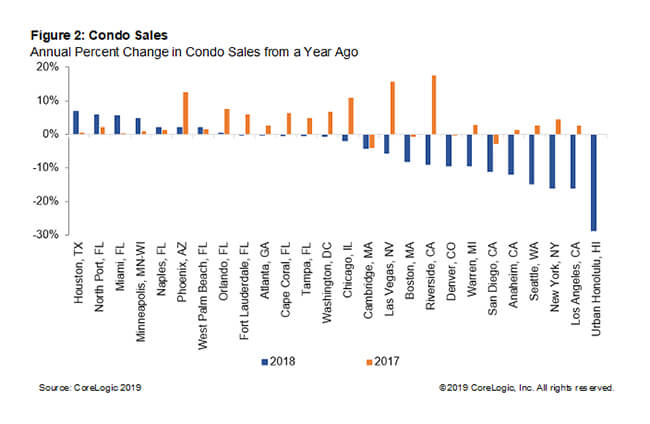

Houston, North Port, FL and Miami are seeing increase in condo sales

Condos can be the most affordable option for many looking to purchase a home, including younger and first-time homebuyers (FTHBs) and down-sizing baby boomers. CoreLogic Loan Application data shows that FTHBs gravitate toward condos. Last year about 43% of all condo home-purchase mortgage applications were submitted by FTHBs, which submitted just 32% of all mortgage applications for single-family residences. Similarly, the data show condos were more popular with young homebuyers and empty nesters. For instance, 21% of all condo home-purchase mortgage applications were submitted by buyers aged 18 to 30, compared with just 17% of all single-family home-purchase mortgage applications by the same group in 2018. Similarly, 23% of all condo home-purchase mortgage applications were submitted by buyers aged 55 to 80, compared with just 18% of all single-family home-purchase mortgage applications by the same group in 2018.

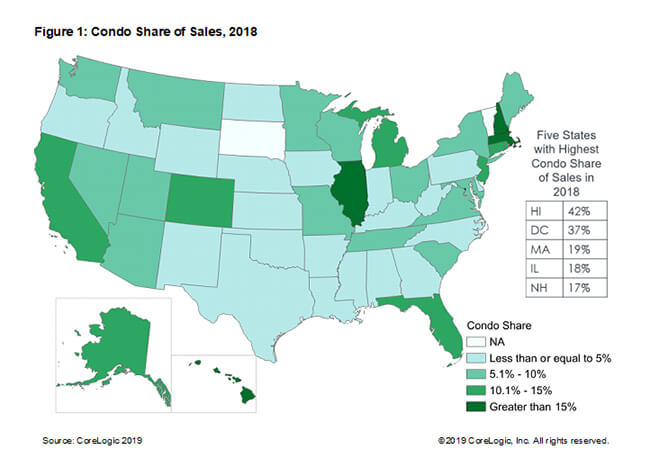

The condo sale activity varies nationally and is much higher in some states (Figure 1). In 2018, the condo share of sales activity was highest in Hawaii (42%), followed by Washington D.C. (37%), Massachusetts (19%), Illinois (18%) and New Hampshire (17%). Condo sales activity varies a lot at the metro level. In 2017, 19 of the top 25 condo markets experienced increases in condo sales relative to the prior year (Figure 2).[1] However, in 2018, only six of the top 25 condo markets experienced increases in condo sales relative to the prior year. Declining affordability, tight inventory and the interest-rate rise in 2018 could have caused condo sales to cool. Among the top condo markets, Houston, Texas, had the largest annual increase in condo sales in 2018, with a gain of 7%, followed by North Port, Fla. (6%), Miami, Fla. (6%), and Minneapolis, Minn. (5%). Honolulu, Hawaii, experienced the largest annual drop in condo sales, with a decline of 29%, followed by Los Angeles, Calif. (-16%), and New York, N.Y. ( -16%). In general, the most expensive markets showed annual declines in condo sales in 2018.

Given worsening affordability challenges in many markets, condos could be a viable option for many. However, the condo supply remains tight. CoreLogic MLS data show the months’ supply for condos fell to 2.6 months in December 2018, the lowest since 2000 (average of 3.3 months for 2018).[2]

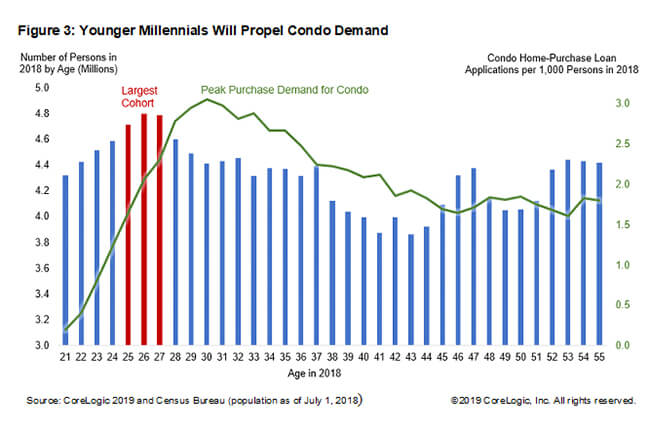

The younger millennials are the largest cohort and are likely to drive much of the condo demand in the coming years (Figure 3). There may be more condo demand than supply as these young millennials approach the peak household formation and homebuying age. Their values and lifestyle drive them toward buying condos because they tend to be more affordable than single-family homes and because condos typically come with a lower maintenance burden and are mostly located in urban cores. There appears to be a need for expanding condo production given the large demographic demand, the continuing strong economy and the challenge of home-buyer affordability.

[1] The 25 largest condo markets were defined at the Core Based Statistical Area (CBSA) level and determined based on total condominium sales between 2000 and 2018 according to CoreLogic.

[2] The months’ supply indicates how long it would take to sell all the current for-sale inventory (assuming no new supply hits the market) at the current sales rate.

© 2019 CoreLogic, Inc. All rights reserved.