CoreLogic helps you determine residential and commercial reconstruction cost values more accurately, using our total component methodology and complete, current, and connected platforms, all of which are designed to meet your specific needs. Our prefill solution covers over 100 million residential properties and 16 million businesses—leveraging our eight decades of experience and unparalleled access to various data sources.

With CoreLogic Risk Evaluation solutions, get detailed intelligence on the structural risk and value of properties in your portfolio to ensure that your clients are not over or under-insured, ensuring optimum risk and premium determination.

Improve the accuracy, consistency, and automation of your reconstruction cost estimate throughout the entire underwriting process.

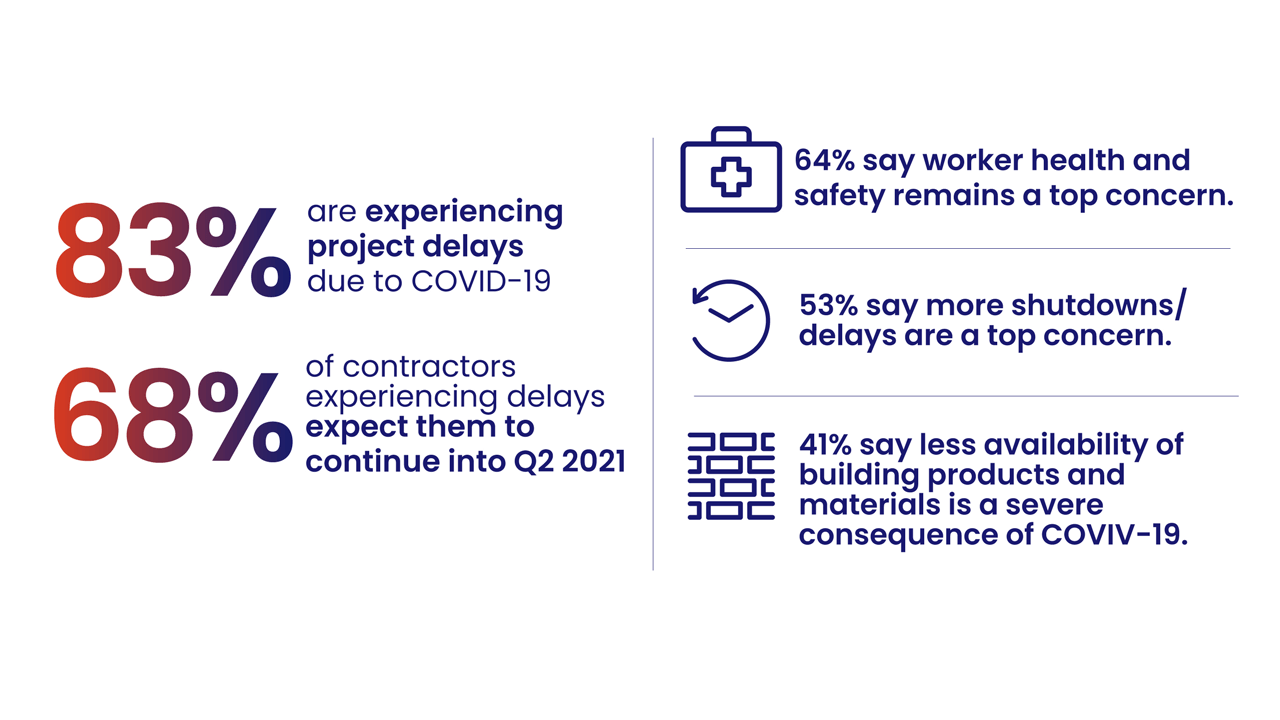

Construction costs are heavily influenced by market conditions, often leading to significant over or under insurance, and resulting in inaccurate risk & premium determination.

