The Impact of Climate Change on Property Values

The risk of natural hazard risk in United States is on the rise. According to the National Centers for Environmental Information, there were 22 weather and climate disasters in 2020 which cost over $1 billion. This is nearly 150% more than the average of 16.2 events for the most recent 5 years and three times the average of 7.1 events for the past 40 years.

But what effect does climate change have on real estate—or specifically, on a home’s property value?

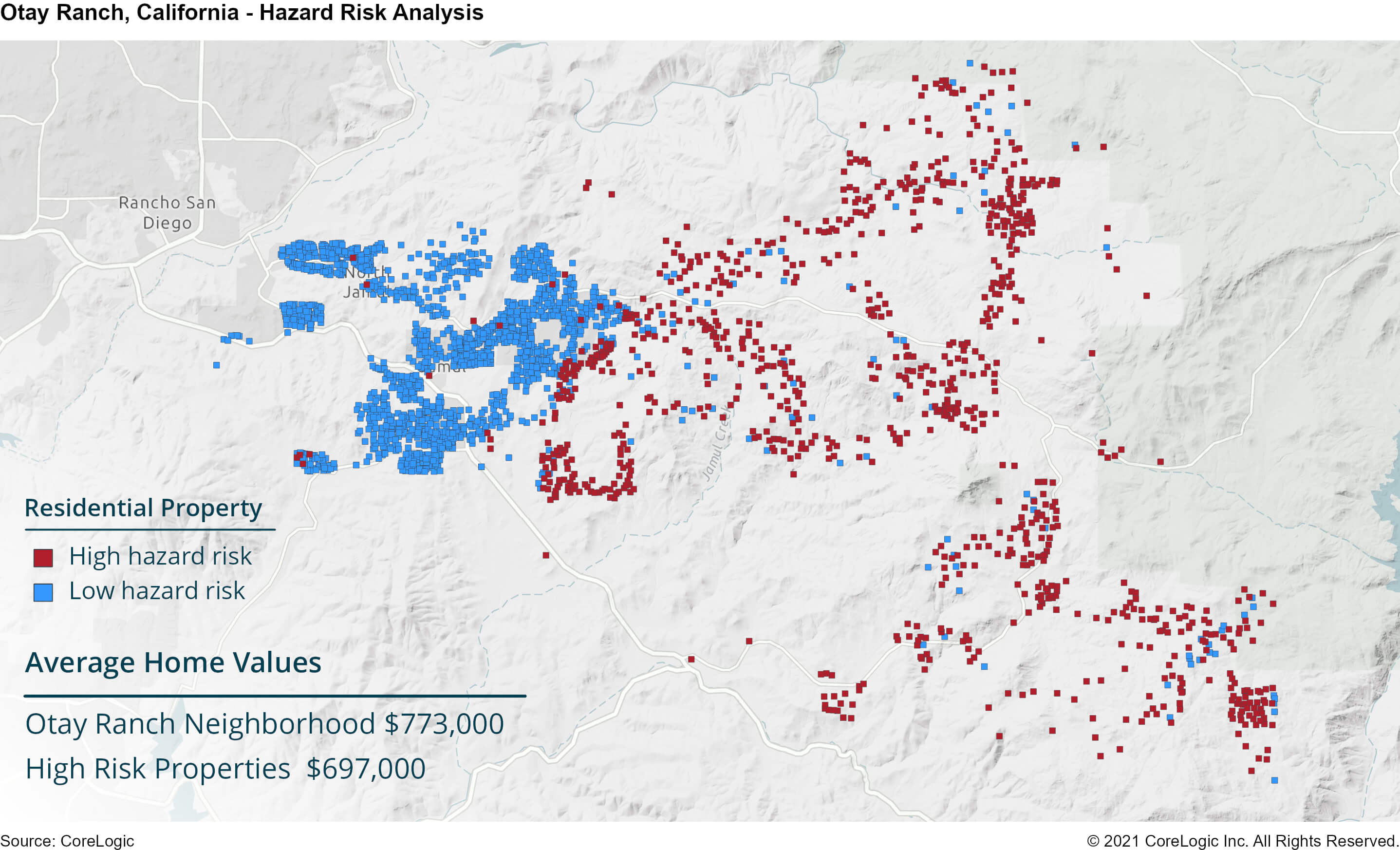

A Closer Look: Otay Ranch

Otay Ranch is a neighborhood 20 miles south of downtown San Diego. It is part of Chula Vista, a city whose name translates to “beautiful view” and has the pleasure of residing between the San Diego Bay and coastal mountain foothills.

In analyzing the relationship between property values and natural hazard risk, we estimated property values with Total Home Valuex, which reflected the price of recently sold similar properties nearby. Properties in the same neighborhood were used to control for value differences between different markets.

In addition, hazard risk scoring was used to identify the properties with greatest risk from perils including flood, wildfire, tornado, hail, surge, earthquake, straight line winds, hurricane wind, and sinkhole. The probability of an event, or the frequency of those events, is a significant factor in determining the risk levels. Otay Ranch, in particular, is close to valleys and parks which have had brush fires in the past.

