Serious Delinquency Rate for all Mortgage Loan Types Up from a Year Ago

As the COVID-19 global pandemic has created havoc in the global economy, millions of American homeowners are struggling to keep up with their mortgage payments. As a result, the mortgage delinquency rate has soared. The CoreLogic Loan Performance Insights Report analyzes mortgage performance for all home loans. Based on this report, the serious delinquency rate for October 2020 was 4.1 percent, representing a 2.8 percentage point increase compared with October 2019.[1]

To further examine how loan product mix contributes to the national delinquency rate, this blog explores default trends over time by loan type.

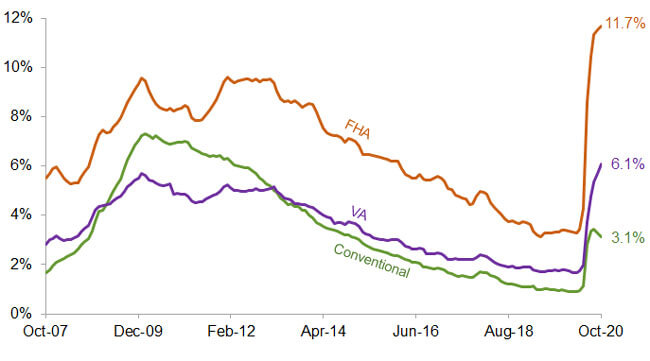

As of October 2020, the serious delinquency rates for Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), and conventional loans were 11.7%, 6.1%, and 3.1%, respectively (Figure 1).[2] The serious delinquency rate increased for all loan types in October 2020 compared with October 2019. In addition, the serious delinquency rate for FHA and VA loans reached a high, surpassing the highs seen post-Great Recession. The serious delinquency rate for FHA loans was above the 2012 delinquent levels by 2 percentage points.

The serious delinquency rate for conventional loans in October was down 20 basis points from September 2020. However, serious delinquency rates for VA and FHA loans were up by 20 basis points and 40 basis points in that same time period, respectively.

CoreLogic data shows the serious delinquency rate for FHA loans is almost four times higher than the serious delinquency rate for conventional loans. Because homeowners with FHA loans are more likely to be low-to-moderate income workers with an occupation related to leisure and hospitality, the pandemic has had a greater impact on those homeowners as compared to those with conventional loans.

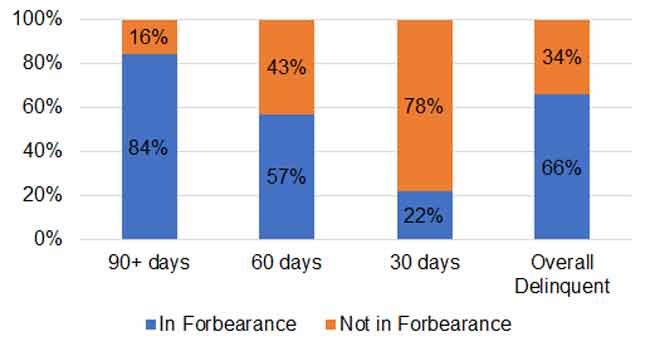

Congress enacted the CARES Act to provide consumer protections, and it includes an option for homeowners to request a pause or reduction in mortgage payments, i.e. forbearance, for up to 360 days. About two-thirds of the overall delinquent loans were in a forbearance plan.

The FHA has further extended the deadline for single-family borrowers with FHA-insured mortgages to request forbearance.[3] Figure 2 illustrates that about 84% of loans that were seriously delinquent in October were in forbearance.[4] The share of delinquent loans in forbearance has risen during the pandemic. Only about 11% of the seriously delinquent loans were in forbearance in May 2020.

Similarly, 57% and 22% of the loans that were 60 days and 30 days delinquent in October, respectively, were in forbearance. The new stimulus package should provide financial support to many borrowers and probably will help to curve the delinquency rate and forbearance rate.

© 2021 CoreLogic, Inc., All rights reserved.

[1] Serious delinquency is defined as 90 days or more past due or in foreclosure proceedings. The serious delinquency rate is the percentage of all loans in a state of serious delinquency.

[2] The analysis is based on the CoreLogic TrueStandings servicing. The CARES Act provided forbearance for borrowers with federally backed mortgage loans who were economically impacted by the pandemic. Borrowers in a forbearance program who have missed a mortgage payment are included in the CoreLogic delinquency statistics, even if the loan servicer has not reported the loan as delinquent to credit repositories.

[3] See HUD Press Release

[4] The analysis is based on CoreLogic Loan-Level Mortgage Analytics. Only servicers providing loan-level forbearance information were included in the analysis.