When property thrives, we all thrive. CoreLogic offers unmatched insights across the entire property ecosystem to help our clients rise to the biggest challenges in the market and create a more resilient, prosperous society.

We partner with millions of real estate professionals; tens of thousands of financial institutions; thousands of lenders and servicers; hundreds of insurers and dozens of federal agencies to construct a people-first perspective for the future of property industry.

Property. It’s the world’s largest asset class, but it’s the people, the businesses, and the communities behind it that matter most to us. Our network, scale, connectivity, and technology help our clients deliver smarter, faster, and more human-centric experiences. CoreLogic’s platforms bring property professionals together to strengthen relationships, grow businesses, and ultimately change the industry.

Every data point is only a pixel in the blueprint of the property industry. That’s why we’ve developed industry-leading capabilities to illuminate insights from our unmatched breadth, depth, and precision in analyzing data across the entire property ecosystem.

The best data is collected at the source. That is why we can connect 99.75% of our data directly to its origin. We bring together over 50 years of property data archives on 99.9% of U.S. properties with the capability to model 30 years into the future, giving our clients access to more than 1 billion records. Our complete, current, and connected property data helps our clients to build an intelligent and dynamic property network that can predict and respond to market needs.

As part of the largest asset class in the world, our work has real impact on people across the globe. We invest in innovation that puts people first. We set the pace to help face affordable housing, climate risk, homeownership rates and sustainable development head-on. We are committed to tackling today’s challenges that will shape tomorrow’s property industry.

We push beyond individual property data points to help our clients synthesize holistic insights and analysis.

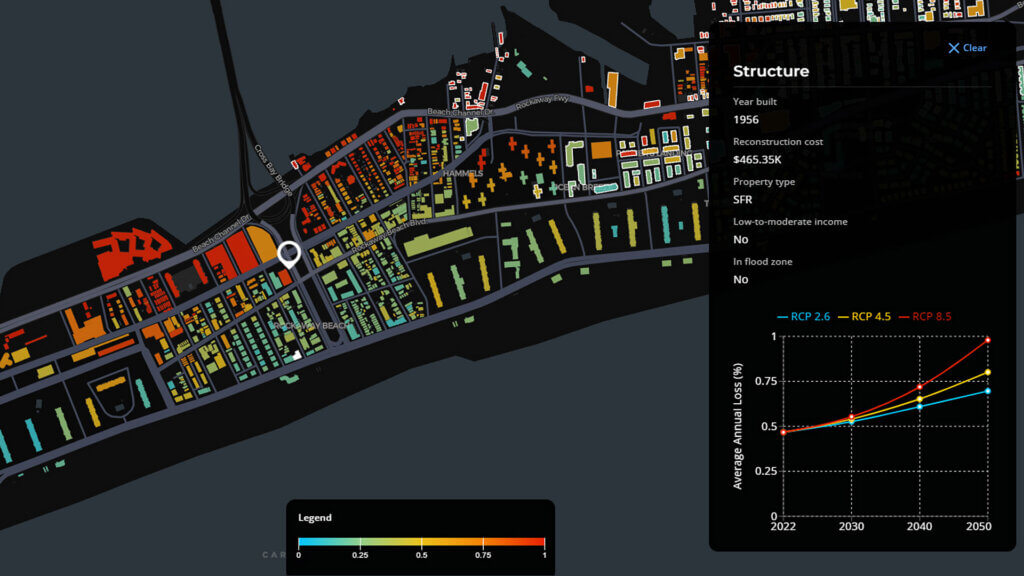

With AI-enabled data analytics and workflow tools, we are advancing the narrative on property and location intelligence; climate risk; and hazard and weather science. Our teams of housing economists, data scientists, technologists, and climate experts develop solutions that simplify the complexities of the property industry.

At CoreLogic, we are imagining new possibilities to increase productivity, minimize risk, grow businesses, and grow relationships. We strive to transform industries for the better through our innovative data science and analytics, technology, workflows, software, and platforms. We help our clients better serve their customers every day.

Our work has real meaning to people, businesses and society. With CoreLogic, the property ecosystem becomes stronger, more efficient, and effective. We’re creating a future where more people are able to achieve the dream of home ownership, more accessible and sustainable properties are built, risk is better managed — and even mitigated. Ultimately, leading to more resilient communities, where both property and people thrive.

Come as you are, be true to yourself, and bring original ideas. We are stronger because of our differences and the unique experiences each of us brings. We value individuality, diversity, inclusiveness, and equity.

Operate with empathy and integrity. When we put people first, we build better relationships, trust, and resiliency. In turn, this sustains stronger communities.

Take personal initiative, own the results, learn from mistakes, and always look to improve. When we commit to improve something every day, we positively impact individuals, businesses, and society.

