Rent is 40% of core CPI

The inflation statistics this summer have captured headlines. Economic policy mavens often look at a price index excluding food and energy, referred to as the core price index, which tends to be more stable over time and a less noisy barometer of underlying inflationary trends. Newsworthy was the spike in core inflation: the Consumer Price Index, or CPI, measured a jump in core inflation to 4.5% in June, the highest in 30 years.

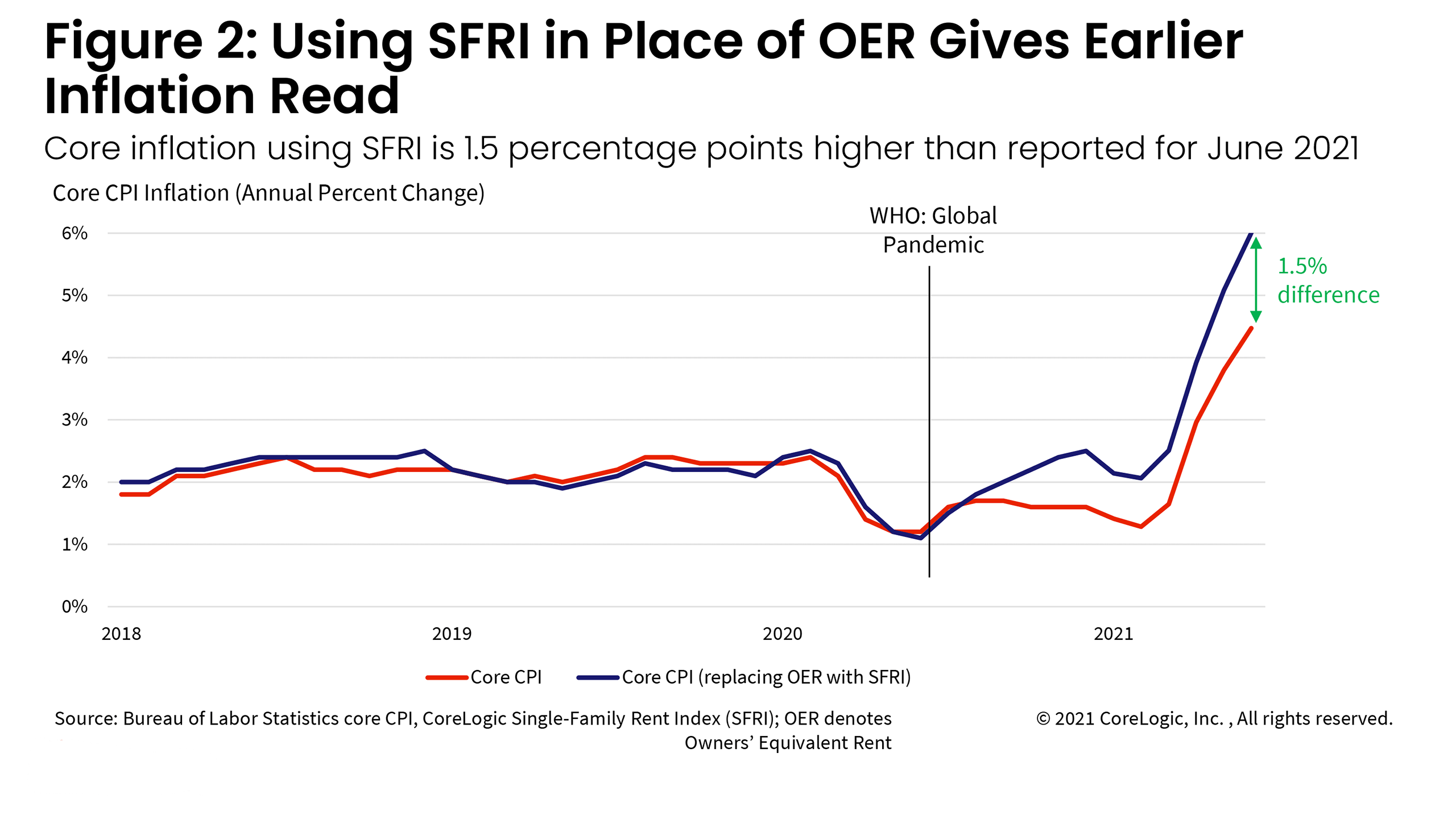

Rent comprises 40% of the core CPI price index.[1] Tenant rent and housing characteristics are used to impute an “equivalent” rent for owner-occupied homes in the index. During the pandemic, this method may have led to distorted estimates for owner-occupied rent because most tenants live in multi-unit properties whereas 9-in-10 owner-occupants live in one-unit homes.

