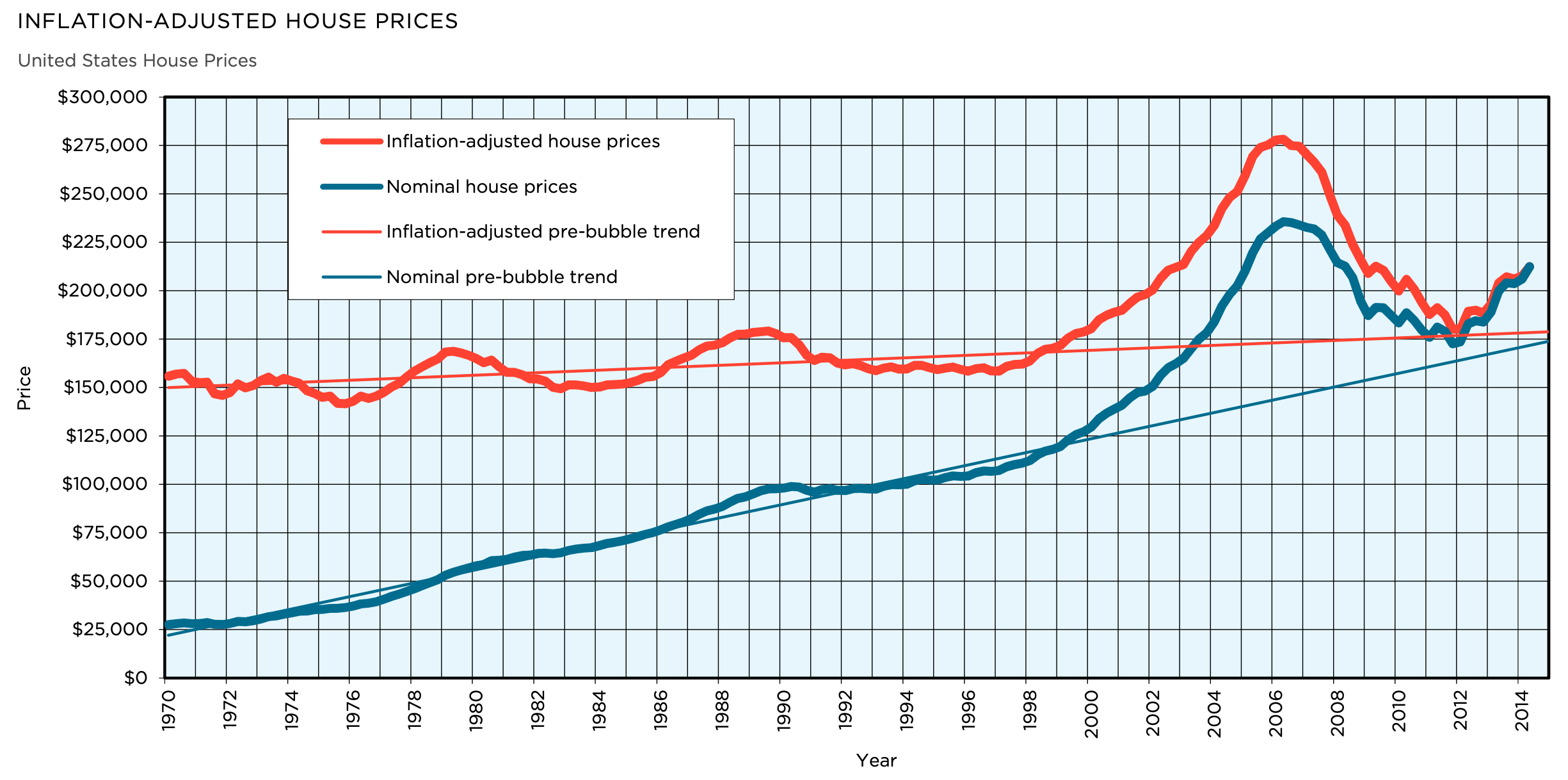

Regular valuations are an extremely important and healthy practice in mortgage portfolio monitoring from both a business and regulatory standpoint. With home prices on an upward trend for nearly the past decade, it is easy to overlook the importance of regular portfolio monitoring. In this cyclical industry, it is only a matter of time before the market could correct and prices may decline in some markets.

