CoreLogic® estimates 1,553,803 million homes at risk of inland flooding

Hurricane Hilary made landfall over the northern Baja California peninsula on Sunday, Aug. 20 at 11:00 a.m. local time (12:00 UTC) as a Category 1 storm with maximum sustained wind speeds of 65 mph (100 km/h), according to National Hurricane Center (NHC) Intermediate Advisory #17A.

Tropical storms are rare in the western U.S. due to the typically dry air and very cold ocean temperatures that inhibit hurricane development. The last time a tropical storm made landfall in Southern California was in 1939. That storm left a path of devastation that will exceed the damage from Hilary.

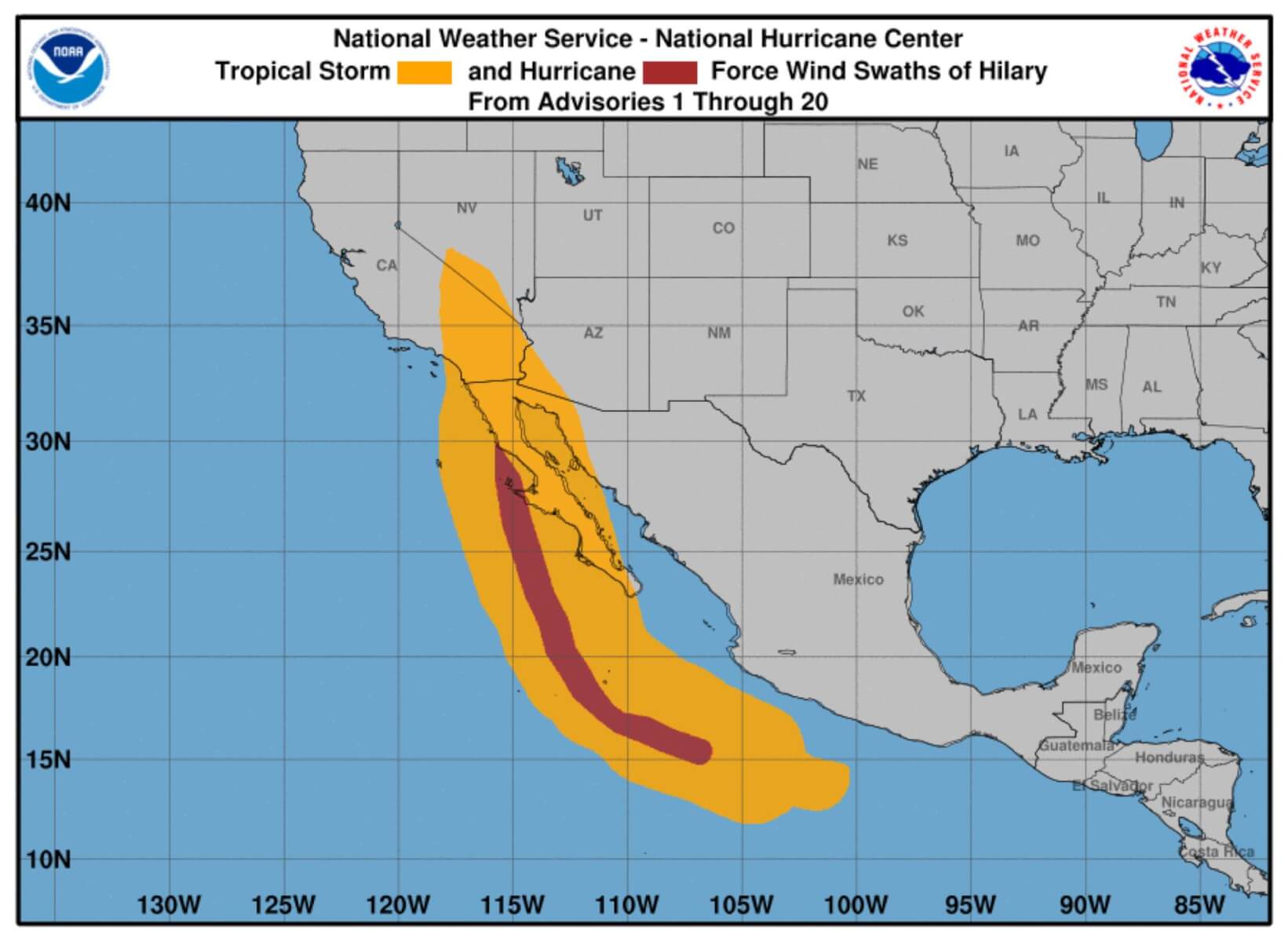

El Niño led to abnormally warm water in the eastern Pacific Ocean, which aided Hilary’s development. Fortunately, the storm degraded rapidly prior to landfall. Tropical storm winds extended throughout Southern California (Figure 1), with maximum sustained wind speeds up to 60 mph and gusts reaching higher speeds.