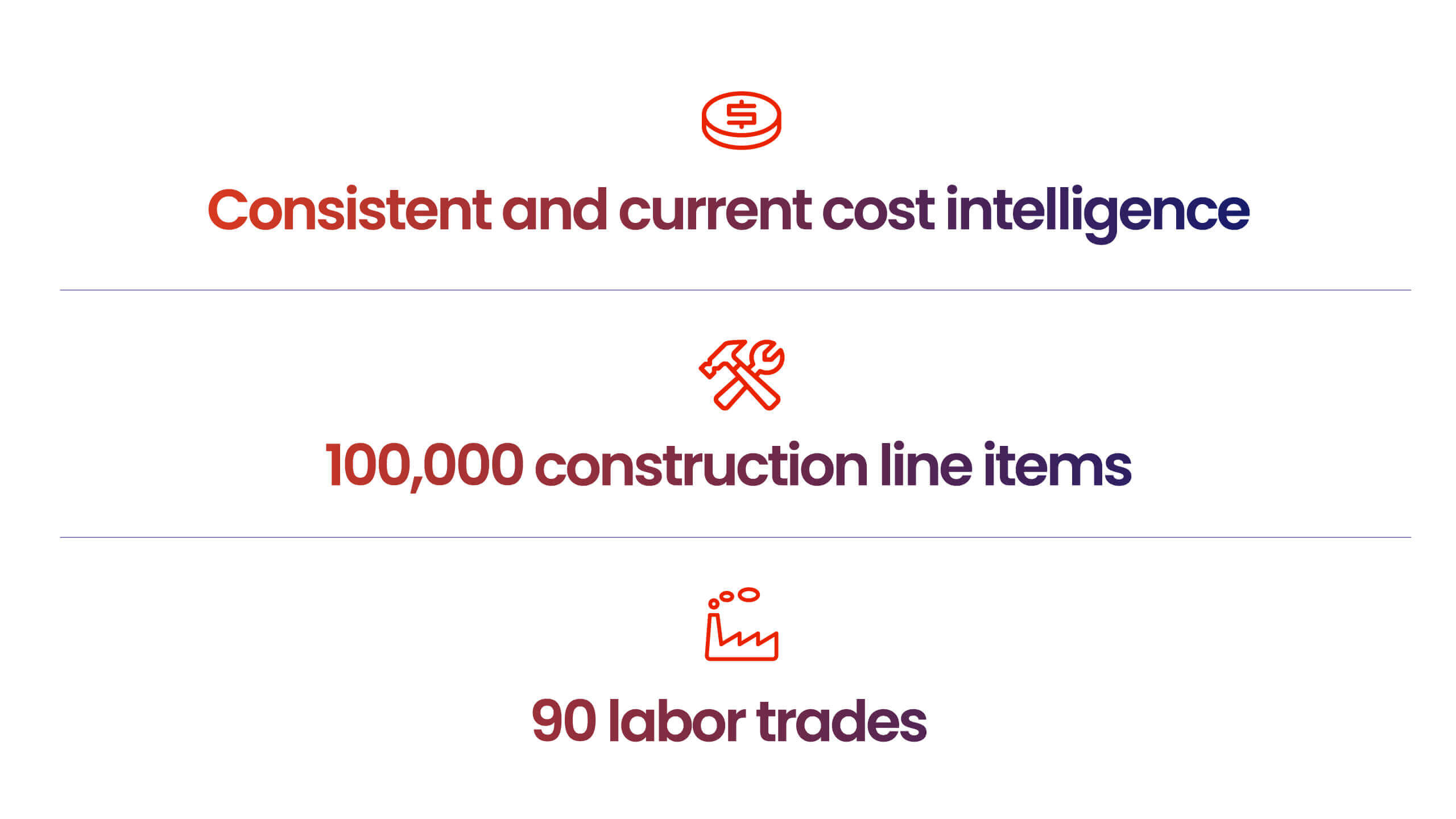

RCT Express by CoreLogic draws on eight decades of experience in order to combine a unique total component methodology with unparalleled building cost research covering local labor, materials and equipment costs in more than 2,600 geographies.

In today’s digitized world, consumers expect an easy interaction when shopping for property insurance. They also want to trust that their property investment is accurately covered in the event of a loss.

CoreLogic’s solutions integrate more structure characteristics when it comes to the reconstruction cost value. CoreLogic streamlines the homeowner experience, and provides more accurate reconstruction cost estimates and business workflow efficiencies.

