growth over the past few months. This environment has led many potential homebuyers and investors to hit the pause button on their purchase plans, resulting in 59% of homes selling below list price in March 2023.

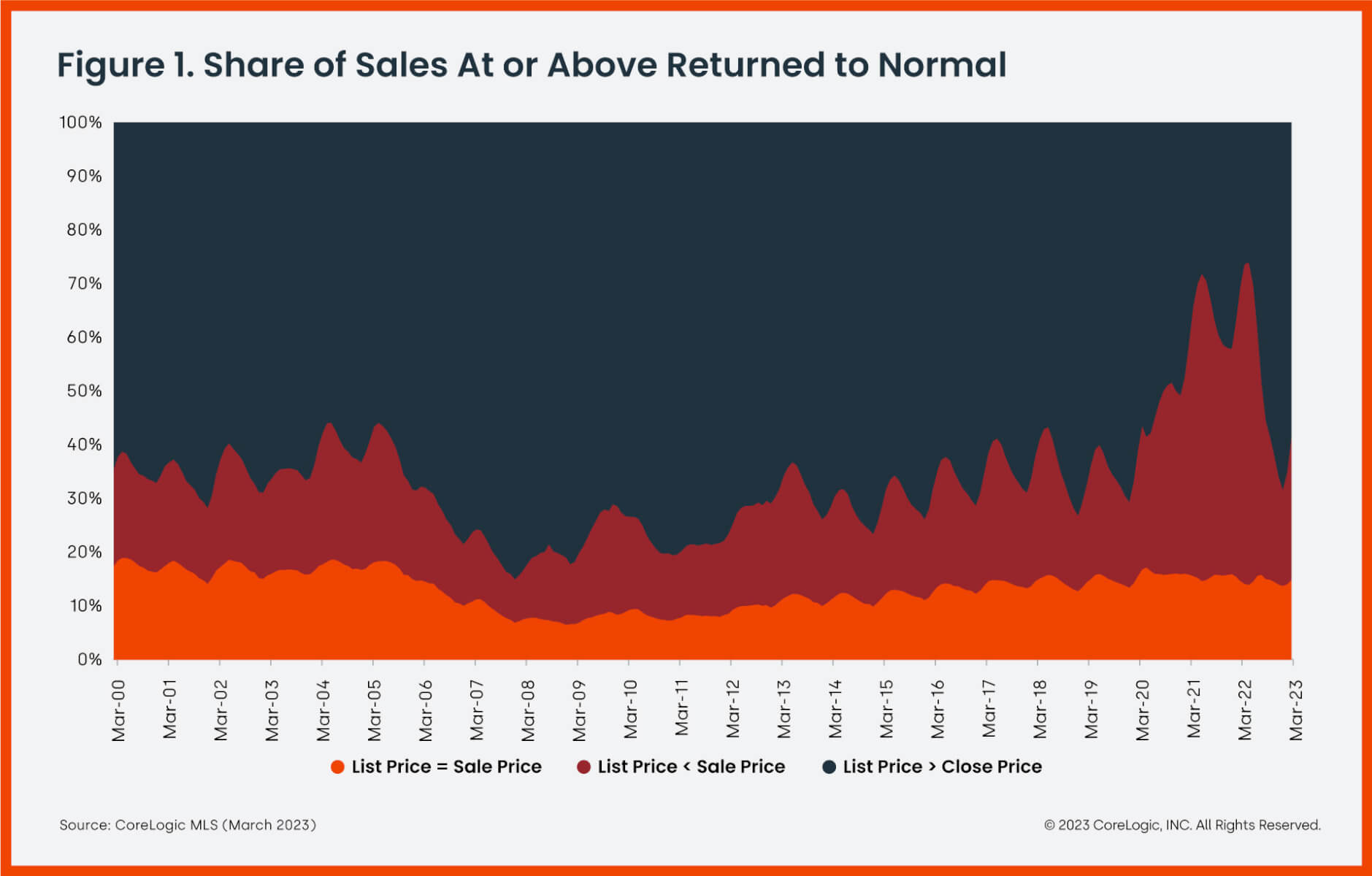

Figure 1[1] shows the share of homes sold at levels above or below list price. Starting in July 2020, the share of homes selling at or above the list price, which is denoted by the orange and blue areas in Figure 1, exceeded the previous peak seen in May 2005. By May 2022, that share reached a new high of 74% of total sales – almost five times the level recorded in January 2008.

But with mortgage rates near a 15-year high in March 2023, the share of homes sold at or above list price decreased to 41%, only 2 percentage points higher than in March 2020 when the pandemic began.