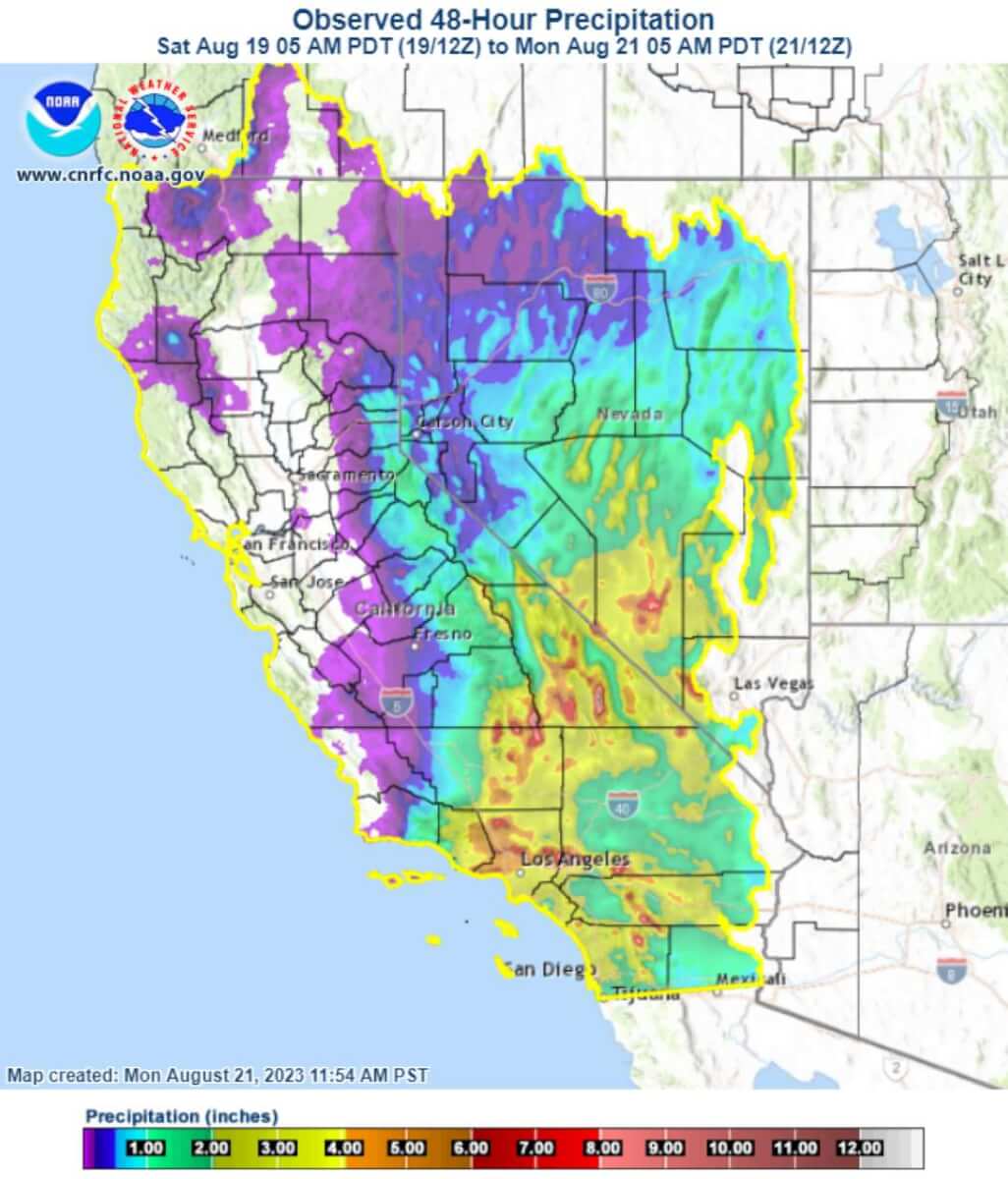

Potentially catastrophic inland flooding, including flash flooding in urban environments, is the primary hazard that this storm is bringing to the southwestern U.S., where rainfall is expected to continue falling through Monday, Aug. 21 (Figure 2). The heaviest rainfall occurred in the mountains outside of Los Angeles. Some areas experienced rainfall totals as high as 10 inches over a 48-hour period.

CoreLogic® estimates that approximately 1,553,803 residential homes in the western U.S. are at an elevated risk of inland riverine and flash flooding. This includes both single- and multifamily residential properties. The majority of residential homes are in California.

Table 1 provides the number of residential properties at risk of inland flooding by state.

| State | Count |

| California | 1,473,852 |

| Nevada | 24,406 |

| Arizona | 21,061 |

| Idaho | 15,428 |

| Oregon | 8,975 |

| Utah | 5,712 |

| Total | 1,553,803 |

Table 1: Number of residential properties Count of single- and multifamily properties at risk of flooding from Hurricane Hilary

Note, not all properties listed above will sustain damage. The number of damaged properties will be a subset of the total 1,553,803 buildings. The property counts represent all single- and multifamily residential properties with a Flood Risk Score Rating of moderate or greater that were exposed to at least one inch of rain in a 24-hour period.

This amount of rainfall could be significant, especially in arid regions of the southwestern U.S. Flash flooding in urban and desert environments is likely due to quick and intense rainfall.

