Pandemic derailed the spring buying season, but single-family activity rebounded

Summary:

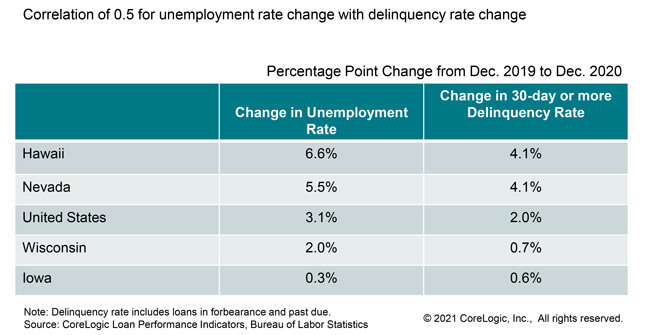

- Places with larger job loss also had a larger increase in home-mortgage past-due rates.

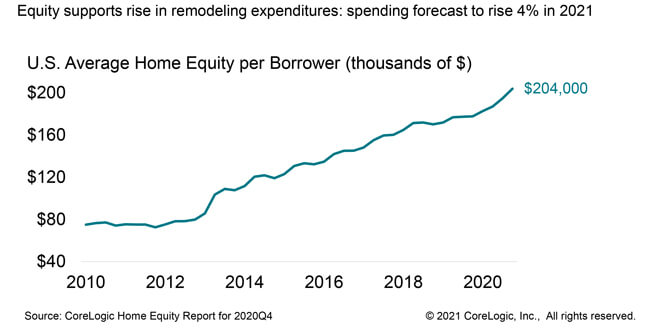

- Average home equity rose to a record level by year-end 2020, enabling a rise in home remodeling spending to an all-time high.

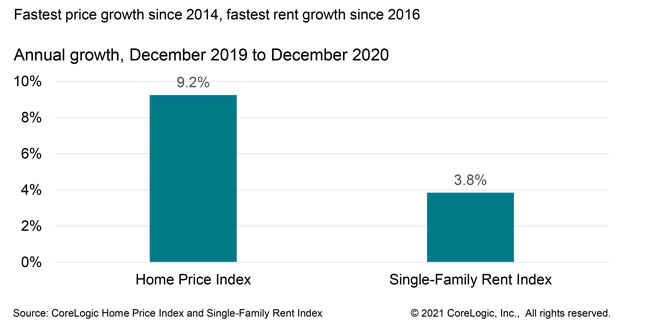

- Home-price and single-family rent growth quickened in the second half of 2020, with prices up 9.2%, the largest annual rise in nearly 7 years.

The World Health Organization declared a global pandemic on March 11 last year. Little did we expect the personal and economic disruption that would ensue. Let’s look back on how the pandemic has changed the housing market.

In January 2020, mortgage delinquencies were at a generational low. After the pandemic hit, many families, especially those working in service occupations that entail in-person contact, faced a large income shock through job loss, illness, or death of a family member. Places that were hardest hit by job loss saw the biggest spikes in past-due loans over the last year.[1] Nationwide, the CoreLogic Loan Performance Indicators reported past-due rates up by 2 percentage points last year. In Hawaii and Nevada past-due rates jumped 4 percentage points.

The pandemic was inequitable in other respects, affecting higher-income families and homeowners less. Most workers kept their jobs and converted part of their home to an office and/or a classroom. With home prices up, the CoreLogic Home Equity Report found average home equity was at a record high, enabling a 4% pickup in home remodeling to a record nominal amount.

The pandemic was also inequitable by age. With the older population at greater health risk, many long-time owners chose to postpone selling, thus adding to the inventory shortfall that has plagued the for-sale market. With supply down but younger families eager to buy with record low mortgage rates, the CoreLogic Home Price Index was up 9.2% in December, the fastest annual growth in more than six years. Detached homes were in stronger demand, with prices up 10.1% compared with 5.5% for attached homes.

Remote work severed the location of the employee from the place of business, allowing some to relocate to cheaper, less densely populated locales. This sparked an acceleration in home prices and rents in places with lesser population density and low-density structures. Among rental homes, our Single-Family Rent Index recorded annual rent growth of 3.8% in December 2020, compared with 2.9% one year earlier.

With vaccination covering more of the population each day, families will be emerging from the pandemic’s shroud. And, indeed, perhaps a moderation may occur in some of the housing trends that emerged during the year of the pandemic.

©2021 CoreLogic,Inc., All right reserved.

[1] The correlation coefficient for the 12-month change in state unemployment rate with the 12-month change in state 30-days-or-more delinquency rate was 0.5.