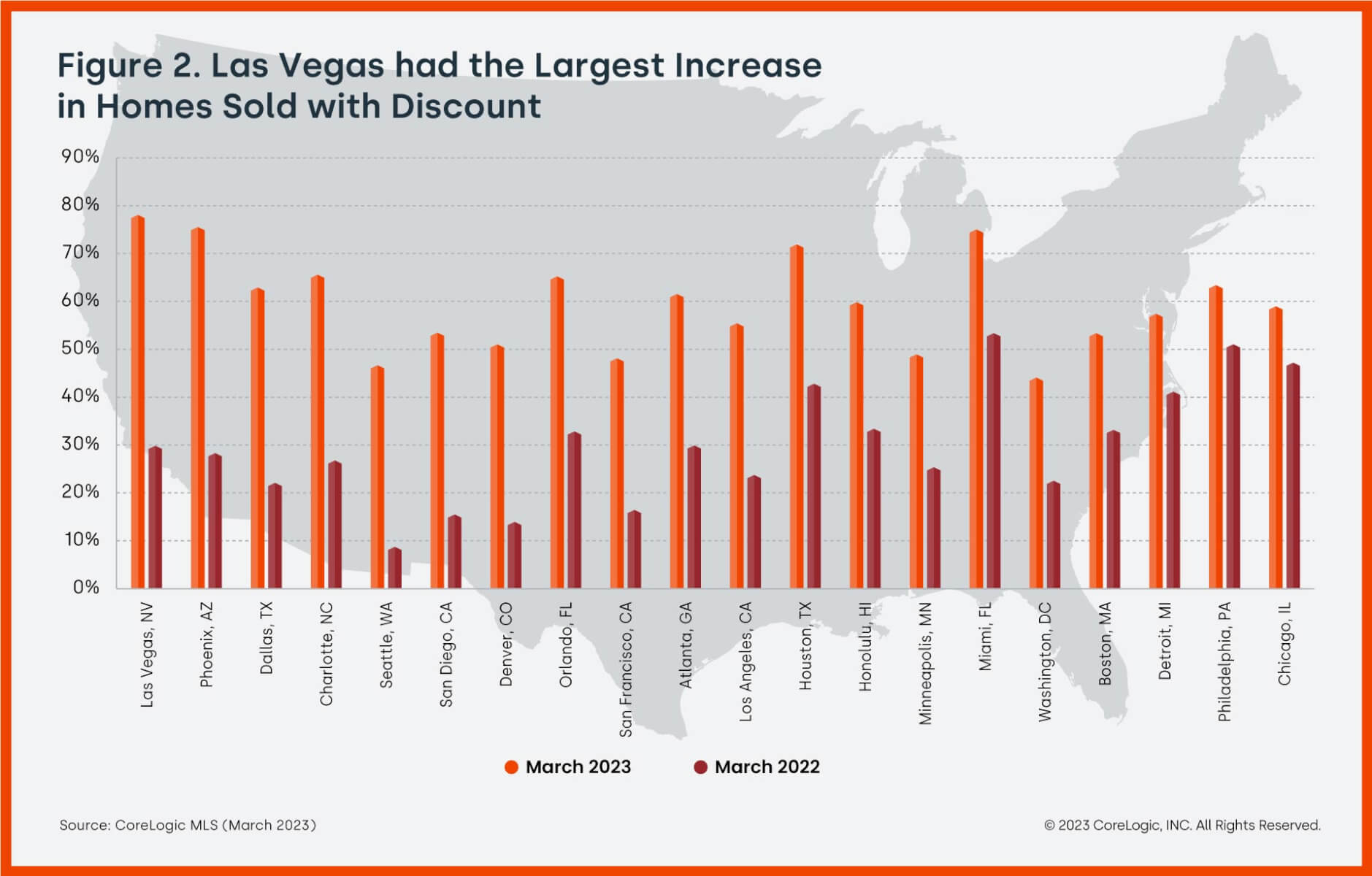

This trend of softening competition in the property market is more pronounced in popular migration destinations. Figure 2 compares the share of homes sold below their list prices in 20 metropolitan areas in March 2023 with the previous year. Las Vegas had the largest increase in the share of homes that sold below list price. In March 2023, 78% of homes in Las Vegas sold at a discount, which is an increase of 4 percentage points from a year prior. Phoenix sales followed a similar pattern where the market saw 47 percentage point increases in the share of homes sold for less than the asking price.