Declining Housing Markets and Low Mortgage Delinquency Rates

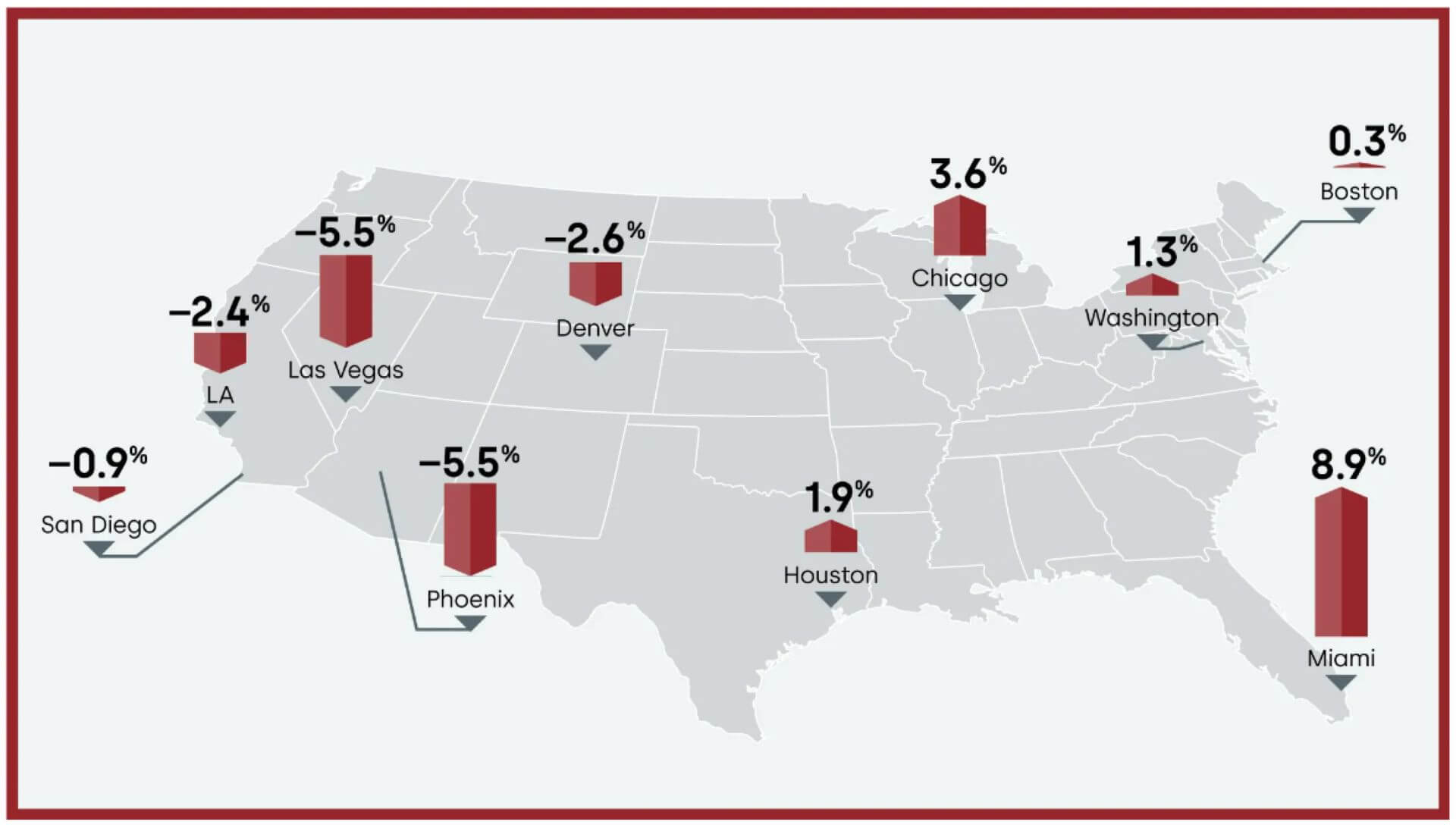

Many metro areas most affected by Hurricane Hilary experienced annual housing price declines. According to the CoreLogic US Home Price Insights – August 2023 report, the CoreLogic Housing Price Index (HPI) for June 2022 to June 2023 decreased in Phoenix, Las Vegas, Los Angeles and San Diego by 5.5%, 5.5%, 2.4% and 0.9%, respectively (Figure 3). The CoreLogic HPI measures multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales.

