Rent is up 12.6% on new single-family leases in January

Recent price indexes show that inflation is at a 40-year high. Supply chain disruptions have led to a spike in prices for various goods, which has added to the cost of construction and delayed home completions. Housing is a big part of every family’s monthly spending, so when housing costs go up, it also adds to inflation measurement.

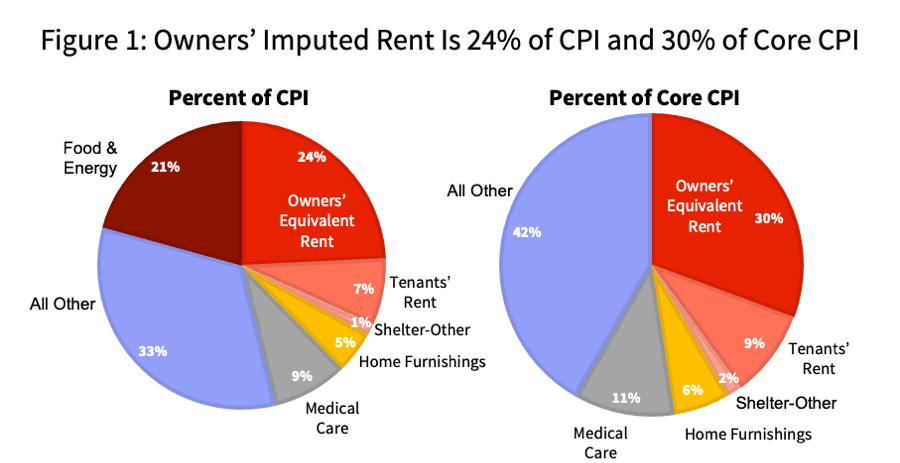

Rent is the main way that housing costs enter U.S. inflation metrics. For owner-occupied homes, the government estimates a rental equivalent to assign value to the flow of housing services. The rent imputed for owner-occupied homes has a large weight in the Consumer Price Index, or CPI. Rent represents 24% of the overall CPI and 30% of the core CPI, which excludes the volatile food and energy components.

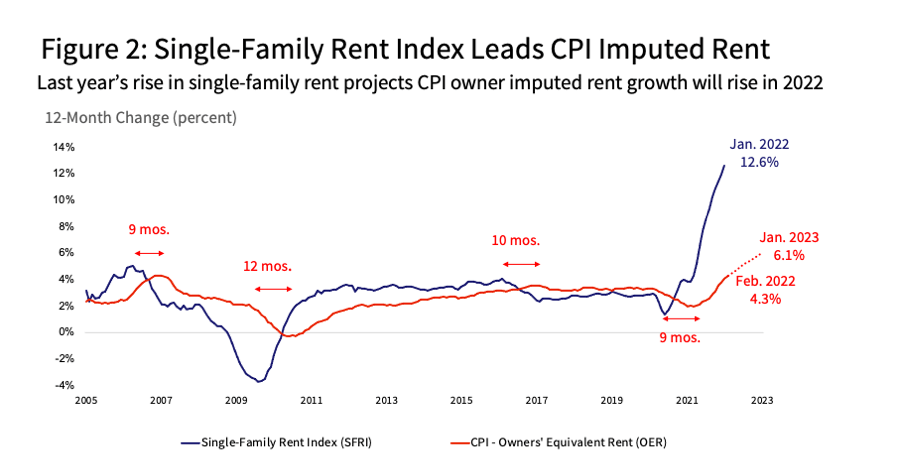

The imputed rent is based on data collected on rental homes. Since a one-year lease is the most common term in the rental market, the average rent will change gradually over the coming year to reflect whether the flow of new rentals is at a higher or lower rate than the average. The CoreLogic Single-Family Rent Index measures the change in rent on new rentals, not the average rate for U.S. rental stock. Due to the prevalence of one-year leases, the CPI rent metric lags our rent index by about 12 months. During the last year, new single-family rentals experienced a much larger growth in rent than indicated by the government’s average metric. Based on the 12.6% annual rise in rent in January’s Single-Family Rent Index, we project that the CPI rental equivalence measure will accelerate to 6% growth by early next year.1

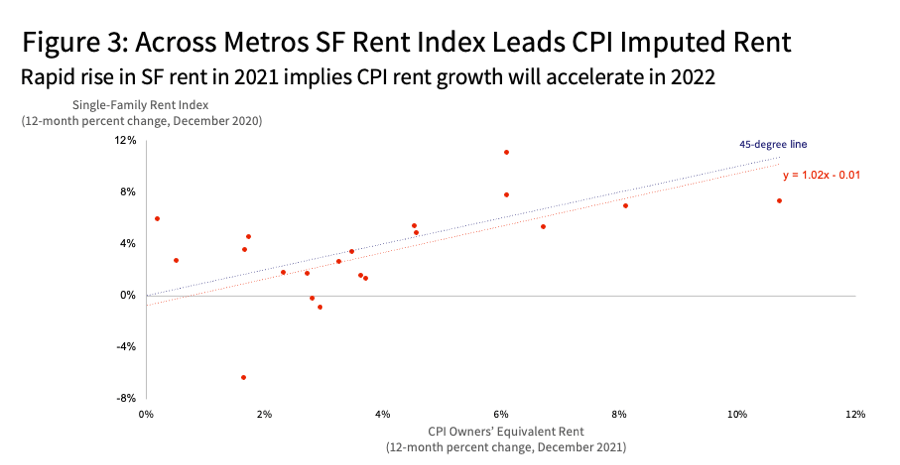

We can also compare the CPI rent with our CoreLogic index at the metro level, and we will notice the same 12-month lag of the CPI rent compared to our index. Thus, the rapid rise in the CoreLogic Single-Family Rent Index for many metro areas in 2021 implies that rents will rise a lot in the 2022 CPI, creating a headwind that limits the amount that inflation will decline after the supply chain disruptions are behind us.

Summary:

- Annual inflation is at a 40-year high.

- Homeowner housing costs are represented by a rental equivalent and have a large weight in the Consumer Price Index (CPI).

- Due to one-year leases and the CPI measurement of the average rent change for the entire housing stock, the CPI rent change reflects market rent growth with a delay.

- Rents on new leases show annual rent growth to be much more rapid than rent in the CPI.

- Rapid rent growth on new leases implies rent growth in CPI will accelerate in 2022.

Acknowledgment: Shu Chen estimated the CPI OER forecast model.

[1] According to the U.S. Census Bureau, 2019 American Housing Survey for the United States, 93% of owner-occupants live in 1-unit properties (including condominiums). Of the remaining owner-occupied homes, 6% were mobile/manufactured homes and 1% were 2- to 4-unit houses. The Single-Family Rent Index should be a good measure of owner-occupied imputed rent because of the large percentage of owner occupants who live in 1-family properties.