Performing proactive and recurring valuations on loan portfolios helps mortgage professionals assess the trendline of their collateral asset valuation so that they can mitigate risk at the earliest possible opportunity. Achieving these insights requires stable and streamlined valuations at a consistent cadence—at least once a quarter—to establish a reliable trendline. Any variation should be the result of market trends versus variations in the valuation solution and/ or methodology.

Per the Comptroller’s Handbook, “the OCC expects each bank to identify, measure, monitor and control risk by implementing an effective risk management system appropriate for its size and the complexity of its operations.” Consistent and regular portfolio monitoring helps organizations achieve compliance with regulations that require adequate capital reserves. It is also an effective risk mitigation tool for collateral asset valuation and management.

The most commonly used and effective tools for regular portfolio valuation are automated valuation models (AVM) and home price indices (HPI). It is important to understand the strengths and weaknesses of each before deciding which tool is the best fit for your portfolio monitoring needs.

Home Price Index

HPIs can be used to index the most recent sales price for each home in a portfolio with the current market trends down to the ZIP code level. This is can be an effective tool when only subject property ZIP codes are available or when AVMs are not able to value a property (e.g., in very rural areas). HPIs are an essential component of AVMs, but the use of an HPI alone does not deliver the same level of information as AVMs, which use additional data sources (e.g., MLS data) and sophisticated analytics to generate reliable value estimates at the property level, instead of the ZIP code level.

Standalone AVM

As noted, AVMs provide useful, property-level valuations when the subject property address is known. Using a single, high-quality AVM offers the benefit of a consistent model for valuations, so that any fluctuation can be attributed to market shifts rather than to different valuation models. However, no single AVM delivers the best accuracy and coverage in all geographic regions. Relying on a single AVM ultimately reduces the chances of achieving the most accurate results possible.

Dynamic Cascade

Dynamic cascades are made up of multiple AVMs, increasing the chance of getting a successful, more accurate valuation on a property. For one-time transactions at a point in time—such as originations—a dynamic cascade is an excellent AVM solution. However, dynamic cascades may change the rank ordering of their AVMs based on specific criteria or methodology from quarter to quarter. While this functionality can increase the accuracy of one-time valuations, it also introduces variability that can be problematic for recurring portfolio monitoring. When making valuations on the same property over time, it is important to ensure that any variability in a portfolio valuation is due to market changes rather than an AVM cascade model calling sequence.

Static Cascade

Like dynamic cascades, static cascades use multiple AVMs to provide highly accurate valuations. However, the rank ordering of the AVMs within a static cascade is fixed, eliminating model variability that can result from a dynamic cascade. Using a static cascade for portfolio valuation allows mortgage professionals to be confident that valuation differences over time are likely due to market trends instead of cascade methodology. It should be noted, however, that occasionally a static cascade will use a different model to value a property. This happens when a model in

the cascade gets a high-quality result during one portfolio run and then does not get a successful hit during a subsequent run. Adding new or removing aged sales data and other factors can cause this to happen.

Conclusion

Sophisticated portfolio monitoring solutions enable organizations to focus on current business initiatives without sacrificing portfolio monitoring vigilance. By combining the benefits of portfolio monitoring solutions without the drawbacks, static cascades provide the best all-around solution for regular portfolio monitoring. However, individual static cascades can vary in terms of performance and quality. Portfolio managers should examine all available solutions to assess their hit rate, accuracy, ease of use and cost to determine the best fit for their organization.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled services provider.

The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers

value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit corelogic.com.

CoreLogic

40 Pacifica, Ste. 900 Irvine, CA 92618