You can now manage your commercial property risk with a higher level of confidence by utilizing better quality, objective submission data for risk assessment in a single, fully integrated commercial risk assessment and valuation platform.

Our fully integrated commercial risk assessment and valuation platform—Commercial Express—gives you a competitive advantage by delivering deep intelligence into commercial building valuations and property risk. The intuitive platform provides accurate reconstruction cost estimates, commercial structure pre-fill, and business occupancy information.

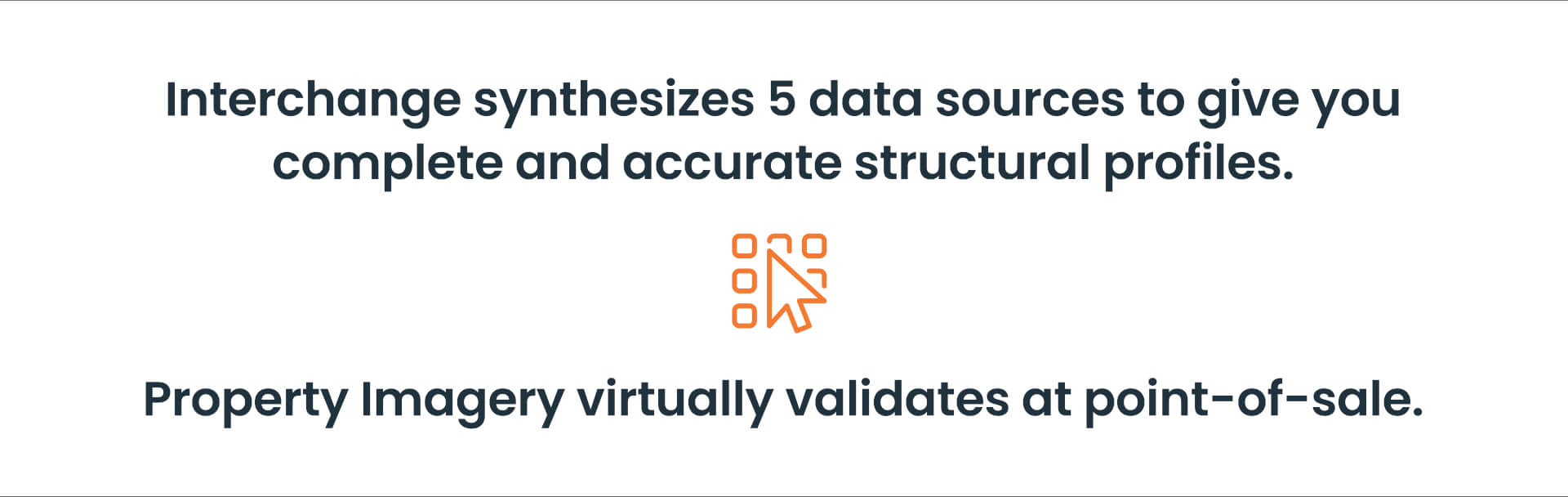

When you depend on outdated records or the recollections of a property owner, tracking down information on a commercial property can be time consuming and error prone. That’s why Commercial Property Pre-Fill provides structural attributes to enable digital workflows. Commercial Property Pre-fill reduces quoting turnaround time and manual data entry and utilizes better quality, objective data for risk assessment and pricing—all to improve agent and underwriter collaboration.

Developed from multiple public and proprietary real estate data sources, Commercial Property Pre-Fill enables digital property workflows and straight-through processing so that you can assess, quote and underwrite commercial property faster and with higher confidence.

The construction economy built the structures we need and love—our homes, workplaces, marketplaces and shared community spaces. But when rebuilding costs increase, owners may find that they are underinsured in the event of damages from natural hazards or accidents.

CoreLogic tracks construction costs for commercial, residential and agricultural construction throughout the United States and Canada. This quarterly report covers labor and material costs for construction, growth rates of these costs, and permit approvals for new construction and construction jobs.

Schedule a free consultation, and empower your team with CoreLogic today!