Fraud Report – National Overview

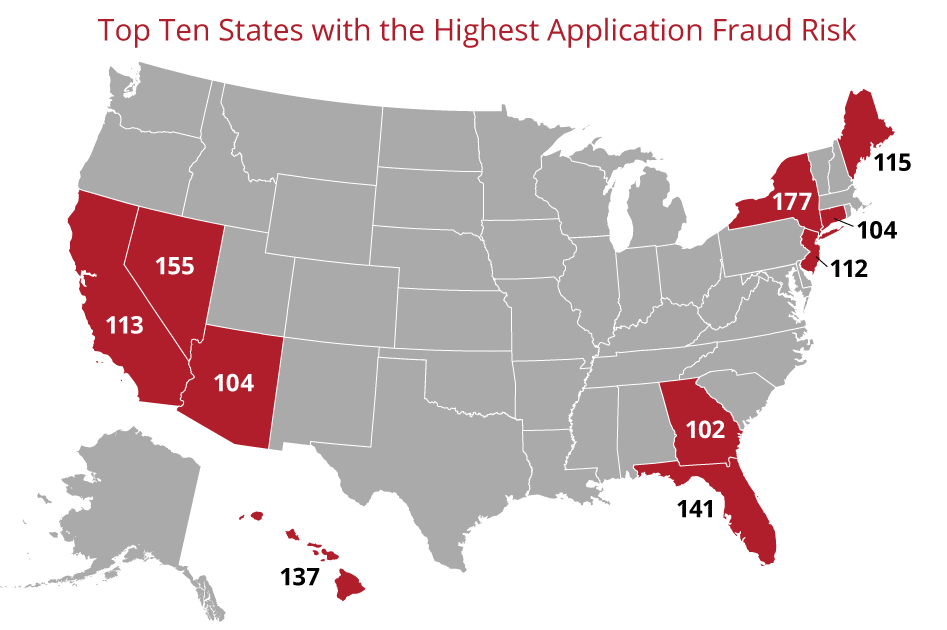

New York, Nevada, and Florida are the top 3 states for mortgage application fraud risk. Nevada moved into the top 3 for the first time since 2014. Hawaii and Maine are the other states in the top 5 for overall risk levels.

Nevada was the only top-5 state with a fraud risk increase – 8% year-over-year. Per CoreLogic’s August 2020 Home Price Insights Report, Las Vegas, NV was ranked in the highest risk category for price decline – at over 70% probability. High unemployment and delinquencies in Nevada were reported in CoreLogic’s July 2020 Loan Performance Insights.

“Fraudsters thrive in uncertain market conditions, where their activities are harder to detect and separate from legitimate investors who are also attracted to variable markets. Nevada’s economy took a big hit with COVID-induced shuttering of gambling/tourist activities and this is driving a decline in home prices as well as an increase in fraud risk. With many economists predicting a recession later this year or early next year, we can expect to see market variability in other regions and likely an increase in fraud as well.”

