Home / Real Estate Data Solutions / Multiple Listing Enterprise Solutions / Listing Management and Public Records Solutions for Multiple Listing Enterprises

North America’s most prominent multiple listing organizations trust CoreLogic® to power and manage the data and insights that make home-finding experiences possible. With CoreLogic’s tools at your disposal, you can feel confident that you have the best information, enabling you to make the most informed decisions.

Choose one or bundle any of the listing management solutions for the subscribers of your multiple listing organization.

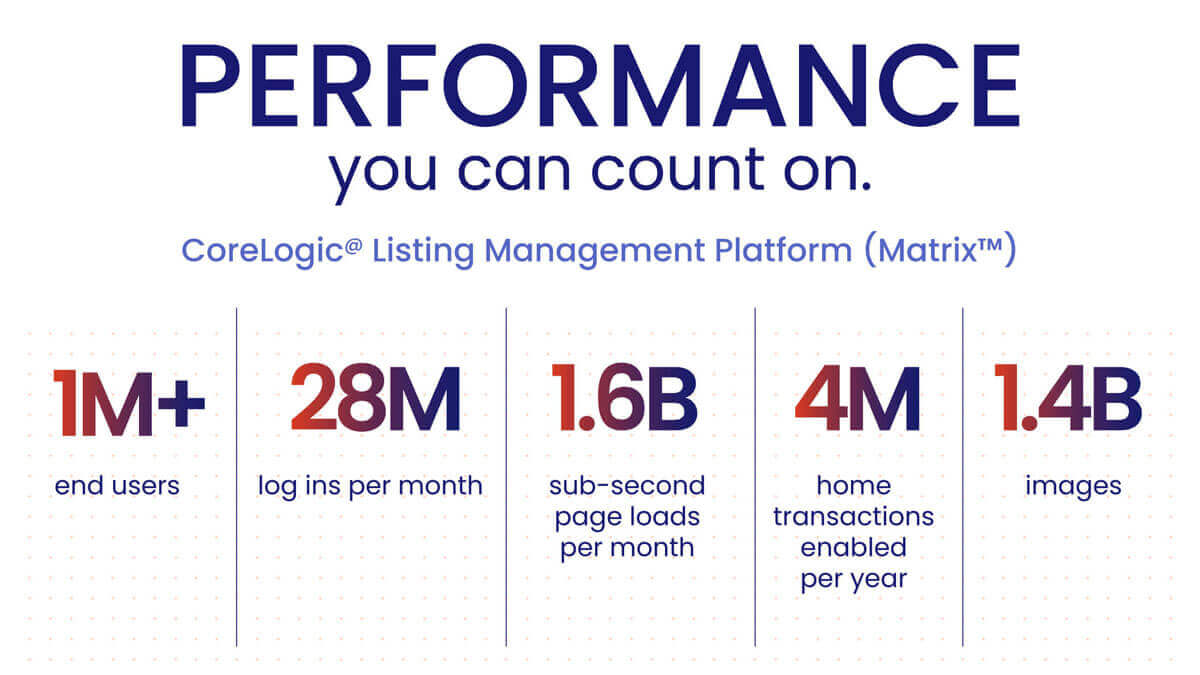

CoreLogic’s Listing Management Platform is the #1 industry standard for listing information about properties. It embraces the perfect combination of efficiency and innovation to help real estate professionals find listings clients will love. Not only can homebuyers research properties through the interface, but they can also communicate with their agents.

This solution integrates with other CoreLogic products like OneHome Client Portal or CoreLogic Property Insights Platform (Realist) allowing real estate professionals new and exciting ways to collaborate with clients.

Empower your subscribers with professional-grade public record data. The CoreLogic Property Insights Platform integrates with any multiple listing platform to provide comprehensive intelligence and accurate property insights, helping agents research listings, identify opportunities, and improve decision-making.

Combine CoreLogic’s Property Insights Platform with our Listing Management Platform (Matrix™) for a single property-centric system. Together, they give real estate professionals a comprehensive view of all properties in your market—including current listings, past listings, and properties never listed at all.

Property tech solutions make your job easier and more efficient, but only if they integrate smoothly with your current platforms. That’s why CoreLogic created the Alliance Network, a curated selection of third-party solutions that build upon and complement your CoreLogic platforms. Guided by your CoreLogic account team, the Alliance Network ensures that you have the tools you need to drive your business forward.

It seems like everyone wants access to the listings in your database, including your broker subscribers, website and app developers, neighboring multiple listing organizations, real estate portals, and more. CoreLogic makes it easy to manage all your data relationships with security and precision―putting ultimate control at your fingertips. Your connections. Your data feeds. Your fees.

If you are a multiple listing organization and are interested in learning more about solutions from CoreLogic, please contact the sales team.