U.S. Single-Family Rents Up 3.7% Year Over Year in November

- Rent growth of lower-tier rentals still lags behind pre-pandemic rates.

- Boston saw the largest decrease in rent prices, falling 4.6% from a year earlier.

U.S. single-family rent growth strengthened in November, increasing 3.7% year over year, showing solid improvement from the low of 1.4% reported for June 2020, and up from the 2.8% rate recorded for November 2019, according to the CoreLogic Single-Family Rent Index (SFRI). The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

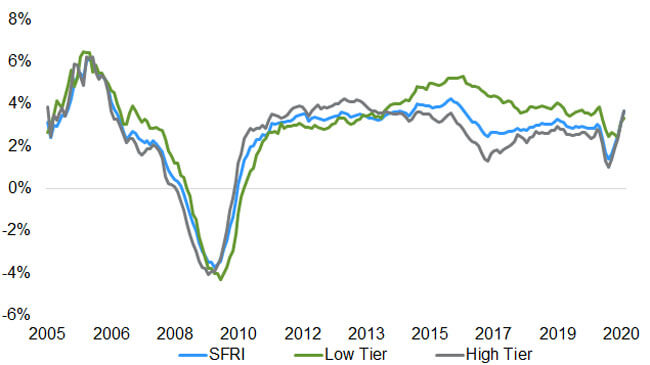

Rent growth for low-priced rentals was slower than that of high-priced rentals in November for the first time since 2014 (Figure 1). Unlike the high-priced tier, rent growth in the low-priced tier remains below year-pre-pandemic levels as the recession has disproportionately affect lower-wages workers. Rent prices for the low-end tier, defined as properties with rent prices less than 75% of the regional median, increased 3.3% year over year in November 2020, down from 3.6% in November 2019. Meanwhile, higher-priced rentals, defined as properties with rent prices greater than 125% of a region’s median rent, increased 3.7% in November 2020, up from a gain of 2.5% in November 2019.

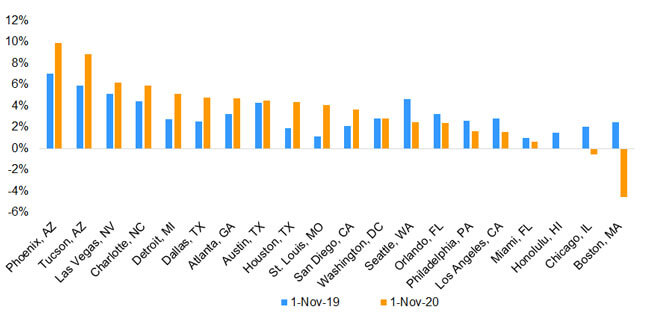

Figure 2 shows the year-over-year change in the rental index for 20 large metropolitan areas in November 2020. Among the 20 metro areas shown, Phoenix had the highest year-over-year rent growth this November as it has since late 2018, with an increase of 9.9%, followed by Tucson (+8.9%) and Las Vegas (+6.2%). Three metro areas experienced annual declines in rent prices: Boston (-4.6%), Chicago (-0.5%) and Honolulu (-0.1%).

While 8 of the 20 metros shown in Figure 2 had lower rent growth than a year ago, Boston had the largest deceleration in rent growth, showing annual rent growth of 7 percentage points lower than in November 2019. The weakness might be attributed to a large number of students choosing to not return to Boston — a city that’s home to 35 colleges and universities — but instead opting to continue virtual learning in their hometowns.

U.S. unemployment rates remain elevated and the nation had 6% fewer jobs in November 2020 than a year earlier. However, some areas of the country are continuing to experience higher rates of job loss — adversely impacting rental demand and slowing rent price growth. For example, Honolulu posted an employment decrease of 13.3%, compared to November 2019, which has contributed to a 0.1% decline in single-family rent prices. Meanwhile, employment declines in Phoenix (-2.6%) and Tucson (-3.7%) were relatively small amongst the 20 metros covered in the report. With the continued resurgence of COVID-19 cases across the country, we may expect to see further disruption of local rental markets.

© 2021 CoreLogic, Inc. All rights reversed.