With home prices continuing to reach new highs and the market showing few signs of slowing in most of the country’s metropolitan areas, questions surrounding rising housing market risks are top of mind for many.

In 2021, home price growth surged to a 15% annual increase from 2020. This is triple the average rate seen in the decade prior. Although home price gains are expected to slow in 2022 and average a little less than 10% growth for the year, the recent rapid acceleration in prices has led to overvaluations in some markets, therefore pushing up the risk of price decline in the year ahead.

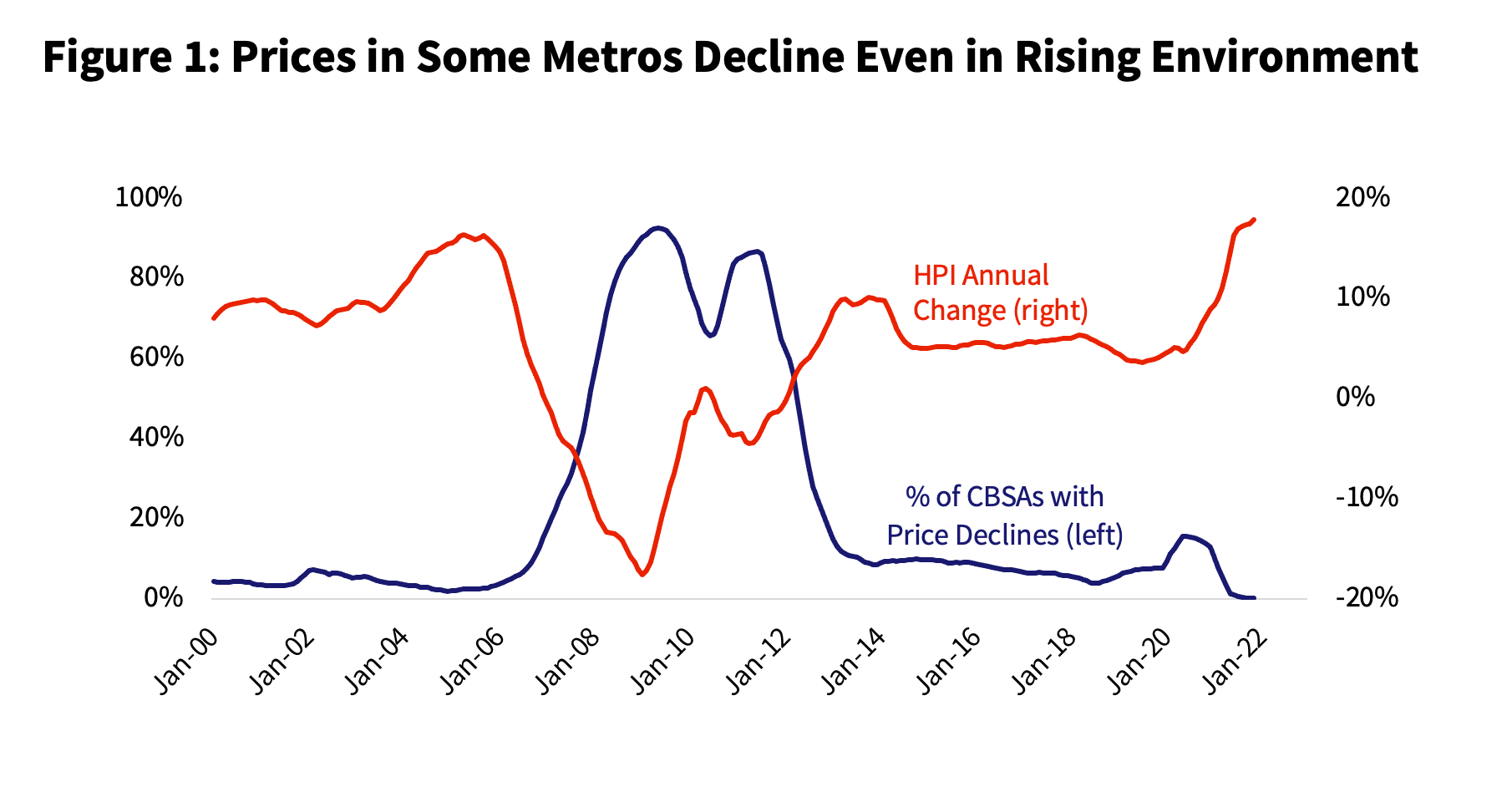

First, however, let’s take a look at the relationship between home price growth and the share of metropolitan areas with price declines.