Figure 1 plots all properties in Otay Ranch neighborhood in San Diego. Blue dots are properties with lower hazard and red dots are properties with higher hazard risk.

Of the 2,546 residential properties in Otay Ranch, 942—or nearly 40% of them—have high hazard risk. The average home value for high hazard risk properties is $697,000 as compared to the neighborhood average of $773,000 dollars.

With a nearly $75,000 gap, it seems homes in Otay Ranch at higher risk also have lower property values.

Does the Trend Persist?

In Otay Ranch, it’s clear that homes with higher risk have, on average, lower property values, but does this trend persist across different neighborhoods?

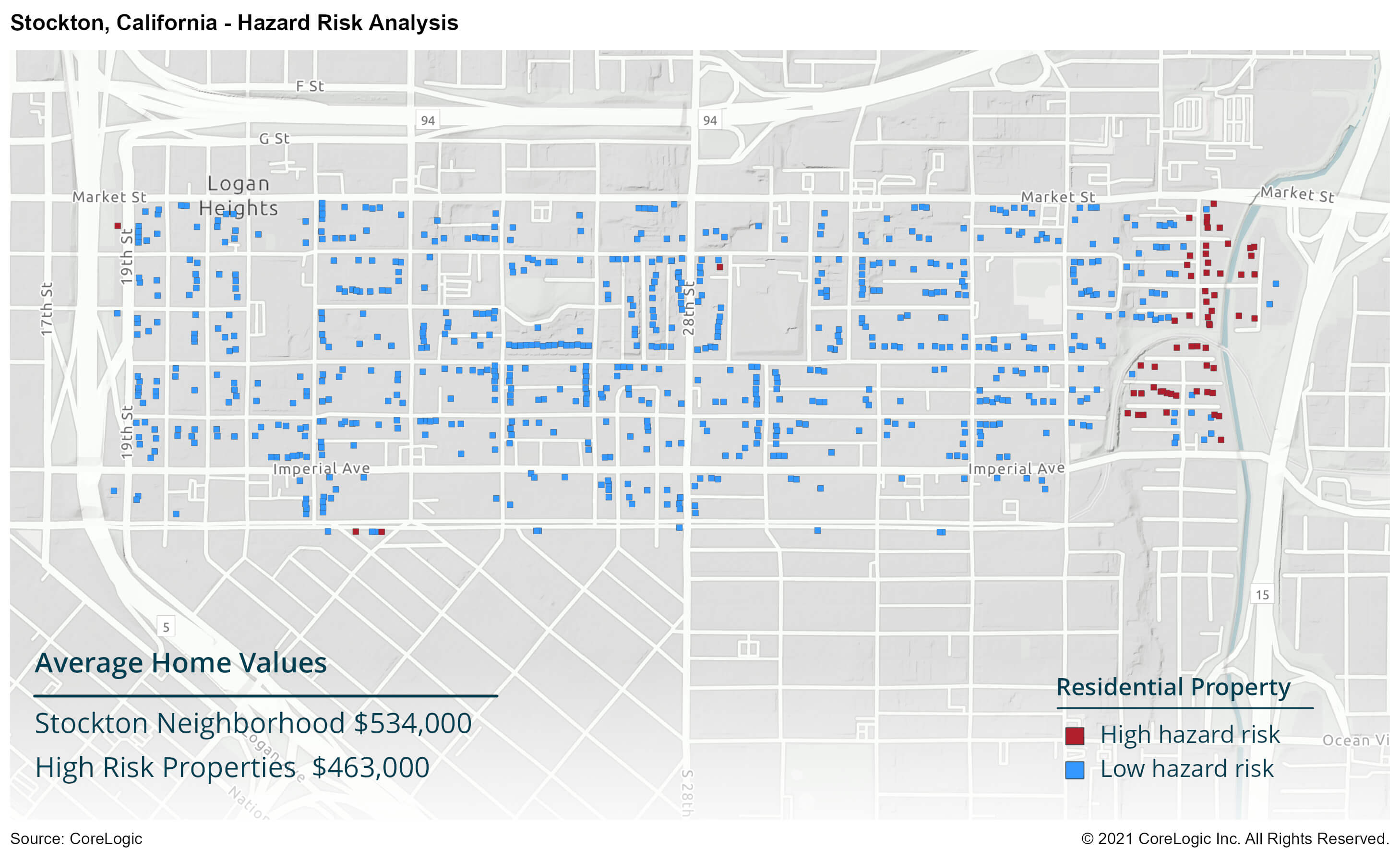

Figure 2 shows a similar analysis for Stockton, a neighborhood on the east side of downtown San Diego.

There are 61 properties that have high hazard risk in Stockton, and their average price is $463,000 as compared to a neighborhood average $534,000. In this case, the difference between higher risk home and lower risk homes was worth almost $70,000.

