2021 has been an extraordinary year for the housing market: record low interest rates, fastest annual growth in single-family prices and rents, foreclosure rates at a generational low, and the largest number of home sales in 15 years. Home sellers saw a market where their homes sold quickly and often above list price as multiple buyers competed to have the winning bid.

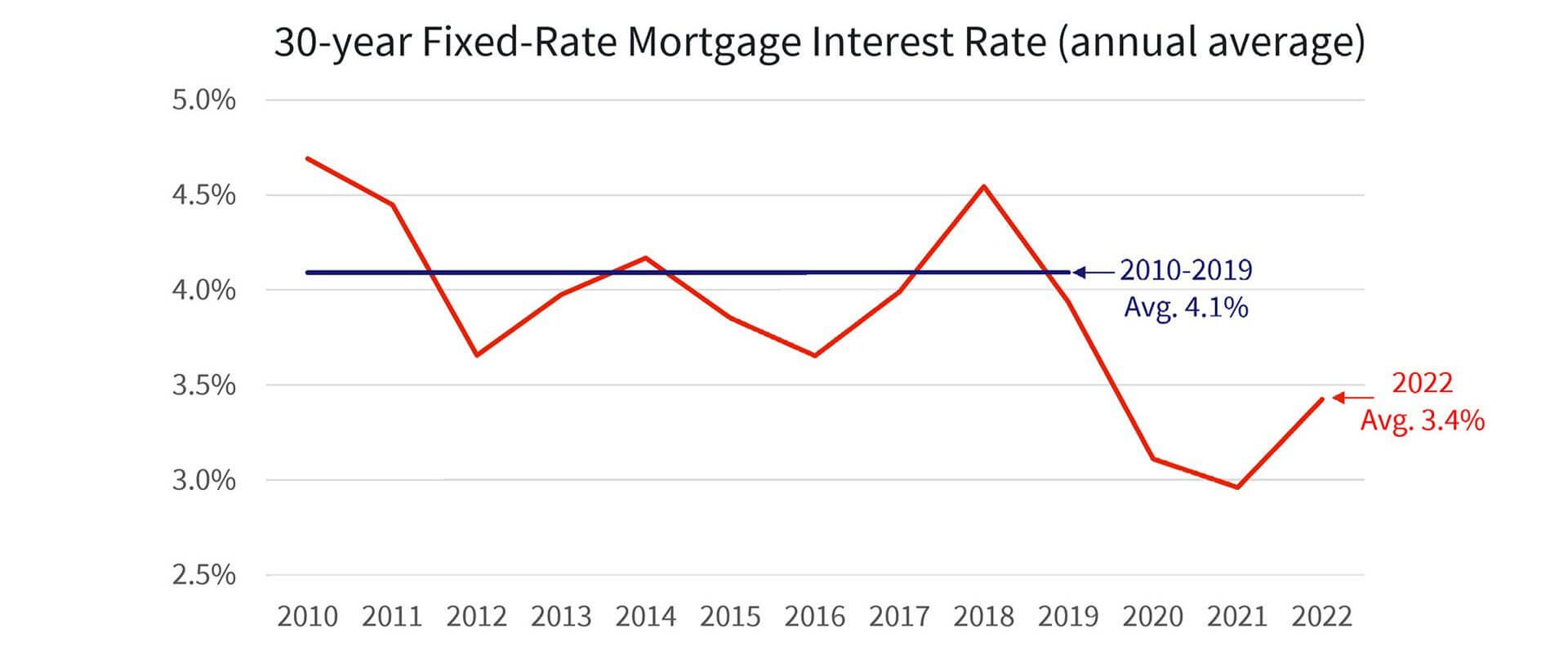

Figure 1: Mortgage Rates Are Forecast to Rise but Remain Low

With the Federal Reserve gradually “tapering” its supportive monetary policy, mortgage rates should slowly rise in the coming year: look for mortgage rates to average about one-half of a percentage point higher in 2022 than they were in 2021, or about 3.4%. We expect to see a moderation in buyer demand as the erosion in affordability takes a toll, and additional for-sale inventory to come on the market. With more supply from new construction and existing owners relocating, home sales are expected to rise to the largest number since 2006.

