- Second annual Refinance Closing Cost Report shows refinance mortgage closing costs increased 3.8% in 2021

- Comparatively, purchase mortgage closing costs increased 13.4%

IRVINE, Calif., May 9, 2022 – CoreLogic’s ClosingCorp, a leading provider of residential real estate closing cost data and technology for the mortgage and real estate services industries, today released its second annual Refinance Closing Cost report for 2021.

Key Takeaways

- The national average closing costs for a single-family property refinance in 2021, excluding any type of recordation or other specialty tax, was $2,375. While this is up $88, or 3.8%, from 2020’s reported amount of $2,287, it is still less than 1% of the average refinance loan amount, which was $304,909.

- By contrast, CoreLogic issued its 2021 Purchase Closing Cost Report and reported the national closing costs average $3,860, excluding transfer and specialty taxes.

- The major differences between average closing costs for refinances versus home purchases is that owner title insurance and several inspection fees common for purchase transactions are not typically required for refinances. Still, most third-party fees, including lender title, settlement service and land surveys, were also lower for refinances.

“In 2021, homeowners were still able to get good deals on both interest rates and closing costs,” said Bob Jennings, executive, CoreLogic Underwriting Solutions. “While refinance closing costs increased marginally, annual increases in fees still remain below the 7% average rate of inflation seen in 2021. Much of the cost control can be attributed to growing use of technology solutions by both lenders and settlement services providers, which enabled the industry to scale up capacity while holding the line on closing costs.”

State and Metro Takeaways:

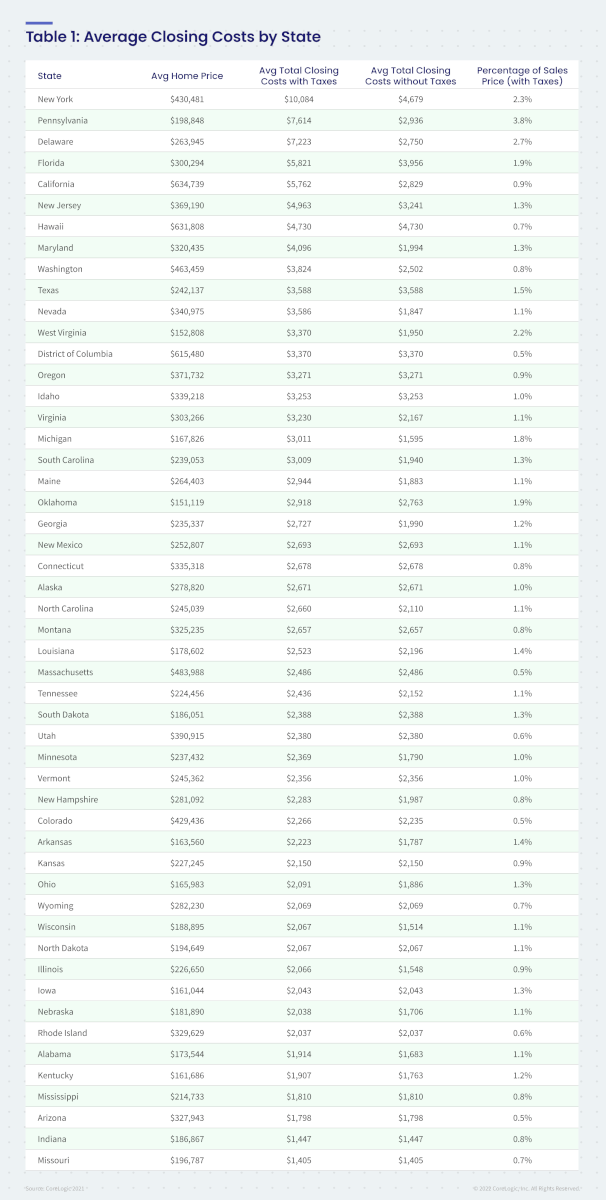

- The 2021 report shows the states with the highest average closing costs, excluding specialty taxes, were Hawaii ($4,730), New York ($4,679), Florida ($3,956), Texas ($3,588) and District of Columbia ($3,370).

- The states with the highest closing costs, including taxes, were New York ($10,084), Pennsylvania ($7,614), Delaware ($7,223), Florida ($5,821) and California ($5,762).

