In early 2018, we reviewed how RMBS 2.0 issuance volumes in the Private-Label Residential Mortgage Backed Securities (PLRMBS) market had shifted towards the Non-Performing Loans (NPL) and Re-Performing Loans (RPL) along with emerging non-QM as early as 2015. In less than two years since that first review, we’ve seen NPL and RPL issuance slow down while the non-QM volume has grown significantly. Back then, there was a desire for a follow up review of the loan performance for each category. Given the dynamics of how the market has changed and the strong interest in the growing non-QM segment, we’ll focus our update on a performance review of the non-QM book. More specifically, for our analysis we’ve isolated non-QM identified loans within non-QM designated deals spanning from 2015 to present. We’ll first review the active non-QM book then we’ll analyze the paidoff non-QM set for a comprehensive perspective.

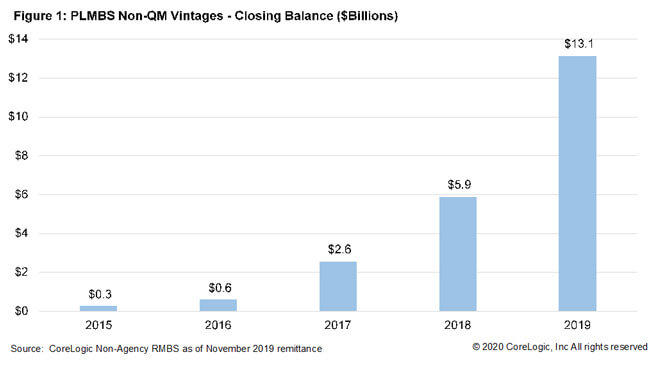

With a starting point of 2015, we see the non-QM volumes ramp up this year and last (Figure 1).

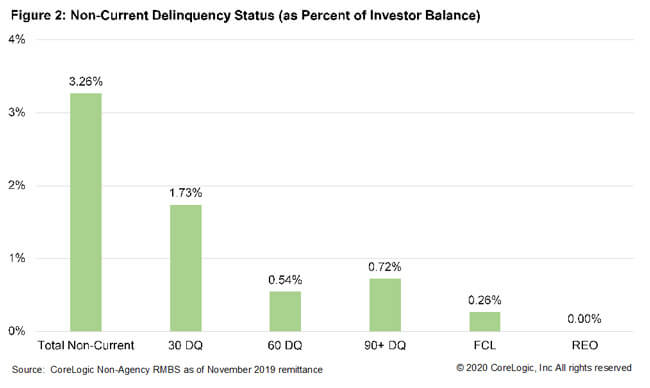

A performance review of the outstanding portfolio reveals that 96.7% of the unpaid principal balances in non-QM RMBS were in current status, or 3.3% were non-current (Figure 2).

In terms of the overall life of the active loans, almost 93% never experienced a delinquency and 5% were never worse than 30 days delinquent.

Turning to the collateral itself, not too surprisingly we see the Never Bad set of loans have stronger credit characteristics and lower initial and current interest rates. Credit score is higher, and original loan-to-values (LTV) and back-end debt-to-income (DTI) ratios are lower for this cohort (Figure 3).

Figure 3: Worst Ever Performance Characteristics On Active Loans

| Worst Ever Performance | Initial Rate | Current Interest Rate | Orig CLTV | Current CLTV | Original Credit Score | Back-End DTI |

|---|---|---|---|---|---|---|

| Never Bad | 6.17 | 6.03 | 73.17 | 68.53 | 720 | 37.04 |

| Worst Ever 30 DQ | 6.80 | 6.72 | 74.45 | 69.65 | 686 | 37.58 |

| Worst Ever 60 DQ | 7.15 | 7.16 | 74.44 | 69.13 | 667 | 38.24 |

| Worst Ever 90 DQ | 7.21 | 7.10 | 76.11 | 70.90 | 671 | 38.39 |

| Worst Ever FCL | 7.30 | 7.22 | 75.12> | 67.48 | 661 | 38.35 |

Source: CoreLogic Non-Agency RMBS as of November 2019 remittance

©2020 CoreLogic, Inc All rights reserved

Not shown in the above collateral analysis but of importance is the owner occupancy. Across all vintages for active non-QM loans, roughly 93% were owner occupied while almost 7% were second home and less than 1% was investor-owned. Comparing loan performance, the owner occupied vs. second home and non-owner occupied/investor performing were at similar levels with a current status between 96% and 98%. Only about 1% of the loans were in a serious delinquency status of 90 days-or-more or in foreclosure with 96% of these being owner occupied and almost 1% being non-owner occupied or investor.