Clients are our North Star. We strive to know their businesses as well as our own. We co-create and collaborate to grow businesses and relationships. When that happens, we all win.

See the bigger picture. Be bold, think big, and ask ‘what if’. We value brave ideas and insight that exponentially unlock new possibilities to better serve people throughout the property ecosystem.

Operate with speed, agility, and purpose. We are the heartbeat of the property market, dynamically adapting and evolving the way the industry works for the better. We value the clarity, focus, and energy it takes to be the industry leader.

Revolutionize your insights with access to 22,000 data sources and over 1 billion property records. Explore new and improved solutions to business problems. And do it all with the collaborative support of a world-class team of data scientists.

At CoreLogic’s Virtual Discovery Center, we work with you to create a future where more people can achieve the dream of homeownership, more accessible and sustainable properties are built, and risk is better managed — and even mitigated.

Putting people first starts with us. CoreLogic connects people with what matters to communities to accelerate the pace toward a more sustainable society.

Find Your Career/Work at @ CoreLogic

We provide property industry professionals with access to big data and cutting-edge analytics solutions, including location intelligence. Experts are also available to help support software implementation and offer consulting expertise to power digital transformations.

Our property data is used throughout the mortgage, real estate, and housing markets as well as across insurance claims and restoration. We also help retailers, government entities, telecommunications enterprises, and other industries supercharge their data on the Discovery Platform, our secure, cloud-native data exchange.

We aggregate our data from thousands of sources across the real estate and housing market, but we provide it to you where you need it, including on a variety of marketplaces like Snowflake, Databricks, AWS, Google Analytics Hub, and ESRI, with more coming.

IDC ranked CoreLogic as No. 10 on the 2023 IDC FinTech Rankings Top 25 program, which lists the top 100 companies deriving more than one-third of their revenue from the financial services and FinTech industries.

We brought our CLIP technology to the Snowflake Marketplace

Roostify came under the CoreLogic brand to expand digital mortgage technology capabilities and bring critical information about borrowers and properties to the beginning of the loan process.

We launched Climate Risk Analytics™, designed to help government agencies and enterprises measure, model, and mitigate the physical risks of climate change to the real estate industry through 2050.

The Discovery Platform comes online as CoreLogic’s new cloud-based property analytics ecosystem and data exchange.

Pat Dodd is appointed president and CEO of CoreLogic.

We expand our suite of claims workflow solutions for property insurers and restoration contractors with the acquisition of Next Gear Solutions.

CoreLogic named on 2021’s Fortune 1000 list, a ranking compiled by Fortune magazine off the 1,000 companies with the highest revenue in the U.S.

Stone Point Capital and Insight Partners acquired CoreLogic as a private corporation.

We purchased Location Inc. to give our commercial and personal insurance line customers access to the most granular, accurate, and predictive set of risk variables available.

We integrated Symbility Solutions into CoreLogic, expanding our domestic footprint in property and casualty insurance as well as increasing our international footprint.

We acquired a la mode to scale our end-to-end valuation solutions workflow suite through a digital platform that expanded the connectivity between a number of the major constituencies in the mortgage underwriting ecosystem.

Myriad Development was acquired, further expanding our property insurance underwriting capabilities.

Frank Martell was appointed as President and CEO of CoreLogic

We announced our new ownership of RELS, LLC, a provider of property valuation and appraisal services in partnership with Wells Fargo.

We expanded our solutions in the construction sector, adding the Australian construction data business, Reed Business Information Ltd, to our portfolio.

Weather Fusion came into our portfolio, expanding our hail, wind, and lightning weather risk-management capabilities.

We acquired catastrophe modeling firm Eqecat to expand our footprint in the insurance property data and analytics space.

Marshall & Swift/Boeckh was added to our portfolio. The heritage company is a leading provider of residential and commercial replacement and repair cost estimates that assist in analyzing risk, underwriting property insurance coverage, and estimating, managing, and analyzing claims.

In response to a growing need for hazard-related data and analytics in risk management services, we bought RiskMeter, a provider of geospatial hazard reports.

Our next big acquisition was Dorado Network Systems Corp, a cloud-based company automating loan origination and providing transparency into real-time lending workflows.

We acquired Australia-RP Data, a provider of residential and commercial property information in Australia and New Zealand.

CoreLogic, Inc. was established as a standalone business, separate from the First American Corporation.

CoreLogic helps diverse businesses and organizations grow revenue, fast track innovations and migrate risk with category-defying data, insights and analytics.

CoreLogic solutions automate and streamline the mortgage process; originate loans faster, improve borrower experiences, and helps lenders manage risk more effectively.

CoreLogic helps real estate professionals and multiple listing enterprises better meet shifting market realities with an ecosystem of collaborative, seamless, secure and compliant solutions.

CoreLogic seamlessly connects the entire insurance process from quote to underwriting, to claims and risk management through our secure digital workflow.