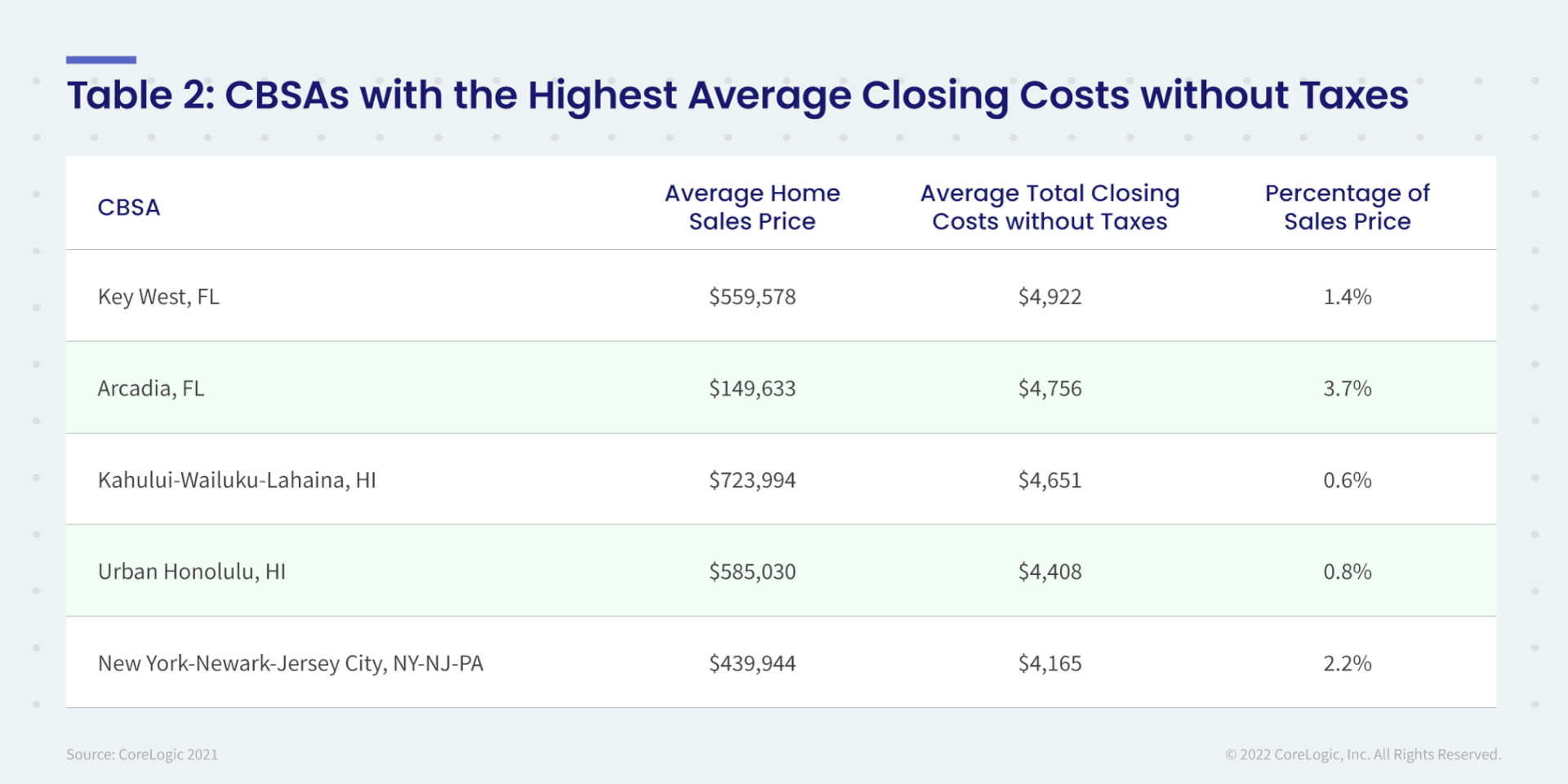

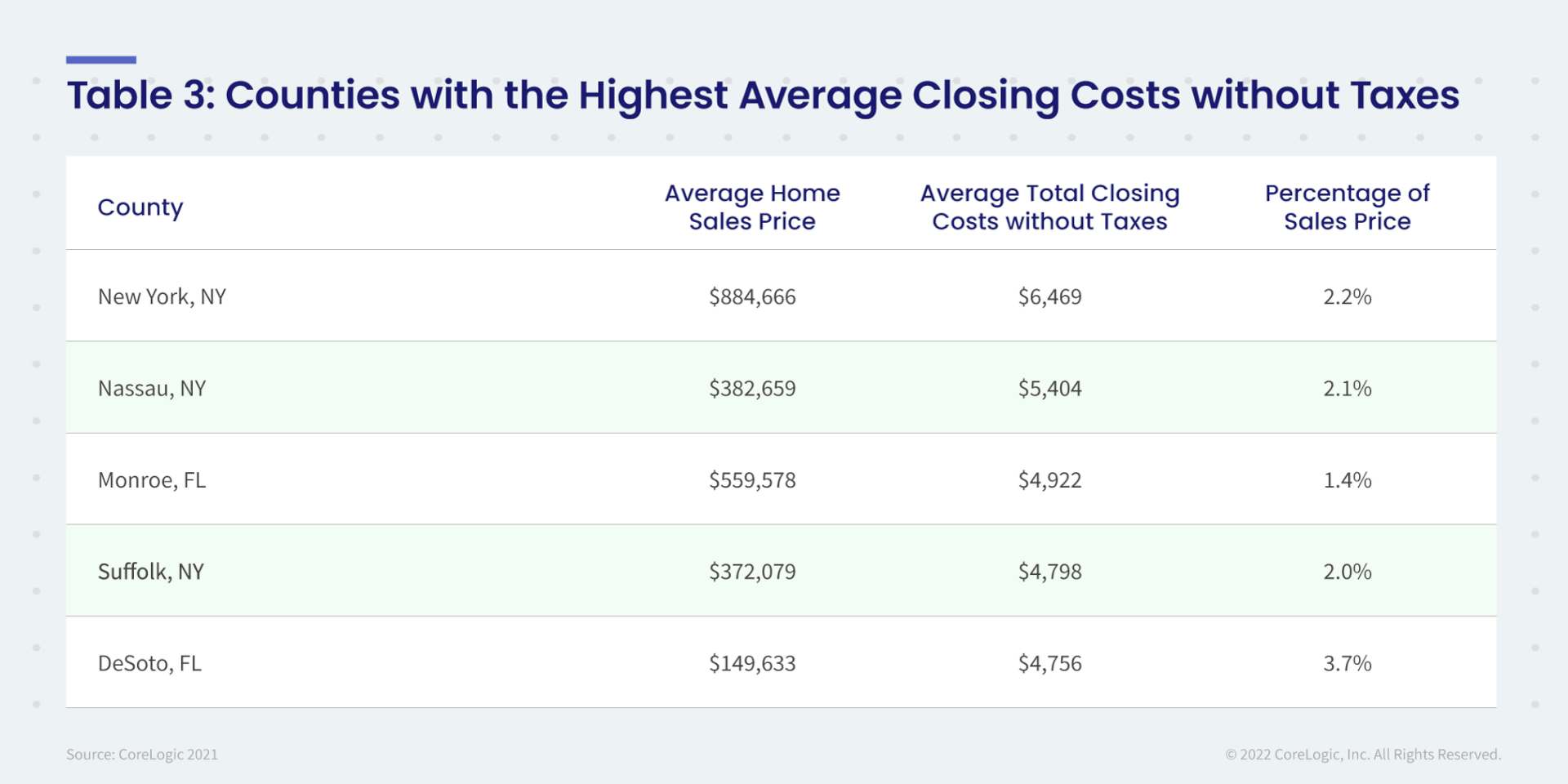

- At the metro level, those with the highest average fees without taxes include Key West, Florida ($4,922); Arcadia, Florida ($4,756) and Kahului-Wailuku-Lahaina, Hawaii ($4,651).

Refinance cost calculations include lender’s title policy, appraisal, settlement, recording fees and various state and local taxes. Calculations use home price data from CoreLogic to estimate closing costs for an average home at the state, core-based statistical area (CBSA) and county levels. Ranges, rather than single values, are used to more accurately capture fees associated with the real transactions.

For more information about this data, or for the full report which offers additional details, please visit closing.com/closingcosttrends.

Methodology

ClosingCorp average closing costs are defined as the average fees and taxes required to close a conventional refinance transaction in a geographical area. These costs consist of fees from the following service types: title policies (lenders only as owner’s policy doesn’t apply for refinances), appraisals, settlement fees, recording fees, land surveys and taxes related to the refinance.

Actual closing fees for 4.99 million single-family refinances from January 1 through December 31, 2021 were analyzed. Average loan amounts were estimated as 80% of average home prices (source: CoreLogic©, a leading global property information, analytics and data-enabled solutions provider). Homes within a $100,000 range of this estimated average loan amount were used to estimate closing costs for an average single family residential home at the state, core-based statistical area (CBSA) and county levels.

The average service type component fee was computed for every geographical area where at least 10 transactions occurred in the specified range during the period under review. Total cost to close was then computed as the sum of the service type averages. Land survey fees only were included for Florida and Texas single-family homes where land surveys are required. Cost to close was computed with and without taxes.

About CoreLogic

CoreLogic, a leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

Media Contact

Robin Wachner

CoreLogic

[email protected]