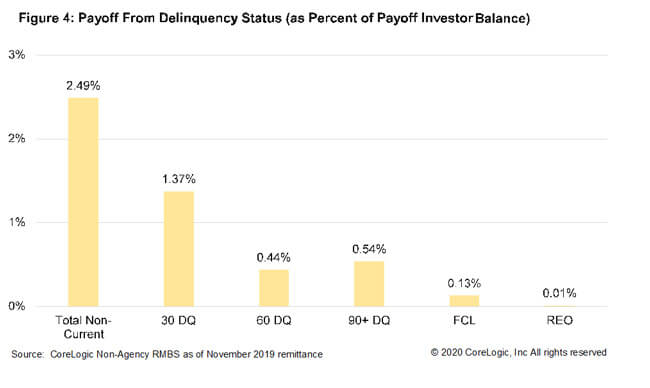

Delving into the pre-payment set of loans, we see a similar and consistent pattern to the active set where the performance was relatively strong. Over 97% pre-paid from a current status (Figure 4).

Looking at the worst-ever status for those paid-off loans shows approximately 94% never went delinquent and nearly 99% never reached a status of 90 days late or worse.

As expected, the credit profile for the pre-paid is similar to that of the active set. Not unlike what we saw in Figure 3, Figure 5 below shows the credit score to be a bigger driver for the performance along with the interest rate at the time of pre-paying.

Figure 5: Worst Ever Performance Characteristics On Paidoff Loans

| Worst Ever Performance | Initial Rate | Payoff Interest Rate | Original CLTV | Original Credit Score | Back-End DTI |

|---|---|---|---|---|---|

| Never Bad | 6.41 | 6.46 | 73.48 | 713 | 38.52 |

| Worst Ever 30 DQ | 6.95 | 6.99 | 74.61 | 680 | 38.73 |

| Worst Ever 60 DQ | 6.96 | 6.96 | 75.46 | 671 | 40.07 |

| Worst Ever 90 DQ | 7.22 | 7.07 | 76.43 | 668 | 37.68 |

| Worst Ever FCL | 7.48 | 7.51 | 78.39 | 653 | 40.24 |

Source: CoreLogic Non-Agency RMBS as of November 2019 remittance

©2020 CoreLogic, Inc All rights reserved

A closer review by vintage from 2015 to present for the pre-paid set does seem to reveal a greater proportion of the loans are from earlier vintages. Roughly 76% of the seriously delinquent pre-paid set came from 2015 to 2017 vintages.

A quick note on the occupancy for the pre-paid shows the behavior in terms of the performance is rather consistent between owner occupied versus second home and non-owner/investor. Overall, we see between 97% and 98% of the loans pre-paying from a current status whether they’re owner occupied or not. However, roughly 95% of the pre-paying volumes were owner occupied homes. Furthermore, for loans that pre-pay from a seriously delinquent state, CoreLogic data reveal about 99% of the volumes were owner occupied.

To date, the performance shows the segment has been doing relatively well overall across vintages. Even at a deal level, there are only a handful of deals with any defaulting balances currently. Nonetheless, should our economy experience a recession, keeping a close tab on loan performance will be increasingly important for investors.

Granted, the non-QM segment of the PLRMBS market is still relatively small and the sample to review is barely over $22 billion in closed deal balances starting from 2015 with the heaviest concentrations located in California (over 45%), Florida (over 13%), Texas (over 5%), and New York (almost 4%). But the interest is quite high given the potential for the segment. Going into 2020, home price and interest rate volatility is expected to remain stable and this should help drive the demand for non-QM even more. Depending on what transpires with the QM Patch expiration slated for January 2021, a portion of the volumes could find a home through the private-label market.

Note: The data compiled in the figured were taken from CoreLogic’s Non-Agency RMBS product with performance data through November 2019 remittance to bond holders.

©2020 CoreLogic, Inc All rights reserved.