HELOC activity has declined so far this year after hitting a 15-year high in 2022

Last week, the average 30-year, fixed-rate mortgage (FRM) reached its highest level in 21 years, according to Freddie Mac. [1] This increase not only further erodes U.S. home affordability but also discourages owners from tapping loans against their accrued equity.

While home equity lines of credit (HELOCs) and home equity loans gained popularity as owners leveraged accumulated equity in 2022, the appeal has dampened in 2023. Demand for HELOCs is typically linked to current interest rates, which have been steadily rising over the past few years.[2]

However, despite interest rate hikes, HELOC activity surged in 2022. Escalating mortgage rates compared with those seen in 2021 significantly curtailed refinancing opportunities and resulted in an uptick in HELOC activity.

However, the HELOC landscape has changed dramatically so far in 2023, as the elevated interest rates of the past six months discourage homeowners from pursuing such loans. Notably, the average rates on 30-year, FRMs surged by nearly 2 percentage points during the first half of 2023, averaging 6.44% compared with the same period in 2022.[3] Because HELOC interest rates are tied to the federal funds rate, monthly payments fluctuate based on interest changes.

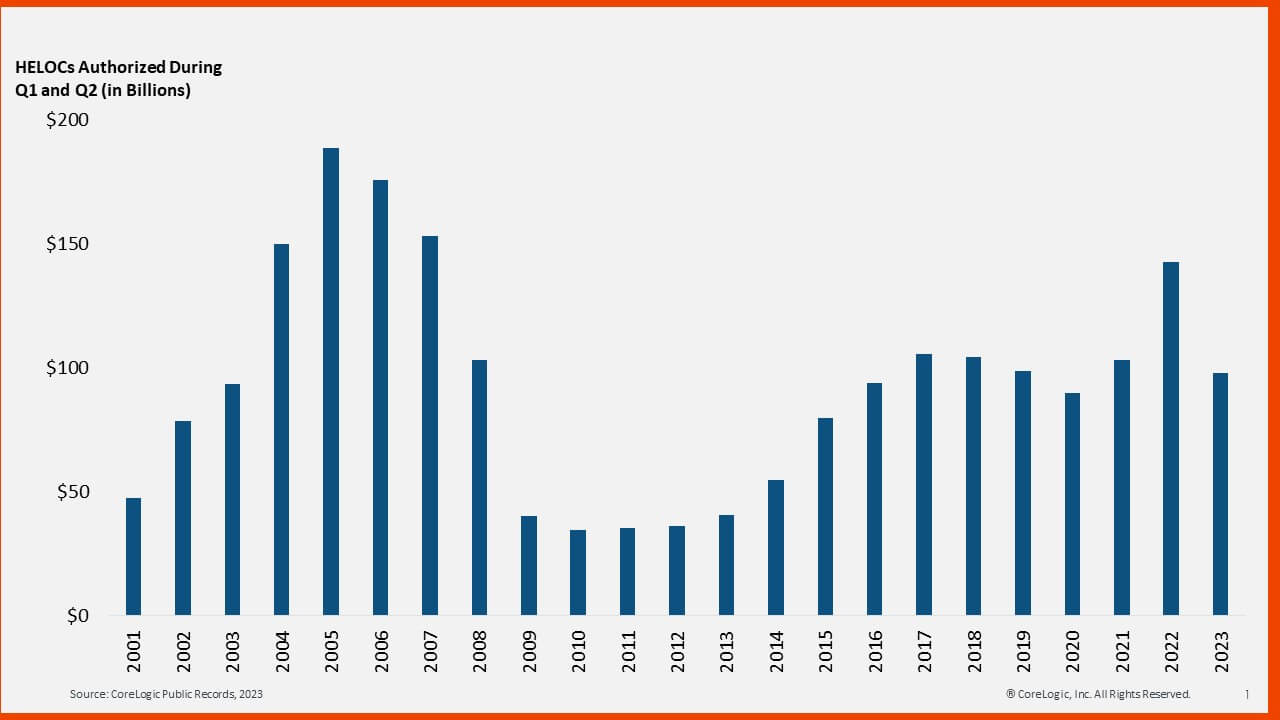

Annual U.S. HELOC Numbers Drop Substantially in the First Half of 2023

As seen in Figure 1, HELOC activity peaked in 2022, marking the highest level since the first half of 2007, but this number dropped in the first half of 2023. During that time period, lenders initiated over 645,000 new HELOCs, amounting to almost $98 billion. Despite a decrease of 26% in HELOC counts and a 32% reduction in amounts on a year-over-year basis in 2023, it’s worth noting that the HELOC market is keeping pace with its pre-pandemic level.

