Commercial Real Estate Lending and Multifamily

- Commercial loan servicing industry leader

- Pre-closing tax certificates

- Reporting and tax payment services

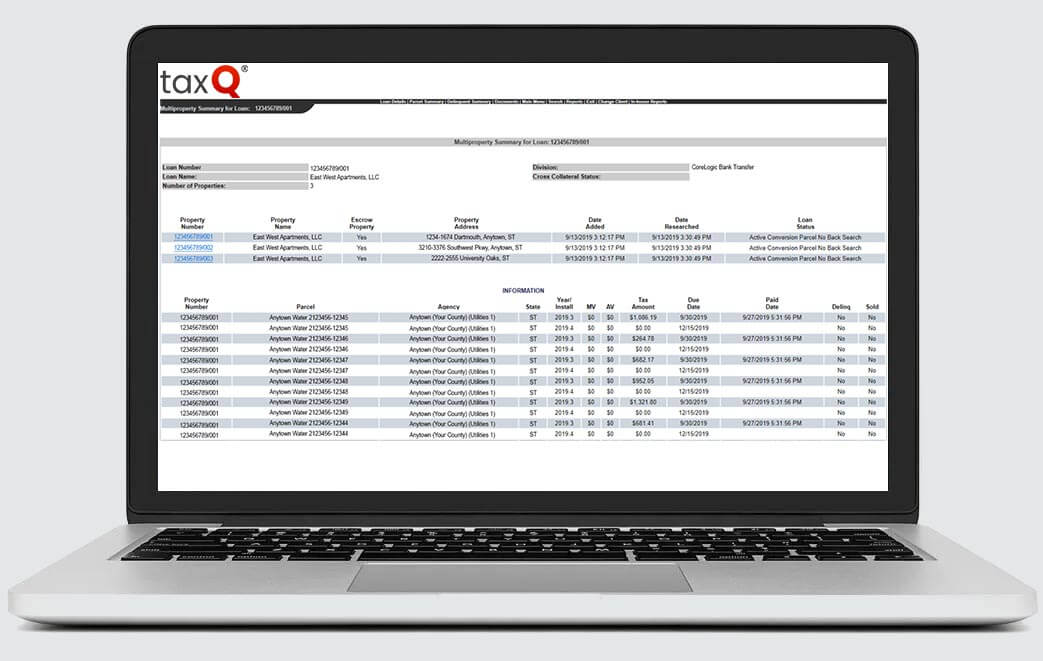

- taxQ for lenders

CoreLogic manages complex Commercial Real Estate portfolios with a comprehensive property tax solution that mitigates risk, ensures compliance, and lowers costs. Backed by near real-time access to critical tax data, CoreLogic Commercial Tax helps clients — investors, lenders, and commercial real estate portfolio owners — eliminate property tax surprises with a seamless and efficient workflow.

Our Commercial Tax Solutions group reports billions of dollars in property taxes each year, maintaining active relationships with approximately 22,000 taxing authorities across the nation. We offer a clear risk assessment, whether it be for just one property or an entire portfolio.

The process of tracking, reporting and paying property tax is complex and full of potential risk. Real estate portfolios are geographically diverse and governed by multiple taxing agencies and regulations. CoreLogic taxQ® makes this process much more efficient and beneficial to lenders and corporate real estate owners:

Our data and automation help you more efficiently manage your commercial tax payments. CoreLogic will automatically obtain all required documentation to process the entire tax cycle, from assessment notices to the tax bill and receipts. When it’s time to pay, CoreLogic manages the entire process and offers flexible payment options including check, ACH, certified funds or federal wire transfer.

Schedule a free consultation, and empower your team with CoreLogic today!