– Ann Regan

Executive, Product Management

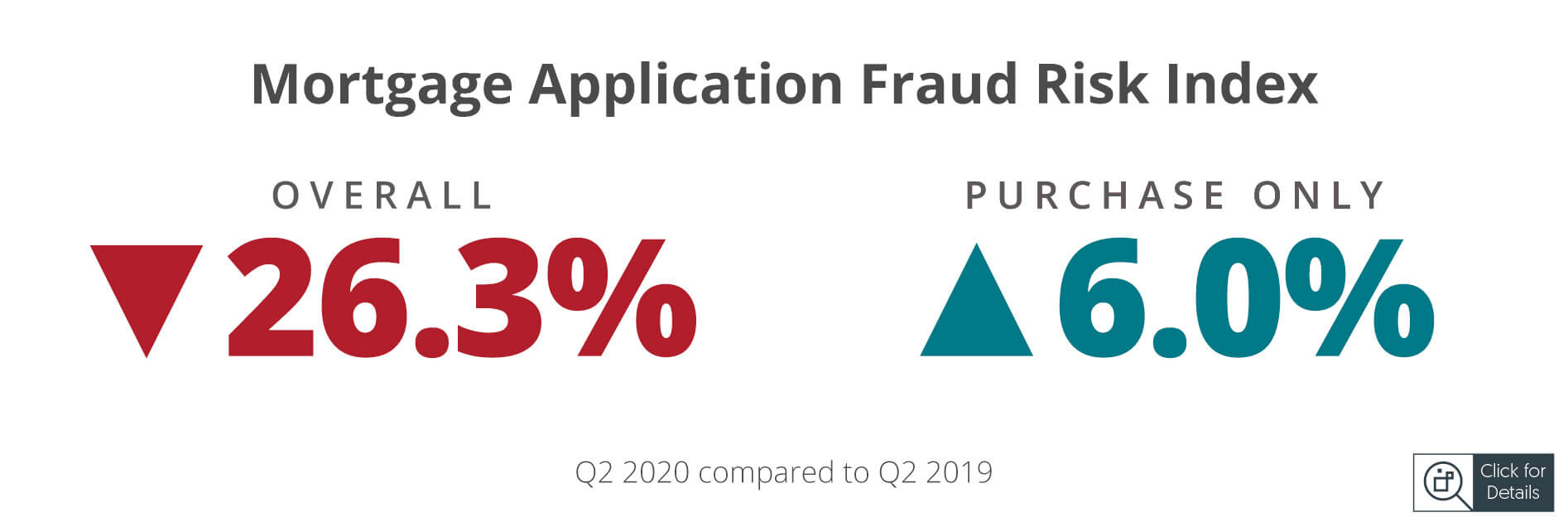

During the second quarter of 2020, an estimated 0.61 percent of all mortgage applications contained fraud, about 1 in 164 applications. By comparison, in the second quarter of 2019, our estimate was 0.81 percent, or about 1 in 123 applications.

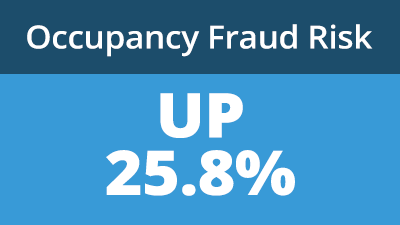

In both purchase and refinance populations, the highest-risk applications were for investment properties, while the lowest-risk applications were VA-backed programs.

Investment purchase applications are showing the highest risk, with 1 in 28 applications estimated to have indicated fraud.

“Investment loan applications are showing a higher risk because real estate investors have a profit motivation for their activity. This introduces other factors and increases the risk compared to a purchase for personal use. Investors often own other real estate and are more likely to have undisclosed ownership and transactions in process. Conversely, VA loans have lower risk because they are restricted to a select group of borrowers and are for personal occupancy, except for certain refis. This makes identity issues and straw buyer situations rare. Many VA borrowers are employed by the military, reducing income risk also.”

– Bridget Berg

Principal, Fraud Solutions

While the decrease in fraud risk overall is not surprising given the current environment, the risk for purchase applications has increased by 6.0%.

National Mortgage Fraud Index

Risk Overview

The national trend for the 12 months ending mid-2020 continues its decrease due to the low interest rates and record numbers of refinances.

- All refinance segments decreased year-over-year except government-backed refinances, which had a slight decrease and overall had the lowest risk levels.

- All purchase segments increased except jumbo purchases, which declined in both risk (26%) and volume. Lenders tightened guidelines for jumbos as markets responded to COVID-19 impacts and forbearance risk.

- Investment purchases show a 74% increase in risk despite lower volumes and tighter guidelines. This is a new high in our index history, slightly above risk levels in 2012.

In 2019, CoreLogic created the new Fraud Risk Score Model 4.0. It has more granular segmentation to reflect the most relevant fraud risk differences between loan programs. For more information on this model, please contact your account executive.

In 2020, we launched a new generation of fraud indices to leverage the new model and better control for volatility. Historic information from the prior model was retained but the new methodology was applied to the historic data.

“Our investment into the new model and indices allows for more precise analysis across the consortium, bringing new insights to keep advancing early identification of fraud patterns with fewer false positives.”

