Be the bridge between your clients’ dreams and their dream homes. Our simple, intuitive and integrated digital mortgage solutions help you manage cost, accelerate workflows, and deliver the data and information you need consistently, accurately and in a fraction of the time.

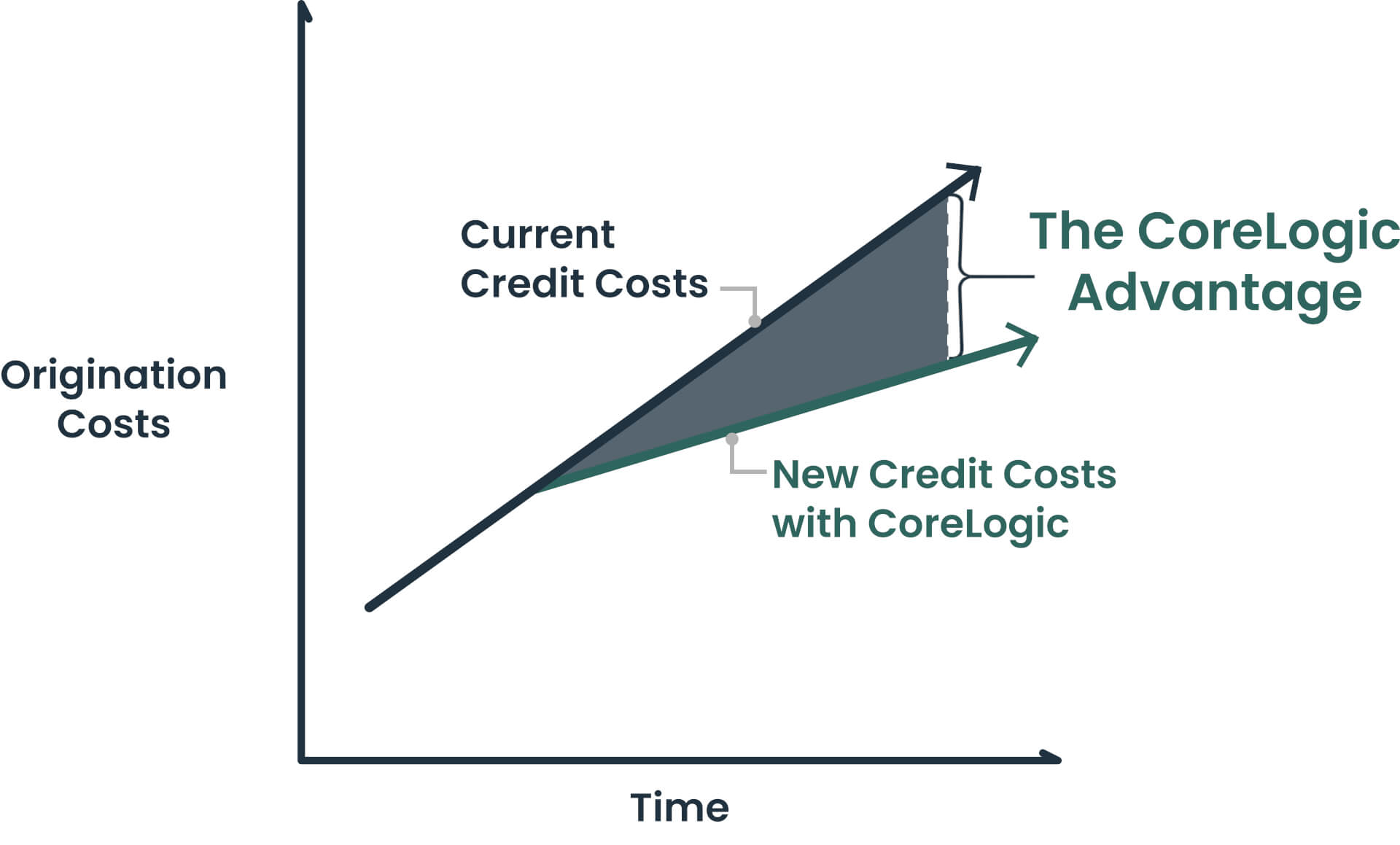

To help you manage the costs associated with applicant fallout, CoreLogic offers several creative credit reporting packages, each designed to provide you with more cost certainty and enhanced flexibility. Some of the options available to you include:

For many lenders, calculating a borrower’s income is a time-consuming task characterized by inefficient processes and inconsistent results. We have a better way.

CoreLogic’s automated Income Calculation and Analysis Solution streamlines and standardizes existing borrower income calculation to yield more consistent results in a fraction of the time. This solution will help you turn your loan officers and underwriting teams into income calculation and analysis experts. We deliver:

The ability to quickly and confidently verify applicant-supplied information is more important than ever. CoreLogic delivers the integrated borrower verification solutions you need to qualify your applicants and accelerate your origination workflows—all while helping you remain compliant with key investor requirements. Our automated borrower verifications include:

LoanSafe Fraud Manager™ is a powerful and intuitive solution that helps you identify and mitigate mortgage fraud risk using your loan application information paired with CoreLogic’s proprietary data.

Fueled by a mortgage fraud consortium of over 100 million loan applications and known fraud outcomes, patented recognition models and the most complete property data collection available today, LoanSafe Fraud Manager is considered the gold standard for fraud risk detection tools. LoanSafe Fraud Manager helps to protect you against:

As part of our ongoing commitment to make sure users are getting the most from LoanSafe Fraud Manager™ and LoanSafe Connect™, we are offering bi-monthly training webinars.

