In this new digital age, agents, policyholders, vendors, and employees expect an easy, fast and automated experience in anything they do. With the UnderwritingCenter™ by CoreLogic, you’ll get the industry’s leading underwriting digital hub.

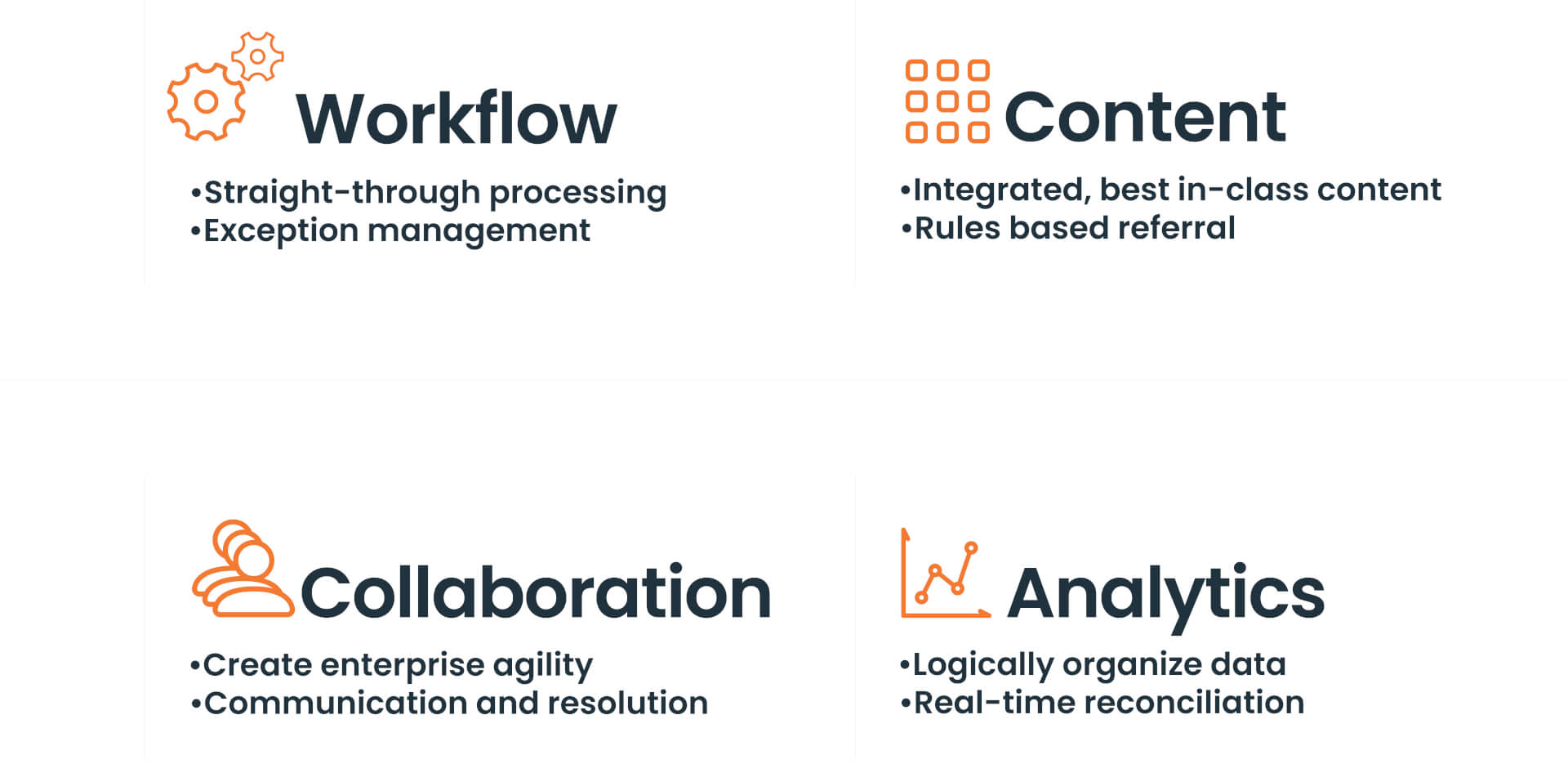

Our modern technology accelerates workflow efficiency via straight-through processing, rule-based referrals, and real-time conciliation. It embeds consumers into your organization’s workflow, which results in better outcomes not just for the insured, but your underwriting teams too. We also provide the flexibility to choose which Insurtech and/or third-party solution provider to integrate into your workflow to help drive innovation.

CoreLogic offers the Underwriting Center—a comprehensive tool that automates and standardizes underwriting tools and survey management.

Time is precious and there is no way to review all underwriting claims. The UnderwritingCenter is a turn-key platform which allows you to optimize your underwriting budget using time-saving workflow automation, straight-through processing, and consistency in underwriting decisioning without a lengthy implementation process. The UnderwritingCenter modernizes your technology with minimal IT resources while allowing integrations with other InsurTech and third-party solution providers.

Unlike legacy underwriting systems, our underwriting platform eliminates inefficient communication practices by giving functional access to agents, homeowners, and claims adjusters. The Underwriting Center allows you to connect all participants in your value chain to create seamless communication and policy status insight without interrupting the underwriter.

Our surveys speed up the underwriting process, reduce costs, and save homeowners from intrusive home visits.

The UnderwritingCenter groups and presents all pertinent information in a cohesive and easy-to-understand report. That means once all the data is retrieved, we process risk identification, highlight hazard eligibility, and score the data to present a meaningful insight of the property to the underwriter. This allows underwriters to make their decision on which action to take and empower seamless communication with agents and insured.

Our open API and easy integration fosters innovation, empowers choice and drives innovation at scale through powerful plug-and-play integrations for underwriting and claims. It’s built to facilitate a streamlined underwriting and claims workflow across your entire ecosystem of stakeholders.

Schedule a free consultation, and empower your team with CoreLogic today!