December 2020 Economic Outlook

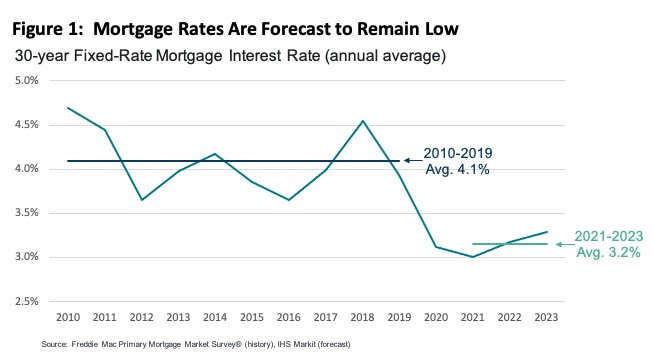

- 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years.

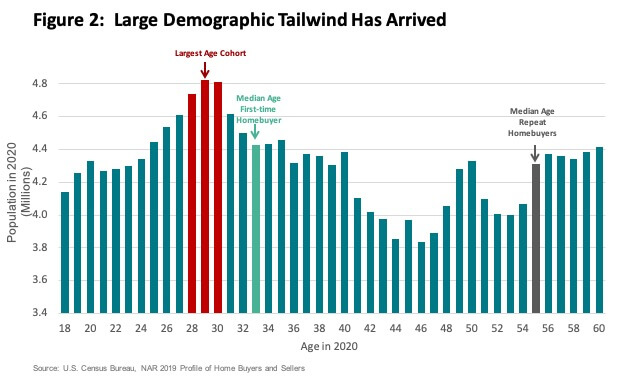

- Millennials will add substantial demand for housing over the next few years.

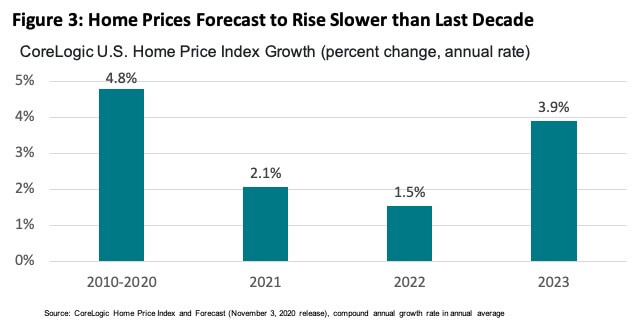

- Home prices projected to rise in most metro areas, albeit slower than in recent years.

2020 was a truly unprecedented year. With it behind us, let’s look ahead at three housing market trends that are likely during the next three years.

First, exceptionally low mortgage rates are likely to be around for an extended period. We expect 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years. This would be nearly a percentage point lower than the average over the 2010-2019 decade. These low rates will provide an excellent opportunity for families with good credit to buy or refinance homes.

Second, Millennials will add substantial demand for housing over the next few years. Looking at America’s population by age, the largest numbers of Millennials are those aged 28 to 30. With 33 as the median age of recent first-time buyers, demographic forces will add an important tailwind to home-buying demand. In fact, we expect home sales relative to the housing stock, a measure of home “turnover”, in 2021 to 2023 to be above the average annual turnover rate of the prior two decades.

Third, we expect home prices to rise in most neighborhoods, albeit at a more modest pace than in recent years. Price appreciation is expected to average 2.5% per year during the next three years, compared with 4.8% per year during the prior decade. One reason for slower value growth is because we expect for-sale inventory will increase. 2020’s pandemic delayed new construction and led many prospective sellers to postpone listings. Once the coronavirus dissipates or a vaccine is widely available, we expect to see the number of new and existing homes listed for sale to rise, helping to ease price appreciation. One caveat: while we predict most communities will see gradual price growth, some metros that have been especially hard hit by the pandemic recession will likely have price declines.

Low mortgage rates, growing numbers of first-time buyers, and gradually rising home values are three housing market trends we expect during the next three years.

Best wishes for a healthy and successful new year!

© 2020 CoreLogic, Inc. All rights reserved.

Get the CoreLogic Economic Outlook for December 2020 on YouTube. Each month, CoreLogic Chief Economist Dr. Frank Nothaft will provide data driven analysis for the economy and property industry. For more insights, subscribe to our YouTube channel.