– Fabien Huard

Senior Leader, Science and Analytics

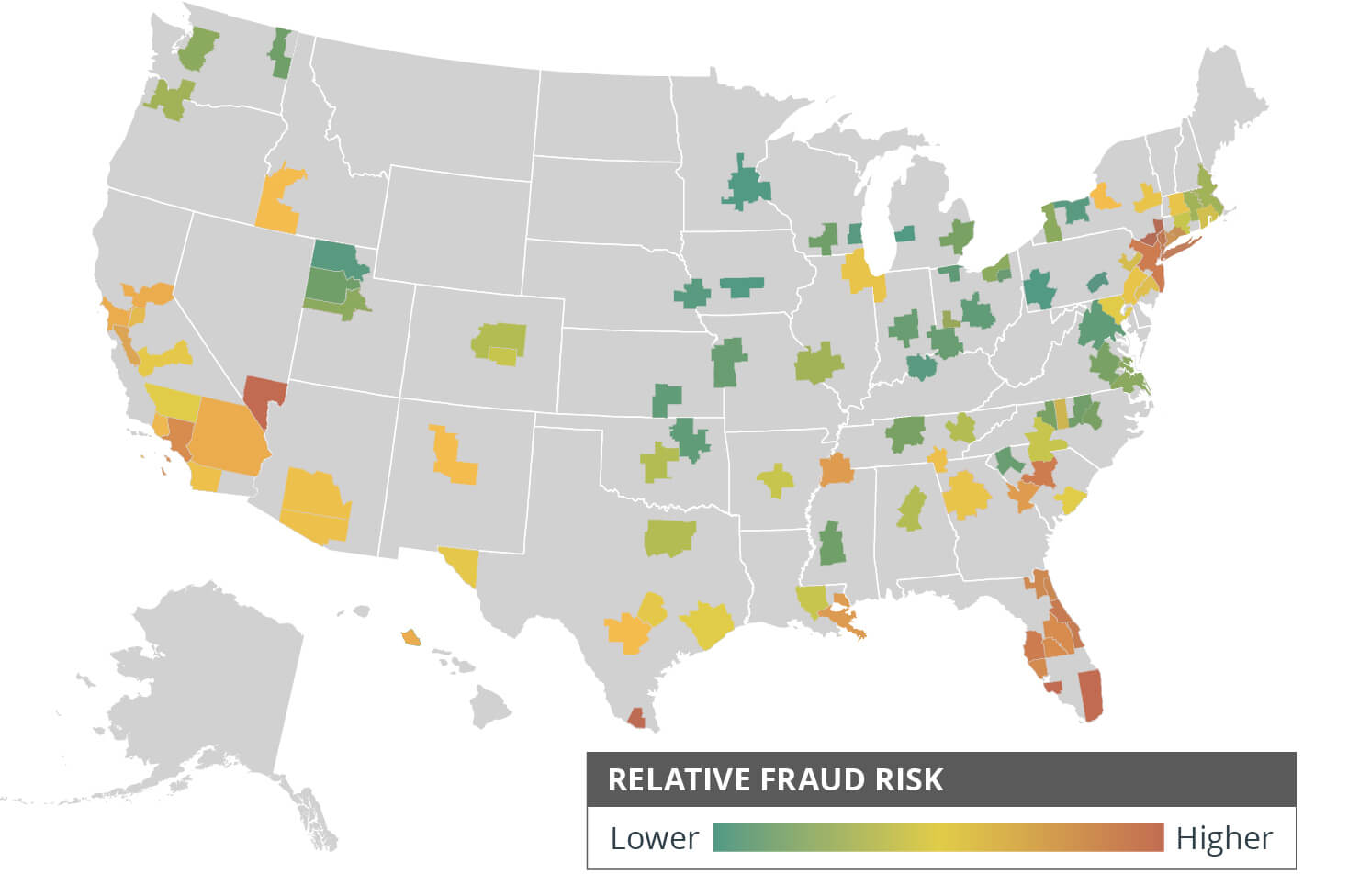

CBSA Heat Map

Multi-Closing Fraud Risk

Multi-lien fraud is an extremely profitable scam that takes advantage of the lag between closing and records to solicit multiple loans on a single property. According to the CoreLogic Multi-Close Alert Program (MCAP), 2020 is projected to have a similar level of findings as was seen in 2019. Some lenders have scaled back their home equity lending in 2020 due to economic conditions.

Income fraud includes misrepresentation of the existence, continuance, source, or amount of income used to qualify.

Undisclosed real estate debt fraud occurs when a loan applicant intentionally fails to disclose additional real estate debt.

Transaction fraud occurs when the nature of the transaction is misrepresented, such as undisclosed agreements between parties and falsified down payments. The risk includes third party risk, non-arm’s length transactions, and straw buyers.

Property fraud occurs when information about the property or its value is intentionally misrepresented.

