Home / Real Estate Data Solutions / Economic Trends

As a trusted voice worldwide, CoreLogic’s® team of economists, scientists and housing market professionals are the respected go-to experts. By using the depth and breadth of CoreLogic’s property data, they take the pulse of the housing market and provide our clients with the information, insights and risk modeling they need to prepare for the future.

Discover CoreLogic’s insights and trends on property markets that influence policy and shape the housing economy.

The CoreLogic® HPI Index provides the fastest home-price valuation information in the industry. It has the most up-to-date, accurate indication of home-price movements and trends available. The complete index includes pricing history from 1976 to the present. All datasets are refreshed monthly, and the fully revised index is published five weeks after the month’s end.

Recognize pivotal signals with:

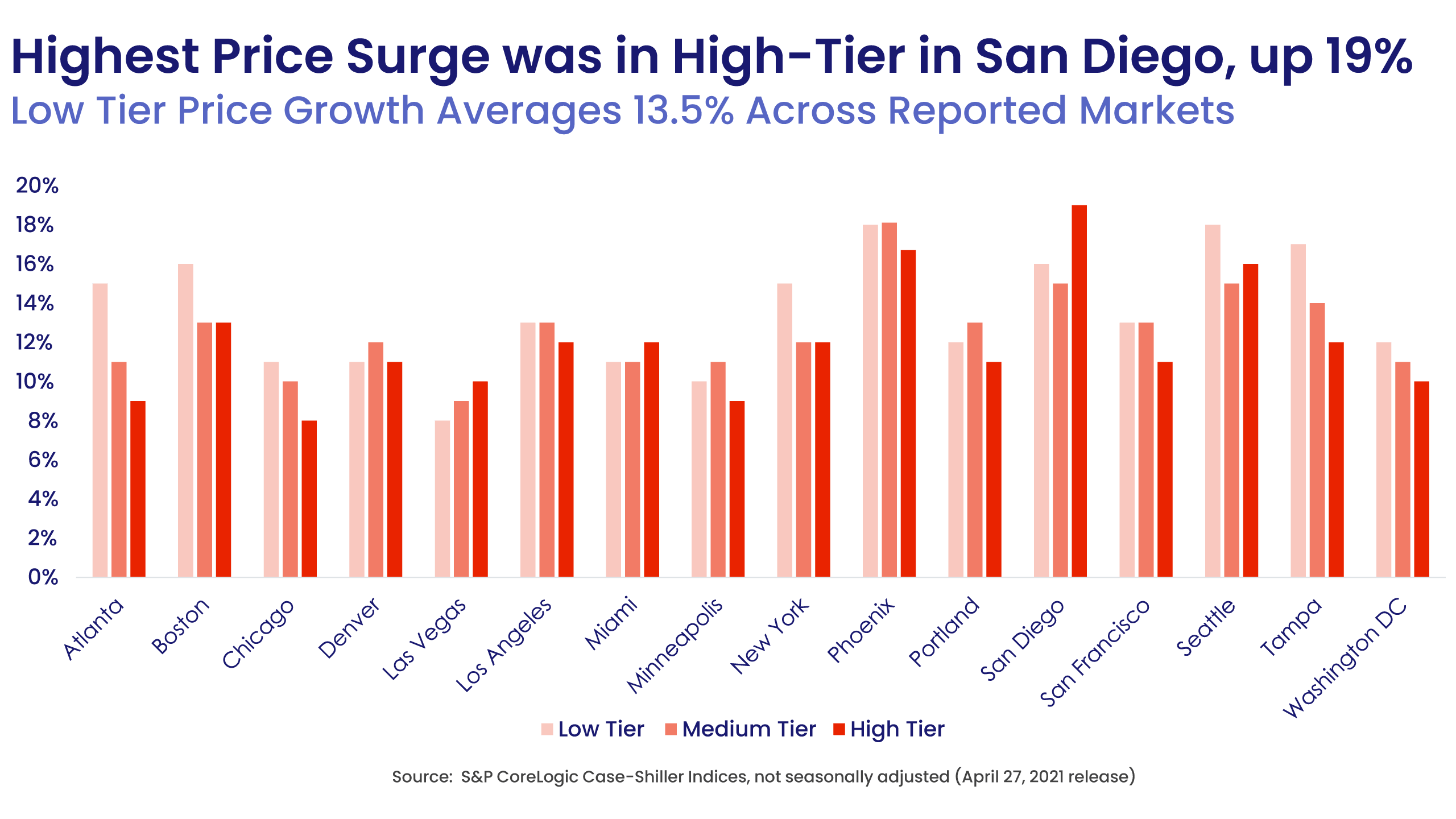

Our CoreLogic Case-Shiller products are versatile. They determine value for home equity loans, evaluate risk for an entire loan portfolio, model aggregate collateral value in a security, or research historic real estate valuation trends. These products clarify your tasks, simplify your challenges, and produce results that sharpen your understanding and enhance your results.

