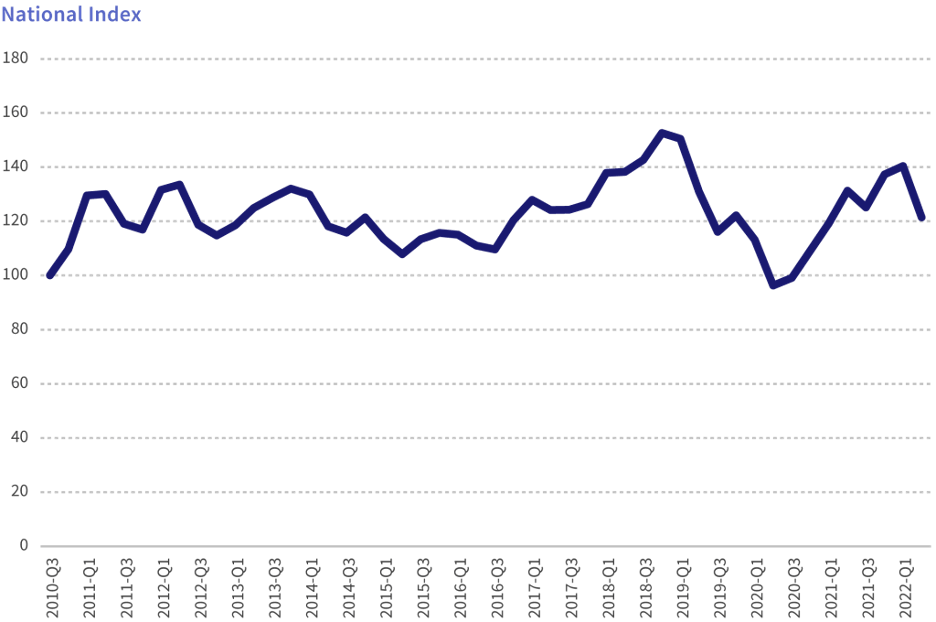

Our 2023 Annual Mortgage Fraud Report shows relative stability in fraud risk levels year-over-year, with a 3.1% decrease in fraud risk at the end of the second quarter of 2023. The decline is partially due to the recalibration of our scoring model released in 2022. More careful loan screening due to higher repurchase risk is a primary driver of the stable levels of risk.

After large increases in mortgage fraud risk for much of 2022, our 2023 Annual Mortgage Fraud Report shows a 7.5% year-over-year decrease in fraud risk at the end of the second quarter of 2023. The decline is partially due to the recalibration of our scoring model in the first quarter of 2023. However, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

Segments with increasing risk since Q2 2022 include 2- to 4-unit purchases (up 23%), 2- to 4-unit refinances (up 20%), jumbo refinances (up 7%), and jumbo purchases (up 3%).

We estimate that in the second quarter of 2023, 0.75% of all mortgage applications were estimated to contain fraud, about 1 in 134 applications. The highest risk segment remains 2- to 4- unit properties, with 1 in 28 transactions estimated to have indications of fraud. Purchases in this segment showed higher risk than refinances, although risk in both has increased by more than 20% compared to Q2 2022.

One trend we’ve identified to watch is the increase in occupancy misrepresentation. This type of fraud typically occurs when an investor identifies an investment property as a primary residence to obtain more favorable rates. While this type of fraud is very difficult to spot during origination, it is relatively easy for an investor to identify after closing, which increases repurchase risk. We have found that suspect occupancy loans have nearly tripled since 2020.

To combat this risk, we recommend increased scrutiny of loans that score in the high-risk range of our predictive fraud risk score. Our analysis found that these loans are more than twice as likely to have indications of occupancy misrepresentation.

Additional insights into these topics and more can be found by downloading our 2023 Annual Mortgage Fraud Report.

Download the 2023 Mortgage Fraud Report

Interested in reading the full report? Let us know where to email the PDF by filling out the form below.