Mortgage Fraud Trends: An Update on Out-Of-State Investors

| Years | Average Percentage of Out of State Investors |

| 2013 | 16.8% |

| 2014 | 17.4% |

| 2015 | 18.5% |

| 2016 | 18.6% |

| 2017 | 20.8% |

| 2018 | 22.2% |

| 2019 | 23.1% |

| 2020 | 23.3% |

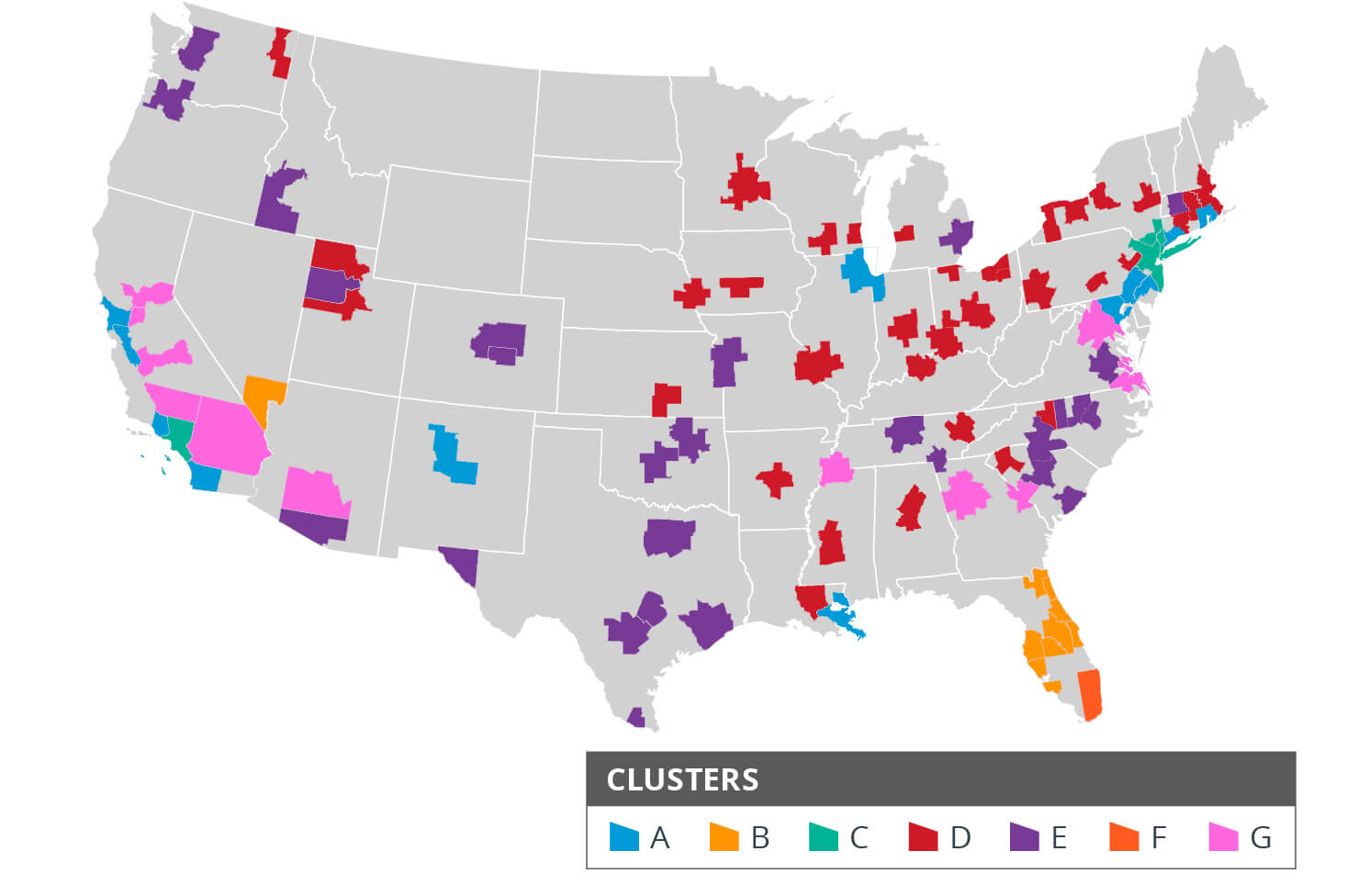

CBSA Clusters

Fraud trends often have a geographic component, and the conditions that provide opportunity for a specific fraud scheme in one area may be echoed in other areas. We identified seven CBSA clusters using unsupervised machine learning techniques that pool geographies with similar patterns and rates of change in fraud risk.

This analysis may help risk managers identify other areas to target when investigating schemes. Observations:

- Miami, often the highest-risk CBSA, stands alone. No other CBSAs closely mirror it.

- Central Florida, historically high risk, behaves more like Las Vegas than Miami.

- Los Angeles, New York, and Poughkeepsie form a cluster, but the areas around them are in different clusters.

- Chicago, San Francisco, San Jose, Philadelphia and Albuquerque have similar fraud risk patterns.

Fraud Trends by CBSA Clusters

Data sources

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk the mortgage industry is experiencing each quarter. CoreLogic develops the index based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager™, a predictive scoring technology. The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction, and undisclosed real estate debt.