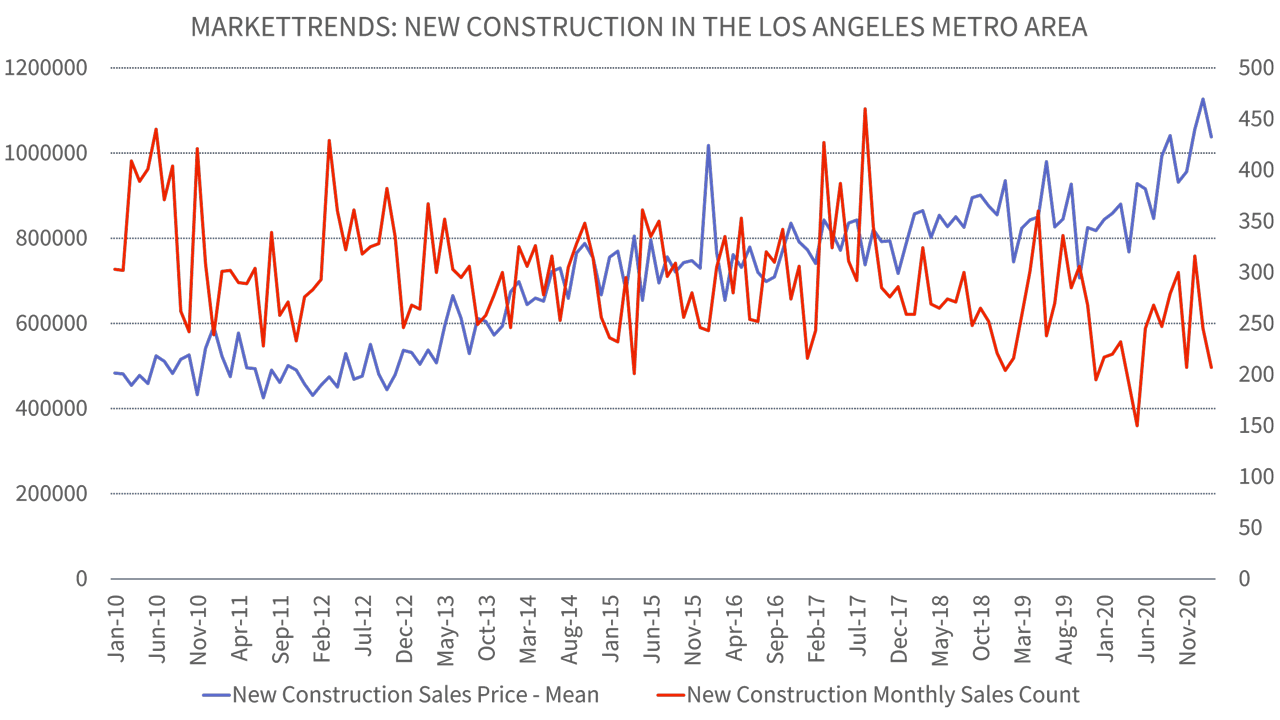

MarketTrends provides key data points related to market health that are used to identify potential markets for opportunity. Within those new markets, you can benchmark and analyze performance, risk, valuation trends and local real-estate cycles. This extensive, detailed, monthly market health coverage lets you:

