Loss Estimation Requires More than Hazard Science

Catastrophic risk models and analytics are commonly used by the insurance, reinsurance, financial and mortgage industries to help understand and quantify risk exposed to natural catastrophes including earthquakes, hurricanes, floods, wildfires and hail storms. The first step in developing a view of risk is understanding the landscape of the hazard. For earthquakes, the preferred view of hazard is generally a country-specific national seismic hazard map.

As their names suggest, seismic hazard maps assess hazard, but the insurance and financial industries often require more information and seek to obtain a quantitative view of risk. When hazard intersects with exposure – what can potentially be damaged by the hazard – it changes the focus from hazard to risk. For example, there can be areas of extremely high hazard, but if there is nothing in the areas to be damaged, the risk will be lower.

When quantifying catastrophe risk, the full spectrum of risk must be evaluated, ranging from the more frequent and generally less damaging events to the extreme, catastrophically damaging events. This is where probabilistic modeling is advantageous. Probabilistic modeling – or more specifically, probabilistic loss modeling – offers a quantitative view of risk for all potentially feasible events that may occur, including their frequency of occurrence. Risk managers in the insurance and financial industries use these models to estimate financial losses from catastrophic events. From a financial perspective, the higher-frequency events are often smaller and less damaging, but multiple events in one year can have an impact on the cash flow of a company. On the opposite end of the spectrum, low-frequency, high-consequence events can impact the solvency of a company. To assess the financial losses for each event through a probabilistic loss model, much more is required than an understanding of the hazard.

Framework for Probabilistic Loss Modeling

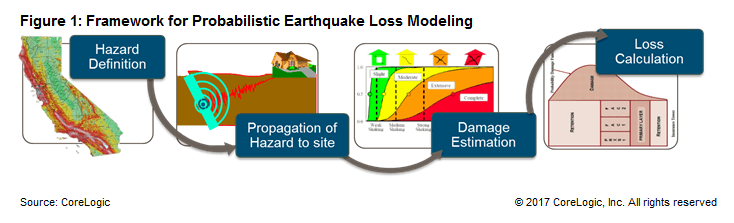

Typically, there are four components that make up a probabilistic loss model: hazard definition of all possible events, determination of hazard footprint for each event, vulnerability assessment of structures impacted by each event, and financial loss calculation (Figure 1).

Component 1: Definition of hazard through development of a stochastic event set. This is defined by defining all possible earthquake sources (i.e. faults or areas of active earthquake activity), defining a range of magnitudes on each source and a probability of each magnitude occurring on each source.

Component 2: For each possible event in the stochastic event set, the ground motion propagation is calculated to understand the extent of potential impact of each event. This step involves an understanding of the underlying soil conditions and equations for propagation of earthquake ground motion.

Component 3: Relates hazard to damage by assessing the vulnerability or damageability of each structure (e.g. residential, commercial or industrial properties) within the footprint of hazard for each event. To assess the vulnerability of structures, local building codes, building practices and features including the age, type of construction and height of the building are used.

Component 4: The final step relates damage to loss through a sophisticated financial calculation to estimate a quantitative loss estimate for each possible event.

Risk managers utilizing probabilistic loss models use portfolios of their assets as input to understand the loss impact specific to their exposure. With the goal of being able to measure and manage their risk, risk managers seek to understand the specific details of their exposure – where are their assets, how concentrated are they, how vulnerable are they? This allows them to measure the financial losses for their portfolio of assets and understand which features are driving their risk.

When understanding drivers of earthquake risk, a probabilistic loss model can help risk managers understand which fault sources or magnitudes are the greatest contributors to the risk. By obtaining a deeper understanding of the distribution and severity of the risk, risk managers can more adequately manage their risk.

Evolution from Hazard to Risk

An assessment of hazard is often the quickest and simplest way to get a snapshot of areas to be concerned with, but by evolving this method to include the vulnerability of different types of structures exposed to the hazard, risk managers can obtain a more comprehensive view of risk and financial losses.

Risk managers have several tasks when it comes to managing earthquake risk within the insurance and financial industries, ranging from policy pricing, to capital management, capital allocation or meeting solvency requirements. Every step forward in evaluation of catastrophe risk is a step towards the ultimate goal of becoming more resilient. By leveraging analytical tools like probabilistic loss models to help quantify financial losses, identify the distribution risk and additional impacts such as business continuity, the industry can achieve a more measurable view of their risk and ultimately become more resilient.

© 2017 CoreLogic, Inc. All rights reserved