Know more sooner. There’s a reason why the nation’s most successful servicers choose us, year after year, for their data and analytics needs. Our residential property tax services are the industry’s gold standard. Our battle-tested default and loss mitigation solutions provide end-to-end automation to accelerate your workflows at scale. And our Portfolio Insights and Monitoring Solutions leverage the broadest data sources and predictive analytics to help you identify risks and opportunities sooner.

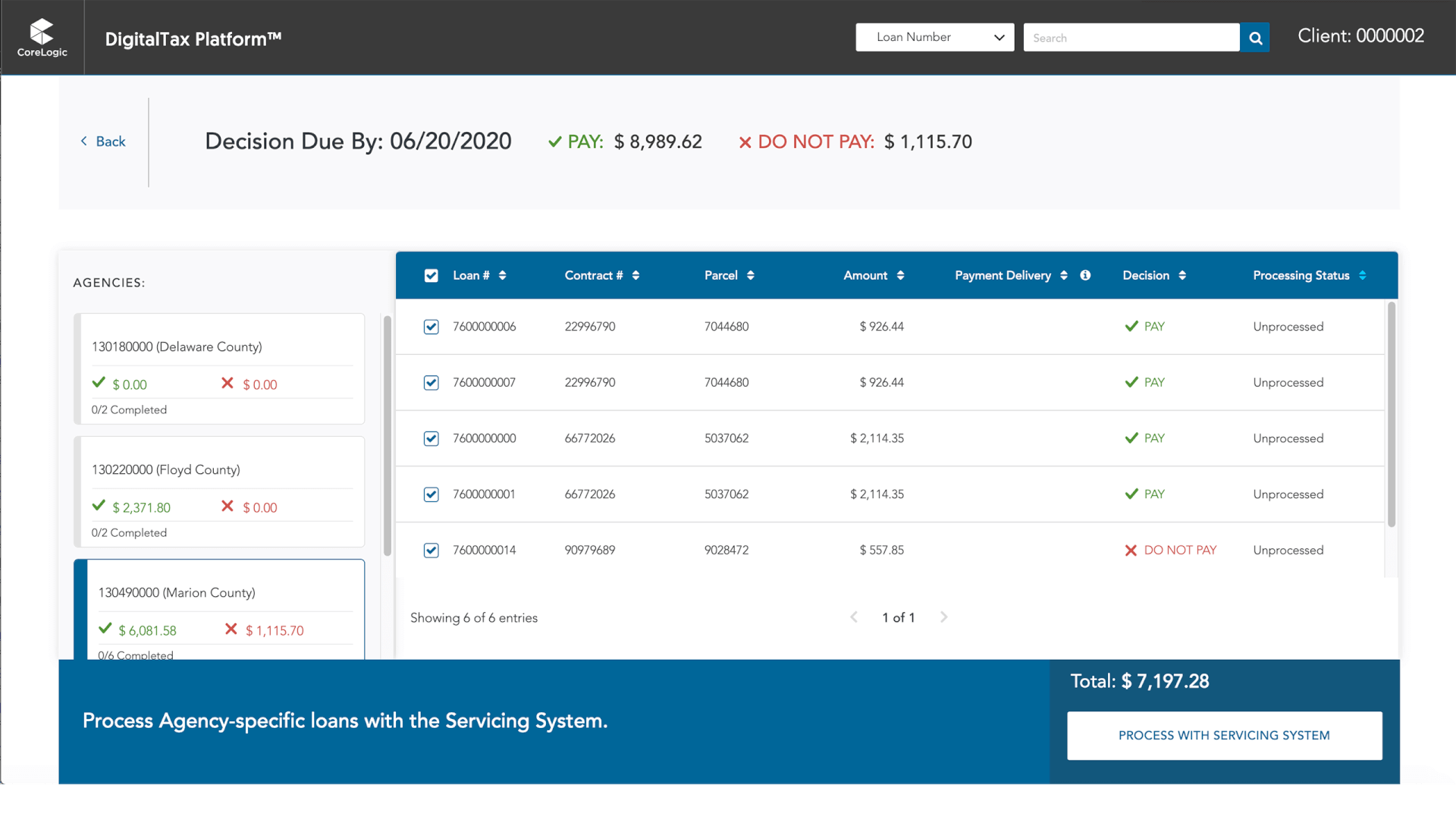

Our competitors rely on periodic bulk downloads of tax data from the nation’s taxing authorities. CoreLogic, on the other hand, has built near real-time integrations with many of these entities. As the foundation for CoreLogic residential real estate tax and payment solutions, the DigitalTax Platform transforms your tax service performance by facilitating near real-time data exchange between servicers, borrowers and taxing authorities. The result is a tax service that delivers a unified and consistent view of property tax data across the entire ecosystem.

With our comprehensive tracking and reporting of over 22,000 tax authorities, we can help optimize your escrow administration process. Our Tax Amount Report provides details such as due dates, tax amounts, and required methods of payment. Lenders and servicers rely on CoreLogic for reliable procurement of tax information, accurate payment specifications of tax authorities, and timely payments.

If your borrower is responsible for paying taxes directly to the taxing authority, our Tax Payment Status reporting service provides the visibility you need to help reduce risk. Through our automated interfaces with taxing authorities and near real-time data, we can promptly notify you of delinquent taxes, provide updated information when required and pay delinquent taxes on your behalf and according to your guidelines. Our services can also assist with regulatory and investor reporting requirements.

Introducing DigitalTax™️ Connect

Enhance your customer workflow with instantaneous access to accurate property tax payment information and customer service statuses via a robust suite of APIs. Check out DigitalTax Connect’s Payment Data API & Research Inquiry API.

Full data transparency

Improve borrower experience, satisfaction, and client retention rates through data transparency

Empower your customers

Expand borrower engagement through your digital solutions.

Platform Integration

Deliver property tax information directly through your property applications.

Easily manage payment processing, balance and delivery of tax payments from a single source. This comprehensive Staff Augmentation service allows you to focus on your borrower while we help manage:

Contact Center Services are also available to help further protect and optimize the borrower experience. Combined with our technology and ability to scale, our focus on quality helps ensure an optimal experience for your borrower throughout the servicing lifecycle.

CoreLogic’s Portfolio Insights & Monitoring Solutions deliver a comprehensive suite of multi-faceted monitoring and analysis solutions with leading analytics and predictive modeling to create a one-stop-shop for mortgage servicers. These solutions will identify hidden risks, capitalize on opportunities, and maintain compliance, by leveraging the broadest and most current:

Once armed with these actionable portfolio insights, servicers are able to spend less time validating liens and more time addressing new risks and capitalizing on new opportunities

Schedule a free consultation, and empower your team with CoreLogic today!