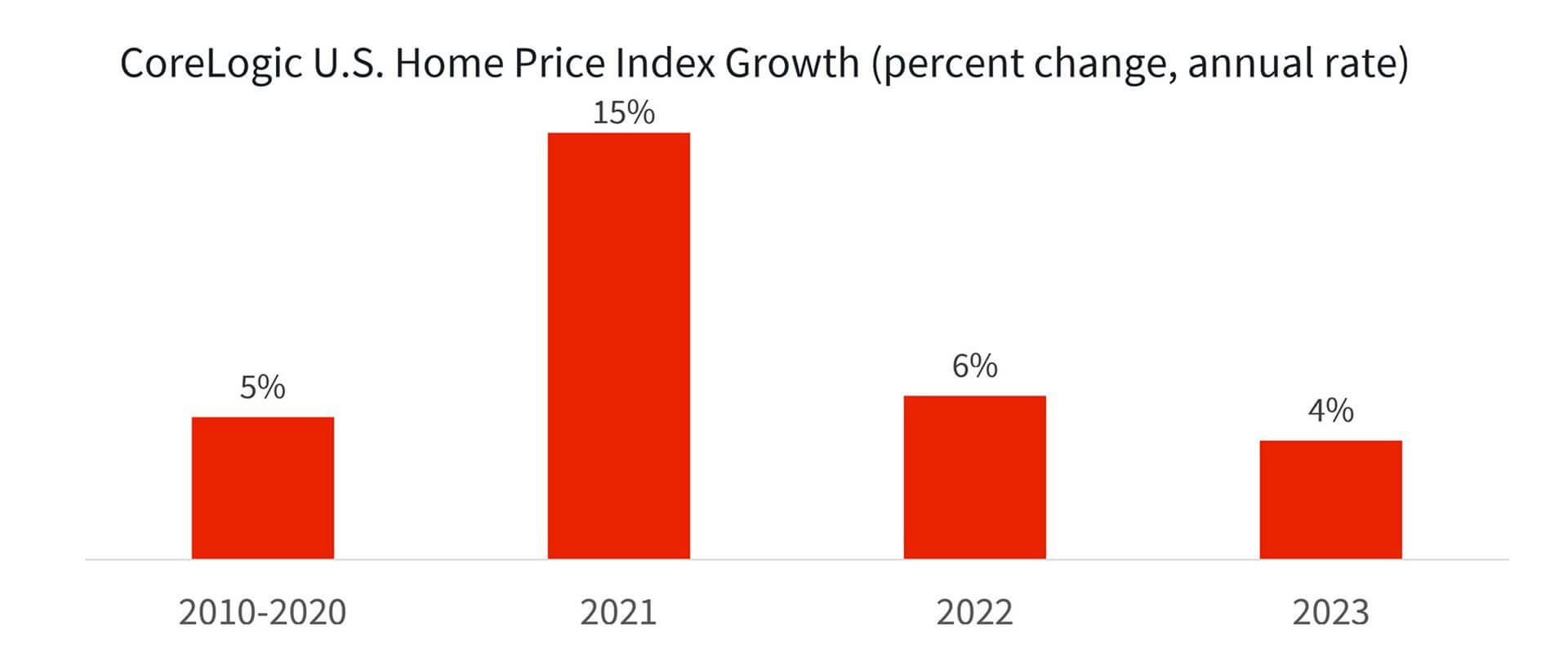

Figure 2: Home Price Growth Is Forecast to Slow

With less demand, we expect homes listed for sale will be on the market a bit longer with fewer competing bidders, which should moderate price growth. The CoreLogic Home Price Index Forecast has the annual average rise in the national index slowing from 15% in 2021 to 6% in 2022.

Rent growth on single-family homes reached the highest ever recorded in the CoreLogic Single-Family Rent Index in 2021 and is projected to slow as additional rentals enter the market.

While we expect home-purchase originations to rise, the higher mortgage rates will reduce refinance originations and alter its composition. Refinance originations will likely have a much larger cash-out share in 2022 with slightly lower average credit scores and lengthening of the average loan term.

Employment and income growth should continue to keep new delinquencies at a very low level. But the end of foreclosure moratoria and the CARES Act forbearance programs will likely result in a rise in distressed sales in 2022, but this increase will be small.

Figure 3: Housing Outlook for 2022

2022 should be a strong year for housing. Look for mortgage rates to rise but remain historically very low, home sales to grow to a 16-year high, price and rent growth to slow, refinance to shift toward cash-out, and delinquency rates to remain low albeit with an uptick in distressed sales.