The Valuation Workflow Solutions from CoreLogic help you make faster, more reliable collateral underwriting decisions by uniting all the data and analytics you need to validate a property’s value, title, condition, and hazard risks. Built on industry leadership and a commitment to relentless innovation, CoreLogic’s Valuation Workflow Solutions leverage the industry’s largest collateral vendor network to simplify the mortgage experience into one orchestrated workflow.

Home Equity and refinance lending are competitive markets that require speed to ensure customer retention. The OptiVal AVM Cascade is built upon real-world AVM performance data and is designed to help lenders impartially find the optimal AVM quickly and inexpensively while maintaining compliance.

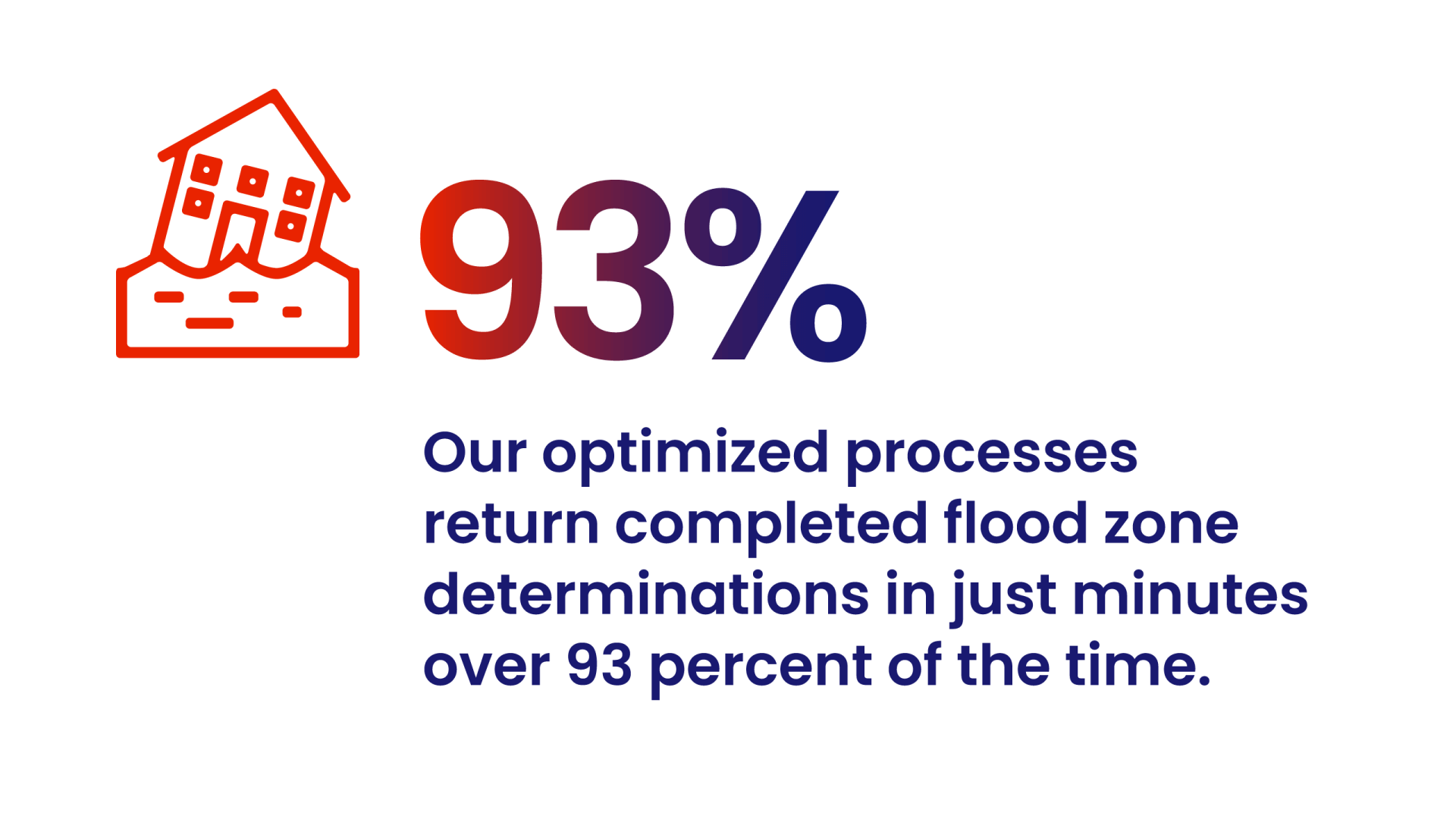

More lenders choose CoreLogic Flood Zone Determinations than any other provider. Whether you’re processing a first position loan or a second refinance, our complete line of origination products keeps your workflows moving forward. In fact, over 93 percent of the time our optimized processes return completed flood zone determinations in just minutes. There’s a reason why we’re number one: we’re fast, we’re accurate and we help you reliably maintain compliance with federal regulations while mitigating your flood risk.

When it comes to calculating a new property tax payment prior to closing, your borrowers expect an accurate estimate. Unfortunately, there’s no industry standard for calculating property tax for existing homes or new construction loans. As a result, tax estimates for escrow can vary wildly—which frustrates your borrowers.

When all parties know what to expect before, during and after closing, you can deliver a more positive borrower experience and build customer loyalty. That’s where our Property Tax Estimator comes in. By combining up-to-date property tax data with our proprietary estimation engine, CoreLogic’s Property Tax Estimator solution helps you provide an accurate estimate for each borrower’s specific address prior to closing, even for new construction loans. This will help you avoid any last minute surprises upon closing and make for a better borrower experience.

Schedule a free consultation, and empower your team with CoreLogic today!