Even when and while home prices are increasing nationally, there are still places where home prices could be falling. Prior to 2006 — a period when home prices grew steadily — an average of 4% of U.S. metro areas saw price declines. More recently, when the pandemic started in 2020, some 15% of the U.S. urban areas saw price declines. That share dropped to near zero during 2021.

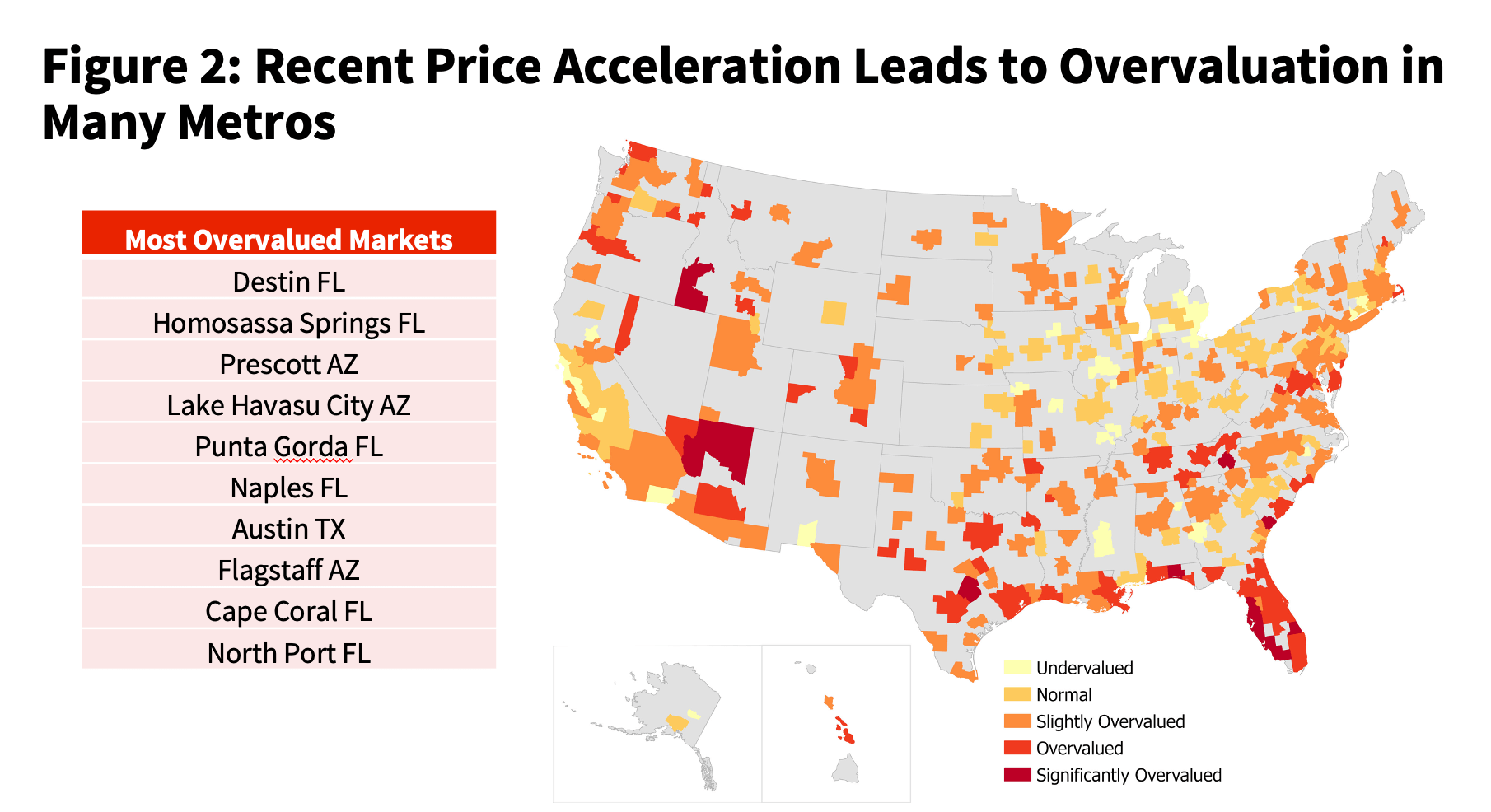

Now, let’s see where rapid home price growth has led to an overvaluation of home prices.

For that we will look at the CoreLogic Market Conditions Indicator which provides a benchmark that indicates if a metro area’s home prices are overly high compared to local household incomes. If they are, the market is considered overvalued. As the map illustrates, many of the markets in the Mountain West and Southeast — where home prices grew by as much as 20% to 30% year-over-year in December 2021 — are now overvalued.