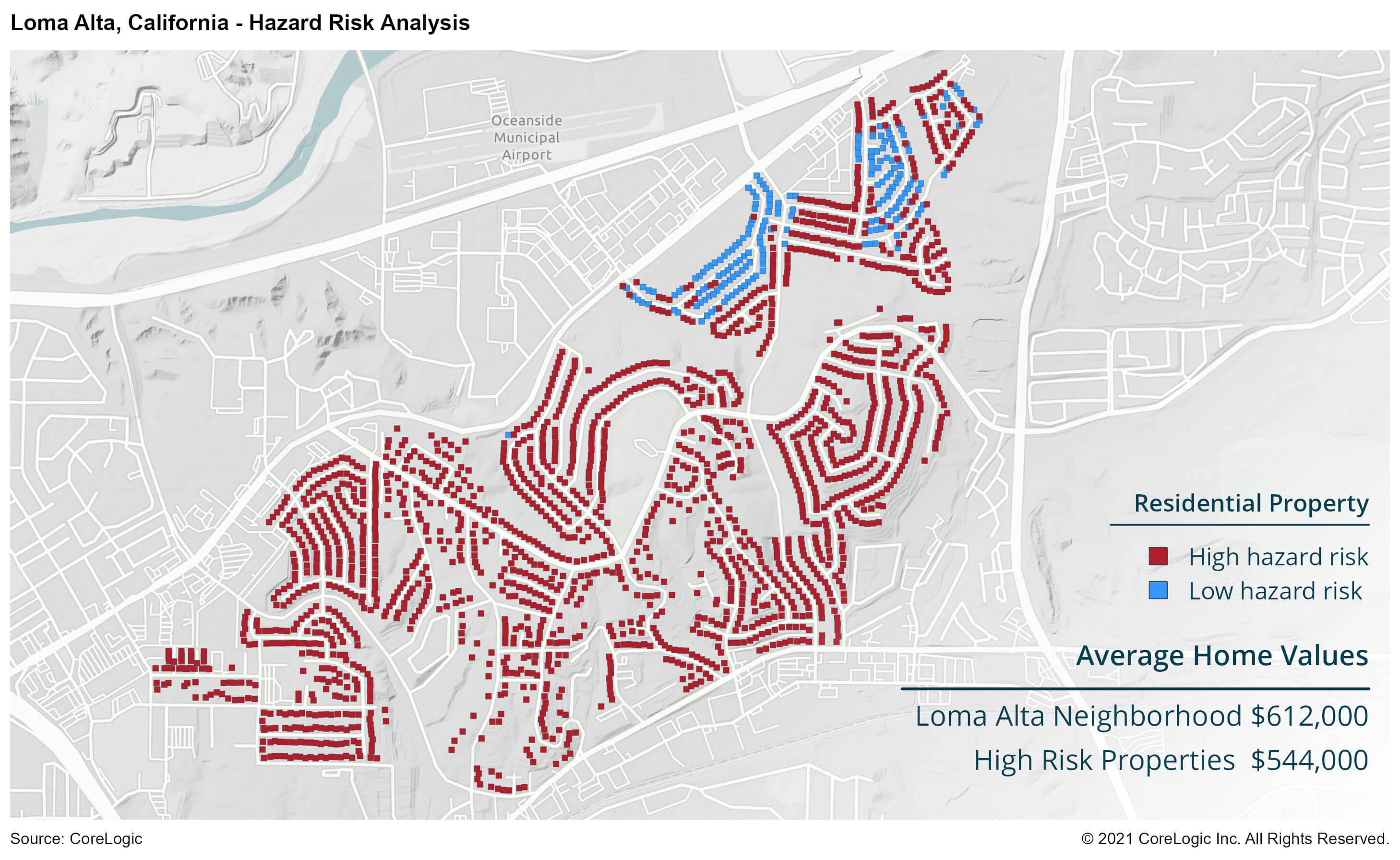

Similarly, in neighborhood Loma Alta, as seen in Figure 3, 191 out of 2,098 properties are identified as high hazard risk with an average value of $544,000 as compared to a neighborhood average $612,000. The discount for high hazard risk properties is more than 10% in both neighborhoods.

As our growing population and associated residential development expands into higher natural hazard risk areas, thus increasing the number of homes in those areas, more and more properties are becoming more exposed to climate change risk.

In San Diego in particular, the expansion of new construction and development into the wildlands means a greater number of homes are susceptible to wildfire. But even outside of California, hurricane-prone Florida has become an increasingly popular destination for homeowners seeking sunshine and lower prices. As the climate changes, these homes will only increase in exposure to hazard risk.

Although this research is still seminal, and other factors could give rise to pricing differentials in various neighborhoods, it is of crucial importance for homeowners, mortgage lenders, insurers, and policymakers to understand the holistic impact of climate change—and thus, natural hazard risk—on property values. A proactive approach to this challenge—and the resultant effect it has on the housing market—will be critical in promoting a healthy housing ecosystem.

©2021 CoreLogic Inc., All rights reserved.