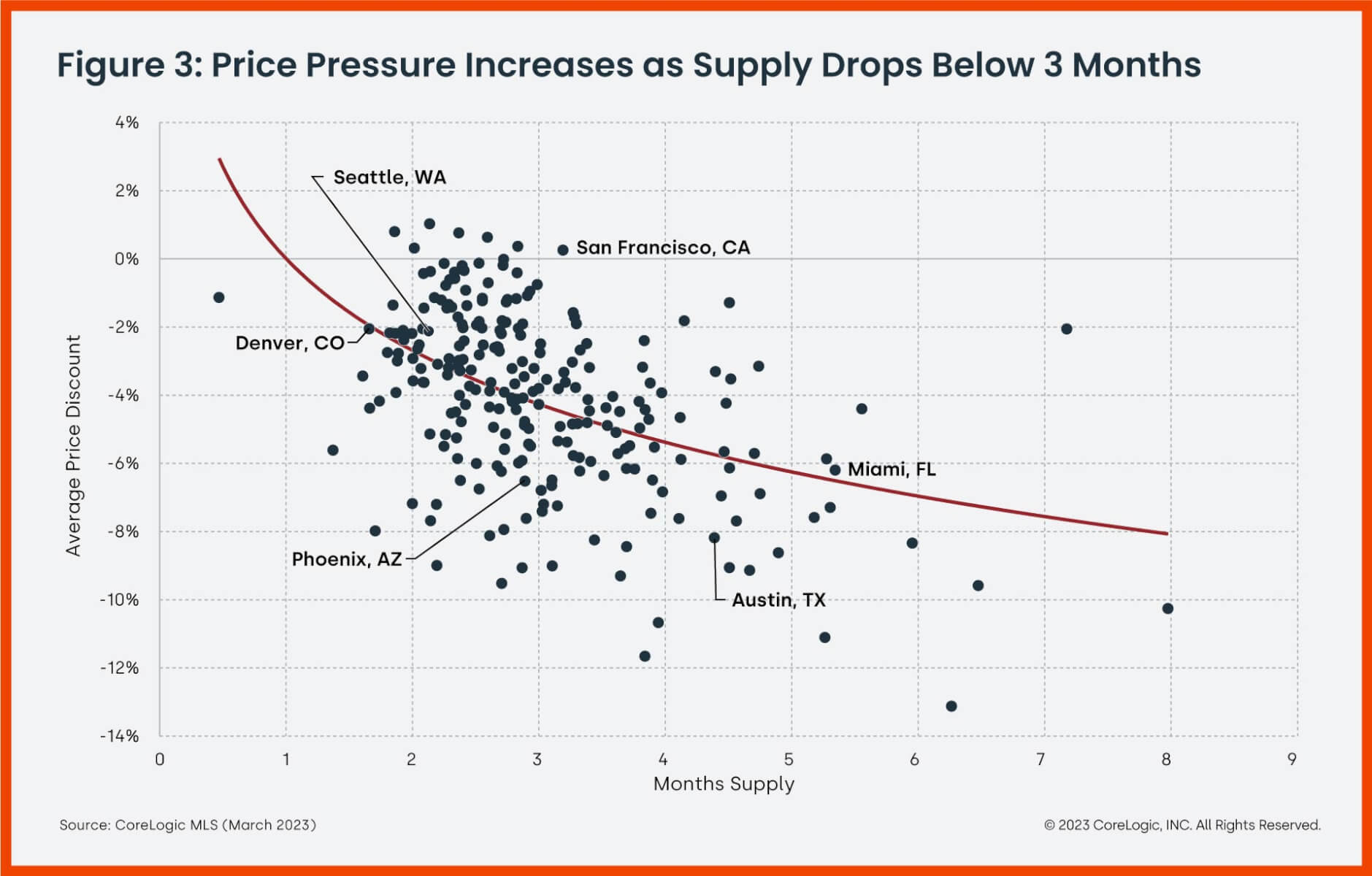

With fewer buyers in the property market, the overall active for-sale inventory increased across all U.S. markets. Figure 3 shows the price discount and months’ supply[2] for more than 200 metropolitan areas. In Miami, where supply increased by two months to 5.3 months in March 2023 compared to a year prior, homebuyers were able to negotiate below the asking price and save an average of 6.2%. In Phoenix, the months’ supply increased from 1.7 to 2.9 months between Mach 2022 and Mach 2023, and homes sold at an average price discount of 6.5%. Similarly, in Austin, Texas, buyers gained an average discount of 8.4%, and the market maintained a 4.4-month supply in March 2023.

Property market trends are shifting in favor of buyers, and this dynamic could continue, as CoreLogic projects that prices will continue to cool in 2023. To stay up to date with the latest data, regularly check the Home Price Index, which is released on the first Tuesday of each month.

[1] The U.S. statistics are based on data from 68 metropolitan areas. Each of these metros has had at least 50% coverage since 2000. CoreLogic MLS data coverage usually increases over time, which might also contribute to inventory increases.

[2] The months’ supply is calculated as the ratio of the for-sale inventory at the end of the month compared to the number of homes sold during the same month. It represents the number of months it would take to sell the inventory at that month’s sales pace.