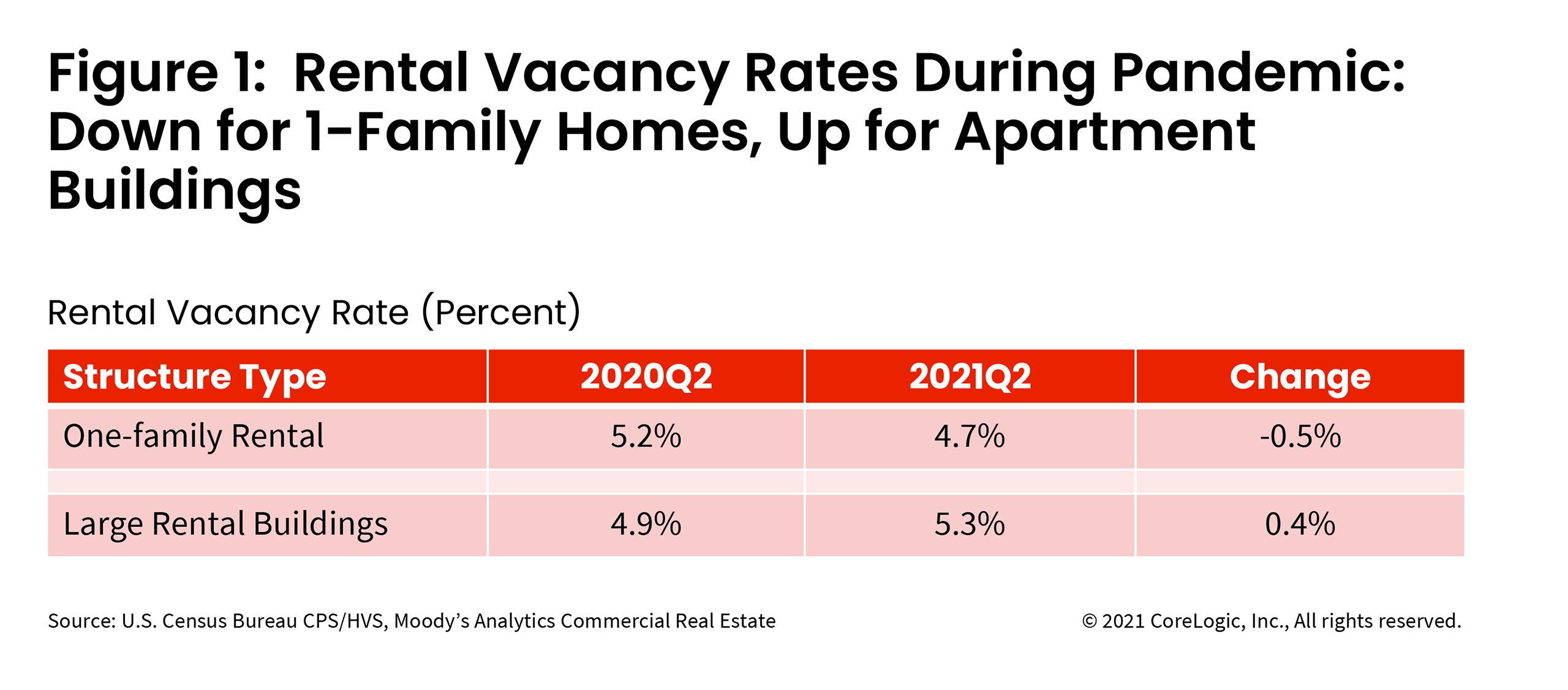

Since the pandemic began, families have revealed a preference for single-family homes over high-rise apartment buildings. High-rise properties have had a rise in vacancy and slower rent growth while one-family rental homes have had a decline in vacancy and faster rent growth.[2]

The owners’ equivalent rent metric in the CPI has shown a slowing in imputed annual rent growth from June 2020 to June 2021, contrary to the acceleration in single-family price growth from 4.5% to 17.2%, as measured by the CoreLogic Home Price Index. The CoreLogic Single-Family Rent Index registered a pickup in rent growth from 1.4% to 7.5% during the same time span. Replacing the imputed owners’ equivalent rent with the CoreLogic Single-Family Rent Index shows that core CPI inflation would be 6%, or 1.5 percentage points higher in June than was reported.

The last time core CPI inflation was above 6% was 1982. Elevated, sustained levels of inflation could prompt the Federal Reserve to increase interest rates sooner than it had planned.

