CoreLogic Economic Outlook: July 2019

June marked the beginning of the Atlantic hurricane season and the start of another arid summer in the West. More than 500,000 acres have been burned by wildfires during the first six months of 2019, and there is increasing fire risk as the summer progresses.[1]

The bulk of wildfires are in rural locations and cause limited structure damage, but occasionally a fire explodes into an urban center. Two recent examples in California were the Camp Fire in November 2018 and the Tubbs Fire in October 2017. The Camp Fire incinerated about 20% of the one-family housing stock in Butte county and the Tubbs Fire destroyed about 6% of the one-family homes in the city of Santa Rosa in Sonoma county.[2] CoreLogic estimated the value of property loss at $11 to $13 billion from the Camp fire and $5 to $7 billion from the Tubbs fire.[3]

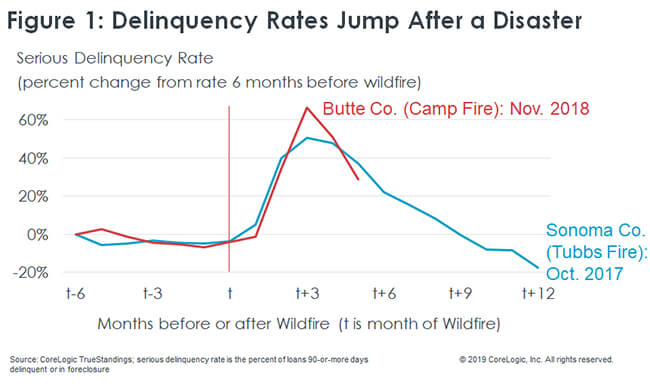

As with other natural disasters, the damage or destruction of homes and businesses disrupts the regular cadence of income and payments and can trigger mortgage default. (Figure 1) Within three months of each wildfire, the serious delinquency rate on home mortgages had spiked about 50% in Sonoma county and 70% in Butte county before beginning to recede. While payment forbearance programs provided by lenders, mortgage insurers, and secondary market investors can lessen the financial stress, local default rates still rise.

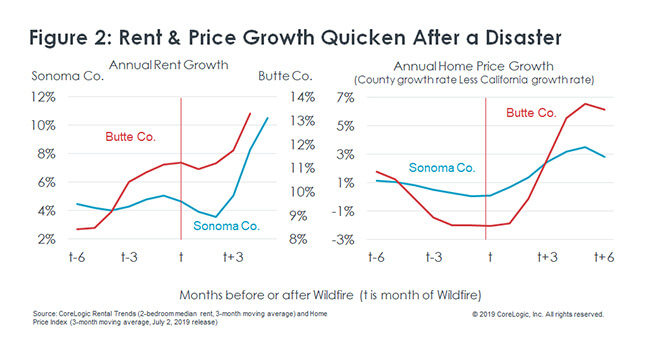

The significant loss of housing stock also affects the cost of shelter in affected neighborhoods. (Figure 2) In both Sonoma and Butte counties, rent and price growth accelerated after the disaster. At the time the wildfires struck each locale, home-price growth was running at or slower than the statewide rate; after the disasters, price growth accelerated to 4- to 7-percentage points faster than statewide growth.

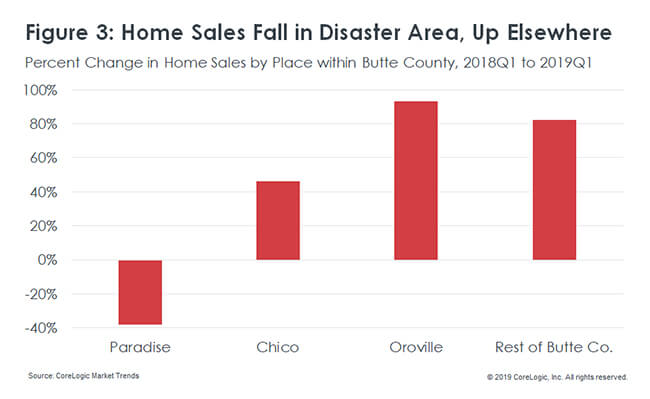

The pressure on prices reflects the reduced housing stock and increased demand for shelter from displaced families. (Figure 3) Whereas home sales in Butte county jumped 50% during the first quarter of 2019 from one year earlier, sales fell 19% in the rest of California. Within Butte county, sales fell in Paradise, the place that bore the brunt of destruction, but jumped in neighboring communities.

Despite the acreage burned this year through June, 2019 is running well below the 10-year average year-to-date. Let’s hope that pattern continues.

Call outs:

- Mortgage delinquency rates spiked at least 50% after the Tubbs and Camp fires.

- Property loss totaled $11-13 billion for the Camp fire, $5-7 billion for the Tubbs fire.

- Housing stock loss and increased demand by displaced families add to shelter costs.

- Rent and home-price growth accelerated after the Tubbs and Camp wildfires.

- Home sales fell in Paradise but jumped elsewhere in Butte county after the Camp fire.

[1] National Interagency Fire Center at https://www.nifc.gov/fireInfo/nfn.htm

[2] Homes destroyed from Cal Fire at http://cdfdata.fire.ca.gov/incidents/incidents_details_info?incident_id=2277 and KCRA at https://www.kcra.com/article/santa-rosa-mayor-2834-homes-destroyed-in-tubbs-fire/12836229; one-family occupied housing stock (detached, attached, and mobile home) from Census Bureau, American Community Survey, Table C25032.

[3] See https://www.corelogic.com/press-releases/

© 2019 CoreLogic, Inc. All rights reserved.