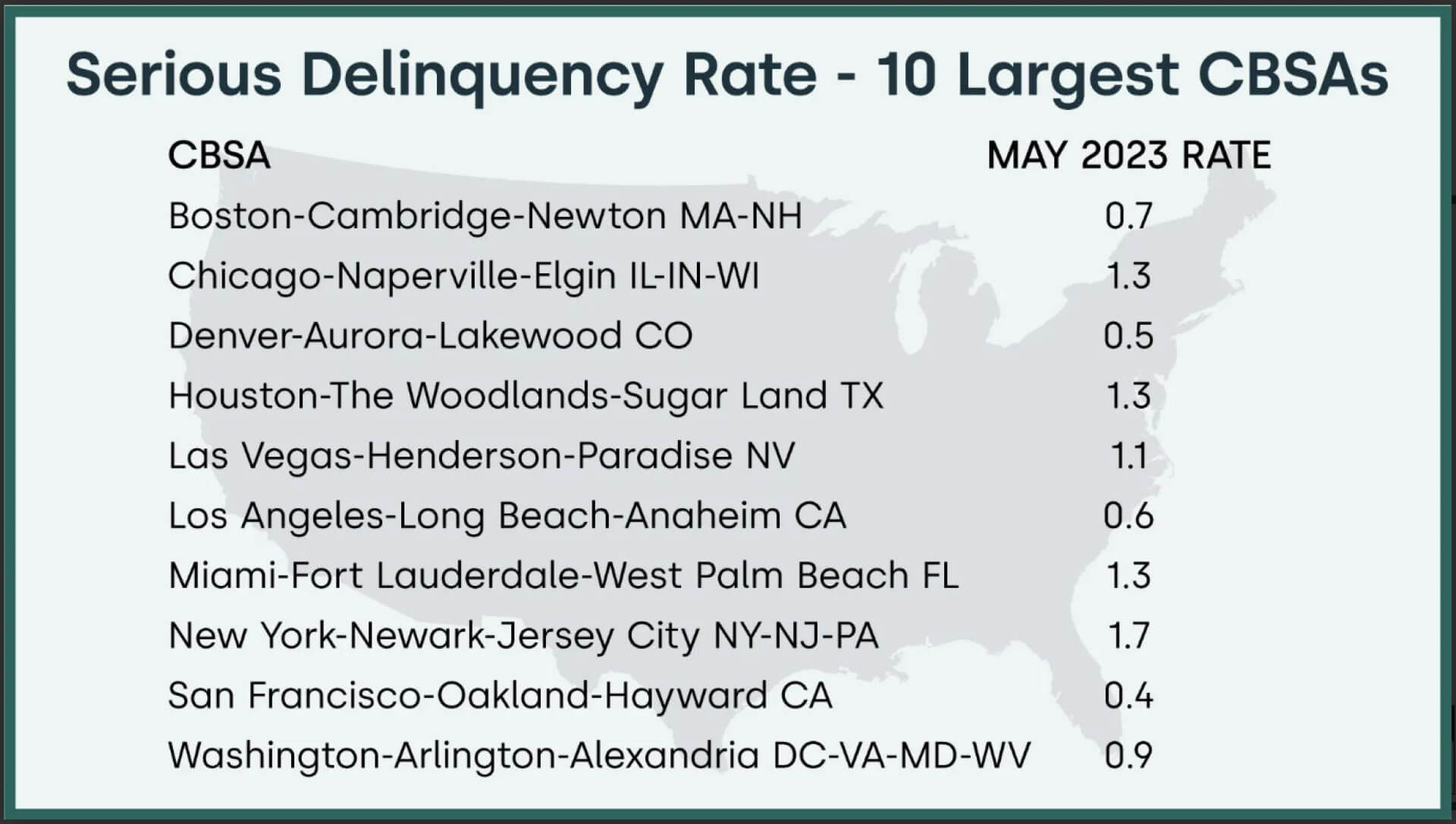

However, the Los Angeles and Las Vegas metro areas, both of which experienced annual HPI declines, are among the top 10ten largest metro areas with low serious delinquency rates (Figure 4), according to the CoreLogic Loan Performance Insights – July 2023 report. “Serious delinquency” is defined as a mortgage that is 90 days or more past due, including loans in foreclosure.

Nationally, the U.S. overall mortgage delinquency rate again fell to a historic low in May, returning to the level recorded in March of this year. Foreclosures also remained near an all-time low, a rate that has remained unchanged since the spring of 2022.

The CoreLogic Hazard HQ Command Central™ will continue to monitor the remnants of Hurricane Hilary. Updates may be provided when more is known.

©2023 CoreLogic, Inc. The CoreLogic statements and information in this blog post may not be reproduced or used in any form without express written permission. While all the CoreLogic statements and information are believed to be accurate, CoreLogic makes no representation or warranty as to the completeness or accuracy of the statements and information and assumes no responsibility whatsoever for the information and statements or any reliance thereon. CoreLogic® and Hazard HQ Command Central™ are the trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contact: Please email [email protected] with questions regarding Hurricane Hilary or any CoreLogic event response notifications.

Visit www.hazardhq.com for updates and information on catastrophes across the globe.