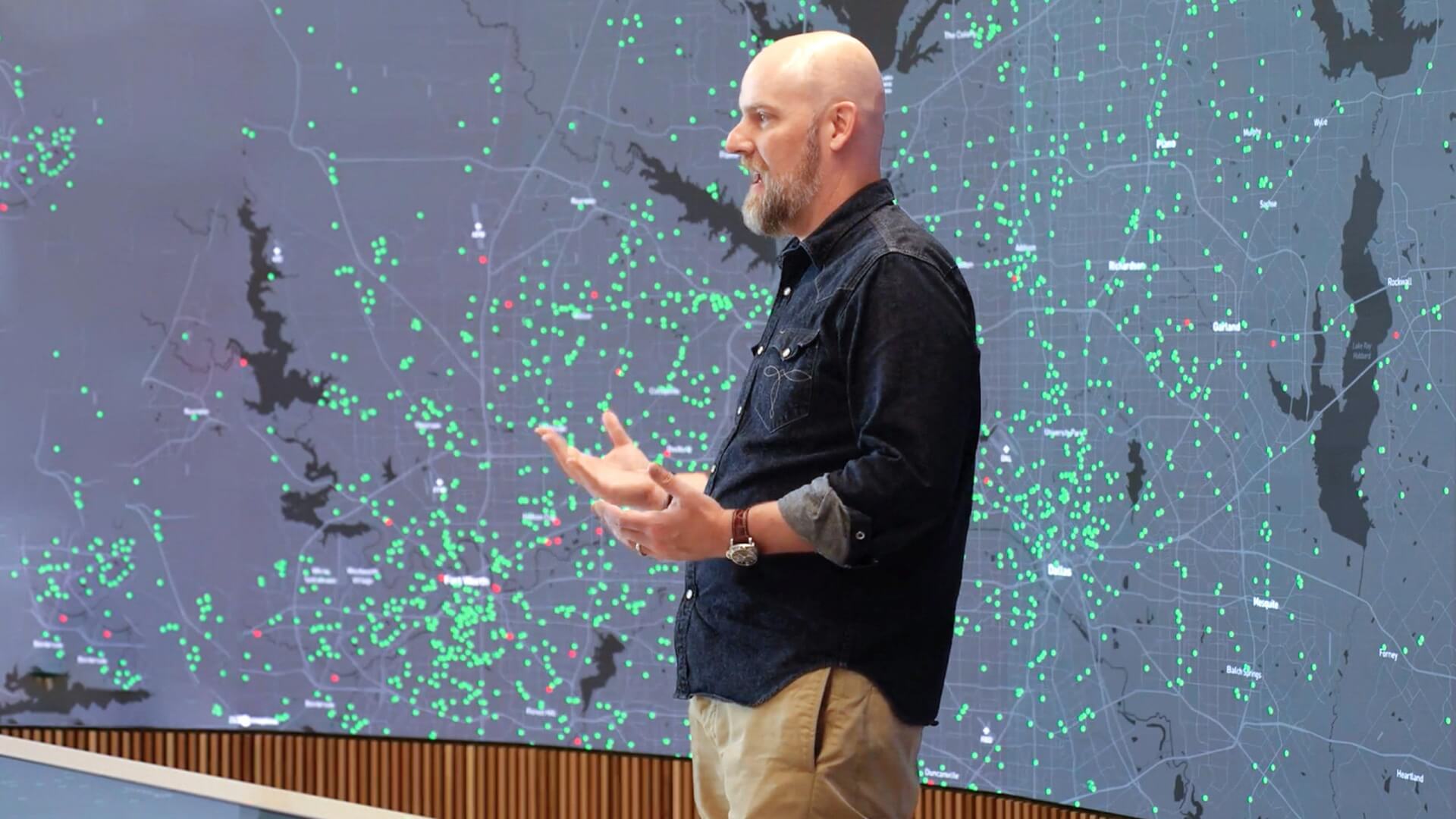

Our Insurance solutions provide clients with rich property content and innovative platforms to enable real-time decision making based on a deeper and wider view of risk that both insurers and consumers can trust. From precise location information to industry-leading structure risk, claims management and hazard risk, our solutions help you get a complete view of property — inside and out.

Keep homeowners and agents connected during the underwriting process eliminating inefficient communication and deliver a better experience.

Reduce costs, eliminate complexity and provide a market-leading claims experience to customers with a frictionless user experience

Get answers to the critical questions underwriters, claims professionals, risk managers and reinsurers ask, and reveal insights into what’s at stake before, during and after the storm.

CoreLogic solutions are versatile. Contact us to start a conversation.

CoreLogic helps diverse businesses and organizations grow revenue, fast track innovations and migrate risk with category-defying data, insights and analytics.

CoreLogic helps real estate professionals and multiple listing enterprises better meet shifting market realities with an ecosystem of collaborative, seamless, secure and compliant solutions.

CoreLogic solutions automate and streamline the mortgage process; originate loans faster, improve borrower experiences, and helps lenders manage risk more effectively.