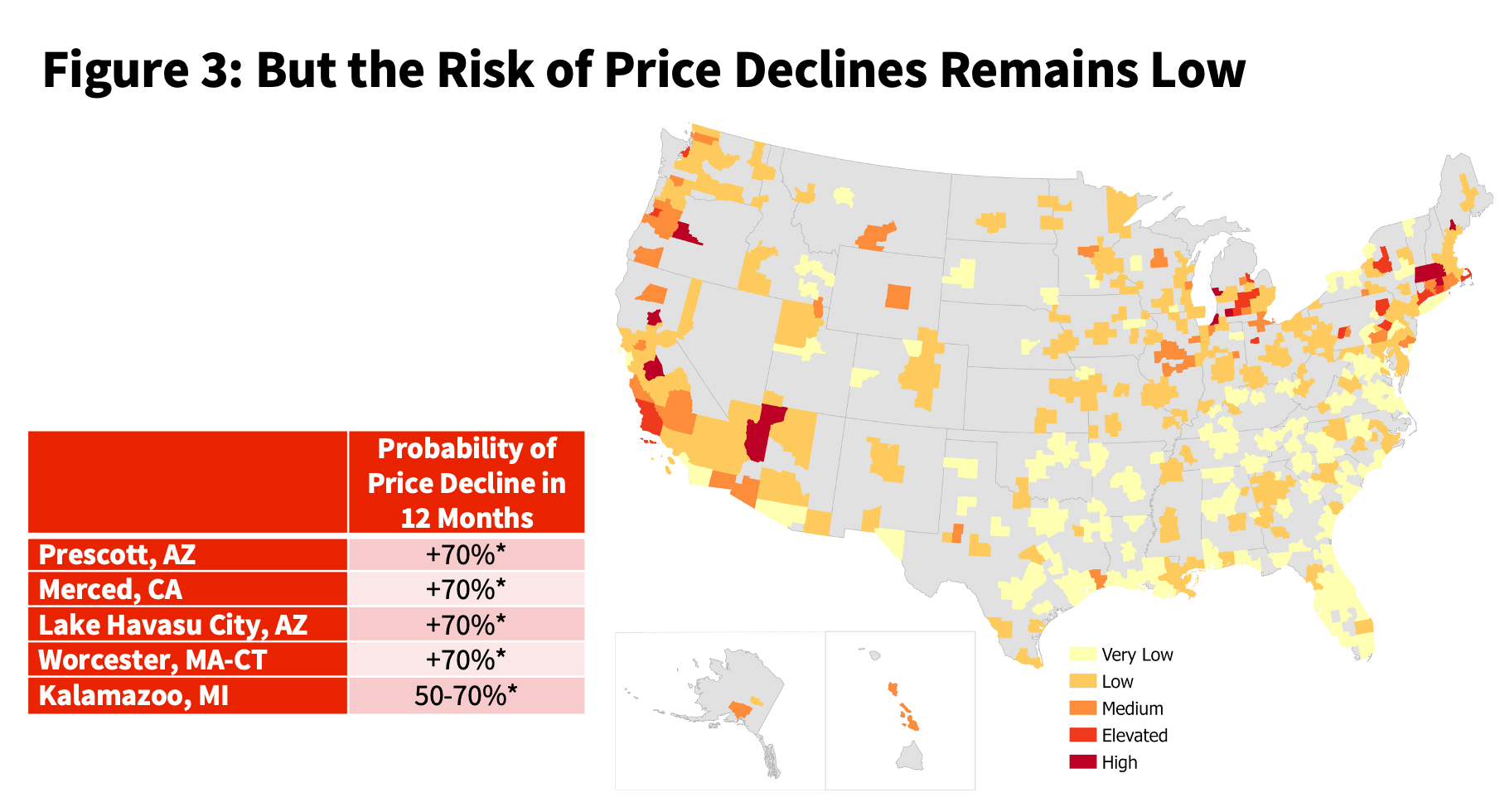

Nevertheless, the risk of price declines remains low.

According to the December CoreLogic Market Risk Indicator, only 12 metro areas had over a 50% probability of a price decline in 12 months. One-third of the metro areas had a less than 10% probability of a price decline. The risk for price decline, however, remains higher in the Northeast, the West and the Southwest and is generally driven by a higher rate of unemployment, lower income growth and/or a lower rate of population growth. On the other hand, the areas that are considered overvalued, but remain with a low risk of price decline, are supported by low unemployment rate and stronger income growth largely brought on by in-migration of populations with higher incomes and solid housing starts.

For more information on CoreLogic’s perspective on the property market, please subscribe to our channel, like this video and visit our blog – www.corelogic.com/intelligence/.