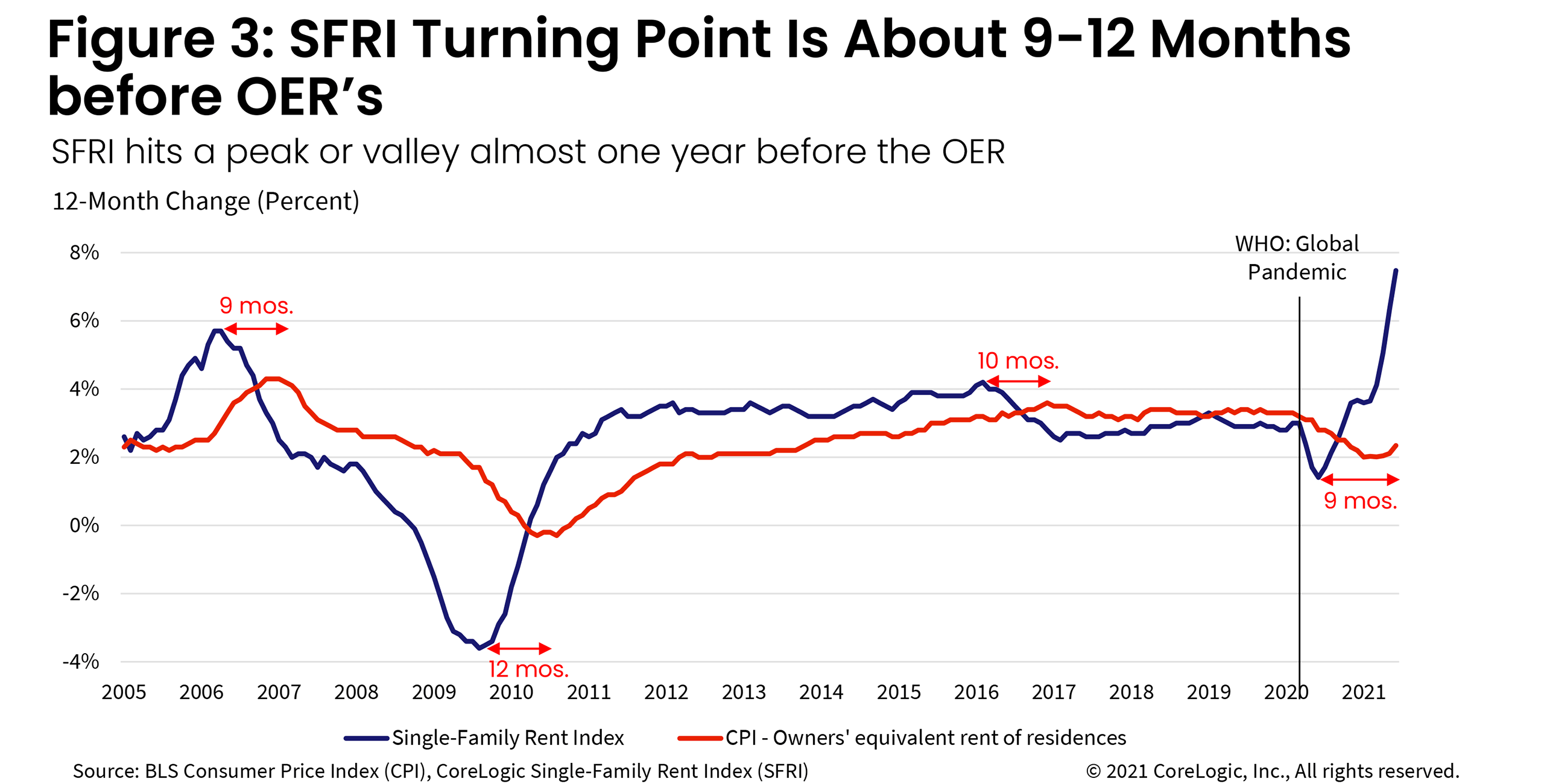

Inflation forecasts generally indicate that this summer’s bulge is temporary and inflationary pressures should recede in coming months. However, we have noticed that the owners’ equivalent rent generally lags the CoreLogic Single-Family Rent Index by nearly 12 months.

If this relationship continues in the coming year, then the owners’ equivalent rent growth will quicken and be a headwind to lower inflation. This implies that shelter inflation will likely rise in the coming year and place upward pressure on core CPI inflation measurement.

Summary:

- Core CPI excludes food and energy costs and is a more stable measure of inflation.

- Tenant and Owners’ Equivalent Rent (OER) comprise 40% of core CPI.

- OER is imputed using tenant rent and housing attributes.

- OER growth slowed June 2020 to June 2021, whereas SFRI growth quickened.

- Replacing OER with SFRI reveals that core inflation may be much higher than reported.

- ©2021 CoreLogic, Inc. All rights reserved.

[1] Tenant rent makes up 10% and owners’ equivalent rent 30% of core CPI.

[2] Moody’s Analytics CRE reported that in large multifamily rental buildings the effective rent declined 2.4% from 2020Q2 to 2021Q2. In contrast the CoreLogic Single-Family Rent Index increased 6.3% (second quarter average, annual growth).