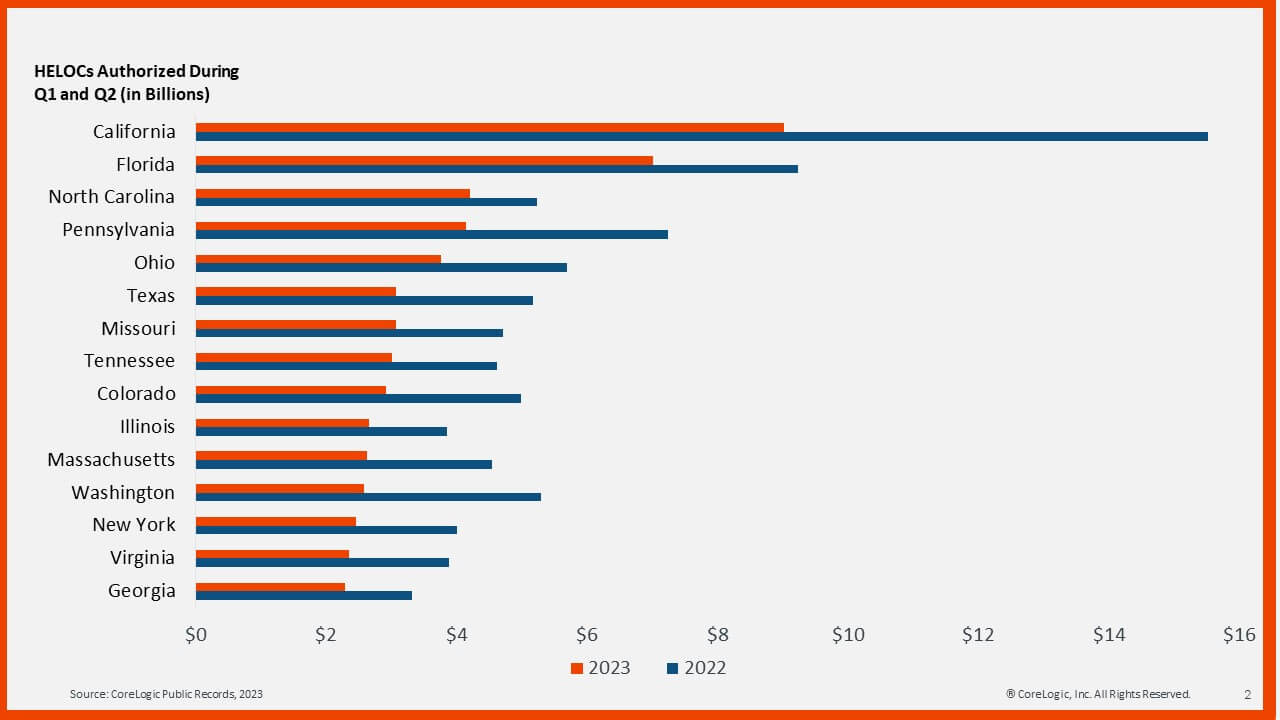

HELOC Trends by State: California, Florida and North Carolina Lead in 2023

Figure 2 shows a comparative analysis of approved HELOC amounts (by billions) during the first half of 2023 and the corresponding period in 2022 across 15 U.S. states.

In 2023, all tracked states have seen HELOC activity decrease compared with 2022. Notably, California posted the highest approved HELOC amount, surpassing $9 billion so far in 2023. That number is currently down from the $15 billion in HELOC loans that the Golden State recorded in 2022 but still accounts for around 10% of the nation’s overall activity.

Florida followed closely, with $7 billion in HELOC loans, while North Carolina ranked No. 3 at $4.2 billion. It’s worth noting that the states that saw the most significant HELOC activity declines were those where home prices have either recently remained flat or dropped, including Utah, Idaho, Hawaii and Montana (not shown in the chart below).

Given prolonged high home prices, some owners will likely continue to tap accrued equity if necessary. On the other hand, current high interest rates may cause some potential HELOC borrowers to rethink that decision. If mortgage rates start to fall, demand for HELOCs will likely pick up again.

Stay tuned for CoreLogic’s Q2 Home Equity Insights report in early September. For more data-driven insights and expert commentary, visit CoreLogic’s Office of the Chief Economist’s home page.

[1] Freddie Mac Primary Market Mortgage Survey

[2] A home equity line of credit (HELOC) is secured against the borrower’s home equity value and allows them to access cash as they need and repay the HELOC at a variable interest rate. In contrast to a cash-out refinance, HELOCs allow borrowers to take advantage of the low interest rate on their first mortgage while tapping existing equity for necessities such as home improvements or to pay off higher interest rate debts.

[3] Freddie Mac Primary Market Mortgage Survey