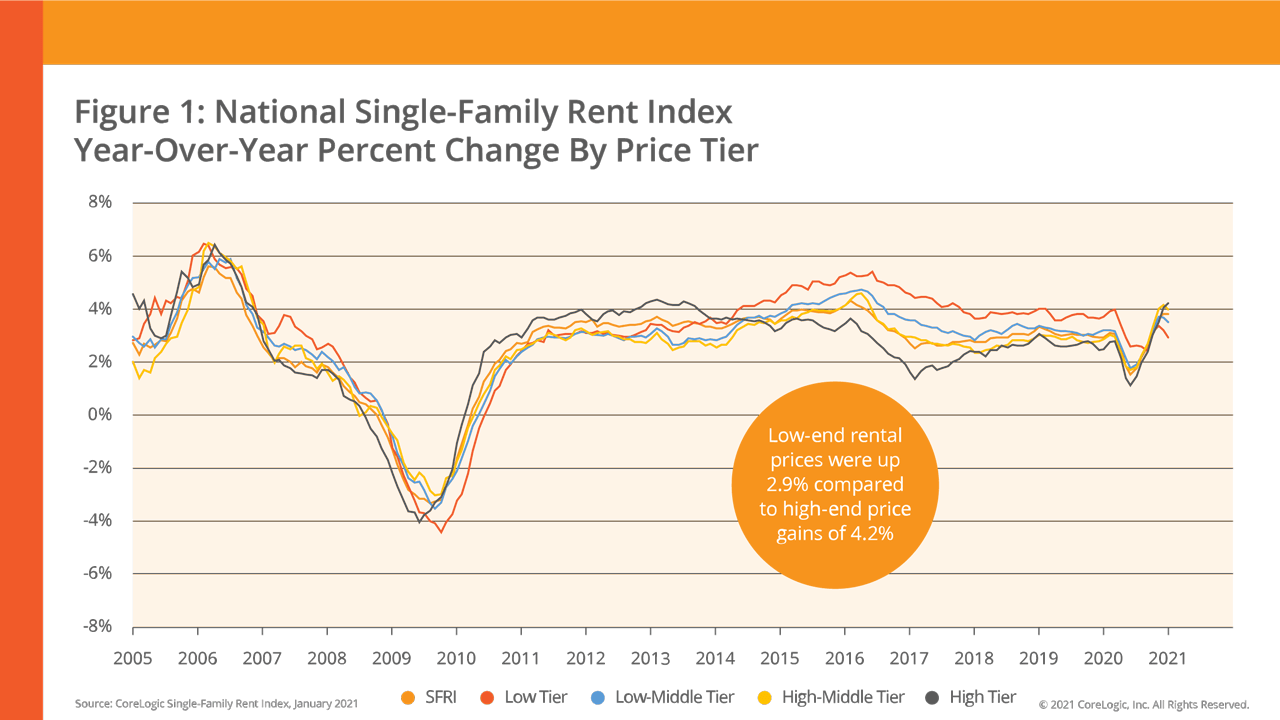

Evaluate the Single Family Residential investment and property management process with RentalTrends. The report provides vital time metrics at the ZIP-code level. It also offers extensive coverage of rent amounts, capitalization rates and vacancy rates derived from industry leading data and modeling. With this coverage, you can reduce time and minimize uncertainty in the rental market.

RentalTrends is a critical tool for:

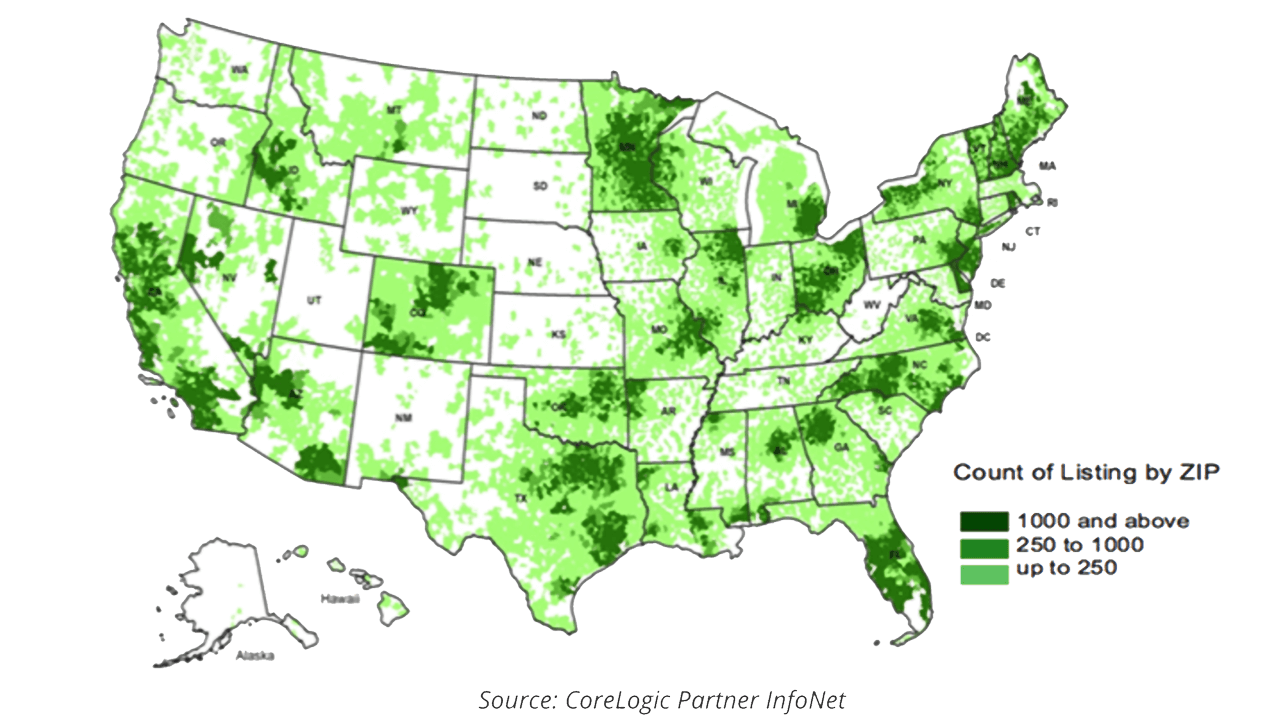

With deep and broad coverage of U.S. Multiple-Listing Services (MLS) data, CoreLogic ListingTrends provides monthly snapshots of time-series housing data – at the ZIP Code-level and above – from 2007 forward. It also aggregates key housing metrics, including leading indicators of house prices, listing inventories, days on market and absorption rates by listing type—new, active, pending, closed and sold.

Schedule a free consultation, and empower your team with CoreLogic today!